I went on Yahoo! Finance yesterday immediately following the “Bankers Meeting” at the White House. What is happening with Coronavirus and OPEC+ is serious. However, there are some stocks coming down to levels that may be near pricing in the “worst case scenario.” Here’s what I had to say:

Notice I did not “call the bottom,” but rather laid out a rational plan about how we are thinking about risk/valuations moving forward. It could get worse before it gets better.

On Monday, on i24News, I discussed the other factor ailing the markets, namely the unraveling of OPEC+ and how it might play out:

This mirrored my quote in the Wall Street Journal which pointed to a potential recession if Credit Markets got tight due to imminent high yield defaults in the oil patch – should nothing change regarding cuts:

So now that we’ve addressed some of the risks and downside, let’s talk about what could potentially go right…

What could the catalysts be in coming weeks? Here are a few possibilities:

- Gilead’s Remdesivir is proven effective in the Phase 3 test and rolled out for mass human use to treat COVID19.

- Russia comes back to the table with OPEC+ and they implement cuts.

- Fed Meeting March 18.

- Global Coordinated Fiscal Stimulus Package Announced.

- Fed added ~$100B of liquidity in past week (balance sheet increase – after stalling since January).

- China steps in as a major buyer of oil as was the case in the 2009 and 2016 oil crashes.

- US administration could add to the Strategic Petroleum reserve at these prices and sell it when the market stabilizes.

Demand/Recovery will just be kicking in as unprecedented global monetary/fiscal stimulus is filtering through the system – setting the table for a back half recovery.

2021 earnings still holding in at $195.16 on S&P. 2020 at $174.92 but will come down materially in coming weeks. Demand will be pushed forward to back half and Boeing 737 Max will help 2020 earnings recover.

China Recovery Model Could Replicate Globally

In each country the first few days that new COVID19 cases level off or go down, stock market will begin to rally (like 20%+ China rally in February).

-Disney re-opening park in Shanghai.

-Apple re-opened 85% of stores in China.

-Starbucks re-opened stores in China.

-China and Singapore mostly contained at this point (South Korea looking better).

The same thing will happen in each market one by one. The first day that new cases level off or go down, that country’s market will start to rally like China in February. The challenge is that it feels like early days for new cases in much of the developed world.

Turning Points to look for:

When companies rally on negative news, dividend cuts, pre-announcements that will be a sign that things could be turning.

It is frequently at these points of acute pessimism that something changes in the near term. The last time there was a meeting of the banks like we saw yesterday was a phone call in December 2018 (the weekend before the market bottomed). Time will tell…

No one can perfectly call the bottom, but when you have high quality stocks down off their recent highs like: BRK/B (>17%), AXP (>30%), WFC (>40%), PFE (>20%), XOM (>40%), it is evident that they are starting to price in “close to a worst case scenario” that may not materialize (as was the case with China, Singapore, South Korea that are now on the uptrend).

“Wall Street is the only place in the world that when they throw a clearance sale, no one shows up.” Unfortunately, what’s cheap can become cheaper until “new cases” level off. The market is a discounting mechanism and if you wait for them to declare a “recession” you are too late and you missed it. At some point you have to start to take advantage when it looks darkest and take a 1-2 year view.

Like Warren Buffett said in his historic Op-Ed in the New York Times on October 16, 2008 (depths of the Great Financial Crisis), “So if you wait for the robins, spring will be over.”

Again, we are not trying to call the bottom. As we said on Yahoo! Finance in the clip above, “what if you bought some high quality stocks in April 2008 (way too early)?” Looking back, would that have been such a bad move? If you take a 1-3 year view, are selective and ease in slowly, there are some opportunities to be had now, and potentially more in coming days and weeks (just opinion, not advice – see “terms” above).

Now onto the shorter term view for the General Market:

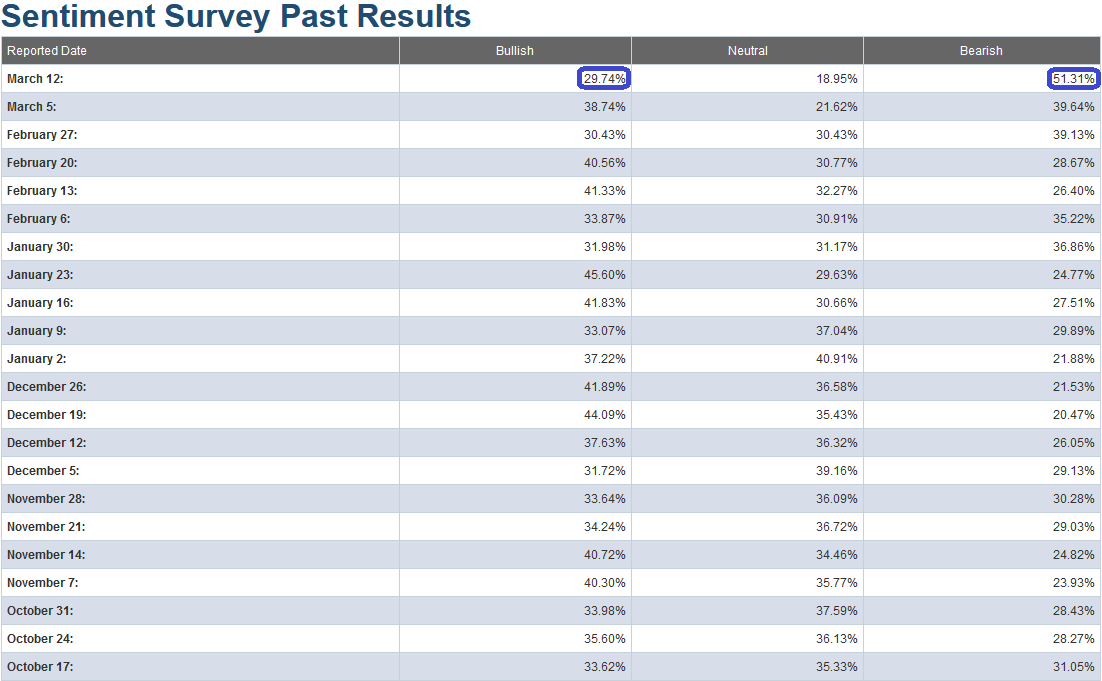

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent fell to 29.74% from 38.74% last week. Bearish Percent rose to 51.31% from 39.64% last week. Neutrality dropped from 21.62% last week to 18.95% this week. While bearishness is at an elevated level, Bullishness is still a bit high to call complete capitulation.

The CNN “Fear and Greed” Index dropped from 15 last week to 4 this week. We are at an extreme in sentiment on this measure. You can learn how this indicator is calculated and how it works here: (Video Explanation)

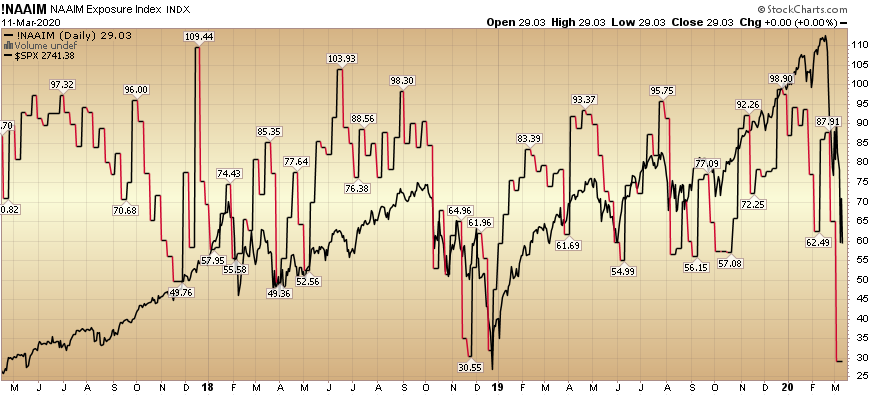

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) collapsed from 65.03% equity exposure last week, to 29.03% this week.

Our message for this week is similar to last week:

We are selectively and slowly adding to those stocks/sectors which are nearing valuation levels that we would define as “pricing in at/near the worst case scenario.”

Most stocks do not yet meet this measure (as the “worst case” is unlikely to materialize), but for those that do we are adding and will continue to do so as opportunity presents itself in coming days and weeks.

But for now, it’s day by day and opportunistic execution…