- HIV drugs are being used as part of coronavirus treatment (New York Post)

- Here’s What Could Help Calm Markets, According to Wall Street’s Best Minds (Barron’s)

- U.S. Stock Futures and European Equities Surge as Markets Try to Stabilize After Historic Meltdown (Barron’s)

- It’s Time for Warren Buffett to Get Greedy. Here’s What He Might Be Looking to Buy. (Barron’s)

- ‘This Is All Coming to a Head’: Investors React to Market Chaos (Bloomberg)

- Mohamed El-Erian: The stock market looks ‘less scary’ (CNBC)

- Fed to Inject $1.5 Trillion in Bid to Prevent ‘Unusual Disruptions’ in Markets (Wall Street Journal)

- New Coronavirus Test 10 Times Faster Is FDA Approved (Bloomberg)

- Germany Pledges Unlimited Cash as EU Set to Green Light Spending (Bloomberg)

- Oracle earnings show best revenue growth in nearly two years (MarketWatch)

- 11. Trump’s $800 billion payroll tax cut plan would dwarf Obama’s stimulus package from the height of the financial crisis (Business Insider)

- What Warren Buffett thinks of his Occidental investment after shares crashed with oil prices (Yahoo! Finance)

- Time to Buy, Says GMO (Institutional Investor)

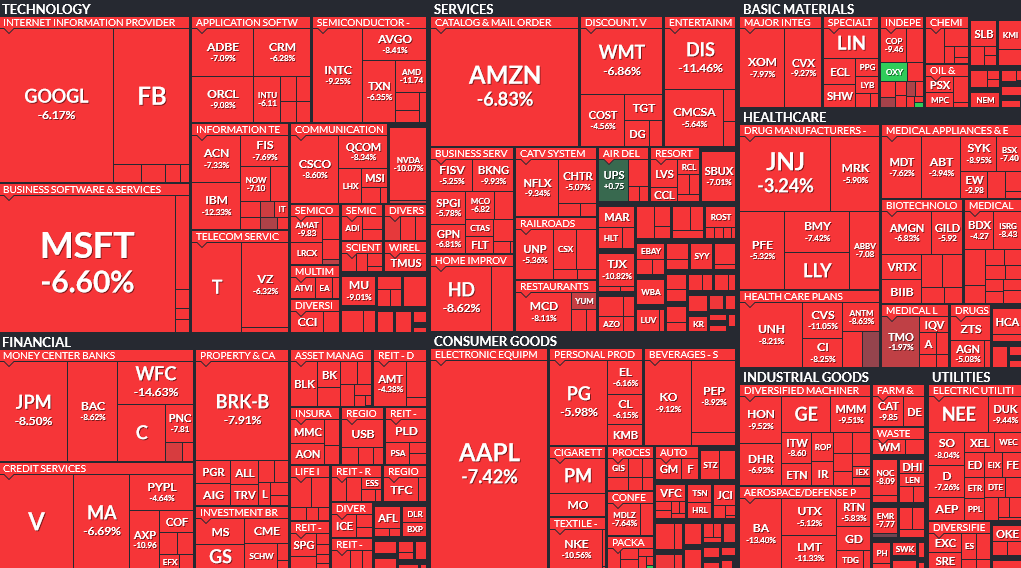

Where is money flowing today?

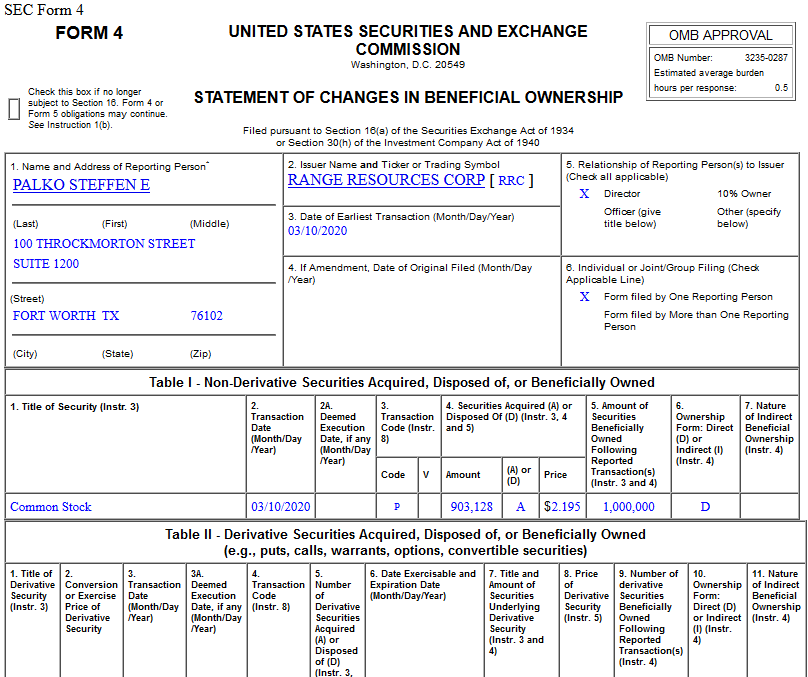

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 13 key reads for Thursday…

- Carl Icahn Boosts Occidental Stake to Almost 10% as Shares Plummet (Wall Street Journal)

- Can Gilead’s Virus Test Results Cure Broader Stock Market Woes? (Investor’s Business Daily)

- Let’s Talk About Coronavirus Bailouts, Before We Need Them (New York Times)

- Stocks Plunge With Virus Response Missing Mark (Bloomberg)

- 21 Stocks To Buy In a Virus Economy (Barron’s)

- Markets Are in Turmoil. Buy These Stocks, Jefferies Says (Barron’s)

- The losers — and even bigger losers — of an oil price war between Saudi Arabia and Russia (CNBC)

- Here’s how Invesco’s top strategist says long-term investors should navigate this market panic (MarketWatch)

- Buffett and Occidental: We’ve Seen This Movie Before (Wall Street Journal)

- Oil Price Shock on Top of Coronavirus Compounding Sovereign Credit Risks (24/7 Wall Street)

- ECB approves fresh stimulus for reeling economy but keeps rates steady (Reuters)

- Private Equity Firms Won’t Waste Another Crisis (Institutional Investor)

- What Warren Buffett thinks of his Occidental investment after shares crashed with oil prices (Yahoo! Finance)

The “Sky is Falling” Stock Market? (and Sentiment Results)…

I went on Yahoo! Finance yesterday immediately following the “Bankers Meeting” at the White House. What is happening with Coronavirus and OPEC+ is serious. However, there are some stocks Continue reading “The “Sky is Falling” Stock Market? (and Sentiment Results)…”

Yahoo! Finance TV Appearance on Wednesday (Video)

Watch the segment directly on Yahoo! Finance Here

Highlight: “We were buying some stocks today,†@HedgeFundTips says. “When you see such a quick, fast dislocation, you take the amount of cash that you wanna put to work and you break it up into 5 or 10 different slugs.†Talks about Pfizer, Berkshire Hathaway and Wells Fargo. pic.twitter.com/2JvODQm1wk

— Yahoo Finance (@YahooFinance) March 11, 2020

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 1,000 contracts of Oct $50 strike calls (or the right to buy 100,000 shares of Exxon Mobil Corporation (XOM) at $50). The open interest was just 600 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”