Data Source: Thomson Reuters

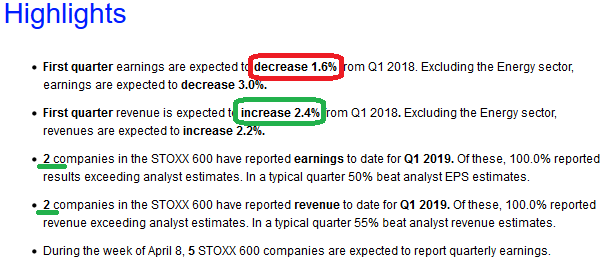

Despite mass pessimism on Europe, earnings estimates are more sanguine for the Stoxx 600 than the S&P 500 in the US. Q1 estimates for the Stoxx 600 are -1.6% year on year compared the the S&P 500 at -3.9% year on Continue reading “European (Stoxx 600) Earnings Estimates Q1”