Be in the know. 8 key reads for Thursday…

- Twitter stock falls after light outlook, plans to phase out monthly-active-user metric (Market Watch)

- Why liberal billionaire Warren Buffett is not likely to be a big fan of the new Democratic Party war on stock buybacks (CNBC)

- Trump Loves the New Nafta. Congress Doesn’t. (New York Times)

- Theresa May’s demands to renegotiate Brexit deal rejected by EU (Business Insider)

- Tesla Cuts the Model 3 Price Again (Wall Street Journal)

- Pound Tumbles After BOE Slashes GDP Forecast, Warns Of Rising Brexit Damage (Zero Hedge)

- Trump Preparing Plan to Boost AI, 5G Technology (Wall Street Journal)

- NXP Semiconductors Falls After ‘Worse-Than-Feared’ Forecast (Bloomberg)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

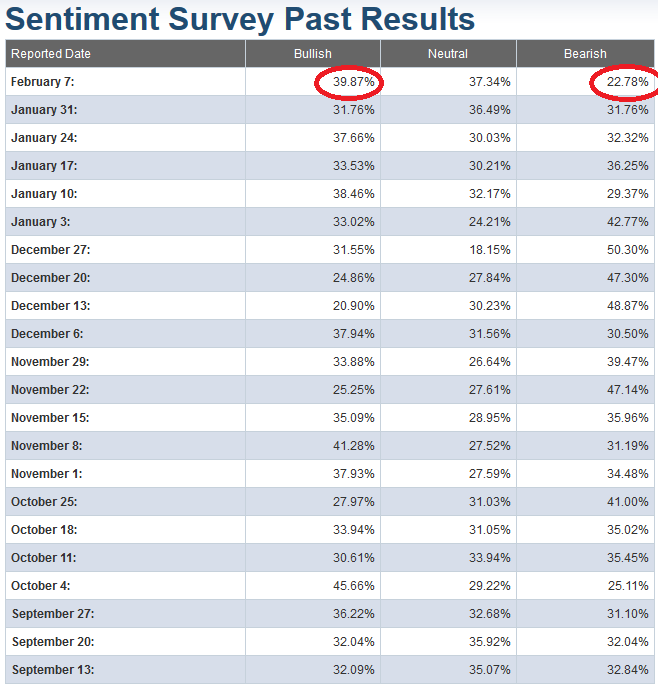

AAII Sentiment Indicator

Last week we said we wanted to see an AAII sentiment reading ~40 in order to lighten up longs and add some shorts: https://www.hedgefundtips.com/aaii-sentiment-indicator-4/#more-703. This morning we got that read Continue reading “AAII Sentiment Indicator”

Unusual Options Activity

Today some institution/fund purchased 8,532 contracts of March 97.5 strike puts (or the right to short 853,200 shares of Texas Instruments TXN at $97.5). The open interest was just 509 prior to this purchase. Continue reading “Unusual Options Activity”

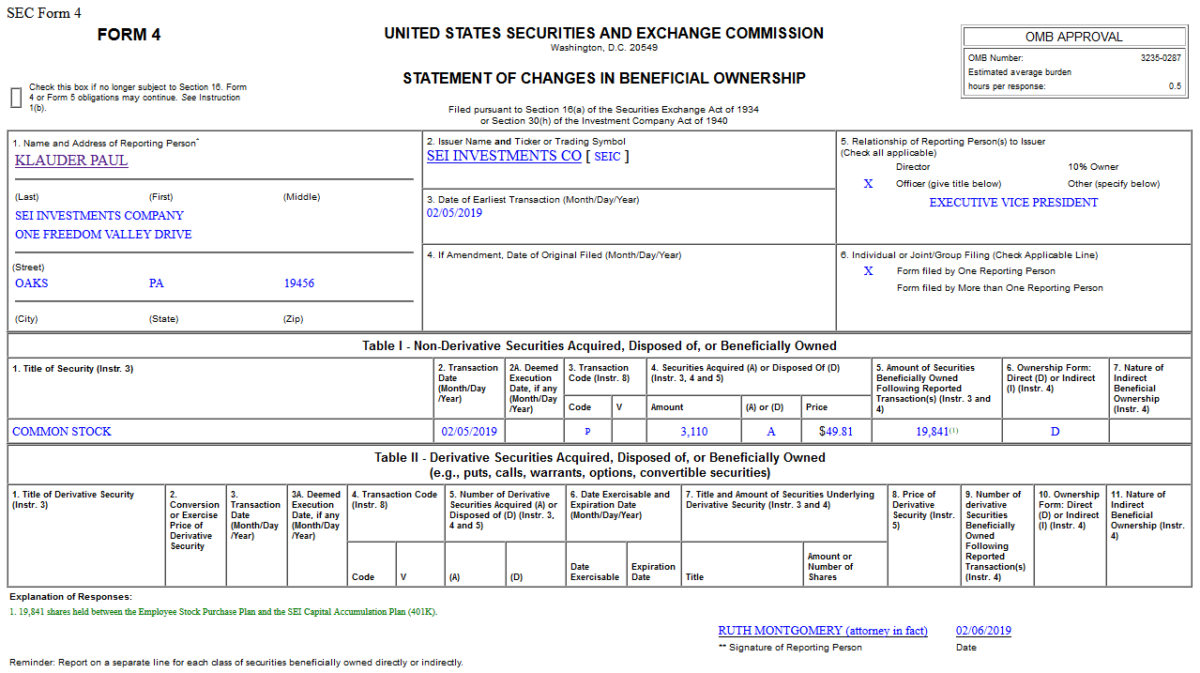

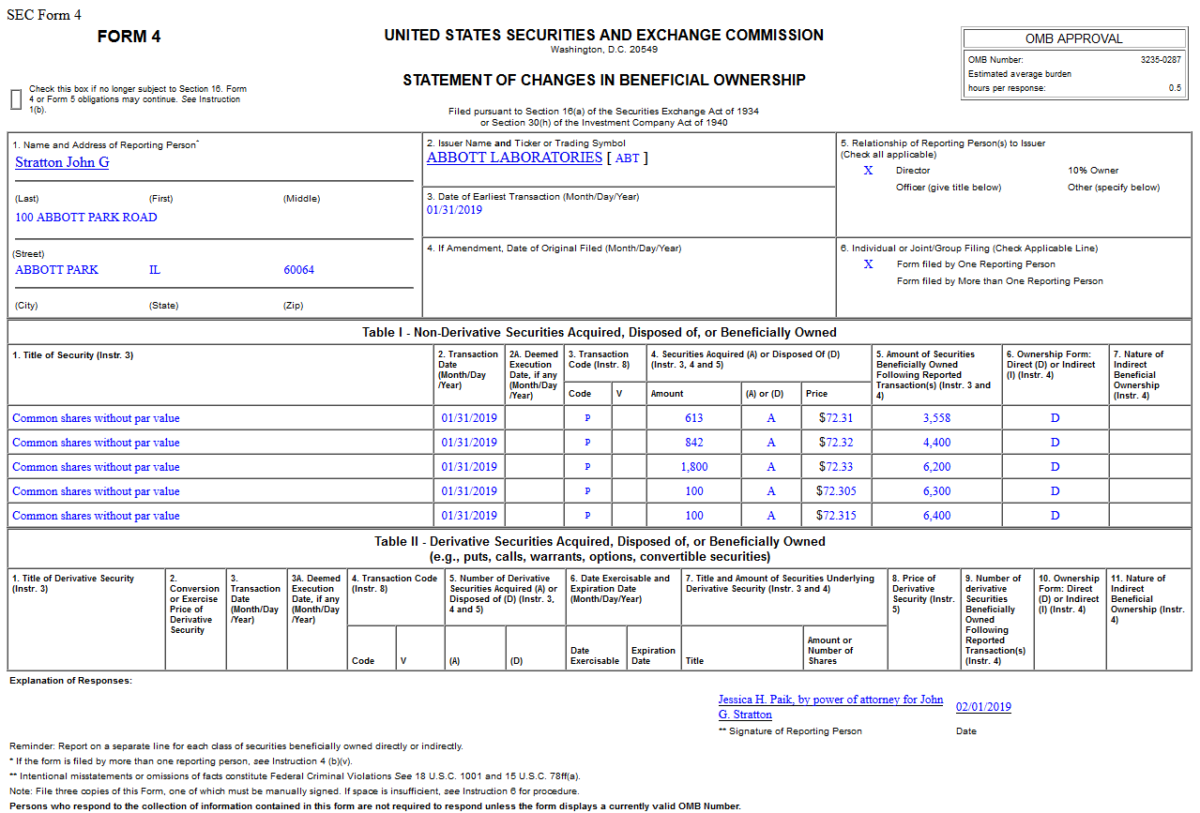

Insider Buying

Hedge Fund Trade Tip – Position Idea Notification (PIN)

Be in the know. 7 key reads for Wednesday…

- EU now sees Brexit unstoppable, aims to avert ‘fiasco’ (Reuters)

- Tom Brady Really Is Bad for Your Portfolio? (Wall Street Journal)

- 5 Stocks on Goldman Sachs Conviction List With Massive Upside Potential (24/7 Wall Street)

- Aussie set for biggest drop in a year on central bank swerve (Street Insider)

- Profit margins may be starting to erode because of rising costs (CNBC)

- Walt Disney gooses profits with jacked-up ticket prices at parks (New York Post)

- Snap Stems the Flood of Users Leaving Its App (New York Times)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

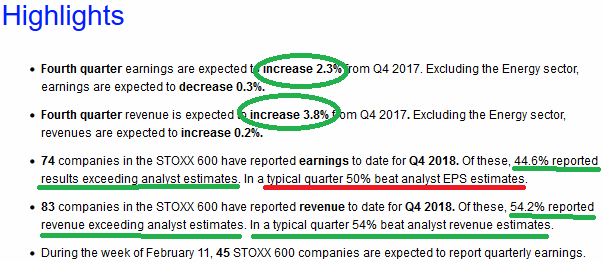

European (Stoxx 600) Earnings UP year on year (update)

source: Thomson Reuters

With all of the pessimism about European earnings/economy, the facts are that they are UP year on year. So far Q4 2018 earnings (of those 74 reported) Continue reading “European (Stoxx 600) Earnings UP year on year (update)”

Unusual Options Activity

Today some institution/fund purchased 12,346 contracts of June 30 strike calls (or the right to buy 1,234,600 shares of Cars.com, Inc. CARS at $30). The open interest was just 124 prior to this purchase. Continue reading “Unusual Options Activity”