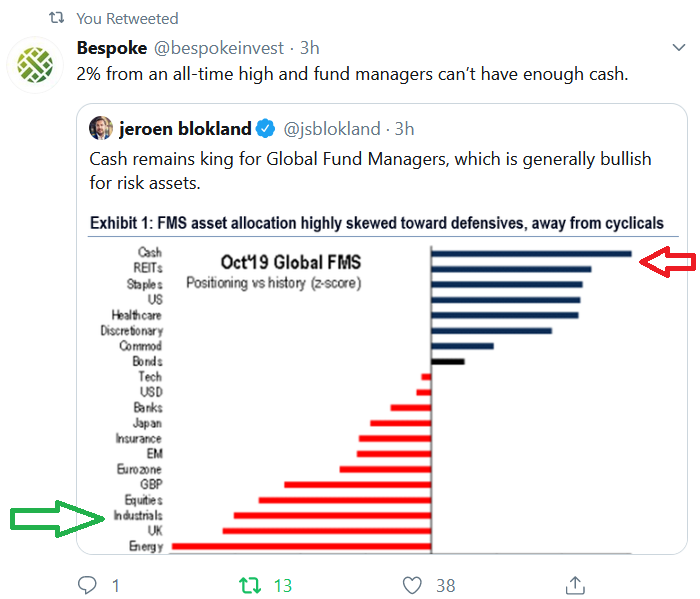

I have posted the October BAML (Bank of America Merrill Lynch) global fund manager survey above. Hat tip to Paul Hickey at Bespoke and Jeroen Blokland for tweeting it out this morning. Continue reading “BAML Global Fund Manager Survey: Slippery When Wet”

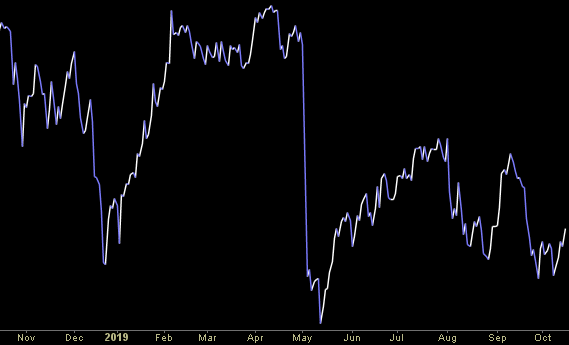

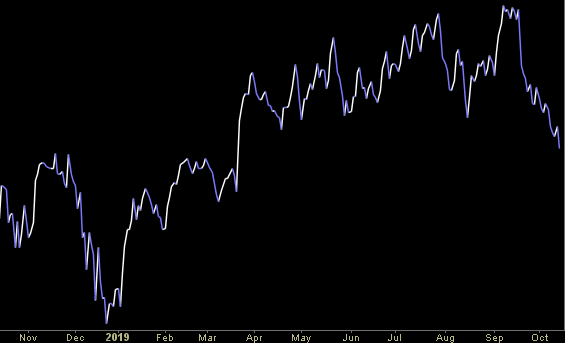

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Tuesday…

- JPMorgan (JPM) Tops Q3 EPS by 23c, Offers Outlook (Street Insider)

- Fed’s Bullard: Risks remain high and Fed is on a ‘meeting by meeting’ basis (CNBC)

- UnitedHealth Stock Is Up After ‘Medicare for All’ Political Risk Fails to Dent Earnings (Barron’s)

- Industrial Stocks Look Bad but Some See a Return to Growth by Mid-2020 (Barron’s)

- The Biotech Sector Is Lagging. Blame Gene Therapy Stocks, Analysts Say. (Barron’s)

- European stocks nudge higher on Barnier’s Brexit optimism (MarketWatch)

- Prescription drugs boost drives J&J forecasts higher, shares rise (Reuters)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – Dell Technologies Inc. (DELL)

Today some institution/fund purchased 2,811 contracts of Dec $57.5 strike calls (or the right to buy 281,100 shares of Dell Technologies Inc. (DELL) at $57.5). The open interest was just 750 prior to this purchase. Continue reading “Unusual Options Activity – Dell Technologies Inc. (DELL)”

Where is money flowing today?

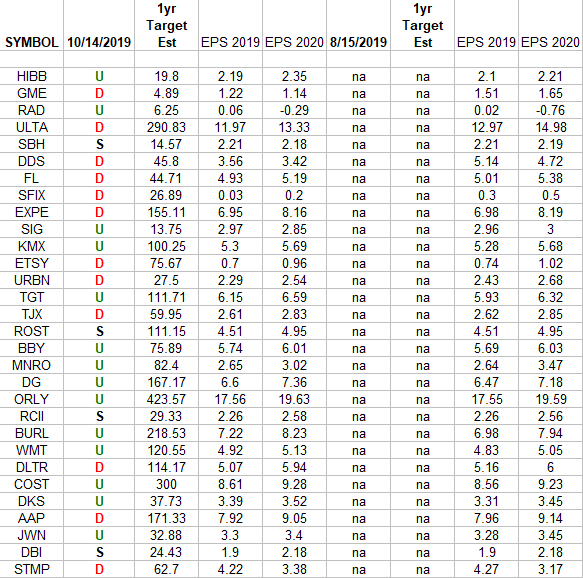

Retail Sector Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Sector Earnings Estimates/Revisions”

Be in the know. 8 key reads for Monday…

- The S&P 500 Earnings Outlook Is Terrible. It’s Not as Bad as It Looks. (Barron’s)

- China September exports, imports in deeper contraction as tariffs take toll (Reuters)

- Peak Shale: How U.S. Oil Output Went From Explosive to Sluggish (Yahoo! Finance)

- Private-equity deals depress worker wages, study finds (MarketWatch)

- ‘If You Ever Do That to Me Again, I’m Going to Kill You.’ (Institutional Investor)

- Blackstone Talked With Ken Griffin’s Citadel About Buying Stake (Wall Street Journal)

- Apple’s ‘key growth driver’ in 2020 will be a new $399 iPhone, top analyst says CNBC)

- Western Digital upgraded to Buy from Hold at Loop Capital (TheFly)