- Among the world’s 20 fastest growing retailers, Amazon just ranks at No. 4 (USA Today)

- Regeneron says FDA approves EYLEA injection for diabetic retinopathy (TheFly)

- No easy options for China as trade war, U.S. pressure bite (Reuters)

- Four reasons why the bears are wrong about a second-half slump: J.P. Morgan (MarketWatch)

- Alibaba’s stock surges after earnings and revenue rise, beat FactSet expectations (MarketWatch)

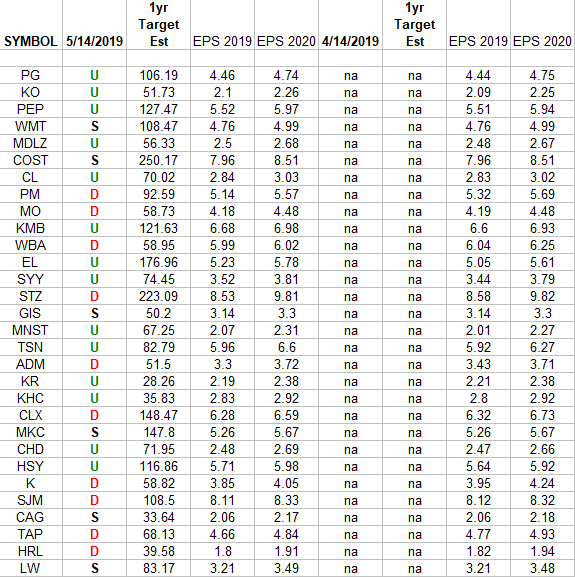

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. The column under the date 5/14/2019 has a letter that represents the movement

Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

Unusual Options Activity – Marathon Petroleum Corporation (MPC)

Today some institution/fund purchased 3,412 contracts of July $50 strike calls (or the right to buy 341,200 shares of Marathon Petroleum Corporation (MPC) at $50). The open interest was just 114 prior to this purchase. Continue reading “Unusual Options Activity – Marathon Petroleum Corporation (MPC)”

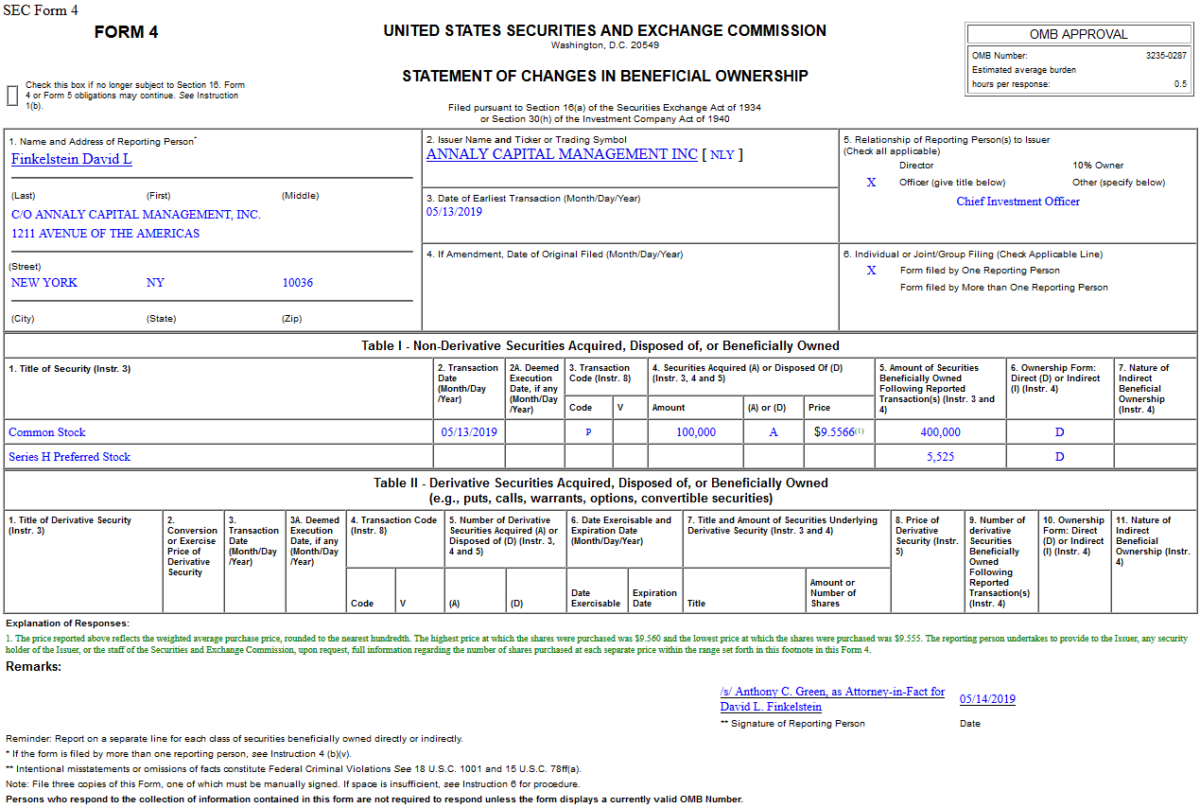

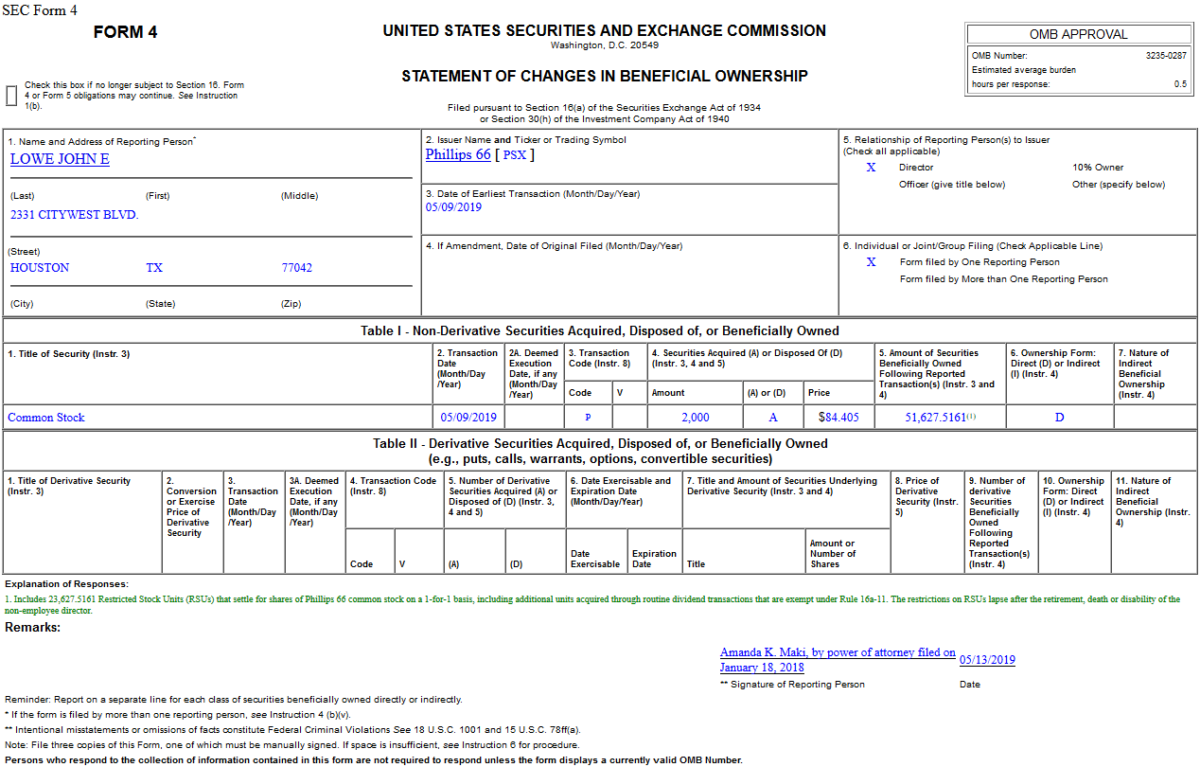

Insider Buying in Annaly Capital Management, Inc. (NLY)

Where is money flowing today?

Be in the know. 10 key reads for Tuesday…

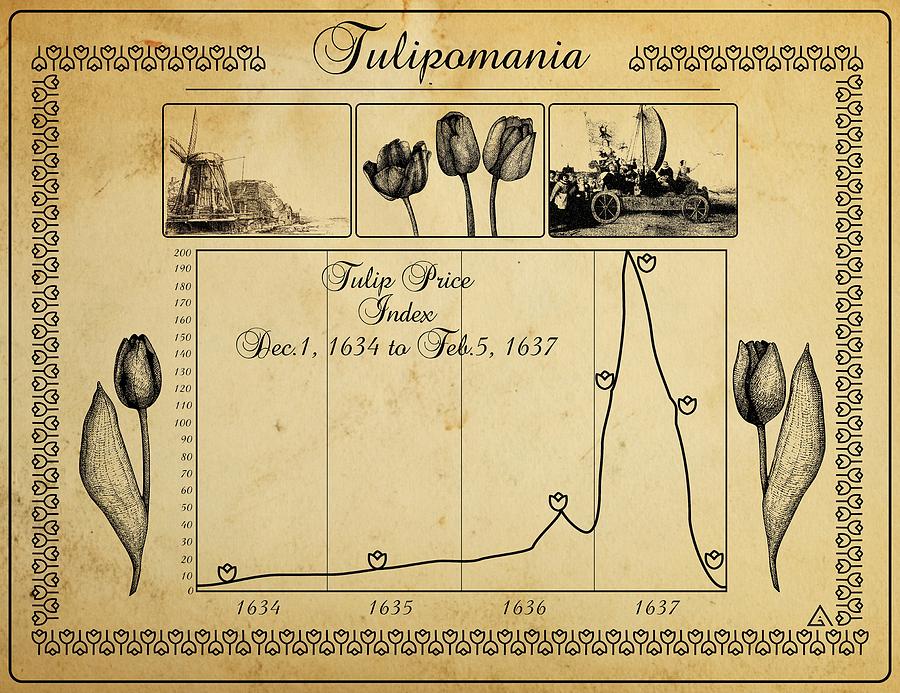

- The Real Story of the Dutch Tulip Bubble Is Even More Fascinating Than the Myth You’ve Heard (Barron’s)

- Small-business optimism index climbs to four-month high in April: NFIB (MarketWatch)

- Fed’s Williams says policymakers need to better prepare for lower interest rate world (Reuters)

- Crude Oil Prices Rise As Saudi Arabia Reports Drone Attacks On Pump Stations (Investor’s Business Daily)

- Moore’s Law Was Just the Beginning, Says This Growth Stock Investor (Barron’s)

- The Fusion Reactor Next Door (New York Times)

- Walmart Matches Amazon With Free One-Day Shipping on Many Items (Bloomberg)

- Trump defends China trade battle, vows deal will happen (Reuters)

- Howard Stern says he has changed. How much? (New York Times)

- With Oil Still Over $60 and Summer Coming, Top Energy Stocks Are a Steal Now (24/7 Wall Street)

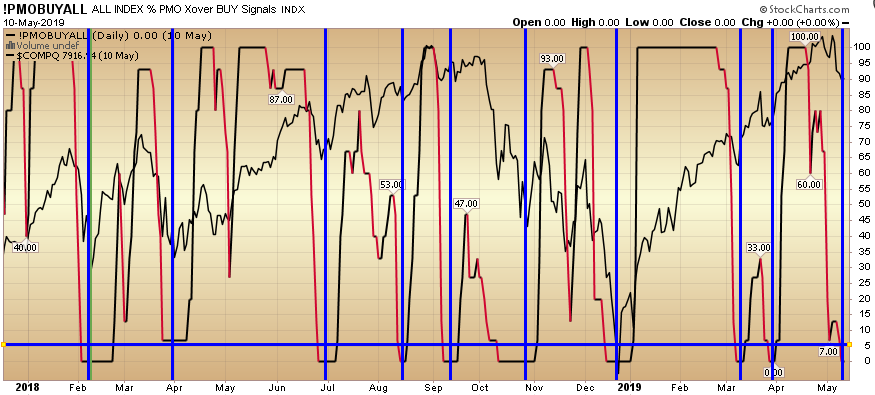

PMO BUY ALL at Extreme

The last 9 times the PMO “Buy All” indicator dropped below 5, it has paid to buy the market for a bounce. It is currently at zero. The blue vertical lines mark those spots where the indicator dipped below 5 in the past 1.5 years. Continue reading “PMO BUY ALL at Extreme”

Unusual Options Activity – Mylan N.V. (MYL)

Today some institution/fund purchased 10,588 contracts of Oct. $20 strike calls (or the right to buy 1,058,800 shares of Mylan N.V. (MYL) at $20). The open interest was just 118 prior to this purchase. Continue reading “Unusual Options Activity – Mylan N.V. (MYL)”