Source: Factset

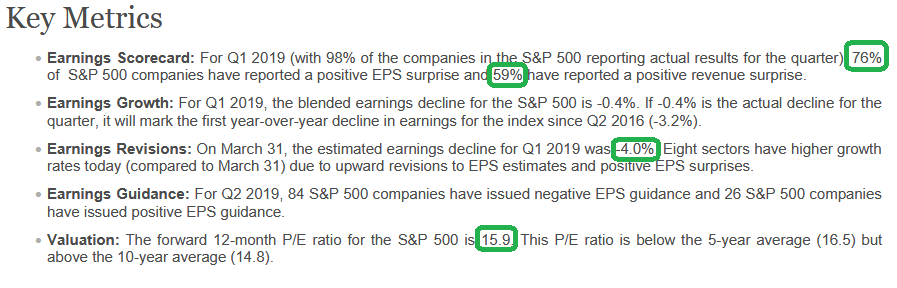

Despite all of the negativity around trade, earnings came in strong for Q1 and forward estimates have held up. The forward multiple is now down to 15.9x (below the 5 year average of 16.5x).

“Despite Tariff Concerns, Analysts Making Smaller Cuts than Average to EPS Estimates for Q2 During the first two months of the second quarter, analysts lowered earnings estimates for companies in the S&P 500 for the quarter. The Q2 bottom-up EPS estimate (which is an aggregation of the median EPS estimates of all the companies in the index for the second quarter) dropped by 2.1% (to $40.61 from $41.46) during this period. How significant is a 2.1% decline in the bottom-up EPS estimate during the first two months of a quarter? How does this decrease compare to recent quarters?

During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the first two months of a quarter has been 2.5%. During the past ten years, (40 quarters), the average decline in the bottom-up EPS estimate during the first two months of a quarter has been 2.2%. During the past fifteen years, (60 quarters), the average decline in the bottom-up EPS estimate during the first two months of a quarter has been 3.1%. Thus, the decline in the bottom-up EPS estimate recorded during the first two months of the second quarter was smaller than the 5-year average, the 10-year average, and the 15-year average.”

Earnings: Low Single-Digit Earnings Growth Projected for 2019

For the first quarter, S&P 500 companies are reporting a decline in earnings of -0.4% and growth in revenues of 5.3%. For the remainder of 2019, analysts see a decline in earnings in the second quarter, slight growth in earnings in the third quarter, and single-digit growth in earnings in the fourth quarter.

-For Q2 2019, analysts are projecting a decline in earnings of -2.1% and revenue growth of 4.1%.

-For Q3 2019, analysts are projecting earnings growth of 0.3% and revenue growth of 4.2%.

-For Q4 2019, analysts are projecting earnings growth of 7.2% and revenue growth of 4.6%.

-For CY 2019, analysts are projecting earnings growth of 3.2% and revenue growth of 4.6%.