Be in the know. 22 key reads for Monday…

- How the Pandemic Has Changed What Home Buyers Want. (Barron’s)

- Goldman Says Mom-and-Pop’s Stock Picks Are Trouncing Wall Street (Bloomberg)

- Why Investors Shouldn’t Worry About Last Week’s Fall (Barron’s)

- Lilly Is Testing Its Arthritis Drug as a Coronavirus Treatment (Barron’s)

- Americans Are Driving Again. What That Means for Auto Stocks. (Barron’s)

- Get Ready for the ‘Mother of All Bidding-War Seasons’ (Barron’s)

- Hedge fund Elliott Management shifts to elephant hunting as fund size balloons (CNBC)

- Warren Buffett says this is ‘by far the best book on investing ever written’ (CNBC)

- A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch)

- China’s factory output perks up but consumers stay cautious (Reuters)

- Big money may soon be chasing the ‘Robinhood’ investor (Yahoo! Finance)

- Retail investors top Wall Street pros as stock market recovers from coronavirus selloff (Fox Business)

- Barron’s Picks And Pans: Chevron, Goldman Sachs, Progressive And More (Benzinga)

- AstraZeneca Strikes Deal With Four EU Countries Over 400M Coronavirus Vaccine Doses (Benzinga)

- Source image: Unsplash.com

- ByteDance Explores Partnership With Singapore’s Lee Business Family For Digital Banking License: Report (Benzinga)

- Morgan Stanley Economists Double Down on V-Shape Global Recovery (Bloomberg)

- Singapore to Ease Virus Curbs, Resume Most Activities Friday (Bloomberg)

- China a Bright Spot for U.S. in Gloomy Global Trade Picture (Wall Street Journal)

- Signs of a V-Shaped Early-Stage Economic Recovery Emerge (Wall Street Journal)

- Kudlow Urges Replacing Unemployment-Benefit Boost With Return-to-Work ‘Bonus’ (Wall Street Journal)

- ‘Billions’ Recap, Season 5, Episode 7: Axe Capital on Drugs, a Scandal and a Firing (Wall Street Journal)

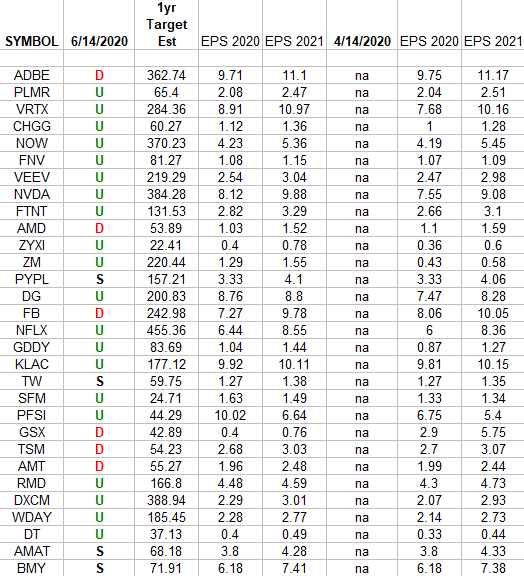

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

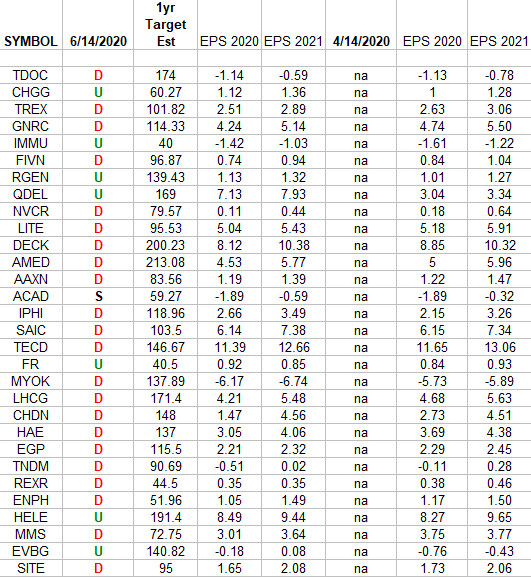

Russell 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2020 and 2021 estimates were on 4/14/2020 and today. Continue reading “Russell 2000 (top weights) Earnings Estimates”

Be in the know. 12 key reads for Sunday…

- JPMorgan’s Kolanovic Drops Caution on Stocks, Says Buy the Dip (Bloomberg)

- Second Wave Fears Won’t Crush Oil Demand (Futures Mag)

- 2 Energy Stocks to Buy in June 2020 (Insider Monkey)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Here’s Proof That the 2021 Ford Bronco Has a Seven-Speed Manual and Crawler Gear (The Drive)

- The Cost Of Contact Tracing (NPR)

- A Guy Named Craig May Soon Have Control Over a Large Swath of Utah (New Yorker)

- Two Investors Search The Globe For An Investment Edge (Podcast) (Bloomberg)

- Joe Rogan Got Ripped Off by Spotify? (Marker)

- Why the Worst Is Over for Mortgage-Backed Securities, Maybe (Chief Invesment Officer)

- Fresh OPEC+ cuts point to crude and condensate supply deficits through 2021 (Oil & Gas Journal)

- Bond Moves Up (Variety)

Be in the know. 20 key reads for Saturday…

- Lasry: Hertz Debt Is an Opportunity (Barron’s)

- Hedge Fund Tips – Who Was Really the Dumb Money? (Zero Hedge)

- The Fed Is Optimistic—If Congress Does More Now (Barron’s)

- Get Ready for ‘Mother of All Bidding-War Seasons,’ Says Real Estate CEO (Barron’s)

- Why Regional Theme Parks Could Be the Place to Be This Summer (Barron’s)

- Here’s how the stock market tends to trade after brutal selloffs like Thursday’s (MarketWatch)

- Bank of America Stock Stands to Gain on Stress Test and Earnings (Barron’s)

- 10,000 Steps a Day Is a Myth. The Number to Stay Healthy Is Far Lower. (Wall Street Journal)

- Before Catching Coronavirus, Some People’s Immune Systems Are Already Primed to Fight It (Wall Street Journal)

- American Express Gets Nod to Start Operating Card Network in China (Wall Street Journal)

- Steven Mnuchin Says White House Considering Second Round of Stimulus Payments (Wall Street Journal)

- Twitter Restores Zero Hedge Account After Admitting Error (Bloomberg)

- ‘Economists make fortune-tellers look good’: This investment manager thinks the US is on course for a V-shaped recovery as markets ‘have already priced in’ a 2nd wave of coronavirus (Business Insider)

- Global stocks could soar 47% from current levels as recent sell-off rejuvenates the bull market, JPMorgan says (Business Insider)

- US consumer sentiment jumps the most since 2016 on renewed hiring efforts (Business Insider)

- Cliff Asness, AQR Founder and Libertarian Firebrand, Tells Staff That ‘Black Lives Matter’ (Institutional Investor)

- Donald Trump’s New Secret Weapon: Boats (Vanity Fair)

- 5 Signs This Might Be a New Bull Market (A Wealth of Common Sense)

- Jeremy Siegel declares end to the 40-year bull market in bonds (CNBC)

- CNBC’s full interview with Ron Baron (CNBC)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 34

Article referenced in VideoCast above:

The Carly Pearce “I Hope You’re Happy Now” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 24

Article referenced in podcast above:

The Carly Pearce “I Hope You’re Happy Now” Stock Market (and Sentiment Results)…