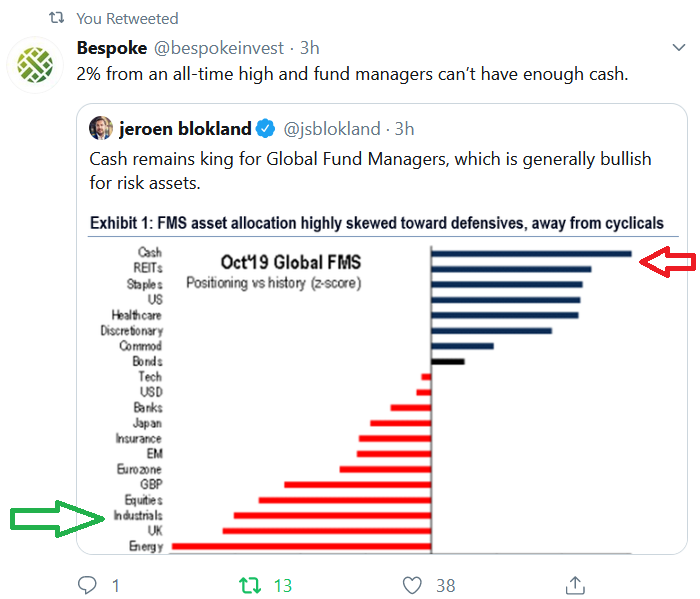

I have posted the October BAML (Bank of America Merrill Lynch) global fund manager survey above. Hat tip to Paul Hickey at Bespoke and Jeroen Blokland for tweeting it out this morning.

The BAML survey is among the most important data points each month (in my view). It generally pays to take the other side of extremes (in the intermediate term) – and in this case it implies there may be some opportunity coming up in Energy.

No one wants to touch this “slippery” sector. This level of pessimism reminds me of Spring 2016 when WTI Crude was trading down to ~$30/bbl. At that point, many commentators came out calling for $10/bbl. That was to point of max pessimism, and by June most E&P stocks were up ~75% off of their lows.

I posted a related article on Energy this weekend entitled “Snake OIL? How Portfolio Managers View Exploration & Production Stocks.” You can find it here:

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…