Source: FactSet

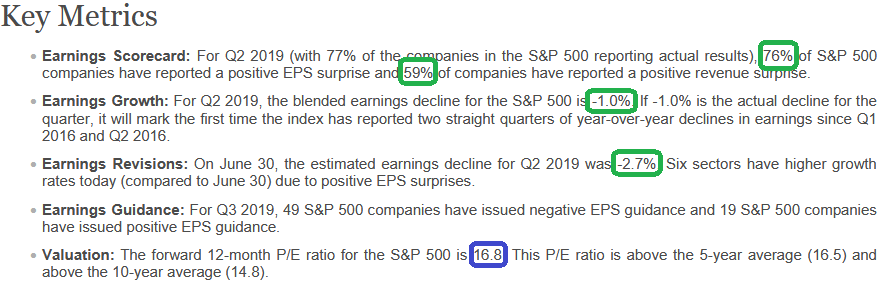

On June 30, the estimated earnings decline for Q2 2019 was -2.7%. As of today (with 77% of the companies in the S&P 500 reporting), the blended earnings decline has improved to -1%.

The percentage of companies reporting actual EPS above estimates (76%) is above the 5-year average.

Health Care Sector Has Seen Largest Increase in Earnings since June 30

Six sectors have recorded an improvement in earnings growth since the end of the quarter due to upward revisions to earnings estimates and positive earnings surprises, led by the Health Care (to 8.0% from 2.1%), Financials (to 5.2% from 0.6%), and Information Technology (to -7.6% from -11.9%) sectors. Five sectors have recorded a decrease in earnings growth during this time due to downward revisions to earnings estimates and negative earnings surprises, led by the Industrials (to -10.3% from -1.9%) sector.

The Financials sector is reporting the second highest (year-over-year) earnings growth of all eleven sectors at 5.2%.

At the company level, JPMorgan Chase and Wells Fargo are the largest contributors to earnings growth for the sector. JPMorgan Chase reported actual EPS of $2.82 for Q2 2019, compared to year-ago EPS of $2.29. Wells Fargo reported actual EPS of $1.30 for Q2 2019, compared to year-ago EPS of $0.98. If these two companies were excluded, the blended earnings growth rate for the sector would fall to 2.0% from 5.2%.

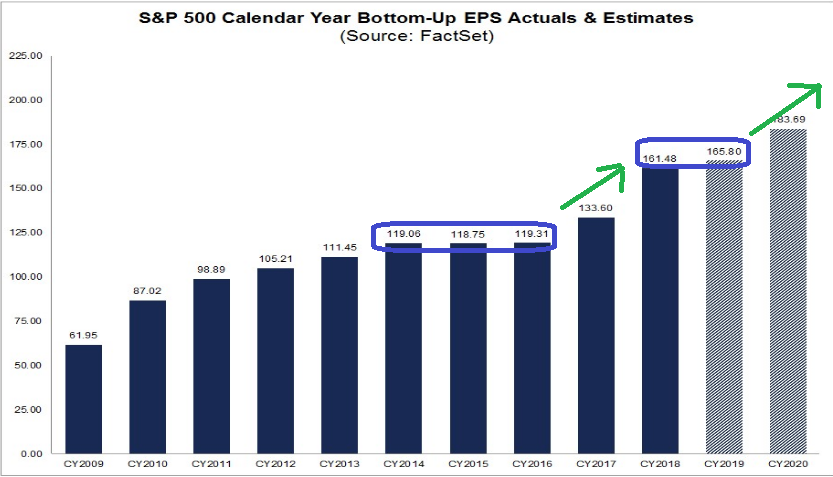

Factset still has 2020 EPS estimates at $183.68 for 2020 or a jump of 10.9%. At a newly reduced discount rate a 16.8x forward multiple remains conservative at this point in the cycle.