Be in the know. 7 key reads for Thursday…

- Hedge Fund and Insider Trading News: Ray Dalio, Steven Cohen, Elliott Management, Woodford Investment Management, Chemed Corporation (CHE), Neogen Corporation (NEOG), and More (Insider Monkey)

- U.S. weekly jobless claims fall; labor market strong (Reuters)

- Japan greenlights first South Korea export since July curbs, but with a warning (Reuters)

- `90210’ is back: Is revived series any good? (USA Today)

- Bears Lose Even on Down Days (Wall Street Journal)

- Tilson Still Bullish After Lumber Liquidators Stock Falls 40% (ValueWalk)

- 3 Stocks for a China First Investment Strategy (Barron’s)

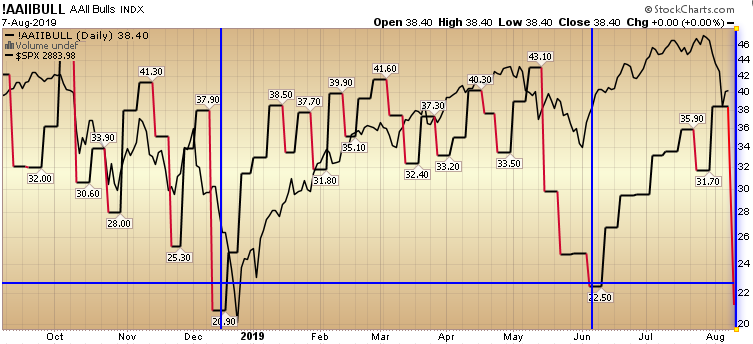

AAII Sentiment Survey Results: What a Difference a Week Makes…

Source: AAII

Last week we had hit full complacency levels on the Bearish Percent which had plummeted down to 24.06%. We did not however get to euphoric levels of bullishness – coming in a couple of percent shy at 38.44%. What a difference a week makes: Continue reading “AAII Sentiment Survey Results: What a Difference a Week Makes…”

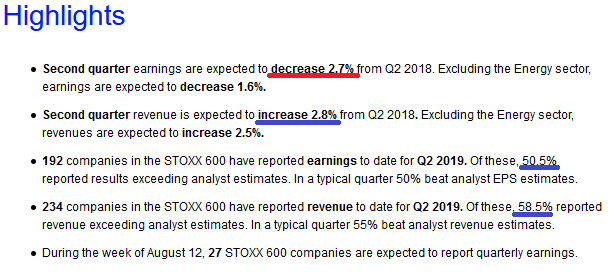

European (Stoxx 600) Q2 Earnings Estimates Drop

Data Source: Thomson Reuters

European (Stoxx 600) Q2 earnings estimates dropped -3.3% this week (to -2.7% from +.6%). You can see last week’s results here: Continue reading “European (Stoxx 600) Q2 Earnings Estimates Drop”

Unusual Options Activity – Wells Fargo & Company (WFC)

Today some institution/fund purchased 20,470 contracts of January 2021 $30 strike calls (or the right to buy 2,047,000 shares of Wells Fargo & Company (WFC) at $30). The open interest was just 3,445 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

Insider Buying in Mohawk Industries, Inc. (MHK)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 5 key reads for Wednesday…

- The Federal Reserve Will Keep Cutting Interest Rates. Thank the Trade War. (Barron’s)

- CVS Health (CVS) Tops Q2 EPS by 20c, Raises FY Guidance (StreetInsider)

- Billionaire Harold Hamm (who owns 76.57% of the stock) said Continental’s (CLR) latest share buyback program goal is to purchase stock that’s undervalued and will ultimately return value to where it should be fairly traded: (Yahoo Finance)

- Ray Dalio calls for investors to back China or miss out on the next global empire (Business Insider)

- Hedge Fund and Insider Trading News: Bill Ackman, Richard Perry, Elliott Management, Amazon.com, Inc. (AMZN), Ford Motor Company (F), and More (Insider Monkey)