Data Source: Factset

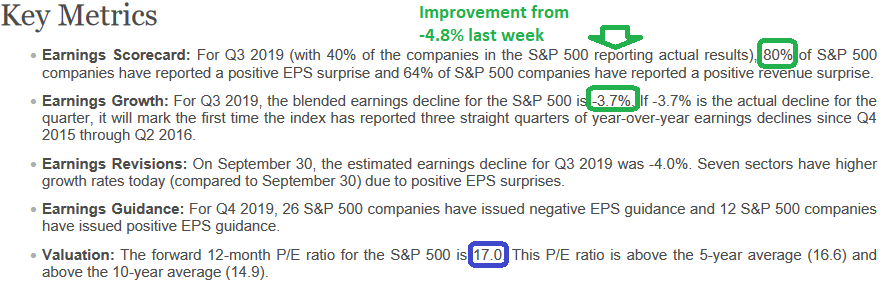

Last week, Q3 Earnings estimates for the S&P 500 dropped down to -4.8%. This week they have already recovered 1.1% to -3.7% expectations. The average recovery during a quarter is 3.7% and with 60% of the S&P 500 left to report, that looks well within the realm of possibility.

We are holding at an 80% earnings beat rate – which is above the 5 year average of 72%. Negative Guidance for Q4 is Below Average to date by around 2% better than the 5 year average.

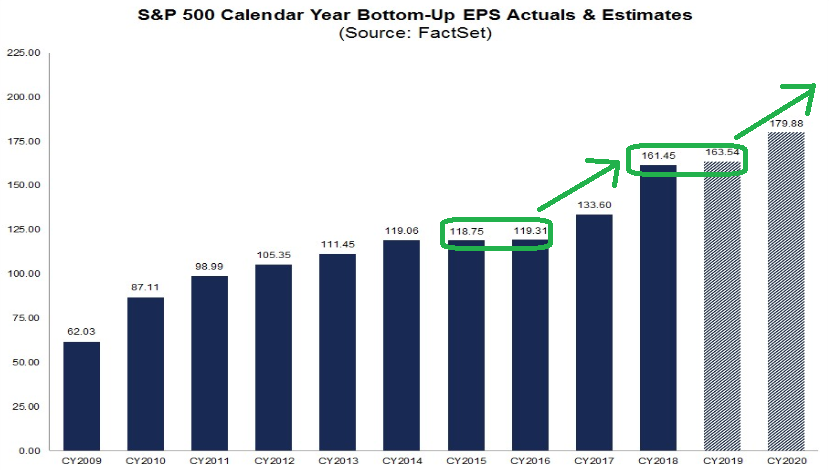

Calendar year 2020 estimates came down .50% to 9.9% – which will be the first jump in earnings growth since 2017.

Analysts have pinned the 12 month bottoms up price target for the S&P 500 at 3328.66 – which would be a 10.6% jump from Friday’s close. This implies they are starting to factor in multiple expansion moving forward (which makes sense considering the discount rate for those earnings will have come down by 75bps before the end of the year).

While the Energy sector has been the worst performer for Q3 at -39.3% earnings decline year on year (rear view mirror data), they are projected to have the highest earnings growth of any sector for 2020 (projected +25.9%).

Our most read article of two weeks ago – addressed this opportunity. You can read it here:

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…

The punchline remains, 2020 estimates are still holding strong at 179.88. If we get 75% of what is estimated (growth rate), coupled with multiple expansion that would be consistent with this renewed growth – we may find that the consensus 12 month target price for the S&P 500 is in fact, conservative.

We cover this possibility extensively in our most recent article on Market Sentiment and Positioning – published just 2 days ago. You can read it here:

The Kenny Chesney “Everything’s Gonna Be Alright” Stock Market: (AAII Sentiment Survey)