Be in the know. 10 key reads for Tuesday…

- What Benjamin Graham Would Tell You to Do Now: Look in the Mirror (Wall Street Journal)

- China’s Stocks Have Recouped Most CoronavirusStocks to Buy Amid the Selloff (Barron’s)

- U.S. Consumers Just Got a $725 Billion Windfall. Here’s How. (Barron’s)

- Coronavirus Is Bad — and Good — for Biotech Stocks (Barron’s)

- How China Slowed Coronavirus: Lockdowns, Surveillance, Enforcers (Wall Street Journal)

- Inside Saudi Arabia’s Decision to Launch an Oil-Price War (Wall Street Journal)

- Here’s why people are panic buying and stockpiling toilet paper (CNBC)

- The Bank of England cut rates by 0.5% in an emergency coronavirus response, mirroring the Fed. Business Insider)

- China’s Stocks Have Recouped Most Coronavirus Losses. Key Points to Watch for the U.S. (Barron’s)

- Goldman Sachs analyzed bear markets back to 1835, and here’s the bad news — and the good — about the current slump (MarketWatch)

i24News TV Appearance on Monday (Video)

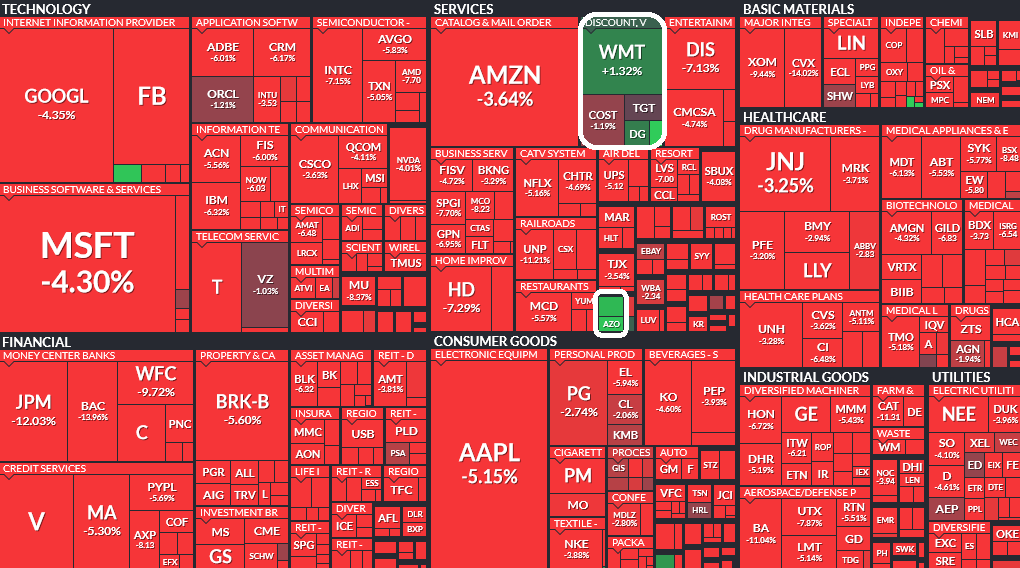

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

- Oil jumps after rout on stimulus hopes, Russian signal on OPEC talks (Reuters)

- Global Markets Are Rising After Trump Hints at Tax Cut Over Coronavirus (Barron’s)

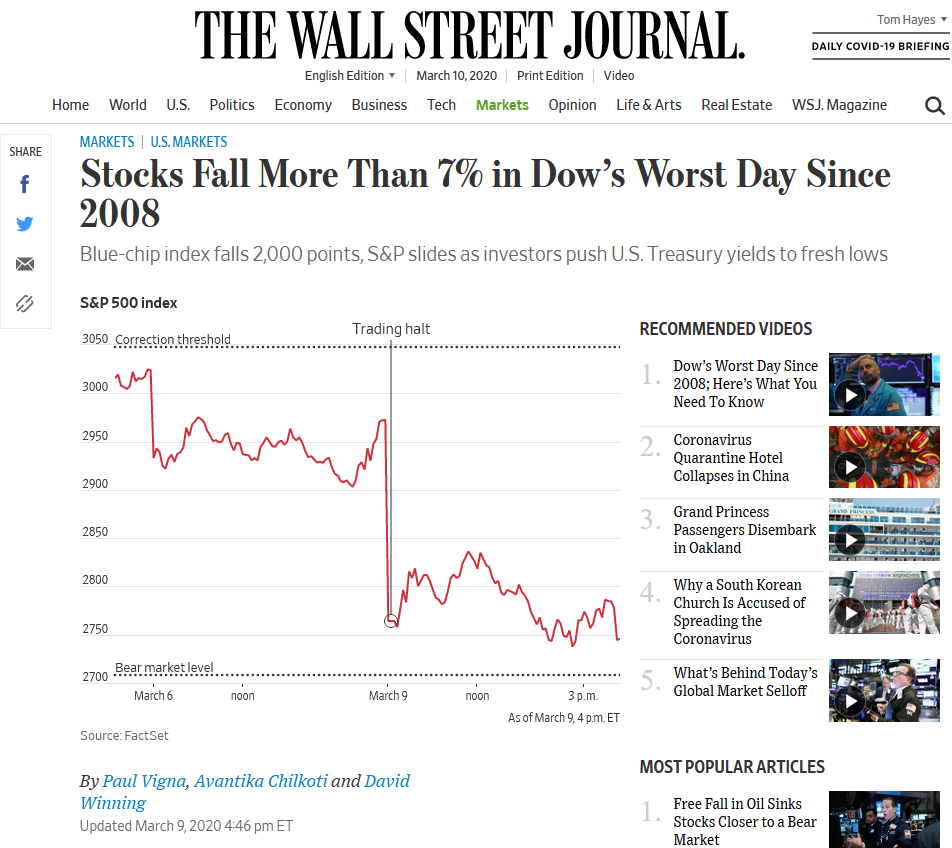

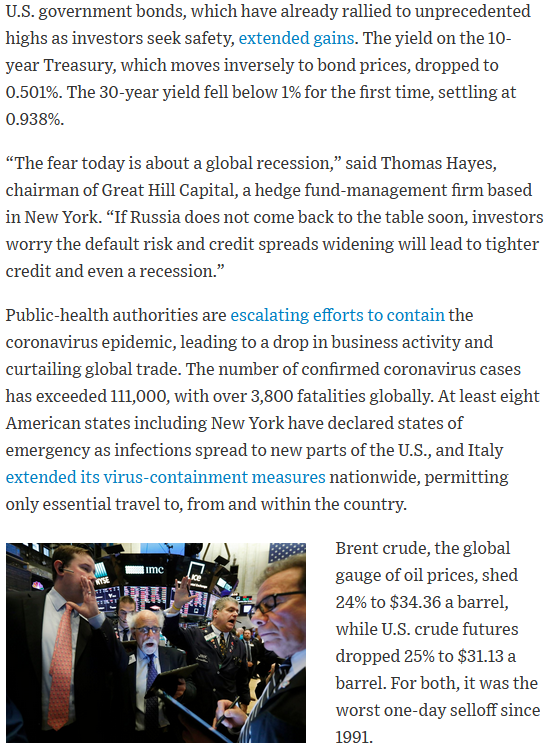

- Stocks Fall More Than 7% in Dow’s Worst Day Since 2008 (Wall Street Journal)

- The Fed Offers Repo Market $50 Billion More to Ease Rate Pressure (Barron’s)

- Russia’s Oil War Has a Political Objective, Says Analyst (Barron’s)

- Interesting: Bullish Percent Transports (Hedge Fund Tips)

- High-Yield Bonds Are Sinking as Bankruptcy Fears Hit the Oil Patch (Barron’s)

- How a Saudi-Russian Standoff Sent Oil Markets Into a Frenzy New York Times)

- As Stock Markets Plunge, Trump Calls for Economic Response to Coronavirus (New York Times)

- Why falling oil prices could boost the Marcellus Shale (Yahoo! Finance)

- Treasurys plunge as Trump floats payroll tax cut amid coronavirus maelstrom (Fox Business)

- Wall Street CEOs to meet at White House (Fox Business)

- New Jersey’s Investment Chief Wants Talent. Here’s How He’ll Get It. (Institutional Investor)

- Lloyd Blankfein Predicts ‘Quick Recovery’ For Markets (Benzinga)

- Cabot Oil & Gas Is One Company Rising in Oil-Sector Carnage (Yahoo! Finance)

- The economy is ‘like a coiled spring’ and a sharp rebound is possible, analysts predict (CNBC)

- Russia to Start Foreign Currency Sales After Ruble Wipeout (Bloomberg)

- These Energy Stocks Were Lighter Than Air Monday (Wall Street Journal)

- Trump Surprised Staff With Vow to Detail Virus Aid Package Today (Bloomberg)

- How the Federal Reserve Can Ease the Coronavirus Panic (Wall Street Journal)

My quotes in the Wall Street Journal today:

Thanks to Yu XIE, Paul Vigna, Avantika Chilkoti and David Winning for including me in their article in the The Wall Street Journal today:

“Stocks Fall More Than 7% in Dow’s Worst Day Since 2008” You can read it here:

Click Here to View The Full Article at The Wall Street Journal

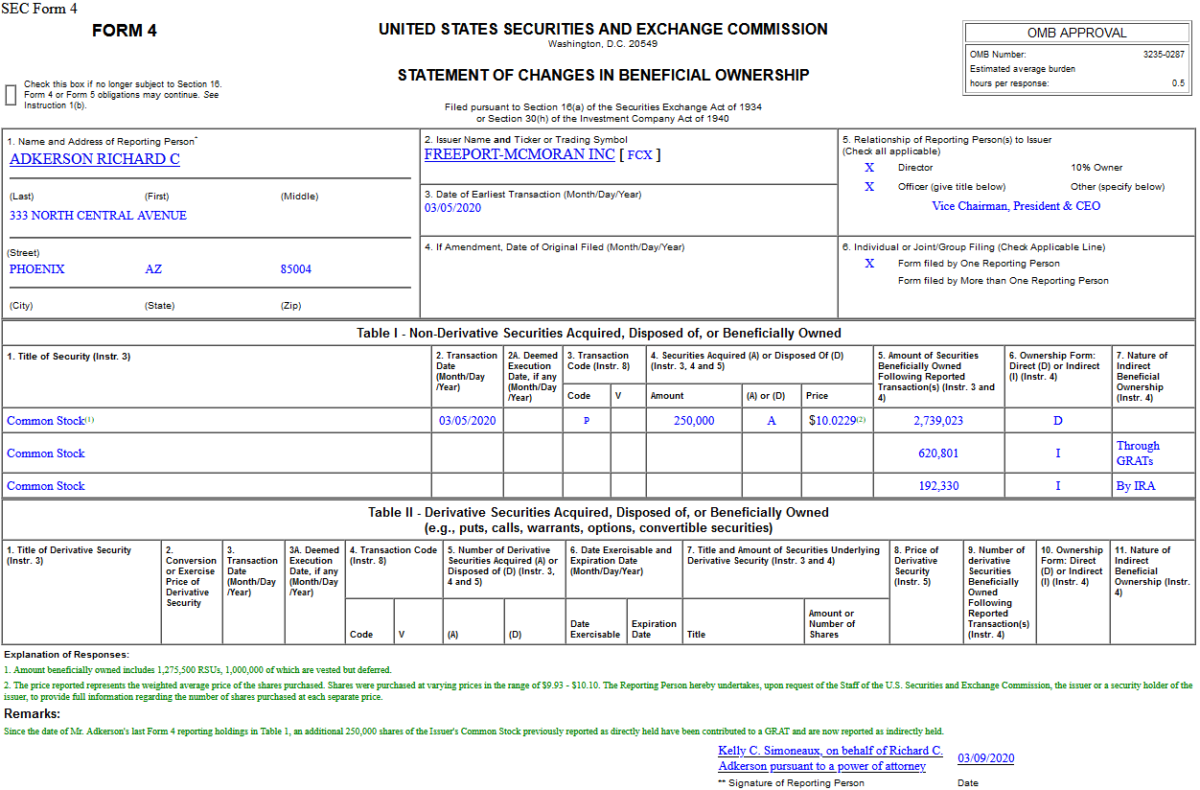

Insider Buying in Freeport-McMoRan Inc. (FCX)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Monday…

- NY Fed raises repo limits to ensure ample supply of bank reserves (Reuters)

- Never Mind The Stock Market. The Real Pain Will Be in the Credit Markets. (Barron’s)

- Hedge-fund manager who called the coronavirus market meltdown says selloff is overdone, covers shorts (MarketWatch)

- How the Trump Campaign Took Over the G.O.P. (New York Times)

- Saudi Aramco shares dive, Gulf debt hit as oil price plunges (Reuters)

- Putin Dumps MBS to Start a War on America’s Shale Oil Industry (Yahoo! Finance)

- Virtu Financial founder says stock market is ‘one big opportunity right now’ (CNBC)

- How Tupperware Lost Its Grip on America’s Kitchens (Wall Street Journal)

- All Your Coronavirus Travel Questions Answered (Wall Street Journal)

- What’s Your Workout? A Huge Leap to Replace the Rush of Ice Hockey (Wall Street Journal)