~224 Managers overseeing >$600B AUM responded to this month’s BofA survey.

OUTLOOK:

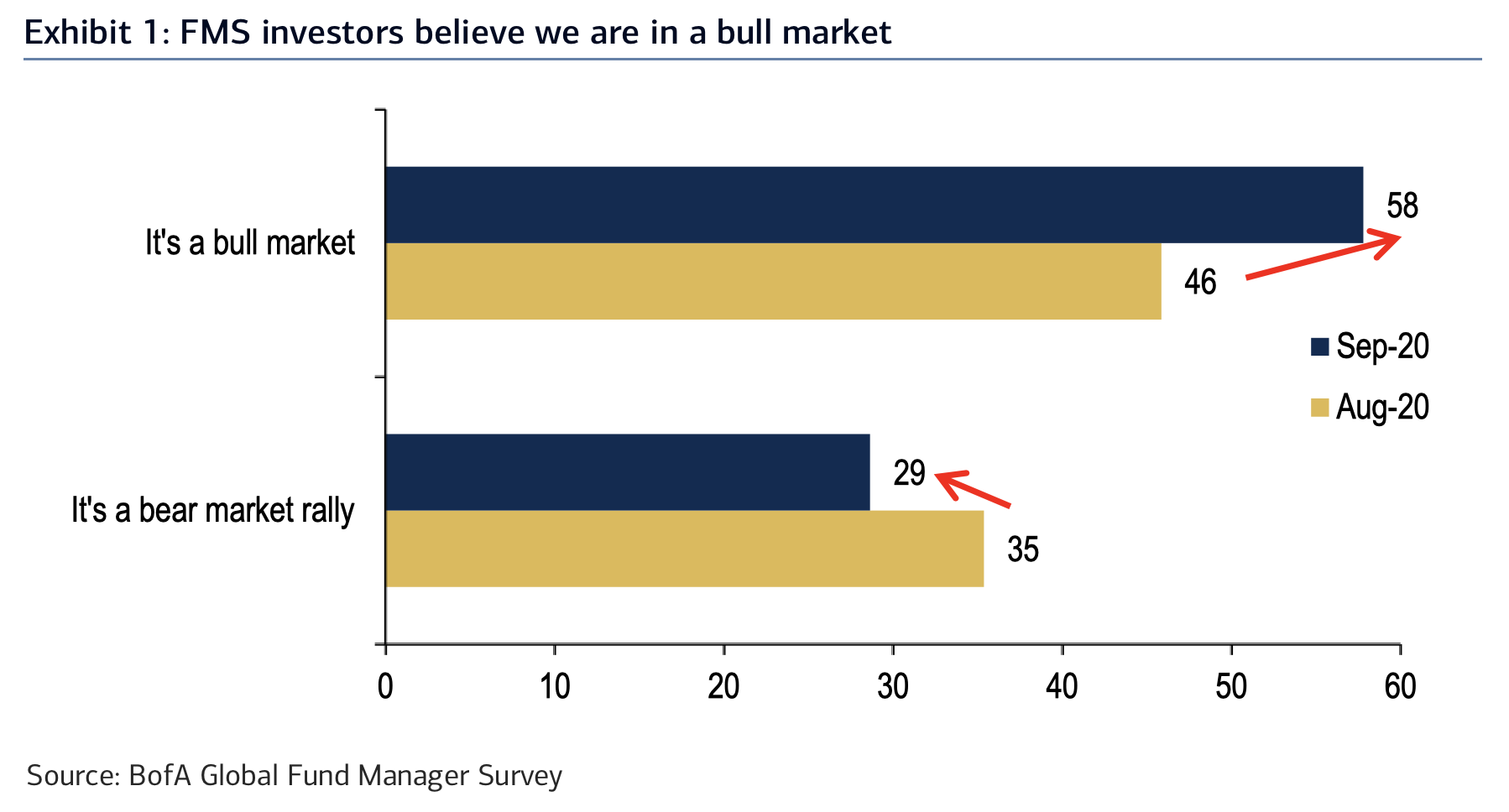

- 29% of respondents (down from 35%) still believe it’s a bear market rally.

- 58% of investors say the new bull market has started – compared to 25% in May.

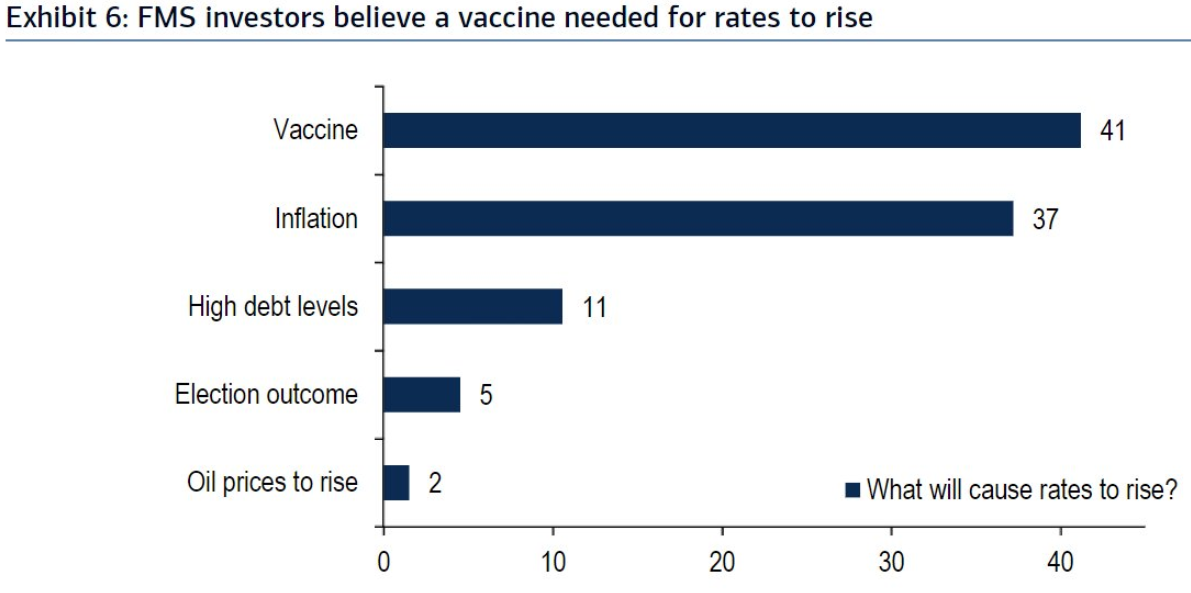

- 41% say credible COVID-19 vaccine most likely trigger for higher bond yields.

- 37% say Inflation most likely trigger for higher bond yields.

- 61% of respondents predict U- or W-shaped recovery.

- 20% say V-shaped recovery.

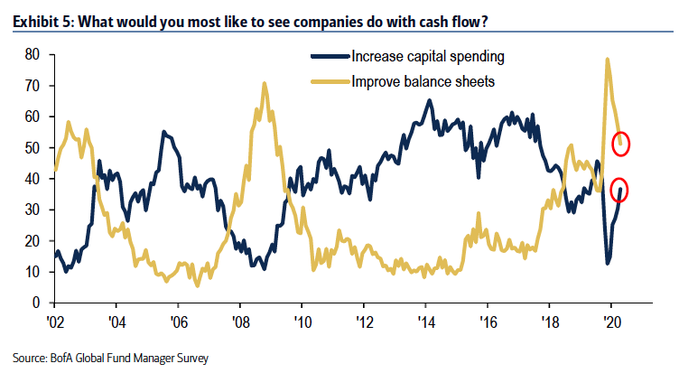

- 51% still prefer balance sheet discipline from companies.

- 37% want increased capex – versus 13% in Apr.

- Investors say vaccine announcement most likely Q121.

- 32% betting vaccine comes in the fourth quarter of 2020.

- Only 11% think 10Y UST yields will break out from 50-100bps range by year-end.

SENTIMENT:

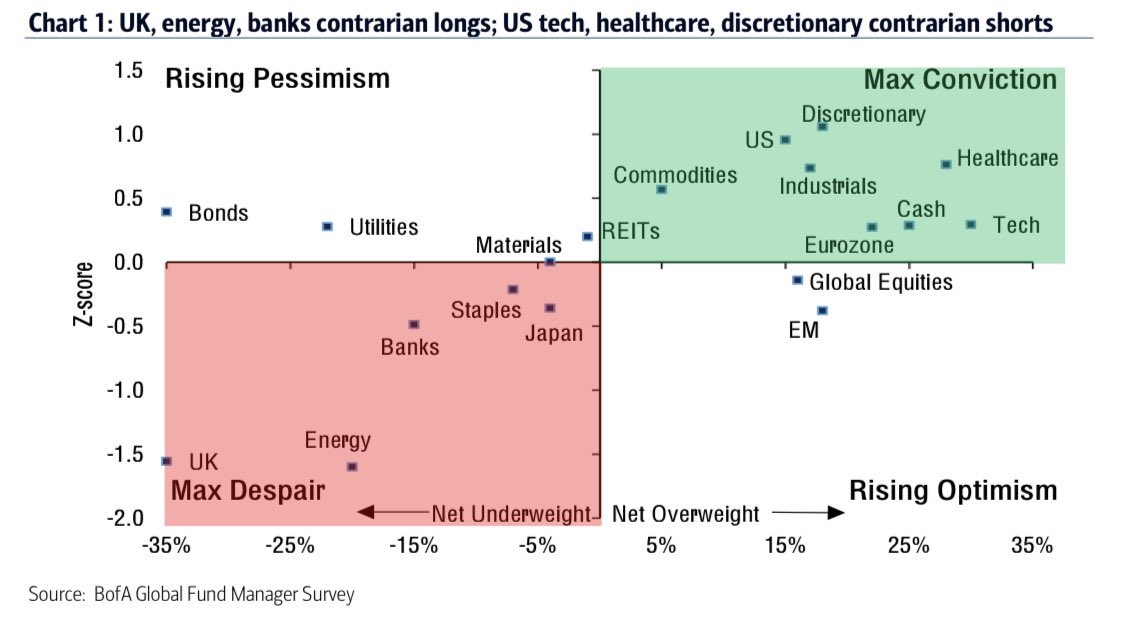

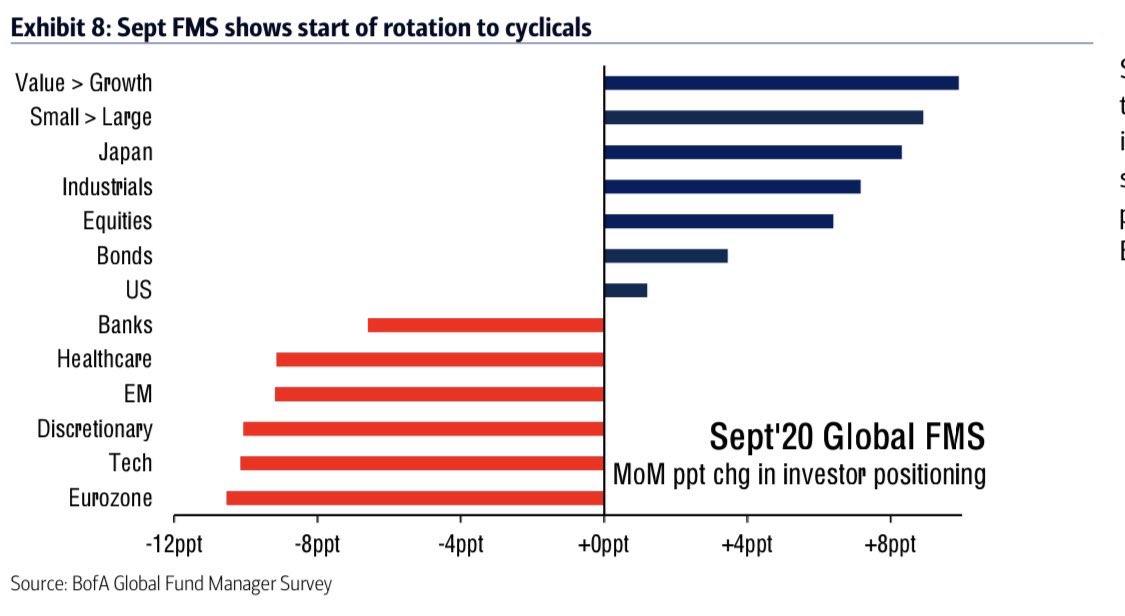

- Michael Hartnett (BofA), said fund managers signaled that they are “paranoid tech” and have been decreasing their allocation to the sector in favor of more cyclical equities, such as cheaper value shares, small-caps and industrials.

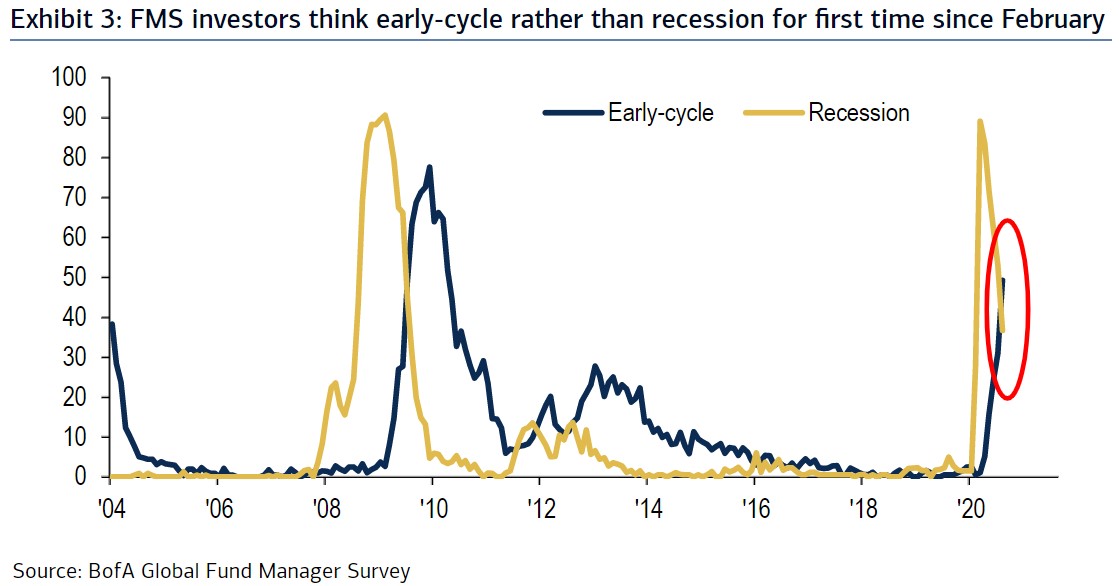

- For the first time since Feb more investors (49%) say macro in early-cycle phase than recession (37%).

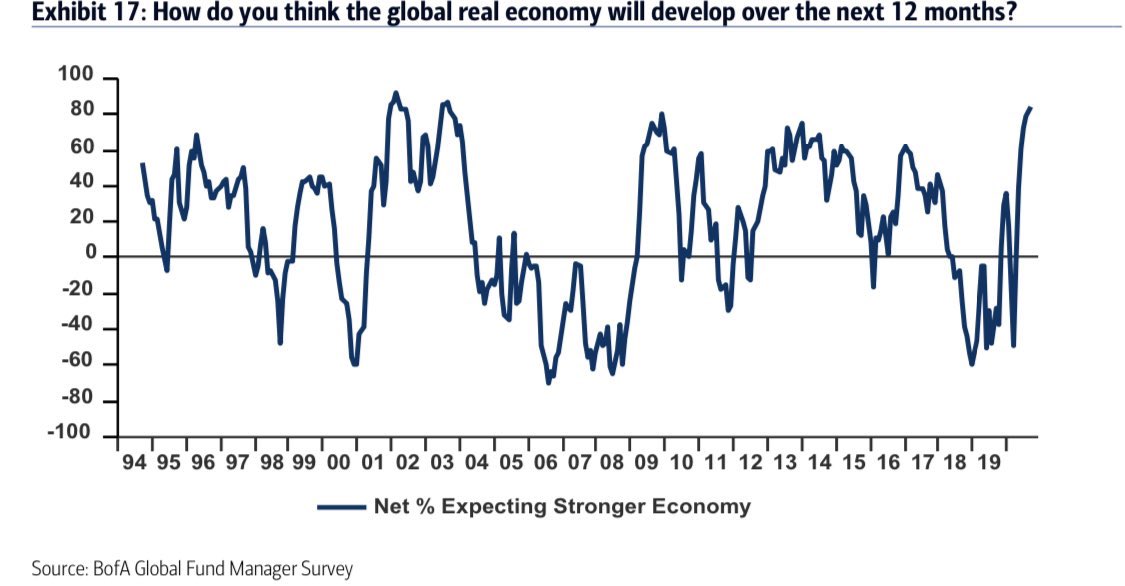

- Net 84% say global growth up next 12 months.

- 4 in 5 investors say flip in US Senate will be risk-off.

- September BofA survey shows switch into cyclicals, out of tech.

- Fund managers are more confident of economic recovery: BofA

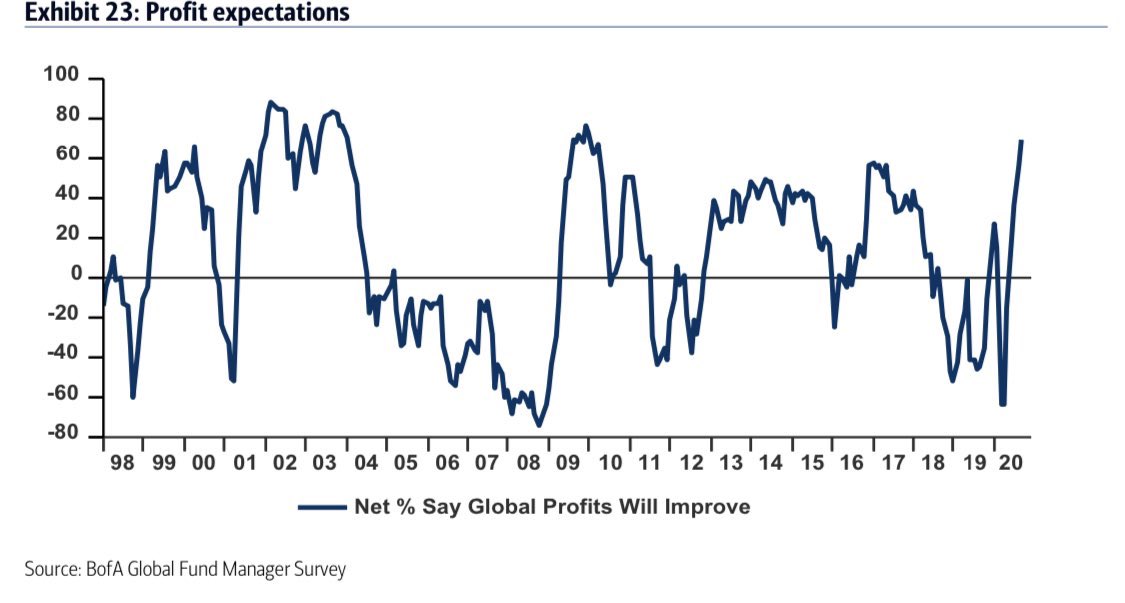

- Investors haven’t been this optimistic on corporate earnings growth since 2011. 47% are betting profits will rise 10% or more over the next 12 months.

POSITIONING:

- Rotation continues: tech, healthcare, large cap longs trimmed.

- Industrials at highest overweight since Jan’18.

- Flows to small cap & value up.

- No regional rotation (US>EU/UK/EM).

- Investors boosted their overweight in U.S. equities and slashed exposure to euro-area and emerging-market stocks.

- Banks/Energy still shunned.

- Cash levels rose from 4.6% to 4.8% (greed <4%, fear >5%).

- Net 18% of investors are overweight equities, but far from “dangerously bullish.”

- U.K. remains the top regional underweight despite allocation rising 2%.

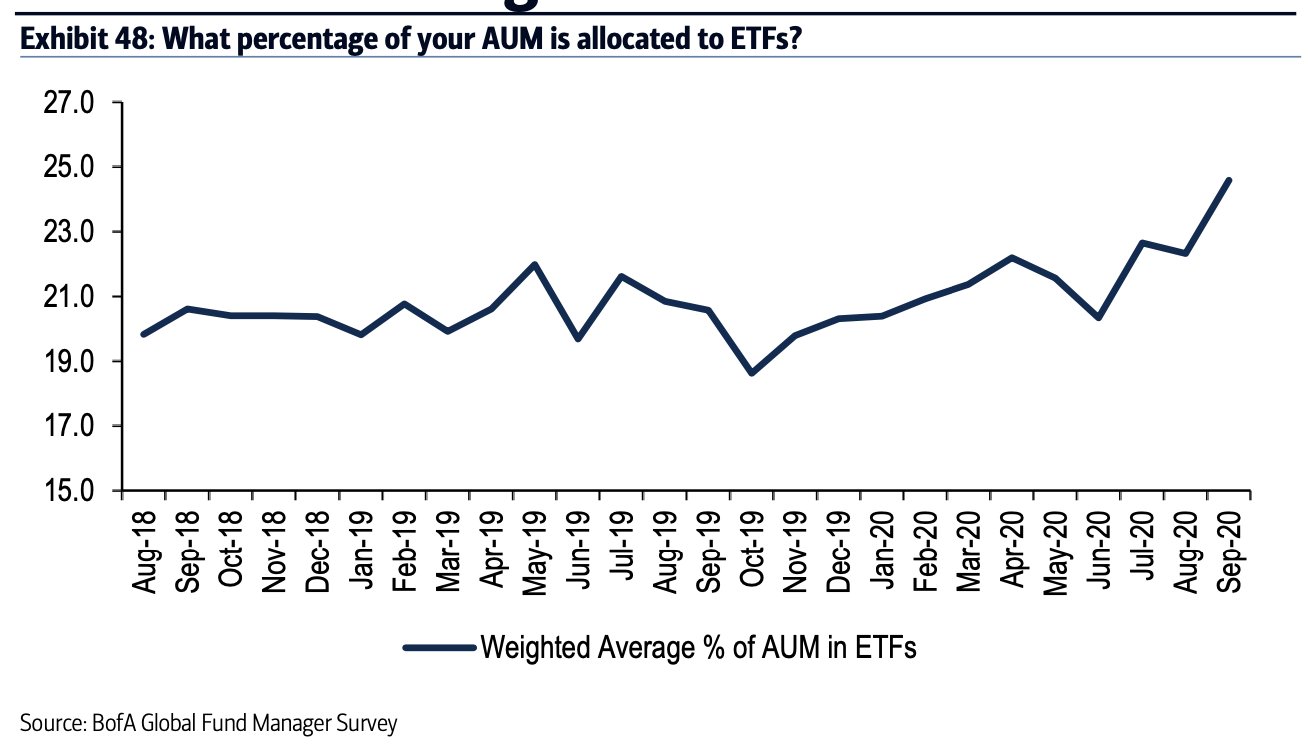

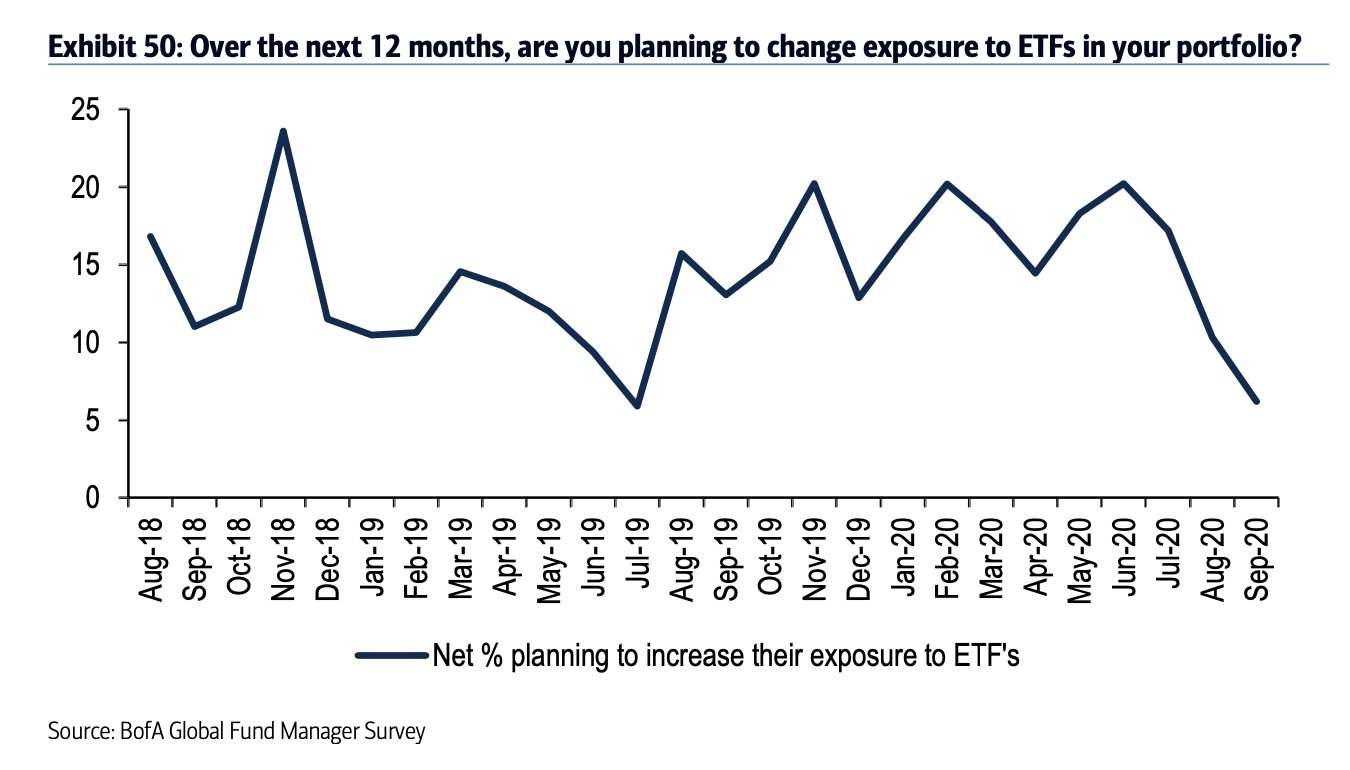

- ETF allocation at a high:

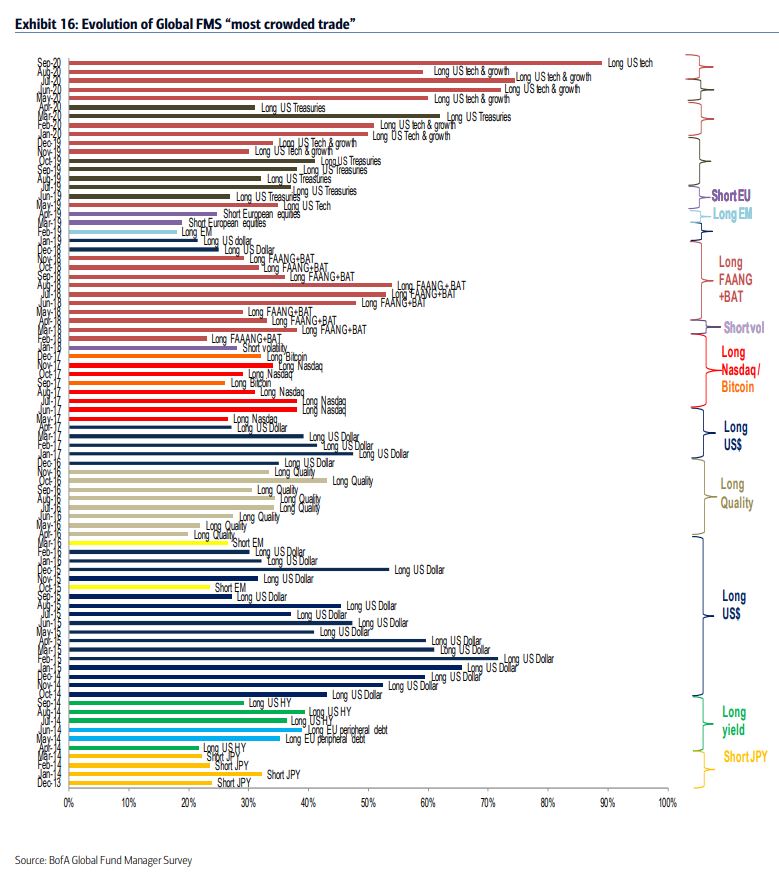

MOST CROWDED TRADE:

- 80% believe “Long US Tech” most crowded trade of all time (up from 59% in August). OF NOTE: 1-month return reversal occurs after “peak crowded trade” in 14/22 months in past decade.

- Long Gold

- Short USD

BIGGEST TAIL RISKS:

1. COVID

2. Tech Bubble

CONTRARIAN TRADES: