- Trump to buy oil for strategic reserve to aid energy industry: ‘We’re going to fill it’ (CNBC)

- Gilead Pops After Coronavirus Drug Helps Cruise Ship Patients In Japan Investor’s Business Daily)

- Europe Pledges Billions in Economic Aid in Rare Sign of Unity (New York Times)

- Dow surges nearly 2,000 points after Trump declares coronavirus national emergency (New York Post)

- Trump Says He Supports Pelosi Virus Bill, Urges GOP to Vote Yes (Bloomberg)

- Trump Waives Student-Loan Interest, Stockpiles Oil in Virus Plan (Bloomberg)

- Esports Leagues Are Only Game in Town After NBA and NHL Go Dark (Bloomberg)

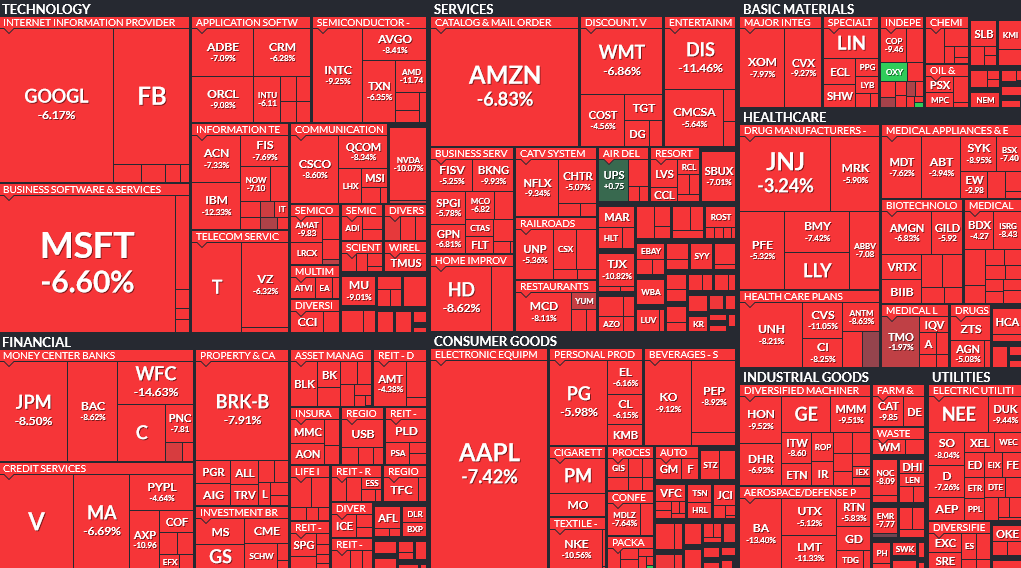

- Stocks Retrace 90% of Thursday’s Sell-Off With Trump Address Hitting Mark (Bloomberg)

- Cash-Rich Billionaire Hargreaves Jumps Back Into Market (Bloomberg)

- Trump called on Walmart, CVS, Target, and Walgreens to help slow the spread of the coronavirus as he declares a national emergency (Business Insider)

- Stocks Surge After Trump Promises Speedier Testing (New York Times)

- How Billie Eilish Rode Teenage Weirdness to Stardom (New York Times)

- Deadly viruses are no match for plain, old soap — here’s the science behind it (MarketWatch)

- 18 Stocks to Buy Amid the Coronavirus Carnage, According to Barron’s Roundtable Experts (Barron’s)

- China’s coronavirus epicenter reports just five cases (Reuters)

- Here’s everything you need to know about 5G (CNN)

- Google, Walmart join U.S. effort to speed up coronavirus testing (Reuters)

- 7 Stocks That Could Ride Out the Turmoil in Energy Markets (Barron’s)

- The World Is One Big Carry Trade (Institutional Investor)

- Value investors: why are they so calm in a crisis? (Schroders)