- Value Finally Trumps Fear for Health Stocks (Wall Street Journal)

- Bank of America Joins the Earnings Party. Strong Profits Push Up the Stock. (Barron’s)

- Hedge Fund and Insider Trading News: Ken Fisher, D.E. Shaw, Dalton Investments, Safehold Inc (SAFE), ResMed Inc. (RMD), and More (Insider Monkey)

- Jefferies Very Positive on 4 Top Internet Stocks in Front of Q3 Results (24/7 Wall Street)

- British Tech Firms Bought Up by Foreign Buyers After the Vote to Leave (Bloomberg)

- How Former Hollywood Mogul Barry Diller Built A $4.2 Billion Tech Fortune Out Of Underdog Assets (Forbes)

- Leon Cooperman says there is ‘one more leg’ higher for the bull market before it ends (CNBC)

- Long-Term Inflation Expectations Hit Record Low: N.Y. Fed (Wall Street Journal)

- Mall Short Seller Shuts Down Before the Malls He Bet Against (Wall Street Journal)

- Bullard Sees Trade Turmoil as ‘Pandora’s Box’ Risk to Economy (Bloomberg)

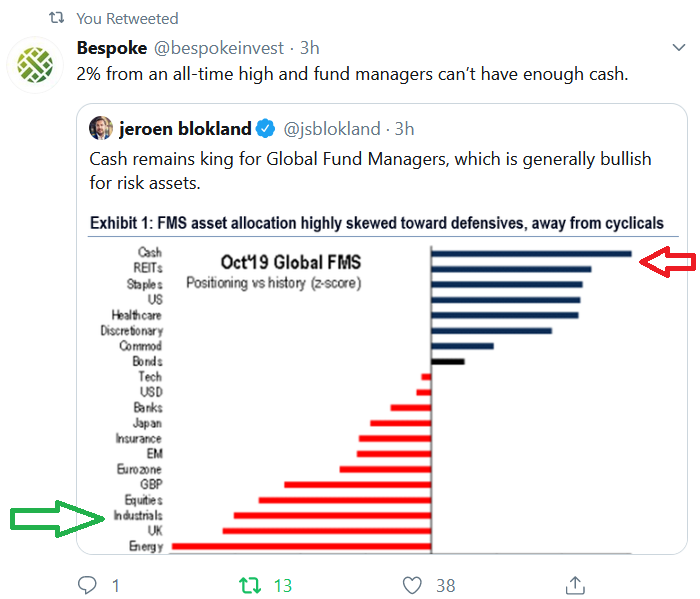

Unusual Options Activity – ConocoPhillips (COP)

Data Source: barchart

Today some institution/fund purchased 1,307 contracts of May $52.5 strike calls (or the right to buy 130,700 shares of ConocoPhillips (COP) at $52.50). The open interest was just 283 prior to this purchase. Continue reading “Unusual Options Activity – ConocoPhillips (COP)”

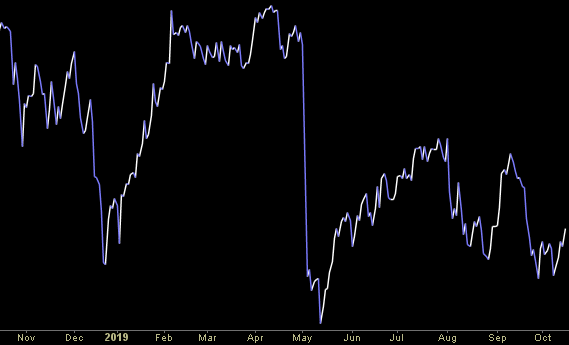

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

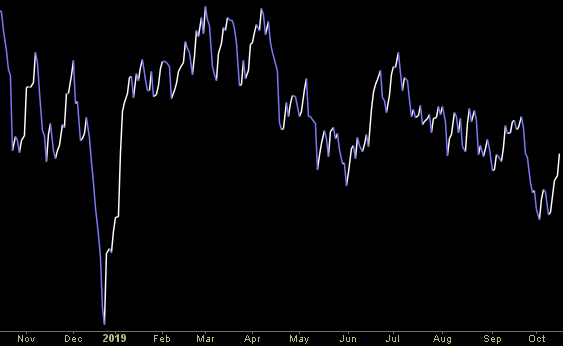

BAML Global Fund Manager Survey: Slippery When Wet

I have posted the October BAML (Bank of America Merrill Lynch) global fund manager survey above. Hat tip to Paul Hickey at Bespoke and Jeroen Blokland for tweeting it out this morning. Continue reading “BAML Global Fund Manager Survey: Slippery When Wet”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Tuesday…

- JPMorgan (JPM) Tops Q3 EPS by 23c, Offers Outlook (Street Insider)

- Fed’s Bullard: Risks remain high and Fed is on a ‘meeting by meeting’ basis (CNBC)

- UnitedHealth Stock Is Up After ‘Medicare for All’ Political Risk Fails to Dent Earnings (Barron’s)

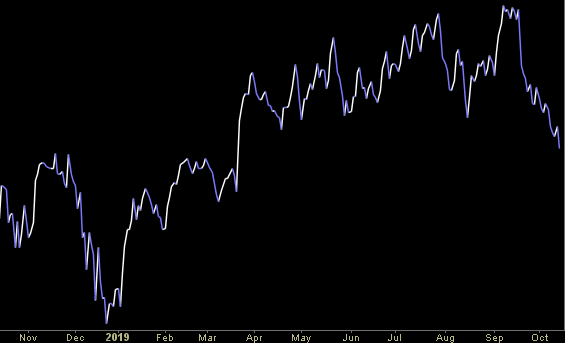

- Industrial Stocks Look Bad but Some See a Return to Growth by Mid-2020 (Barron’s)

- The Biotech Sector Is Lagging. Blame Gene Therapy Stocks, Analysts Say. (Barron’s)

- European stocks nudge higher on Barnier’s Brexit optimism (MarketWatch)

- Prescription drugs boost drives J&J forecasts higher, shares rise (Reuters)