Data Source: FactSet

As of July 12, Q2 estimates had been taken down to -3.0% expectations year on year. With the banks having recorded earnings beats of 11-33% (year on year) this past week, things are looking up. In just one week these estimates have jumped to -1.9% with only 16% of the S&P 500 reporting so far. In other words, off to a strong start.

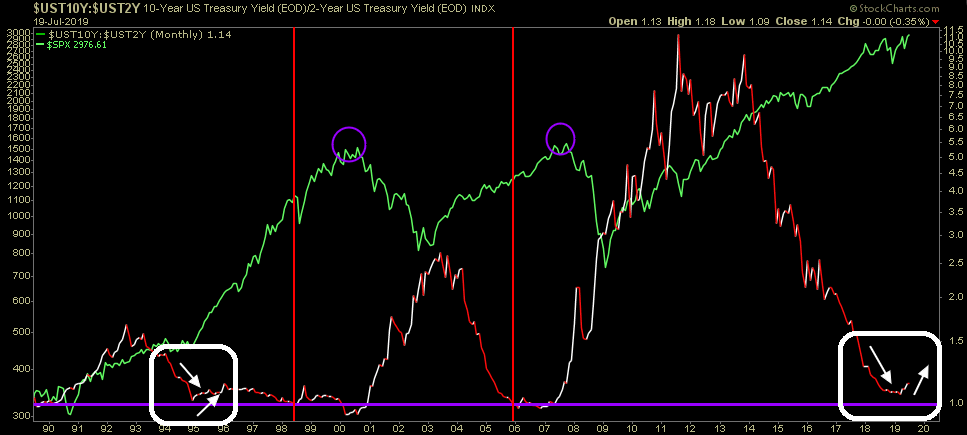

Citi kicked it off with 11% earnings growth year on year. JP Morgan beat expectations, reporting 23% earnings growth. Wells Fargo followed with a beat, growing earnings by 32%. Keep in mind, these earnings were created in a flattening yield curve environment (driven by the strong consumer business). In the last 4 weeks, the yield curve has actually begun to steepen in anticipation of 1-3 Fed cuts in coming months (see white circles below). This should be helpful to net interest margin this quarter.

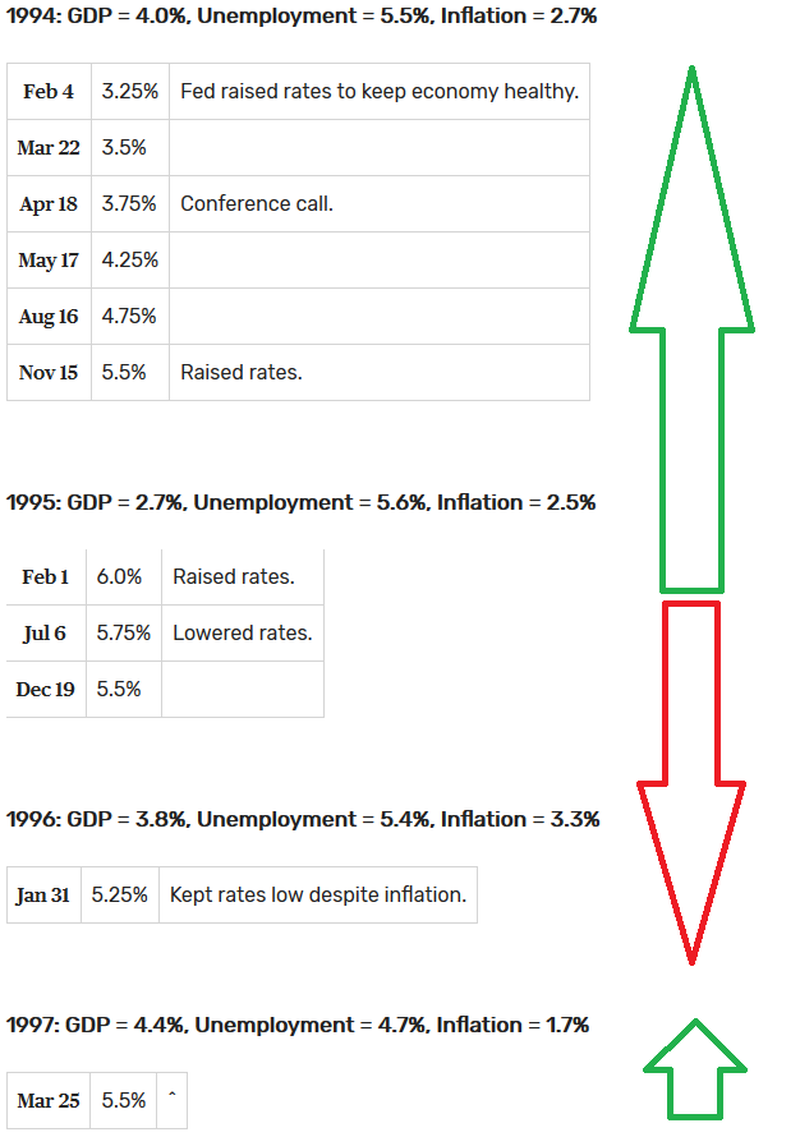

This is similar to the instance in 1994-1995 when the Fed (Alan Greenspan) stepped in to do 3 insurance cuts and extended the cycle by 5 years (after 7 consecutive raises). The 2/10 spread came CLOSE to inverting (but did not invert – see above) and choking off credit/growth in the economy exactly like it did in the Fall of last year. The Fed (Powell) has the opportunity to extend the cycle as Greenspan did – should he choose to make the right decisions in coming weeks and months (see Greenspan’s playbook below).

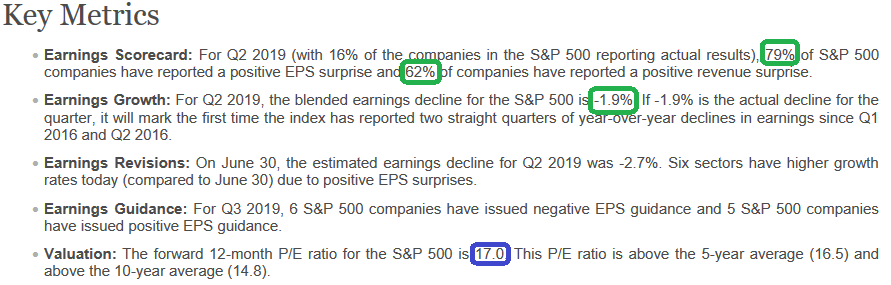

More data on Q2 earnings results to date (Factset):

-In terms of earnings, the percentage of companies reporting actual EPS above estimates (79%) is above the 5-year average.

-In aggregate, companies are reporting earnings that are 7.0% above the estimates, which is also above the 5-year average.

-In terms of sales, the percentage of companies (62%) reporting actual sales above estimates is above the 5-year average.

-In aggregate, companies are reporting sales that are 0.9% above estimates, which is also above the 5-year average.

Guidance better than average so far:

At this point in time, 11 companies in the index have issued EPS guidance for Q3 2019. Of these 11 companies, 6 have issued negative EPS guidance and 5 have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance is 55% (6 out of 11), which is below the 5-year average of 70%.

This week 144 S&P 500 companies (including 10 Dow 30 components) are scheduled to report results for the second quarter.