- What Trade War? Meet The Brilliant Quant Who’s Bullish On China (Forbes)

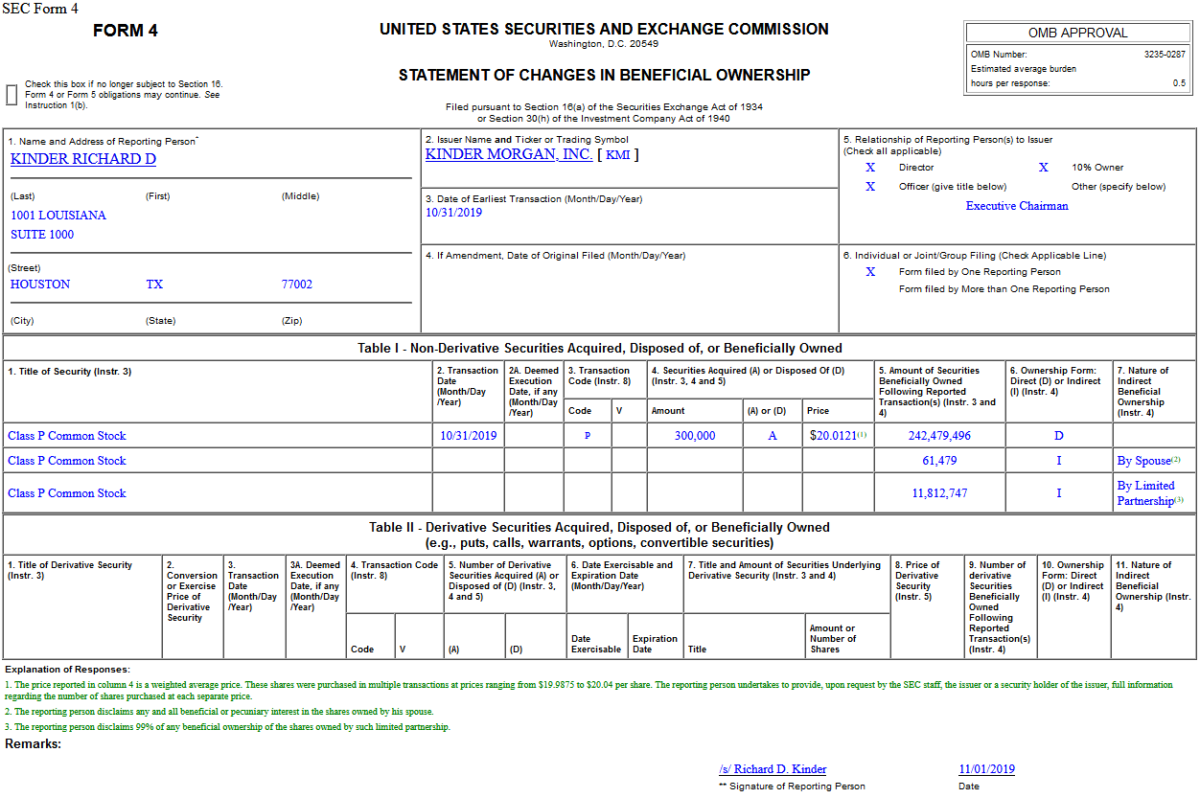

- Hedge Fund and Insider Trading News: Jim Simons, Nelson Peltz, Baker Bros. Advisors, Facebook Inc (FB), Covenant Transportation Group, Inc. (CVTI), and More (Insider Monkey)

- Edward Norton — On Creative Process, Creative Struggle, and Motherless Brooklyn (#393) (Tim Ferriss)

- U.S. net natural gas exports in first-half 2019 doubles year-ago levels for second year (EIA)

- How to Bet on China — and Manage the Risks (Barron’s)

- This ‘Perfect’ Jobs Report Looks Like a Game-Changer (Barron’s)

- Qorvo Stock Soars After Its 5G Chip Gains Wow the Street (Barron’s)

- Health-Insurance Stocks Rise as Elizabeth Warren Details Plan for Medicare for All (Barron’s)

- Investors to Big Oil: Make It Rain (Wall Street Journal)

- China says it’s reached a consensus in principle with the US during this week’s trade talks (CNBC)

- Saudi Crown Prince Gives Green Light for Aramco IPO (Bloomberg)

- How Jim Simons Built the World’s Most Lucrative Black Box (Bloomberg)

- How to Use Occam’s Razor Without Getting Cut (Farnam Street)

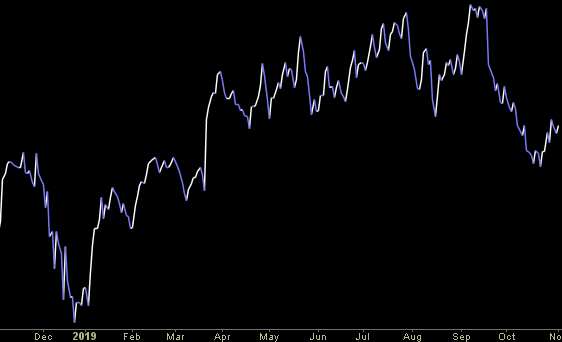

- The Most Bullish Signal in the World (The Irrelevant Investor)

- There’s Never Been a Better Time to Be an Individual Investor. Here’s Why (Fortune)

- Selling Early Is Not The Problem For Legends (Howard Lindzon)

- The Cirrus Vision Jet Can Now Land Itself With the Push of a Button (Robb Report)

- Google’s Fitbit purchase could reshape its healthcare ambitions (TechCrunch)

- SHoP architects tops out slender central park skyscraper, 111 west 57th street (DesignBoom)

- Merrill Lynch Says 4 Broken 2019 IPOs May Have Huge Potential Upside (24/7 Wall Street)

TOP ARTICLE OF THE WEEK: