Data Source: Factset

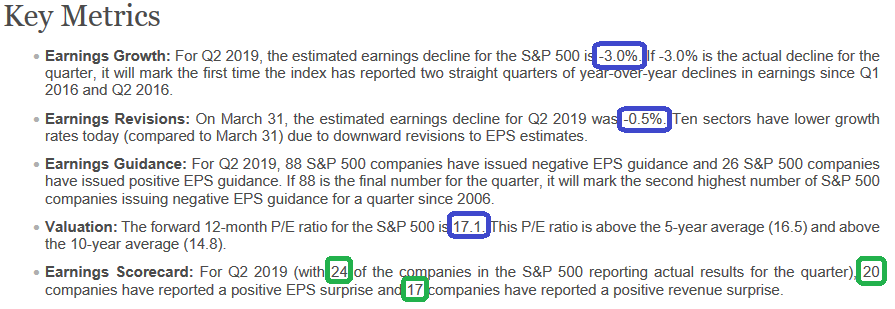

Q2 Earnings estimates have come down from -2.6% on June 30 to -3.0% today. Downward revisions to estimates for companies in the Energy and Financials sectors were mainly responsible for the increase in the expected earnings decline during the week. This compares with Q1 earnings which were estimated at -3.9% right before earnings season and finished flattish.

While no one likes to see estimates come down, it does create an easy bar to step over. In the case of Q2 the most likely outcome is we’ll finish slightly positive as is consistent with historical beat rates. We are already seeing the underpinnings of this type of outcome with 24 components of the S&P 500 already reporting with an 83% beat rate. The key will be forward guidance and whether or not the back half 2019/first half 2020 strong earnings estimates hold. Here’s what they look like as of today:

-For Q3 2019, analysts are projecting a decline in earnings of -0.8% and revenue growth of 3.3%.

-For Q4 2019, analysts are projecting earnings growth of 6.0% and revenue growth of 4.2%.

-For CY 2019, analysts are projecting earnings growth of 2.4% and revenue growth of 4.3%.

-For Q1 2020, analysts are projecting earnings growth of 9.8% and revenue growth of 5.8%.

-For Q2 2020, analysts are projecting earnings growth of 13.5% and revenue growth of 6.6%.