Data Source: Factset

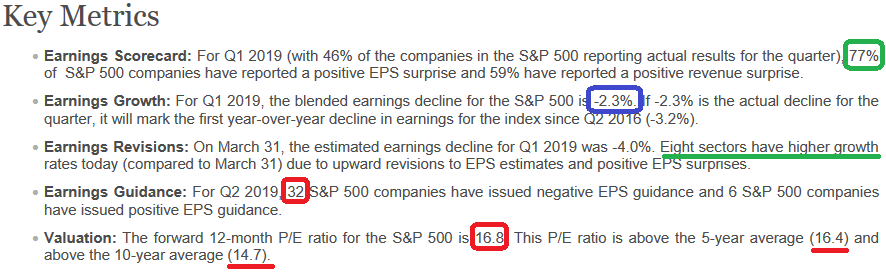

So while we may have hit “peak margins” in Q3 2018 (not good), we have a Q1 “as reported” beat rate of 77% (better than normal). Earnings have improved from a -4.1% expectation several weeks ago – to -2.3% as of Friday. While this is still down from a +2.8% expectation on December 31, 2018, it marks a nice beat rate and puts a flat/positive year-on-year result on the table (not a guarantee, but a new possibility).

So while we may have hit “peak margins” in Q3 2018 (not good), we have a Q1 “as reported” beat rate of 77% (better than normal). Earnings have improved from a -4.1% expectation several weeks ago – to -2.3% as of Friday. While this is still down from a +2.8% expectation on December 31, 2018, it marks a nice beat rate and puts a flat/positive year-on-year result on the table (not a guarantee, but a new possibility).

Fastset still hast the 2019 EPS estimate up at $168.40 (mostly back-end loaded Q3/Q4). Early guidance has been poor: the percentage of companies issuing negative EPS guidance is 84% (32 out of 36), which is above the 5-year average of 70%.

While the Forward P/E Ratio (16.8) is well above the 10-Year Average (14.7) it could go as high as 18x if we get some more good news on China/Brexit/Guidance/Employment/GDP/Fed Restraint, etc.

The data is better than expected so far for Q1 (both GDP and Earnings), but is it good enough on an absolute basis to support further multiple expansion?

Rate expectations will have everything to do with the answer to that question and since the Christmas eve nightmare and subsequent reversal they (the Fed) seem to have fallen in line. My eyes will remain focused on the remainder of “operating earnings” results per the previous post – and take it day by day as new data rolls in.