“O Sole Mio” was composed by Eduardo Di Capua in Odessa during April 1898. He later sold the rights of the song to the Bideri publishing house for 25 lire. It has had many renderings and iterations, but recently is most widely known for its performance by the Three Tenors; Plácido Domingo, José Carreras and Luciano Pavarotti.

The salient lyrics that apply to today’s Stock Market environment are:

Che bella cosa na jurnata ‘e sole,

N’aria serena doppo na tempesta!

Pe’ ll’aria fresca pare già na festa…

Which Google Translates to:

What a beautiful thing na day and sun,

It looks serene after the storm!

The fresh air looks like a party…

Watch the Three Tenors Perform “O Sole Mio” Here

In stark contrast to the solo artist we featured in last week’s article (which was among our highest trafficked of the year),

The Kenny Chesney “Everything’s Gonna Be Alright” Stock Market: (AAII Sentiment Survey)

this week’s note is all about harmony and melody – what can be accomplished when three voices sing as one.

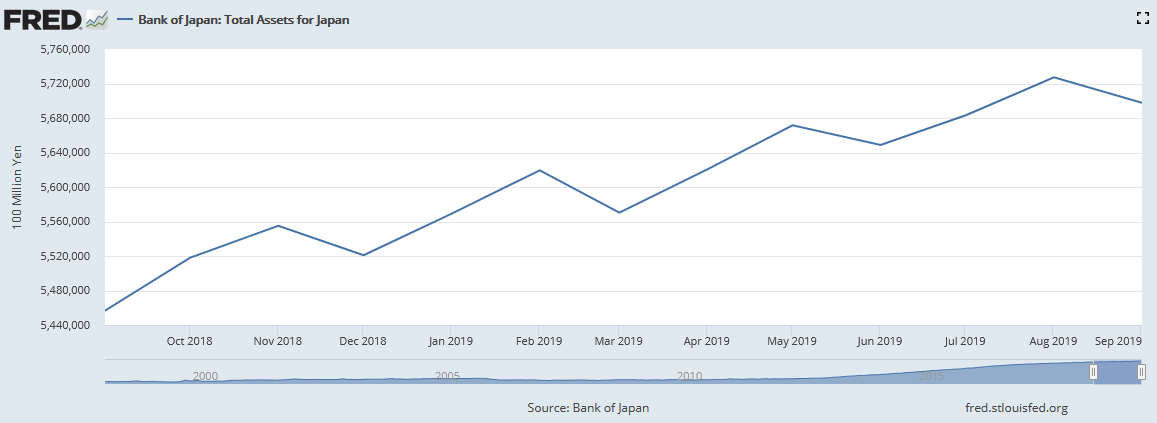

Those three market voices are Regional Central Bank Heads: Jerome Powell (Fed), Christene Lagard (ECB), and Haruhiko Kuroda (BoJ). In the past year, Kuroda kept his foot on the gas, but his two partners (the ECB and the Fed) abandoned him on stage – and he struggled to hold a note on his own.

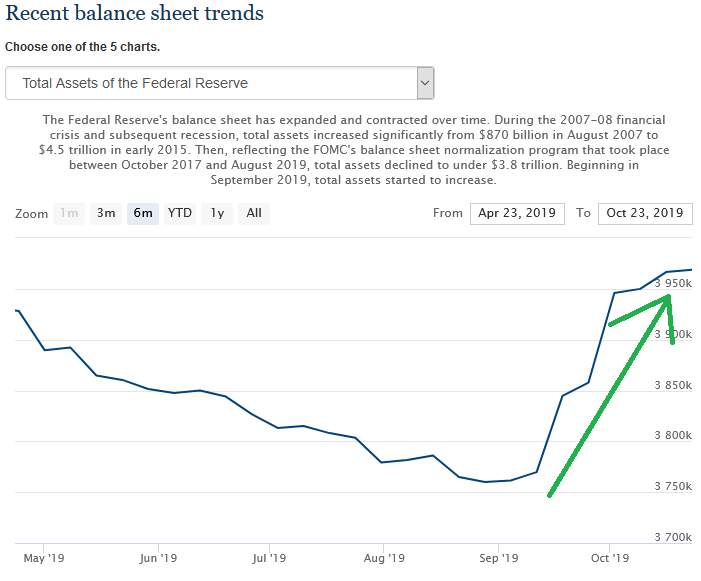

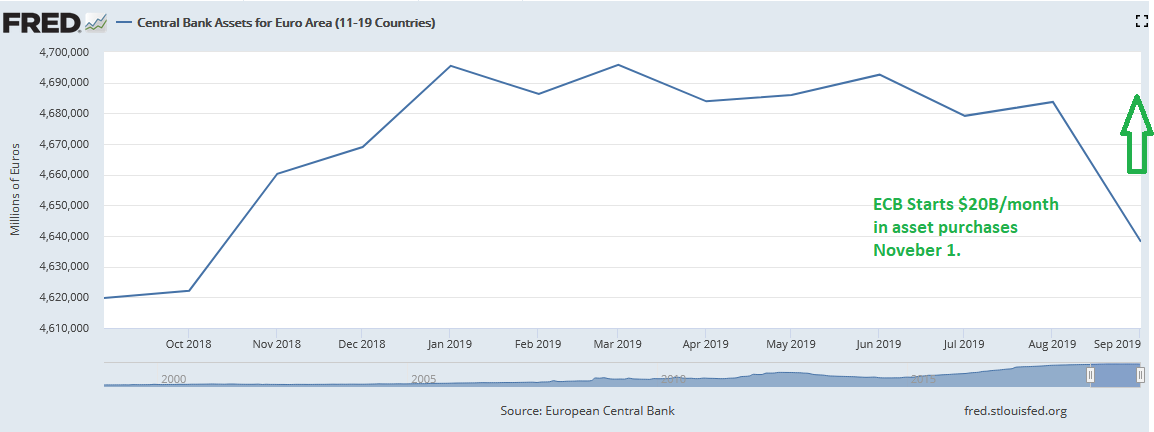

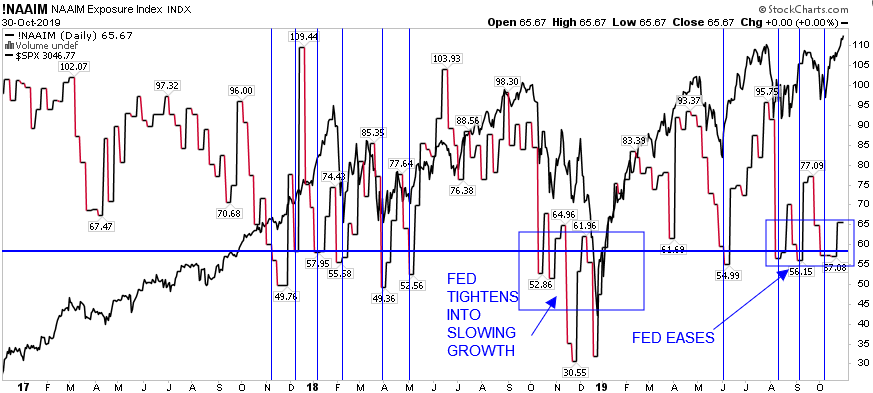

In recent weeks, the Fed has rejoined the party by restoring liquidity to the tune of > $200B since early September. The ECB starts $20B/month on November first, and Japan will stand pat at the wheel. The ensemble is back together and intend to make the kind of beautiful music that characterized the rising equity markets from 2009-2017 before the group broke up for the past two years (Fed tightened too aggressively for too long, ECB shrunk its balance sheet into slowing growth – and the markets churned sideways for nearly two years). Or as the Di Caupa so aptly noted, “It (now) looks serene after the storm! The fresh air looks like a party…”

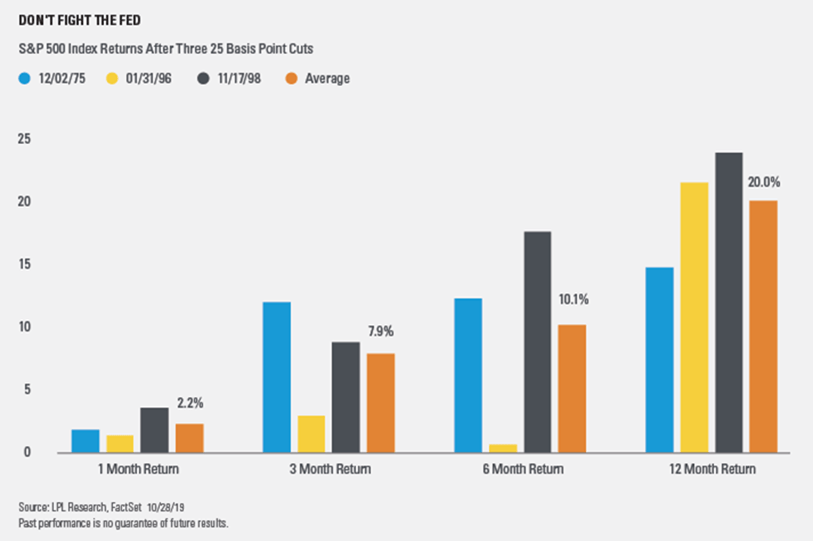

So now that Fed Chair Powell has done his job to get us back on track with three consecutive cuts (and hold) – as Greenspan successfully accomplished in 1995 and 1998 to squeeze some more time out of the cycle – and Lagarde and Kuroda have the pedal to the medal – we are finally set to break out to new highs after a long sideways consolidation. If you think it is unnatural to expand beyond 10 years, I penned a note in July that has had a recent resurgence in traffic over the past week or so. You may find it helpful:

Here’s what is happening in global liquidity:

The Fed is back in the game as we noted in this article three weeks ago:

Here’s the latest on the Fed’s balance sheet:

The BoJ never left the game:

And the ECB will start playing catch up at an initial pace of $20B per month.

And the ECB will start playing catch up at an initial pace of $20B per month.

We have been consistent in our view since mid-August (when pessimism was at its highest), that it was an opportunity to take equity exposure up while money was pouring into Bonds. You can review our notes here:

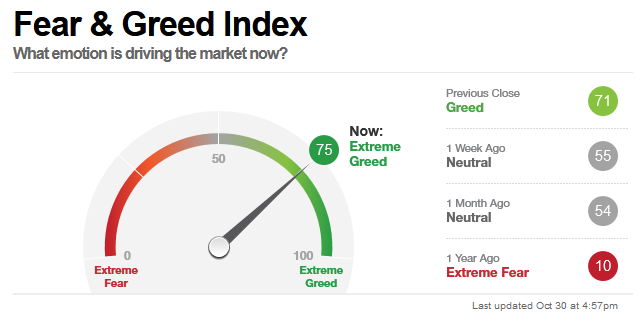

Last week we said we would get more conservative when the AAII Sentiment Survey’s “Bullish Percent” moved into the low to mid-40’s and CNN’s Fear and Greed Index moved above 75-80.

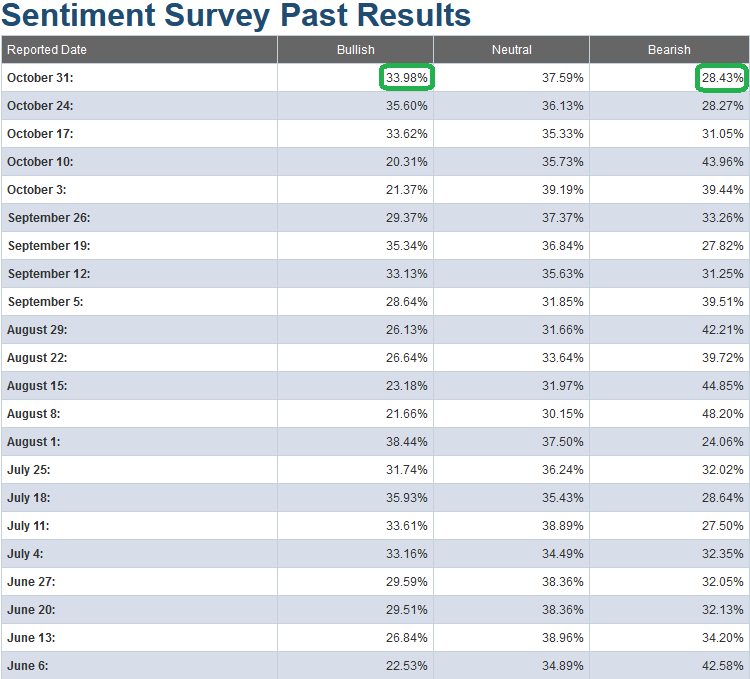

This week’s AAII Sentiment Survey result (Video Explanation) came in at 33.98%, slightly down from 35.60% last week. Bearish Percent rose a hair to 28.43% from 28.27% last week.

CNN’s Fear and Greed Index – which is a compilation of 7 different sentiment and positioning indicators – jumped up 20 points week on week (from 55% to 75%). You can learn how this indicator is calculated and how it works here: (Video Explanation).

This is a mixed read. While CNN’s Fear and Greed is at caution levels, AAII Sentiment shows plenty of room to run. We are there on F&G, however, being more conservative means “hold what you have” and potentially harvest some positions (or portions of positions) with big gains. Add selectively only in names of laggard sectors that can play catch-up into year end like Biotech (which has already had a nice move off the lows), and the Exploration and Production sub-sector that is trying to catch a bid. We wrote about the potential opportunity in both groups in recent weeks (biotech has already had a nice move, the E&P sector (XOP) is up very modestly, but could change overnight with a Phase 1 deal signature):

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…

While we believe this breakout is durable – with 2020 earnings estimates still hovering around double digit growth (see Friday’s note below) – and the discount rate used to value those future earnings affording potential multiple expansion, it’s still not the time to be a pig at the trough (in all sectors).

The time to be a pig (for general indices) was in August – and even as late as October 10 (when bullish sentiment was at 20.31%) when Frank and Jerome said, “The Best Is Yet to Come” in our note:

Frank & Jerome (The Chairmen) agree: The Best is Yet to Come (AAII Sentiment Results)

It’s the time to run with most of what you’ve got – and if you’re off sides – figure out a way to get your exposure into year end (potentially buying groups/companies that have only participated modestly or are just starting to see a rotation). The factors I have laid out set the table for what I started calling for on September 5 – a possibility to “Melt Up” into year end as we broke out to new highs:

AAII Sentiment Survey Results: Pessimism Strong, Opportunity Stronger…

Well now we are here, and everyone who is still underweight equities will have to chase. The likely near term move is a mini-shakeout to rattle the new money from the last week or so that is “late to the party.” Once the weak hands are back out it is a reasonable probability that we can melt-up higher into year-end. That said, when everyone’s waiting for a pullback to buy, you might not get it…

The National Association of Active Investment Managers (NAAIM) Equity Exposure Index (Video Explanation Here) reading this week confirmed that active managers are still underweight equities (relative to bonds and cash) at just 65%. They were not positioned properly for this breakout to new highs (as we noted from the BaML Global Fund Manager Survey several weeks ago).

They will likely be tested with a quick shakeout to assess their meddle in coming days/week – as the late money usually is…

The stubborn managers will miss that opportunity to play catch up and then have to chase like maniacs to make their year.

President Trump has the “all-clear” to sign his Phase 1 deal with Xi Jinping – now that the three cuts are in. He (and the market) knows there’s not more (cuts) behind it. The rest is up to President Trump now (and the balance sheet expansion behind the scenes). He played chicken with Powell and won (ultimately they both won because Powell caught his error in the “nick of time” and bought us another year or so to run).

So, you couple better than expected current earnings, solid forward growth estimates, a lower discount rate leading to multiple expansion and maybe toss in a little Dollar weakness and you have “O Sole Mio” or “My Own sunshine” after the storm…

Time to make hay while the sun shines…

(Source: LPL)