The August survey covered 212 managers with $616 Billion in assets under management. (Check Back Wednesday Morning For Final Version)

OUTLOOK:

-INVESTOR GROWTH EXPECTATIONS NEAR ALL TIME LOW, 72% EXPECT WEAKER ECONOMY NEXT YEAR.

-INVESTOR GROWTH EXPECTATIONS NEAR ALL TIME LOW, 72% EXPECT WEAKER ECONOMY NEXT YEAR.

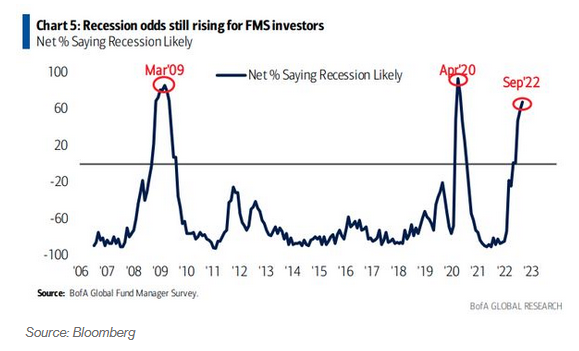

-The number of investors expecting a recession has reached the highest since May 2020.

-A net 79% of participants see slower inflation in the next 12 months, while 36% say the Fed will stop hiking rates in the second quarter of 2023.

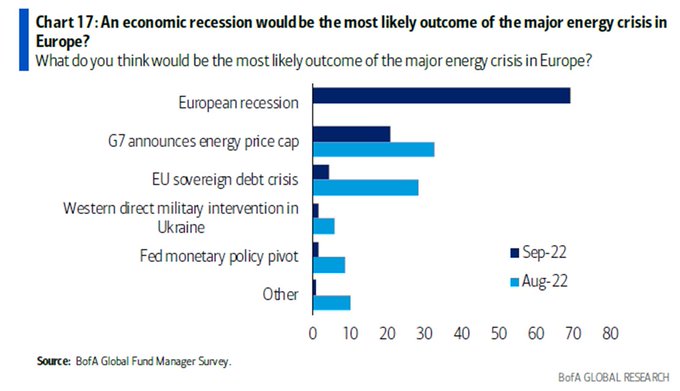

-Europe’s energy crisis will likely push the regional economy into a recession, almost 70% of participants say, while fewer believe an energy price cap announcement to be the most likely outcome.

SENTIMENT:

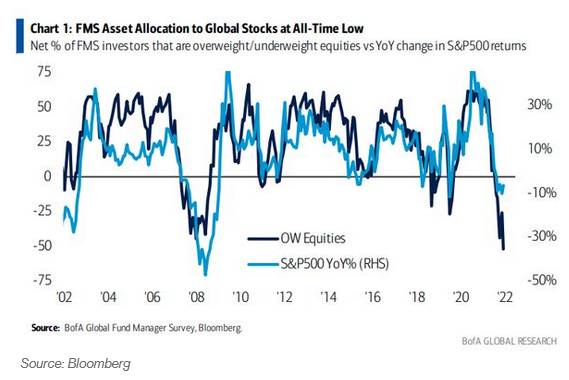

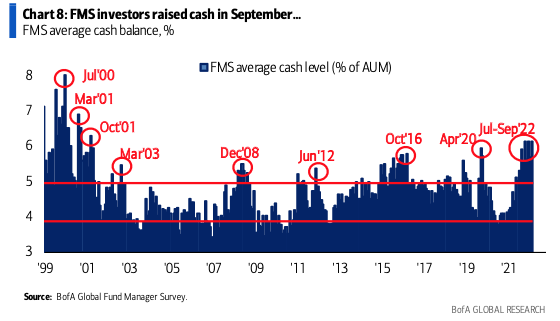

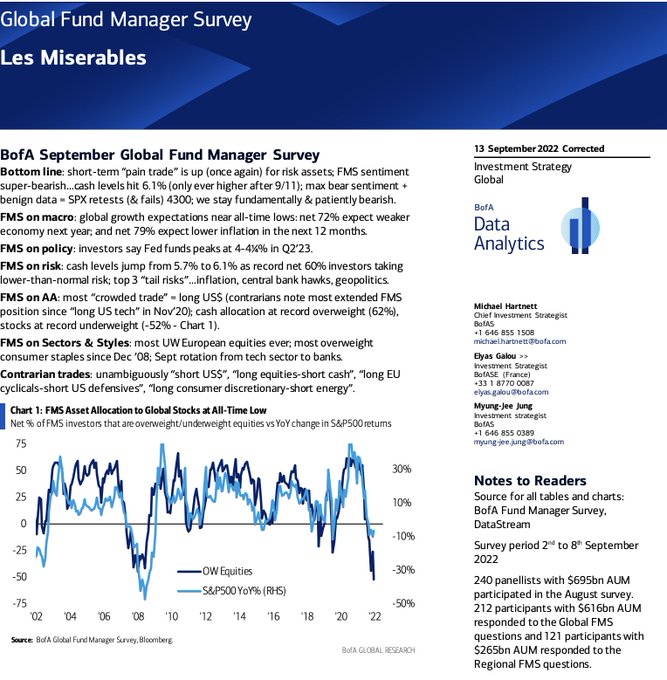

-Fund managers are “super bearish” with average allocations to cash at the highest since 2001 and allocation to global stocks at an all-time low.

POSITIONING:

-BofA’s latest Global Fund Manager Survey showed cash levels rising from 5.7% to 6.1%, a level only ever reached after 11-Sep-01, as the team called the current sentiment backdrop as “super-bearish.”

-BofA’s latest Global Fund Manager Survey showed cash levels rising from 5.7% to 6.1%, a level only ever reached after 11-Sep-01, as the team called the current sentiment backdrop as “super-bearish.”

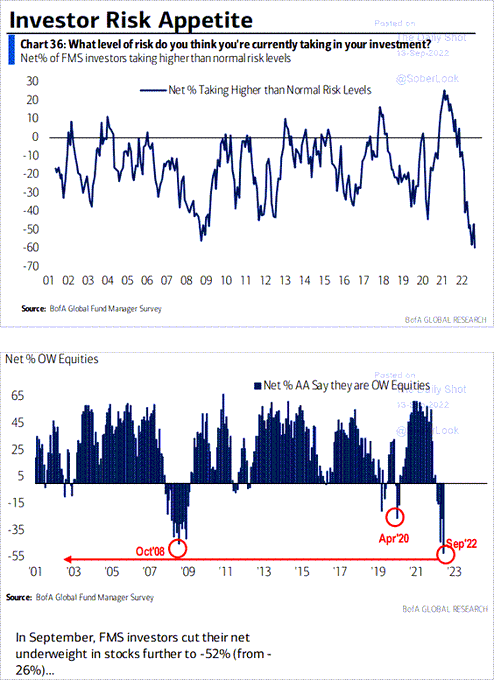

-The net percentage of investors who said they were overweight stocks was -52% compared to -26% the previous month, a lower level than during the financial crisis.

-62% are overweight cash.

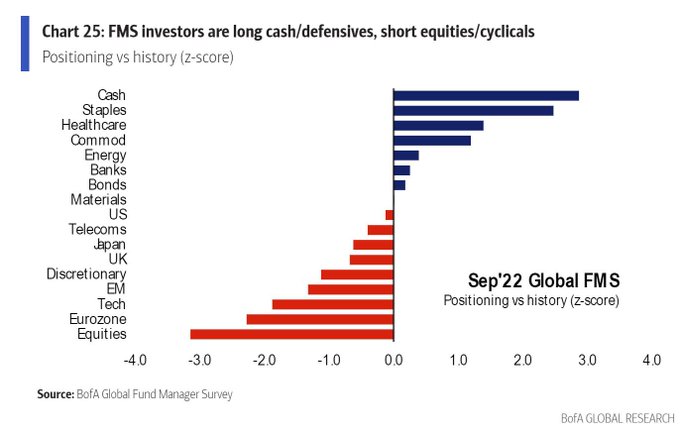

-Relative to the past 10 years, investors are long cash, defensives and energy, while being underweight equities, the euro zone, emerging markets and cyclicals.

MOST CROWDED TRADES:

-LONG US DOLLAR IS MOST CROWDED TRADE.

-The most crowded trades are long US dollar, long oil and commodities, long ESG assets, short US Treasuries, long growth stocks and long cash.

BIGGEST TAIL RISKS:

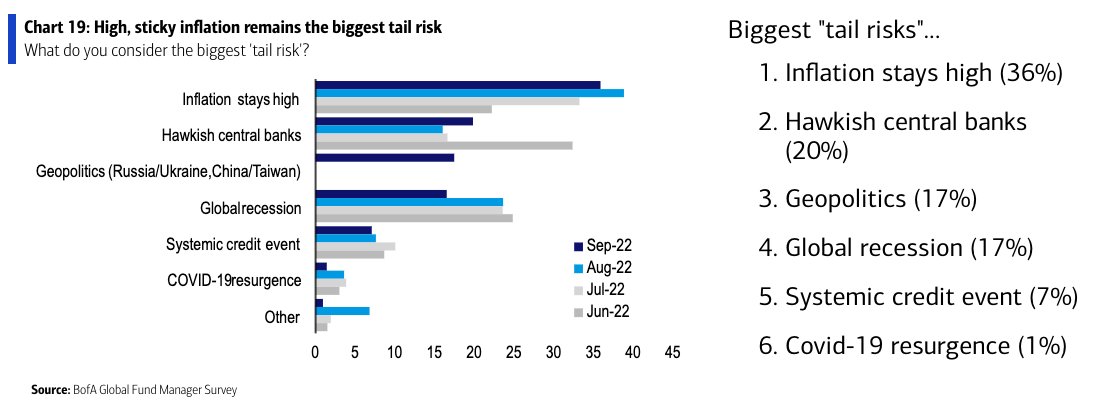

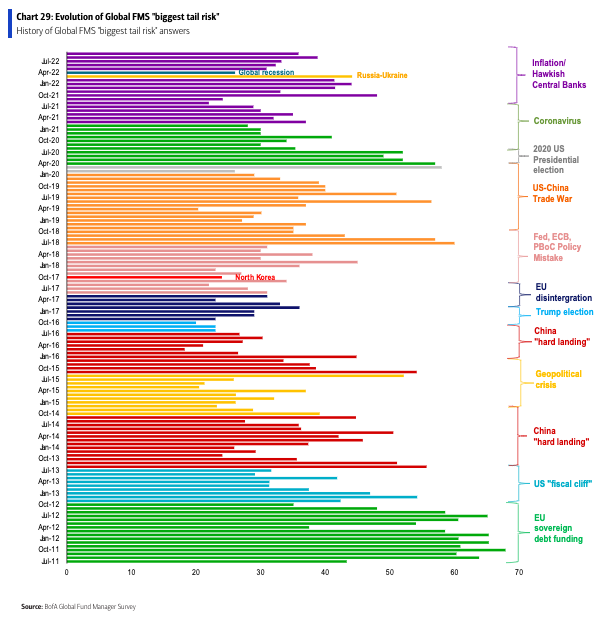

Persistently high inflation is seen as the biggest tail risk, followed by hawkish central banks, geopolitics and a global recession. Only 1% of participants see a resurgence in the Covid-19 pandemic as a tail risk.

Persistently high inflation is seen as the biggest tail risk, followed by hawkish central banks, geopolitics and a global recession. Only 1% of participants see a resurgence in the Covid-19 pandemic as a tail risk.

BANK OF AMERICA COMMENTARY:

“BOTTOM LINE: SHORT TERM PAIN TRADE IS UP ONCE AGAIN FOR RISK ASSETS, FMS SENTIMENT SUPER-BEARISH”