- OPEC and Its Allies Agree to Gradual Increases in Oil Production (New York Times)

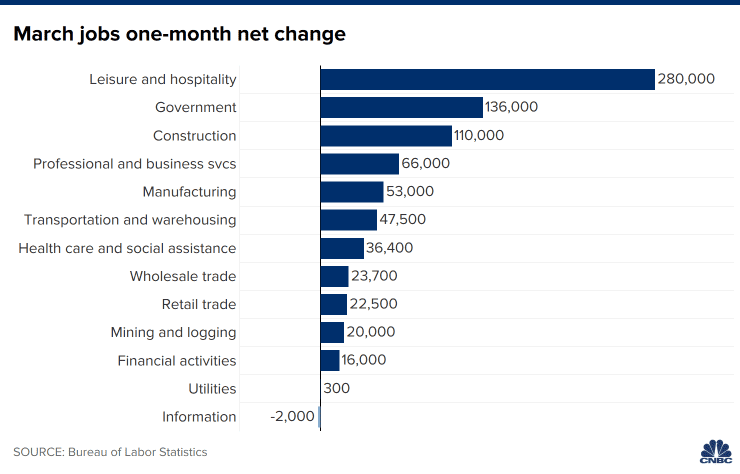

- Job Growth in U.S. Topped 900,000 in March as Hiring Broadened (Bloomberg)

- God and Man Collide in Bill Hwang’s Dueling Lives on Wall Street (Bloomberg)

- Why Biden’s Infrastructure Plan Is a Green Jobs Plan (Bloomberg)

- U.S. Small-Business Job Openings Rise to Record in March (Bloomberg)

- New Supercycle Makes Energy Billionaires Richer Globally (Bloomberg)

- The Bull Market Roulette Wheel Just Keeps Landing on Winners (Bloomberg)

- Saudis keep control of the oil market despite a production increase. (New York Times)

- Asia Goes Big on Hydrogen. What It Means for EVs. (Barron’s)

- Rehypothecated Leverage: How Archegos Built A $100 Billion Portfolio Out Of Thin Air… And Then Blew Up (ZeroHedge)

- Goldman Sachs Sees “Significant Downside Risk” to Apple (AAPL) Services Growth (Street Insider)

- First-time buyers fuel Manhattan housing market revival (Fox Business)

- Oil producer Pioneer to snap up rival DoublePoint for $6.4bn (Financial Times)

- Hotels are reaching the highest occupancy levels since the pandemic, Wyndham CEO says (CNBC)

- Here’s where the jobs are — in one chart (CNBC)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 76

Article referenced in podcast above:

The Dua Lipa “Levitating” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 66

Article referenced in podcast above:

The Dua Lipa “Levitating” Stock Market (and Sentiment Results)…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Top Analyst Says Software Stocks Are Expensive Now: 5 High-Value Conviction Buys (24/7 Wall Street)

- Spac boom fuels strongest start for global M&A since 1980 (Financial Times)

- Long-term US government bonds endure worst quarterly fall since 1980 (Financial Times)

- Archegos debacle reveals hidden risk of lucrative swaps (Financial Times)

- 5 Weirdest Corporate April’s Fool Pranks Of All Time: Voltswagen, Tesla Model W And More (Benzinga)

- The Wrong Guy. The Energy Report 04/01/2021 (Phil Flynn)

- Biden’s Push for Electric Cars: $174 Billion, 10 Years and a Bit of Luck (New York Times)

- 3 Underperforming IPO Stocks Worth a Second Look (Barron’s)

- It’s a Great Time to Own Financial Stocks. Here’s Why. (Barron’s)

- Optimistic Forecasts on Economy Might Still Be Too Dismal (Wall Street Journal)

- Biden’s $2.3 Trillion Infrastructure Plan Takes Broad Aim (Wall Street Journal)

- What’s in Biden’s $2 Trillion Corporate Tax Plan (Wall Street Journal)

- Shoppers Start to See Effect of Higher Commodity Costs (Wall Street Journal)

- How Japanese Investors Accelerated the Treasury Selloff (Wall Street Journal)

- Walgreens Reports Stronger Profit as Covid-19 Vaccine Rollout Ramps Up (Wall Street Journal)

- Pfizer says COVID-19 vaccine lasts 6 months, protects against variants (New York Post)

- Goldman Sachs Sees “Significant Downside Risk” to Apple (AAPL) Services Growth (Street Insider)

- US home prices are rising at their fastest in 15 years – and Goldman says they’ll surge another 7% this year (Business Insider)

- S&P 500 clears 4,000 milestone as data show U.S. factories booming (MarketWatch)

- Japan and South Korea reported unexpectedly strong economic data, as Asian stocks rise (MarketWatch)

The Dua Lipa “Levitating” Stock Market (and Sentiment Results)…

This week we chose Dua Lipa’s billboard hit (featuring DaBaby), “Levitating” to capture the current status of the stock market. She describes it well with her lyrics: Continue reading “The Dua Lipa “Levitating” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 3/29/2021

Thanks to Lawrence Delevingne for including me in his article on Reuters this afternoon. You can find it here: