Tag: StockMarket

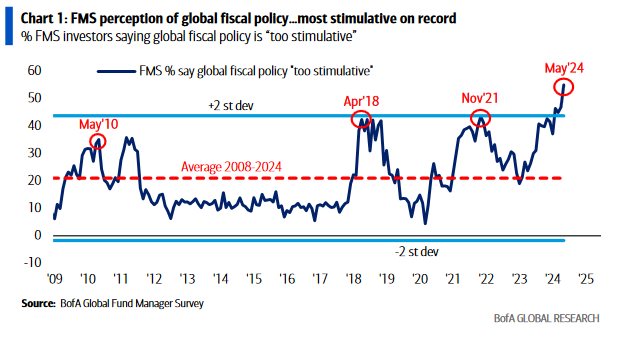

May 2024 Bank of America Global Fund Manager Survey Results (Summary)

The April survey covered 209 fund managers with $562 billion under management. Continue reading “May 2024 Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 16 key reads for Tuesday…

- China’s Alibaba beats quarterly revenue estimates (up 7% yoy), profit drops primarily due to valuation changes from equity investments (reuters)

- Alibaba sees most profitable year since 2021 amid a refocus on e-commerce, AI businesses and rising competition at home (scmp)

- Alibaba sees AI traction. “During the quarter, our core public cloud offerings, which include products such as elastic compute, database and AI products, recorded double-digit year-over-year growth in revenue,” Alibaba said. Alibaba’s board of directors has approved a dividend consisting of two parts. This includes an annual cash dividend of $1.00 per ADS and a “one-time extraordinary cash dividend” of 66 cents per ADS. (marketwatch)

- BofA Strategist Hartnett Warns Stock Rally Is Exposed to Stagflation Risk (bloomberg)

- BofA’s Moynihan Talks US Economy, Lending and M&A (bloomberg)

- BABA-SW (09988.HK) Expects to Finish Conversion to Dual Primary Listing in HK by End-Aug 2024 (aastocks)

- Alphabet to spotlight AI innovations at developer conference (reuters)

- The Fed Depends on Data but Numbers Are Getting Shakier. That’s a Problem. (barrons)

- Berkshire Hathaway’s Mystery Stock Purchase Could Be Revealed on Wednesday (barrons)

- Wholesale inflation surges again, PPI shows. Takeaway: Inflation remains sticky. (marketwatch)

- Money managers are more bullish than at any point since November 2021, survey shows (marketwatch)

- Temu Cools on the U.S. After Shelling Out Billions (wsj)

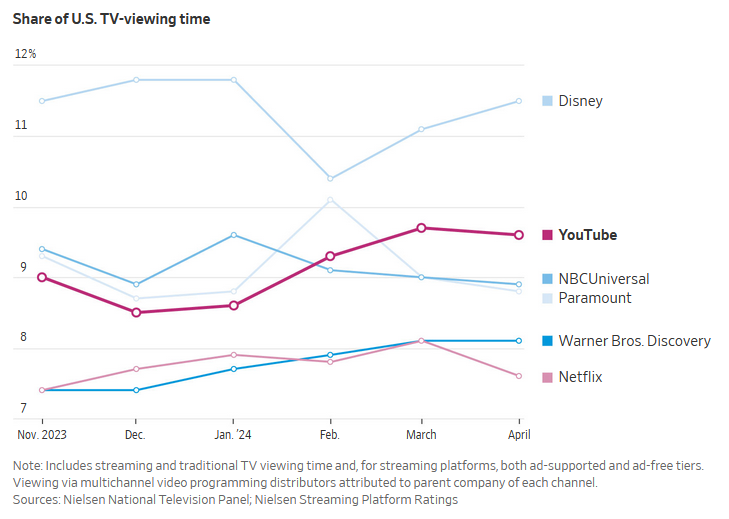

- What’s on TV? For Many Americans, It’s Now YouTube (wsj)

- Investors Crowd Into Soft-Landing Trade Ahead of Crucial Inflation Data (wsj)

- The UK Is No Longer the Most Hated Market (bloomberg)

- Israel’s Once-Dominant Drugmaker Is Revived by Innovation (wsj)

Where is money flowing today?

Data Source: Finviz

Indicator of the Day (video): NYSE New Highs

Our Applied Stock Market Indicator of the Day is:

NYSE New Highs

Tom Hayes – Quoted in Reuters article – 5/13/2024

Thanks to Medha Singh for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 30 key reads for Monday…

- China fires starting gun on $140bn debt sale to boost economy (ft)

- How Alibaba is leading the evolution of online luxury shopping (scmp)

- 1 Growth Stock Down 75% to Buy Right Now (fool)

- China to Start $138 Billion Bond Sale on Friday to Boost Economy (bloomberg)

- Japan Will Likely Restart World’s Biggest Nuclear Plant This Year, BNEF Says (bloomberg)

- Temu Cools on the U.S. After Shelling Out Billions (wsj)

- Japan on track to normalise monetary policy, says ruling party heavyweight (reuters)

- China Takes Advantage of Cheap Gas and Coal to Rebuild Stocks (bloomberg)

- Intel Nears Deal With Apollo for $11 Billion Ireland Partnership (wsj)

- 3 Reasons to Buy GXO Logistics Stock Now (fool)

- Wall Street Turns Up the Heat on Companies to Perform (wsj)

- Investors Crowd Into Soft-Landing Trade Ahead of Inflation Data (wsj)

- Suddenly There Aren’t Enough Babies. The Whole World Is Alarmed. (wsj)

- Wall Street Turns Up the Heat on Companies to Perform (wsj)

- The Secret to Talking to an AI Chatbot (wsj)

- How AI Has Already Begun to Change These Workers’ Jobs (wsj)

- Will AI Be a Job Killer? Call Us Skeptical (wsj)

- A Beginner’s Guide to Using AI: Your First 10 Hours (wsj)

- Why You Need to Tell an AI Chatbot It Has to Do Better (wsj)

- April CPI: Goldman Sachs expects in-line inflation figures (streetinsider)

- GS: Unprofitable growth stocks to remain under pressure from higher interest rates (streetinsider)

- China, Hong Kong enhance Swap Connect scheme in time for its 1st birthday, easing access to mainland interbank derivatives (scmp)

- Hong Kong stocks: index hits 9-month highs, tops 19,000 on earnings optimism and policy support hopes (scmp)

- Can Europe’s economy ever hope to rival the US again? (ft)

- US and China to hold first talks to reduce risk of AI ‘miscalculation’ (ft)

- Hong Kong, mainland China tax waivers a ‘win-win’ for capital markets’ development, experts say (scmp)

- Meredith Whitney Advisory Group CEO: Proposed mortgage reform is a ‘massive game changer’ (cnbc)

- PayPal Business Cashback Mastercard review — Helpful perks with a simple rewards program (yahoo)

- One stock is dragging down the S&P 500’s earnings growth (yahoo)

- China’s visa-free policy ignites European enthusiasm, enhances exchanges (peoplesdaily)

Indicator of the Day (video): Equity Put Call Ratio 10 DMA

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

Equity Put Call Ratio 10 DMA

Be in the know. 13 key reads for Mother’s Day…

- Alibaba leverages cloud business to become a leading AI investor in China (UNLOCKED LINK) (financialtimes)

- Alibaba Cloud’s Qwen LLM Tops 90,000 Enterprise Clients in First Year (alizila)

- Alphabet Bought Up Two Slumping Stocks (barrons)

- Stubbornly High Rents Prevent Fed From Finishing Inflation Fight (wsj)

- China to Nurture Stock Rally (bloomberg)

- Magic Pill — Johann Hari and the New “Miracle” Weight-Loss Drugs (timferriss)

- Charlie Munger and How Not to Invest (morningstar)

- Undervalued by 28%, This Stock Is a Buy for Patient Investors (morningstar)

- The 10 Best Dividend Stocks (morningstar)

- Will Japanese Yen Currency Rally From 40-Year Support? (kimblechartingsolutions)

- Zombie 2nd mortgages are coming back to life (npr)

- Living With the McLaren F1 (roadandtrack)

- Design Analysis – Why the Ferrari Testarossa became a superstar of the 1980s (classicdriver)