Morgan Wallen’s “Last Night” became the country star’s first No. 1 on the Billboard Hot 100 songs chart dated March 18, 2023. The song chronicles an “on again, off again” relationship that reminds me of the stop and start nature of the “China Trade” recovery since the lows in October:

As it relates to China, Morgan said it best:

I know you said this time you really weren’t coming back againBut baby, baby somethin’s tellin’ me this ain’t over yetNo way it was our last night…

“Opinion Follows Trend,” and just as the despondency keeps knocking people out (of BABA stock) today, the euphoria will keep pulling people in (to BABA stock) at some point in the near future. We will discuss the positive developments this week.

Fox Business

On Monday, I joined Cheryl Casone on Fox Business (The Claman Countdown) to discuss the developments in China, as well as expected outperformers in the U.S. through year-end. Thanks to Kathryn Meyers, Liz Claman and Cheryl for having me on:

Watch in HD directly on Fox Business

As it relates to Alibaba, there were several key developments this week:

1) Secretary Blinken met with President Xi Jinping. Blinken said talks were “candind and cunstructive” while Jinping acknowledged “The two sides have also made progress and reached the agreement on some specific issues. This is very good.” Talks will continue with the possibility of Biden meeting with Xi at the G-20 in New Delhi in September.

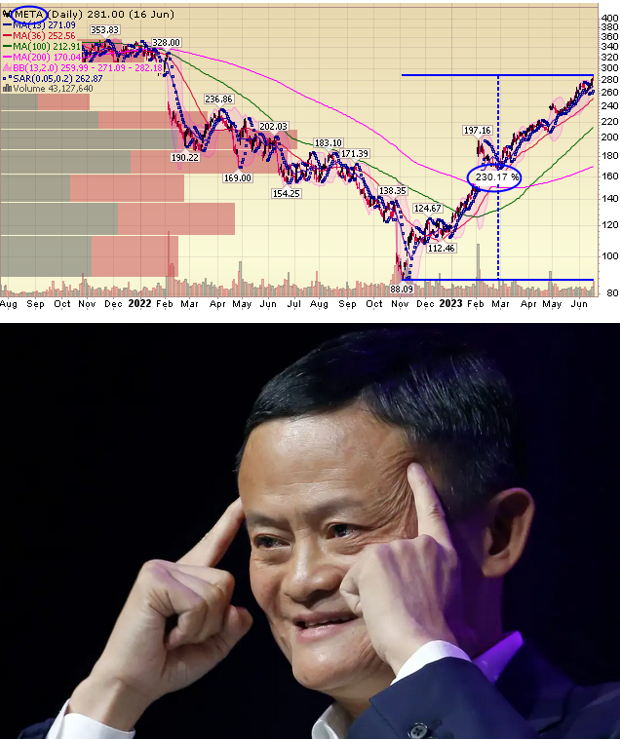

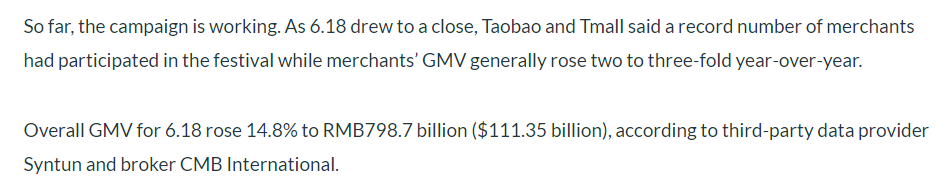

2) Jack Ma is back in the picture at Alibaba (albeit behind the scenes). His “restructuring plan” is mimicking the success seen buy Mark Zuckerberg in his 230% turnaround of META in less than a year:

-Alibaba cofounder Jack Ma held a small group meeting with top company execs in May, per LatePost.

-Ma suggested flattening out Taobao and Tmall’s org charts by cutting managers.

-The move echoes what’s happening in Silicon Valley giants like Meta.

3) Jack Ma is still the #1 shareholder of Alibaba and his position is very important to him. This week he put two of his original co-founders in key roles in the company:

Executive Vice Chairman Joseph Tsai, a longtime confidant of billionaire co-founder Jack Ma, will take Zhang’s position as the chairman of the board.

Eddie Wu, now chairman of Alibaba’s core Taobao and Tmall online commerce divisions, will take over as chief executive of the $240 billion company. “The good thing is that the new CEO and chairman are all co-founders of the company and are the closest to Jack Ma. That means Ma remains the spiritual leader of Alibaba,” said Kenny Wen, head of investment strategy at KGI Asia Ltd. The Chinese e-commerce giant’s latest maneuver brings “old Alibaba management back to the stage again,” said Willer Chen.

“Eddie Wu’s appointment as CEO shouldn’t come as a huge surprise. He co-founded Alibaba and played a key role on both the technology development and monetization of Taobao and Alipay,” Jacob Cooke.

WSJ “The shake-up could maintain the influence of Ma, who engineered the breakup of the e-commerce empire from afar while he traveled overseas for most of the year before the plan was unveiled. On Saturday, he was in his hometown of Hangzhou, where Alibaba is based, to attend an annual global mathematics competition he started in 2018 and chatted with the finalists.”

The reshuffle indicates that Ma is returning “to exercise more direct control,” said Charlie Chai, a tech-focused analyst at equity research firm 86Research.

Tsai is well-liked by investors and his appointment should be seen as good news, said Vey-Sern Ling, a senior adviser for Asia technology stocks at Union Bancaire Privée.

Zhang will continue to head up Alibaba’s cloud-computing unit, the second-largest business by revenue after its domestic e-commerce unit, as the group bets on it for growth.

4) Visible or invisible, Ma is back and it is with the implicit blessing of the government. They need jobs and growth and he knows how to create them.

5) Zhang will remain CEO of the cloud computing business, as it pushes towards a spin-off and eventual public listing.

5) Zhang will remain CEO of the cloud computing business, as it pushes towards a spin-off and eventual public listing.

“Cloud Intelligence Group is now full speed ahead on its spin-off plans and we are approaching a crucial stage of the process, so it is the right time for me to dedicate my full attention and time to the business,” Zhang said in a memo to staff obtained by CNBC.

Zhang’s intentions to only focus on cloud now have been some years in the making. In an interview with CNBC in 2018, Zhang said cloud computing will be the company’s “main business” in the future, underscoring his bullishness regarding the technology.

6) Jack Ma, the founder of Alibaba Group Holding, held an informal meeting with e-commerce executives in late May, advising them to refocus on Taobao. Alibaba has to “go back to Taobao, go back to users, and go back to the internet,” according to the report published on Monday.

“Going back to Taobao” means the platform will pivot from traffic flows to supporting marketing budgets for small and medium merchants from established brands on Tmall. Taobao, launched in 2003, was Alibaba’s first consumer e-commerce platform. It achieved huge success in wooing small merchants online to defeat then rivals such as US giant eBay while Tmall, formally known as Taobao Mall, was spun out in 2008 to fit Chinese consumer’s demand for brands.

Alibaba employees, who declined to be named as they were not authorised to speak publicly, confirmed to the Post that the pivot towards small merchants has been taking place inside the business unit. For example, Alibaba has gradually scaled back subsidies on big-ticket items such as iPhones but has increased incentives for products such as iPhone covers or ornaments, which are mainly sold by small businesses.

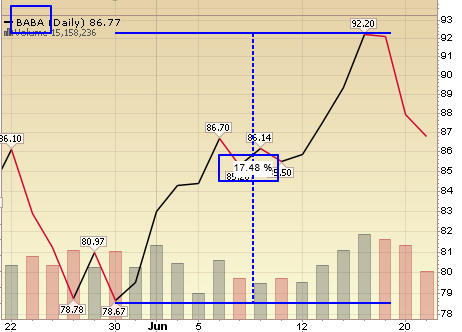

7) Taobao and Tmall had a record 6.18 sales event this month growing 14.8% yoy:

h/t Brendan Ahern

8) USD resumed its downtrend following the debt ceiling “bid to safety” causing BABA to rebound in recent weeks.

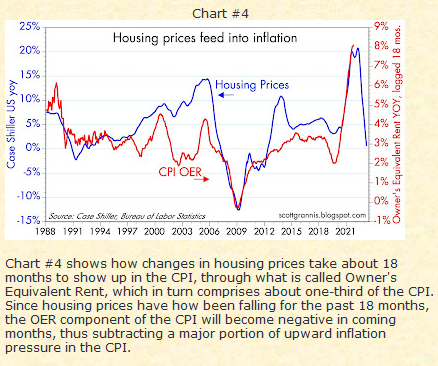

With the owners equivalent rent dropping off a cliff this month (June CPI to be reported in July ahead of the Fed meeting) – we expect the Fed to be done and the dollar to weaken further:

With the owners equivalent rent dropping off a cliff this month (June CPI to be reported in July ahead of the Fed meeting) – we expect the Fed to be done and the dollar to weaken further:

source: Scott Grannis

This will be a boon to Emerging Markets/China equities.

This will be a boon to Emerging Markets/China equities.

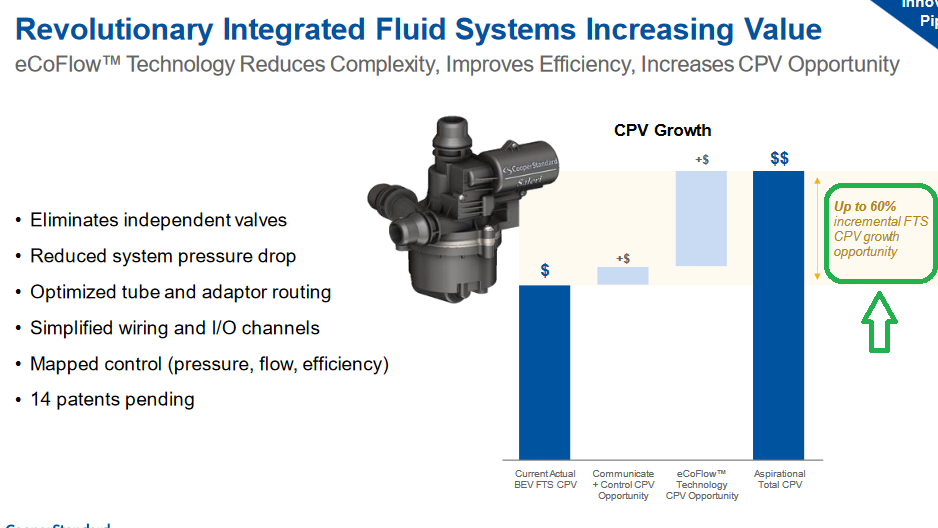

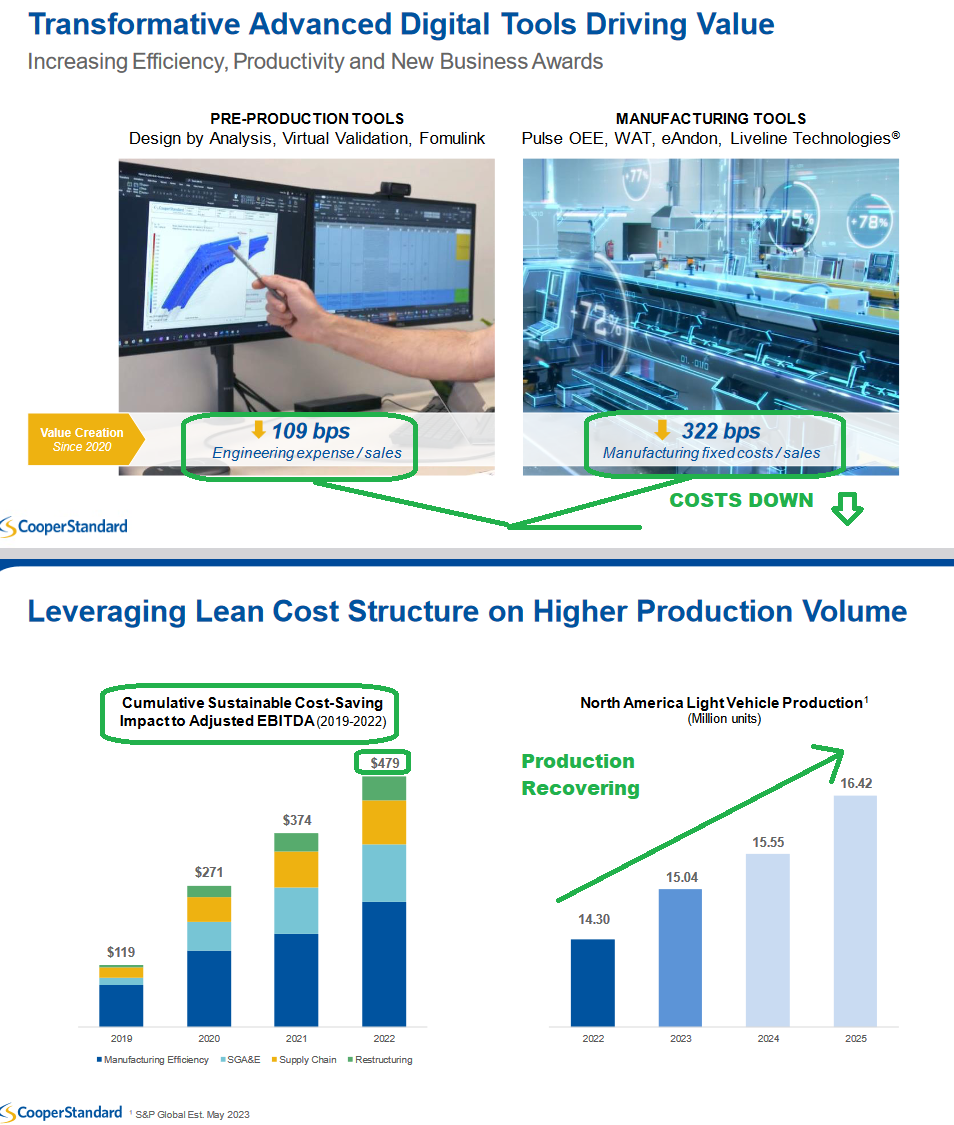

Cooper Standard Update

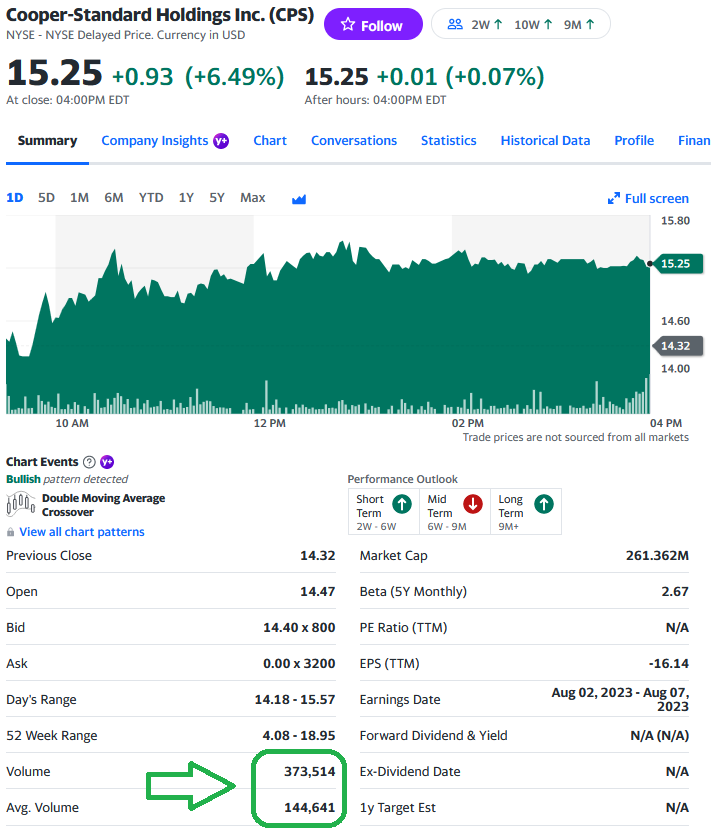

Cooper Standard continues to climb on above average daily volume. Since we put it out publicly on the podcast|videocast in May 2022 and on Fox Business with Liz Claman in June 7, 2022 – it us up ~3x (~200%). We believe the move is just getting started. Clip from Claman Countdown (Fox Business) on June 7, 2022:

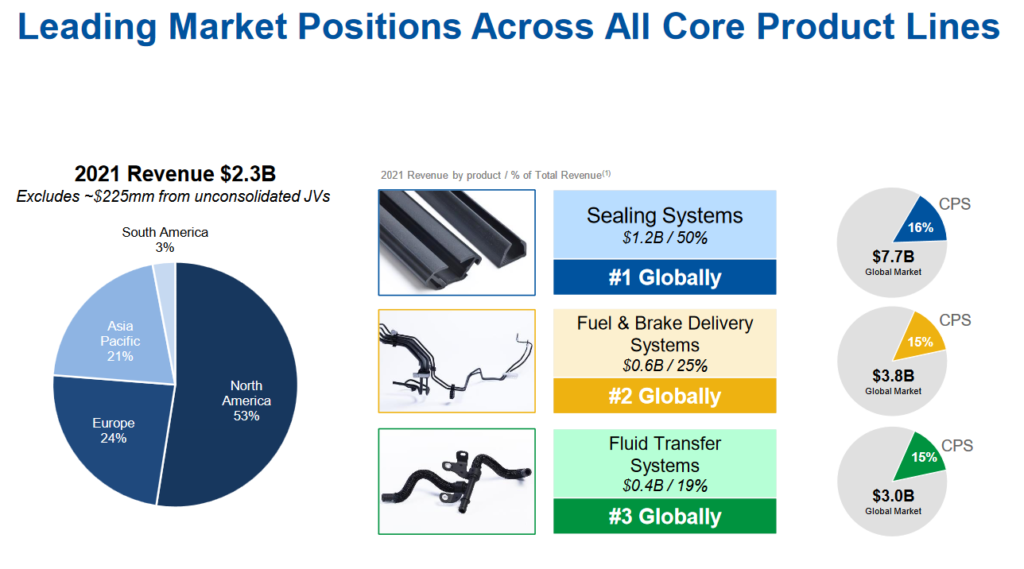

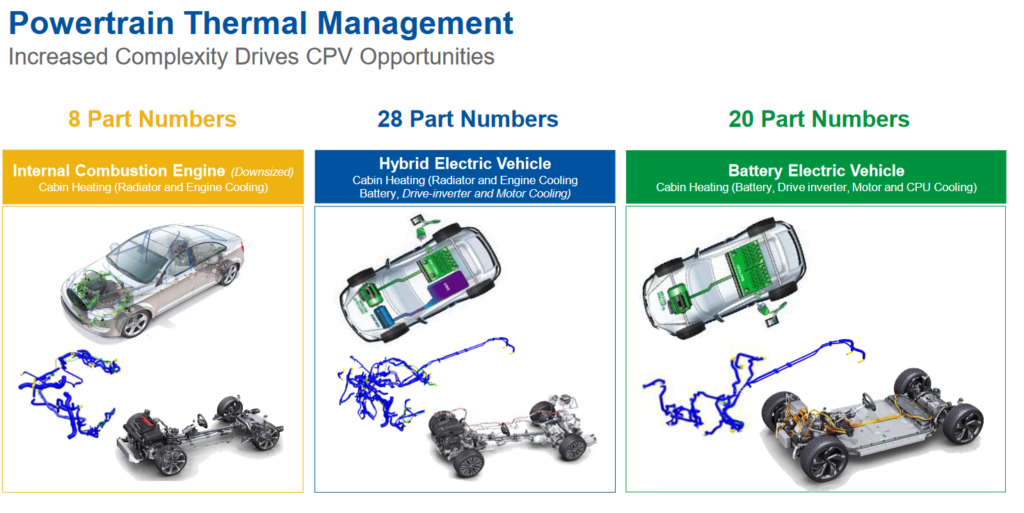

Here is some information from our original thesis and updates:

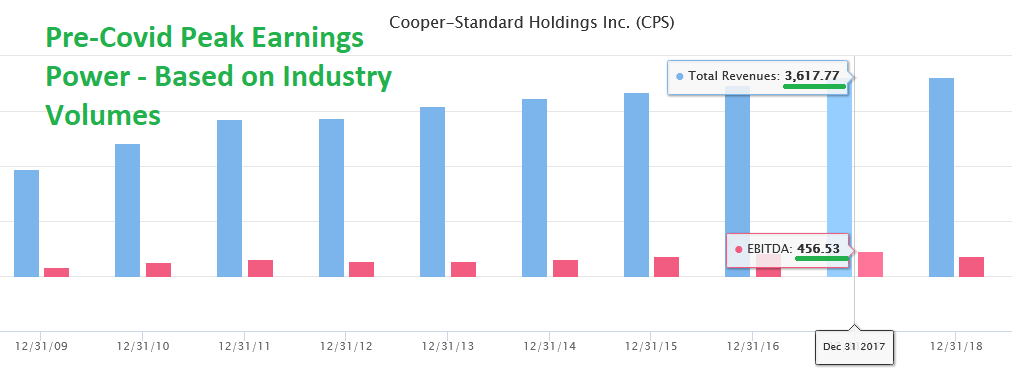

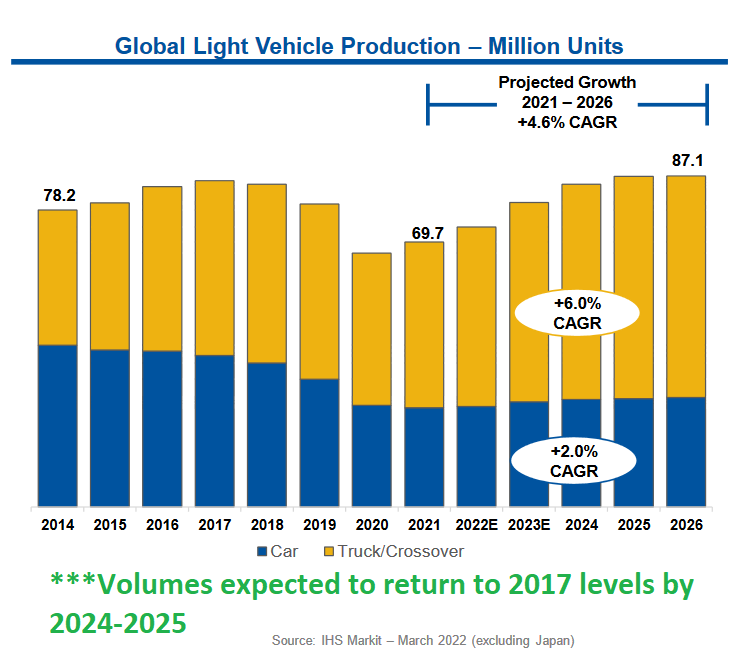

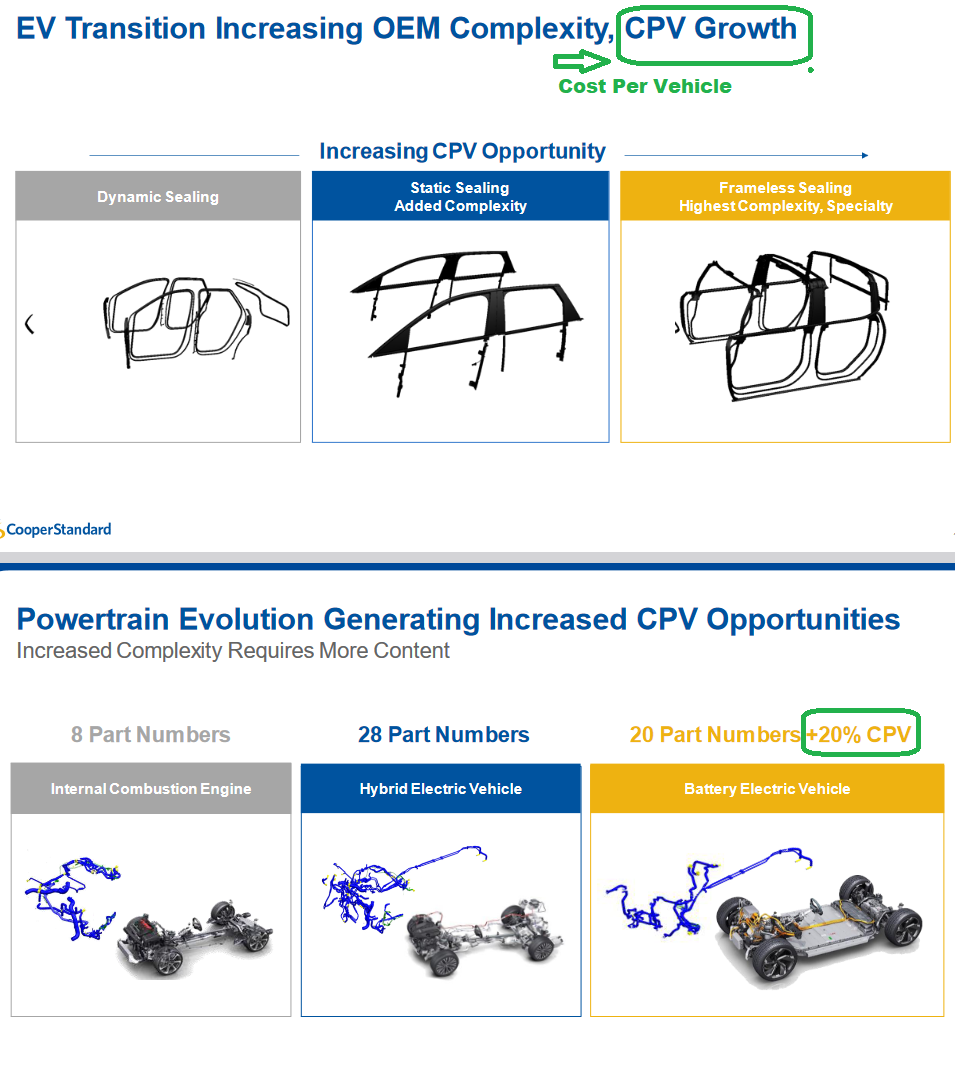

The most important table is the one above with the IHS estimates of Global Light Vehicle production. The key takeaway is that volumes are expected to return to 2017 levels by 2024 or 2025.

Here’s what Cooper Standard achieved in 2017:

$3.62B Revenues

$452M Adj. EBITDA (12.5% of revs)

$135M Net Income (3.73% of revs) ~18.78M fully diluted shares = ($7.21/share EPS)

Peak stock price on $7.21/share EPS was $146.78 (August 3, 2018) = ~20x P/E multiple.

Here’s what Cooper could achieve in 2024-2025 IF INDUSTRY VOLUMES MEET EXPECTATIONS AND RETURN TO NEAR 2017 LEVELS:

$3.3B Revenues (Anti-Vibration unit sold. $320M revenue 2017)

$412M Adj. EBITDA (12.5% of revs)

$123M Net Income (3.73% of revs) ~17.16M fully diluted shares = ($7.19/share EPS).

At 10x P/E = $71.90. At 2017 peak multiple = $146.37. Cut both in half and you’re still at a 5-10x+ bagger.

BUT, you say, EPS will be effected by increased interest expense. THAT IS CORRECT. Interest expense in 2017 was $42M, but TAXES were $74M. While the Interest expense in 2024 or 2025 will be ~$100M (assuming they don’t refinance at lower rates in coming year(s)), keep in mind they have $130MM in Deferred Tax Assets. They will just be moving into profitability and will be able to use a significant portion of that asset to dramatically reduce their cash tax obligation. In effect, it’s possible that EPS in 2024 or 2025 could be a tick higher than 2017 on the same volumes. The key will be what multiple is assigned (peak or trough)?

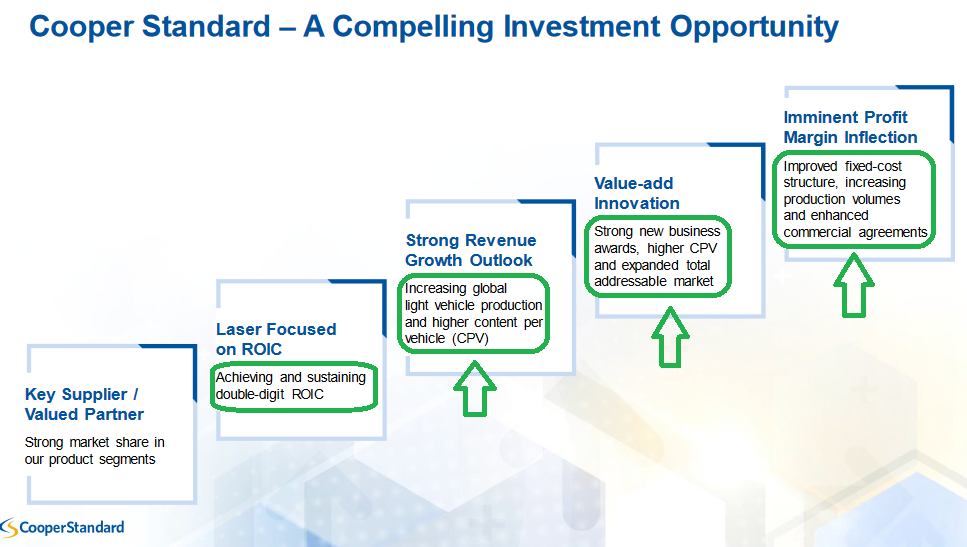

As I have said numerous times on our podcast|videocast there are 3 key reasons I bought ownership in the company: 1) management respects equity (they have brought share count DOWN over the years), 2) management comp is tied to ROIC (return on invested capital) 3) the operating leverage in this business is unparalleled coming out of industry troughs.

*Past performance is no guarantee of future results. See “terms” above.

What’s NEW?

On June 14th they published an “Investor Presentation” on their website. The stock has been moving up aggressively since then (on well above average daily volume):

So what is the new information?

So what is the new information?

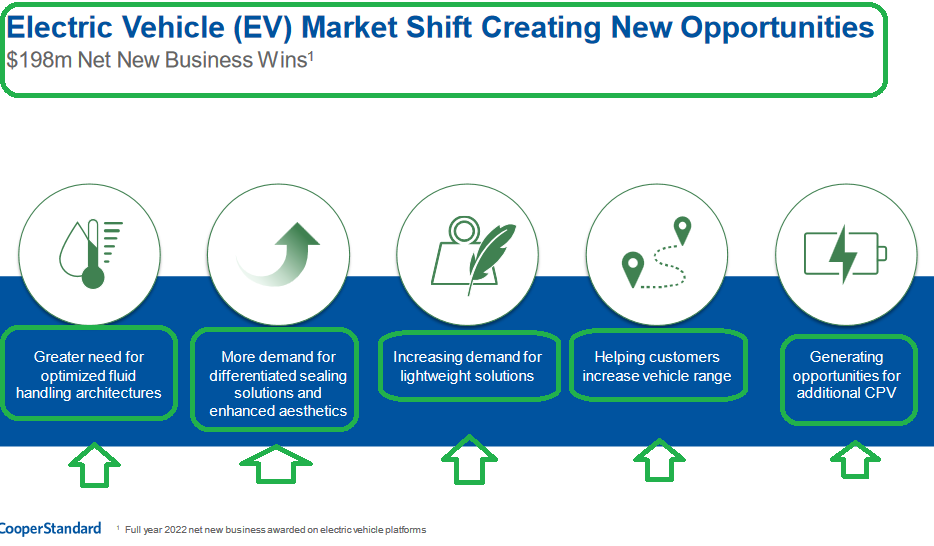

This last slide is the most important. While they have low estimated market growth, they also have conservative revenue growth for the company at 8% CAGR. An 8% CAGR implies $3.15B of top-line revenue in 2025 and $3.4B in 2026. This puts us right in line with our original thesis from last year:

“$3.3B Revenues (Anti-Vibration unit sold. $320M revenue 2017)

$412M Adj. EBITDA (12.5% of revs)

$123M Net Income (3.73% of revs) ~17.16M fully diluted shares = ($7.19/share EPS).

At 10x P/E = $71.90. At 2017 peak multiple = $146.37. Cut both in half and you’re still at a 5-10x+ bagger.”

KEEP IN MIND OUR ORIGINAL THESIS IS PREDICATED ON 2017 MARGINS. AS YOU CAN SEE THEY HAVE TAKEN OUT MEANINGFUL COSTS IN THE LAST FEW YEARS (AND INCREASED PRICING) WHICH MEANS OUR BOTTOM LINE TARGETS COULD BE EXCEEDED OR REACHED EARLIER THAN ANTICIPATED. Time will tell…

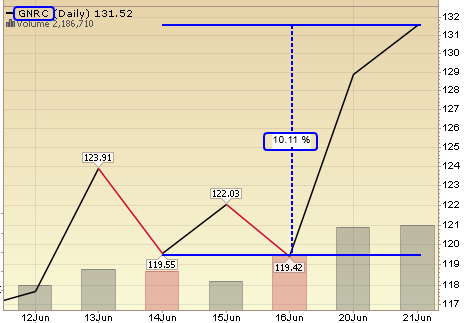

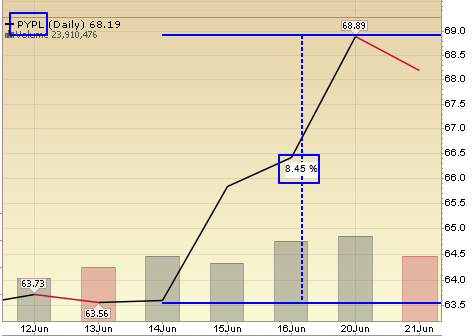

GNRC & PYPL

Last week we discussed Generac and Paypal on Yahoo! Finance. Thanks to Taylor Clothier, Diane King Hall and Brad Smith for having me on. Here were the theses (2nd half of video):

Here’s what has happened since:

Now onto the shorter term view for the General Market:

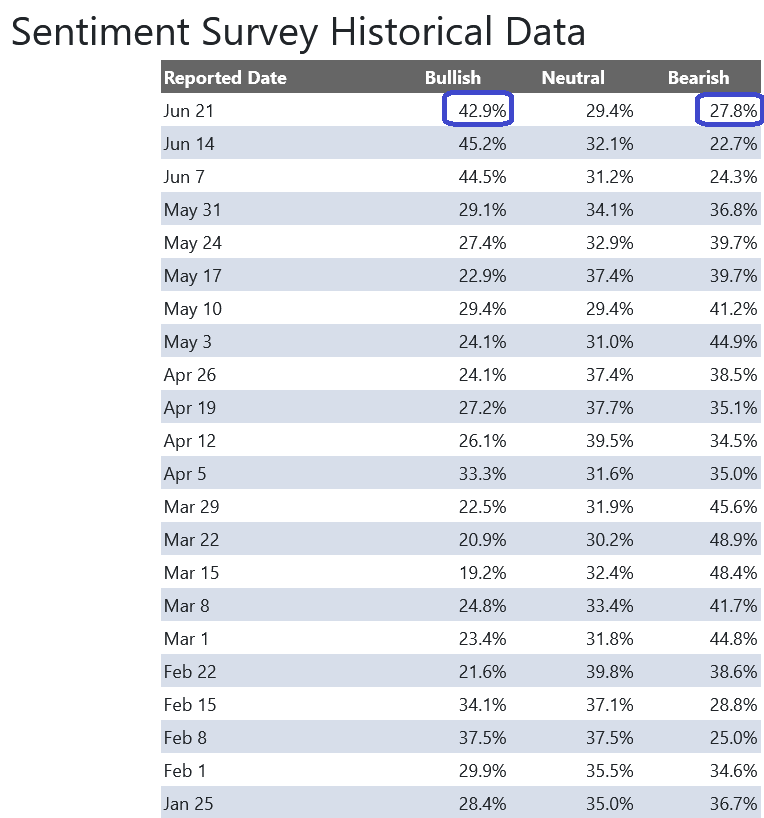

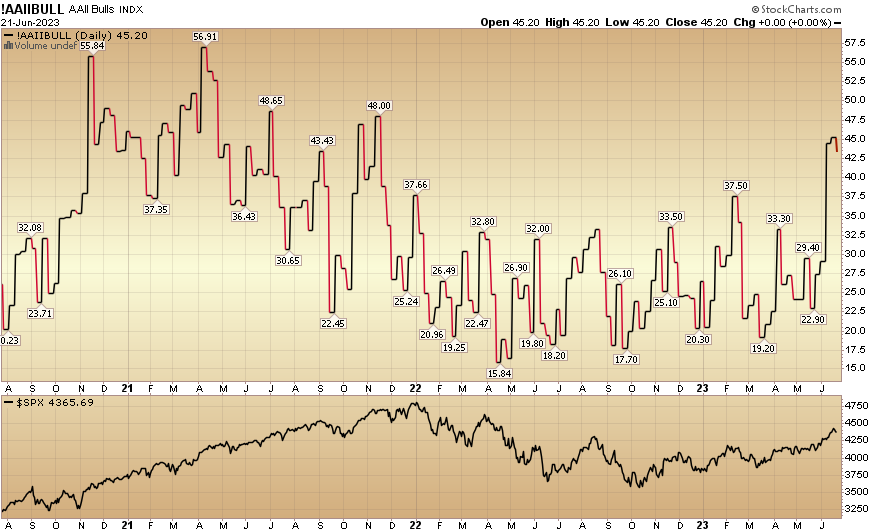

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 42.9% from 45.2% the previous week. Bearish Percent rose to 27.8% from 22.7%. The retail investor is still optimistic. This can stay elevated for some time based on positioning coming into these levels.

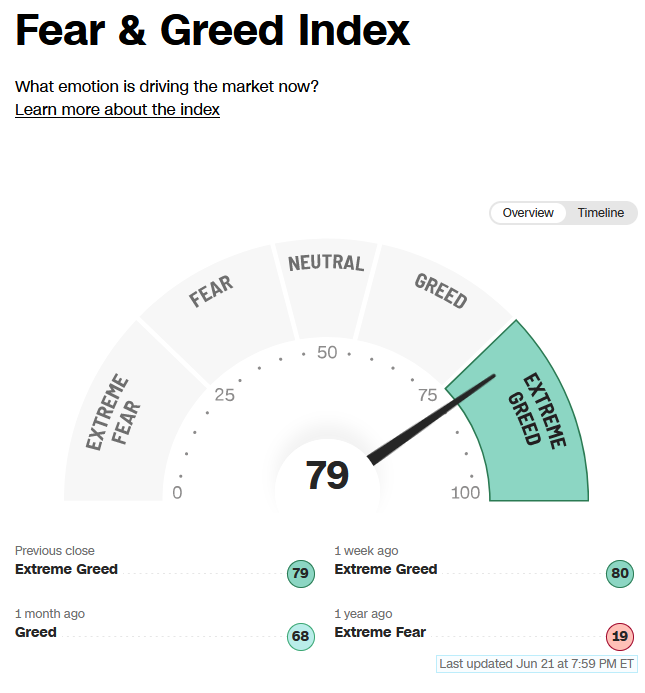

The CNN “Fear and Greed” ticked down from 81 last week to 79 this week. Sentiment is hot but it would not surprise me if it stays pinned for a bit to force people out of their bunkers and back into the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” ticked down from 81 last week to 79 this week. Sentiment is hot but it would not surprise me if it stays pinned for a bit to force people out of their bunkers and back into the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

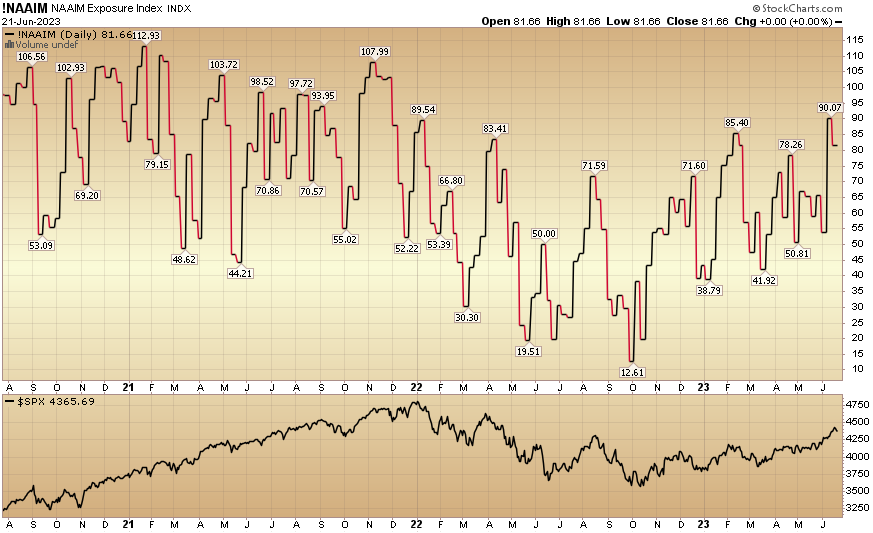

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dipped to 81.66% this week from 90.07% equity exposure last week. Managers have been chasing the rally.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dipped to 81.66% this week from 90.07% equity exposure last week. Managers have been chasing the rally.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.