Today some institution/fund purchased 35,173 contracts of April 20 strike calls (or the right to buy 3,517,300 shares of Amarin Corporation plc (AMRN) at $20). The open interest was just 427 prior to this purchase. Continue reading “Unusual Options Activity”

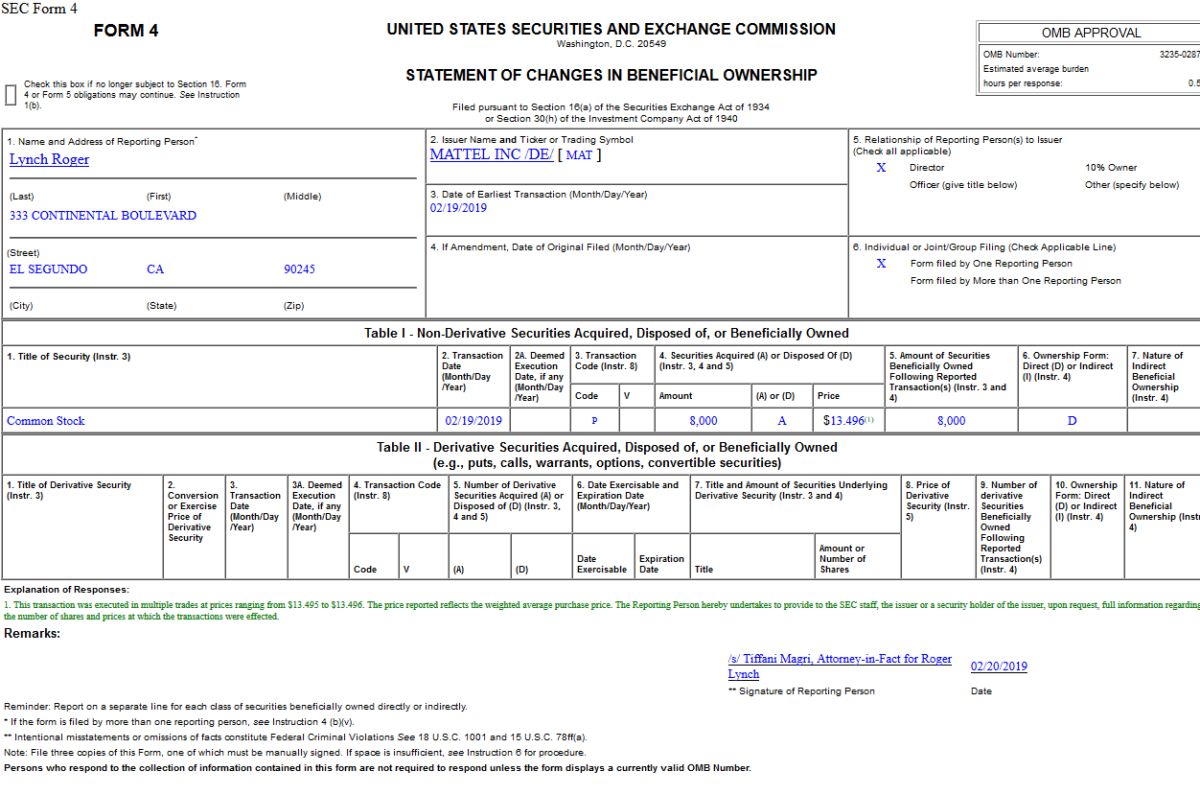

Insider Buying

Quote of the day…

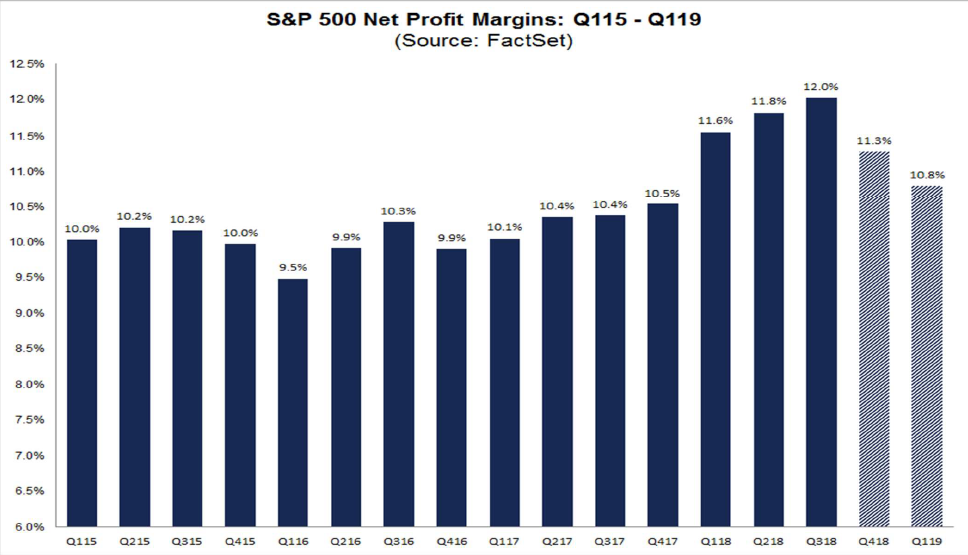

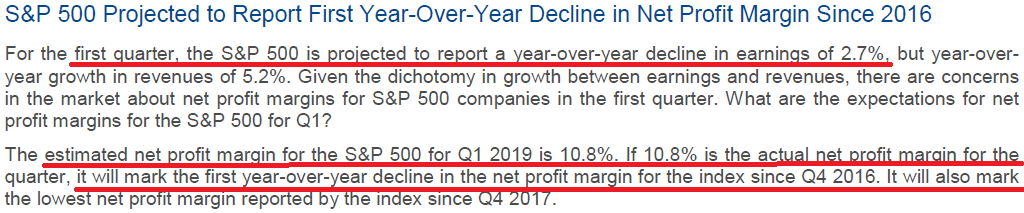

Margins Shrinking and Expectations Subdued

The big story for our Earnings Update this week is margins shrinking materially year on year (per Factset):

Continue reading “Margins Shrinking and Expectations Subdued”

Be in the know. 7 key reads for Friday…

- Closely watched Atlanta Fed GDP model now sees growth at just 1.4 percent for fourth quarter (CNBC)

- Quantum Computing Companies Aim To Go Where No Computer Has Gone Before (Investor’s Business Daily)

- U.S., China haggle over toughest issues in trade war talks (Reuters)

- Pimco: The ‘sugar rush’ is almost over, so it’s time to ‘de-risk’ and raise cash (MarketWatch)

- Natural Gas Price Rises on Another Big Storage Drawdown (24/7 Wall Street)

- Kraft Heinz discloses SEC probe, $15 billion write-down; shares dive 20 percent (Reuters)

- A currency war would be one-sided if US/China trade dispute escalates (HedgeWeek)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 15,223 contracts of September 5 strike calls (or the right to buy 1,522,300 shares of Alamos Gold Inc. (AGI) at $5). The open interest was just 341 prior to this purchase. Continue reading “Unusual Options Activity”

Insider Buying

Quote of the day…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

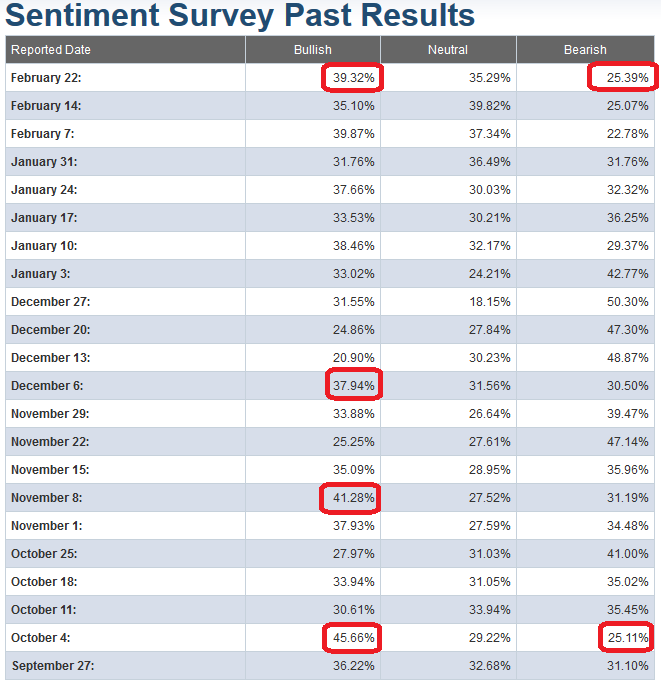

AAII Sentiment Results and Interpretation

AAII Sentiment Survey results are out this morning. Bullishness is now up to the ~40 level – which usually marks market reversals. Bearishness has collapsed. In the S&P500 chart below I have noted those dates in the recent Continue reading “AAII Sentiment Results and Interpretation”