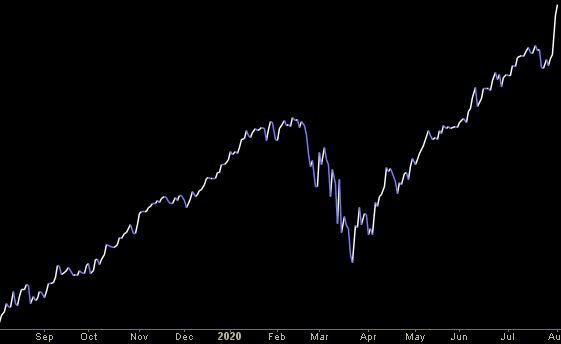

This week I chose Country Legend Tim McGraw’s song, “I Like It, I Love It” to embody the current sentiment of the Stock Market. While anyone who has been around knows – it can change on a dime – right now, market participants are enjoying the ride and singing along:

But I like it, I love it, I want some more of it

I try so hard, I can’t rise above it… Continue reading “The Tim McGraw, “I Like It, I Love It” Stock Market (and Sentiment Results)…”