Be in the know. 7 key reads for Tuesday…

- Wells Fargo earnings blow past estimates (MarketWatch)

- JPMorgan profit beats estimates on strength in consumer banking (Reuters)

- Johnson & Johnson beats profit estimates on pharma strength, raises sales outlook ()

- Goldman Sachs earnings blow past Wall Street on strong investment banking, trading results (CNBC)

- Citigroup Reports Higher Earnings as Bank Results Begin (Wall Street Journal)

- The Future of Interactive Sports on a Brooklyn Race Course (Barron’s)

- The Overplayed, Turbohyped, and Underwhelming World of Artificial Intelligence (Institutional Investor)

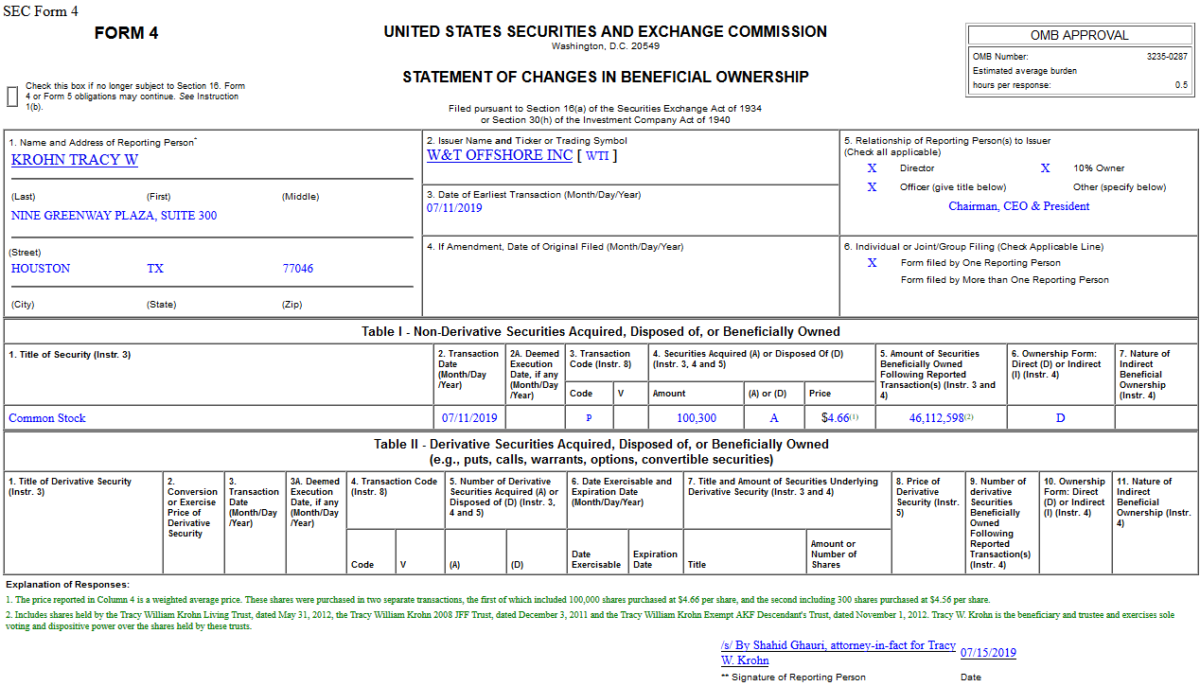

Insider Buying in W&T Offshore, Inc. (WTI)

Unusual Options Activity – Parsley Energy, Inc. (PE)

Today some institution/fund purchased 1,155 contracts of Jan 2021 $20 strike calls (or the right to buy 115,500 shares of Parsley Energy, Inc. (PE) at $20). The open interest was just 633 prior to this purchase. Continue reading “Unusual Options Activity – Parsley Energy, Inc. (PE)”

Where is money flowing today?

Be in the know. 8 key reads for Monday…

- Potential positive for Drug Stocks: Trump took 3 big losses on healthcare this week, and the losing streak probably isn’t going to end anytime soon (Business Insider)

- Trump sees slowing Chinese growth pressuring Beijing on trade (Reuters)

- Health companies start reporting earnings next week: Here are 3 things to keep in mind (MarketWatch)

- Gilead (GILD) Expands Collaboration with Galapagos (GLPG), Raises Stake to 22% (StreetInsider)

- Warren Buffett to MBA students: This is what ‘sets apart a big winner from the rest of the pack’ (CNBC)

- The Space Economy Is Starting to Take Shape 50 Years After the Moon Landing (Barron’s)

- Manufacturers Move Supply Chains Out of China (Wall Street Journal)

- JPMorgan, Wells Fargo, Citigroup, Goldman Sachs and More Major Financial Earnings This Week (24/7 Wall Street)

Be in the know. 13 key reads for Sunday…

- Meet the A.I. Landlord That’s Building a Single-Family-Home Empire (Fortune)

- From a Track-Only Ford GT to De Tomaso’s Return, 5 Standout Cars at the 2019 Goodwood Festival of Speed (Robb Report)

- Football Legend Joe Montana Lists Sonoma Estate for $28.9 Million (Architectural Digest)

- John Legend on Fatherhood, How to Handle Failure, and Essential Albums Everyone Should Listen To (Men’s Journal)

- Floyd Mayweather Literally Laughs at Idea of Conor McGregor Rematch (Maxim)

- Jim Cramer: Save the Bubble Talk for the Bath (TheStreet)

- Kanye’s Second Coming: Inside The Billion-Dollar Yeezy Empire ()

- Episode 926: So, Should We Recycle? (NPR Planet Money)

- This Warby Parker Co-Founder’s Next Startup Set Out to Beat a Razor Giant. 6 Years Later, He Sold Harry’s for $1.3 Billion (Inc.)

- Teucrium Trading’s Sal Gilbertie Talks Tariffs, Climate Change and American Farming (Worth)

- Barry Production Shut-Ins Exceeding LNG Disruptions as Natural Gas Futures Rally (Natural Gas Intel)

- Embezzelcoin ( Ed’s Blog)

- The De Tomaso P72 GT is what happens when a Classic 60s Supercar is Designed Today (Luxuo)

Be in the know. 15 key reads for Saturday…

- Why now is the time to buy bank stocks (Yahoo! Finance)

- Fed’s Evans Sees Two Rate Cuts Needed This Year (Wall Street Journal)

- The Hottest Hands in Hedge Funds (Institutional Investor)

- Hedge Fund Investor Letters 2019 Q2 (Insider Monkey)

- This Pharma Company Is Set to Begin HIV Vaccine Trials ()

- Sisters of Swing (Vanity Fair)

- July Macro Update: Housing Remains The Weakest Link (The Fat Pitch)

- These are the stocks Wall Street analysts believe will lead the Dow to 28,000 (CNBC)

- Fly Intel: What to watch in first round of big bank earnings reports (TheFly)

- 2019 Midyear Roundtable: Where to Find Value Now (Barron’s)

- FTC approves roughly $5B privacy settlement with Facebook (TheFly)

- Mario Gabelli on the Charms of Trucks, Farm Equipment and the Atlanta Braves (Barron’s)

- J&J earnings preview: Wall Street is still optimistic despite company’s legal issues (MarketWatch)

- The Shale Boom in the Permian Is Slowing Down (Bloomberg)

- You Can Now Buy A 2020 Camaro With A Whopping 1,000 Horsepower, But There’s A Catch (Forbes)

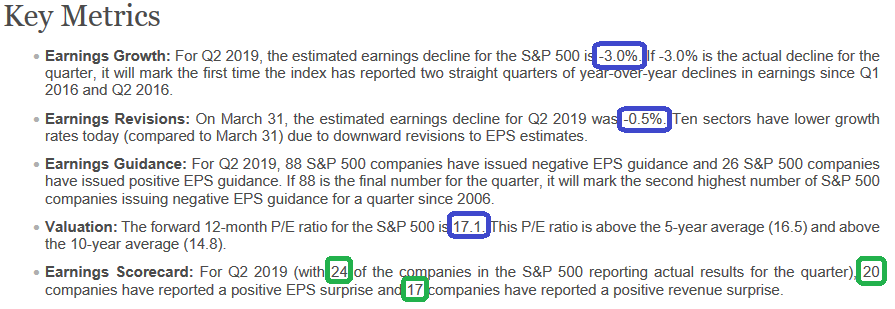

Q2 Earnings Bar Lowered Again

Data Source: Factset

Q2 Earnings estimates have come down from -2.6% on June 30 to -3.0% today. Downward revisions to estimates for companies in the Energy and Financials sectors were mainly responsible for the increase in the expected earnings decline during the week. This compares with Q1 earnings which were estimated at -3.9% right before earnings season and finished flattish. Continue reading “Q2 Earnings Bar Lowered Again”