Today some institution/fund purchased 661 contracts of Jan 2021 $3 strike calls (or the right to buy 661,000 shares of Deutsche Bank Aktiengesellschaft (DB) at $3). The open interest was just 100 prior to this purchase. Continue reading “Deutsche Bank Aktiengesellschaft (DB) – Unusual Options Activity”

Tag: StockMarket

Be in the know. 15 key reads for Friday…

- Regeneron (REGN) Upgraded to “Top Pick for 2020†and “Outperform†by Credit Suisse (TheFly)

- US and China agree to phase one trade deal, December Chinese tariffs canceled (Fox Business)

- 100 Books Everyone Should Consider Reading (AOM)

- Fed Statement on Repo Operations (NY Fed)

- Fed Aims a Half-Trillion Dollar Liquidity Hose at Year-End Risks (Bloomberg)

- Johnson secures crushing UK election victory (Financial Times)

- Watch Out, China: Why Investors May Flock to India Next (Institutional Investor)

- Shares and sterling soar as trade and Brexit fog lifts (Reuters)

- Trump says Britain, U.S. free to strike new trade deal after Brexit (Reuters)

- Are Energy Stocks Hot Again? (Oil Price)

- Emerging Markets Cut Rates With Russia Following Turkey, Brazil (Bloomberg)

- Happy birthday, Taylor Swift! (New York Post)

- The Hedge Fund CQS Is Looking at Unloved Parts of the Credit Market for 2020 (Barron’s)

- Big Pharma’s Coming Back in 2020. ()

- Navy SEAL: How To Pick Yourself Back Up From Failure (Investor’s Business Daily)

Where is money flowing today…

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- Trump meets with top trade advisers to strategize before major China tariff deadline (Fox Business)

- Saudi Aramco touches $2tn valuation on second day of trading (Financial Times)

- Why Exxon’s Stock Could Hit $100 In 2020 (Oil Price)

- The “Crazy Rich Asians” Stock Market (and Sentiment Results) (ZeroHedge)

- Continental Resources founder Harold Hamm steps down as CEO (Financial Times)

- U.S. producer prices unchanged; underlying inflation soft (Reuters)

- Oil prices rise on OPEC deficit forecast (Reuters)

- The Fed Did Everything It Needed To By Doing Nothing (Barron’s)

- The Fed could consider buying other short-term Treasuries, Powell says (Barron’s)

- Supercar maker McLaren to skip electric vehicles. Here’s why — and what it will build instead. (USA Today)

- Cisco says its new silicon, software, router products will ‘change the economics of the Internet’ (Yahoo! Finance)

- Apple (AAPL) China iPhone Shipments in Nov Declined Sharply – Credit Suisse (Street Insider)

- Japan and the Art of Making the Same Mistakes Over and Over Again (Wall Street Journal)

- Britain Votes in an Election That Will Set the Course of Brexit (Wall Street Journal)

- US weekly jobless claims race to a more than 2-year high (CNBC)

The “Crazy Rich Asians” Stock Market (and Sentiment Results)

“Crazy Rich Asians” is a 2018 American romantic comedy film directed by Jon M. Chu. The film chronicles a Chinese-American professor who travels to meet her boyfriend’s family and is surprised to discover they are among the richest in Asia. Continue reading “The “Crazy Rich Asians” Stock Market (and Sentiment Results)”

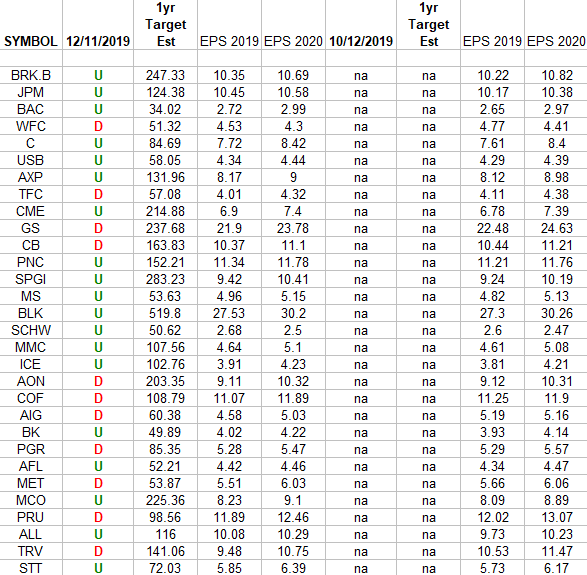

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

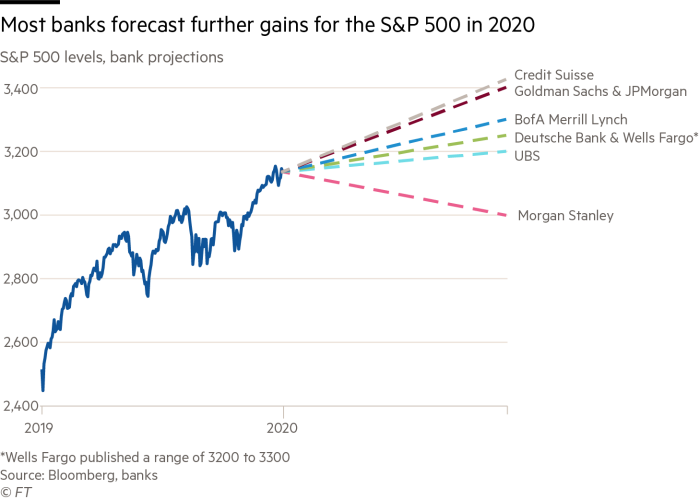

- Wall Street expects bull run to continue in 2020 (Financial Times)

- OPEC sees small 2020 oil deficit even before latest supply cut (Reuters)

- Industrial Stocks Could Rebound on Trade News, Analysts Say (Wall Street Journal)

- The 5 books Bill Gates recommends you read this holiday season (CNBC)

- Exxon Mobil prevails in New York climate change lawsuit (Reuters)

- The stock market will ‘breathe a sigh of relief’ if President Trump is re-elected in 2020, says billionaire Howard Marks (MarketWatch)

- Asleep No More, Traders Buy Hedges ‘Like World Is About to End’ (Bloomberg)

- Ray Dalio Is Now Mentoring Hip-Hop Mogul Sean ‘Diddy’ Combs (Bloomberg)

- Saudi Aramco shares jump 10% in oil group’s trading debut (Financial Times)

- Bank of America is becoming the Amazon of retail banking (Yahoo! Finance)

- Jobs surge boosts housing market (FoxBusiness)

- Brexit Stocks That Could Soar If Boris Johnson Wins the U.K. Election (Barron’s)

- The ‘Dividend Aristocrats’ have nearly matched the S&P’s return (Barron’s)

- The Federal Reserve Is Primed to Launch ‘QE4’, Strategist Says. Others Say That’s Not Likely. (Barron’s)

- Sicilian Homes Went Up for Auction Starting at €1. More Than 100,000 People Called. (Wall Street Journal)

- Ken Griffin Has Another Money Machine to Rival His Hedge Fund (Bloomberg)

- The Fed is expected to hold rates steady and vow to keep short-term lending markets stable (CNBC)

- ‘Gundlach ratio’ suggests bond yields may rise (MarketWatch)

- Christine Lagarde Needs to Be a Negotiator—But Also a Plumber (Wall Street Journal)

- Yuan Is Offering Interesting Entry Point at Current Levels: Pictet WM (Yahoo! Finance)

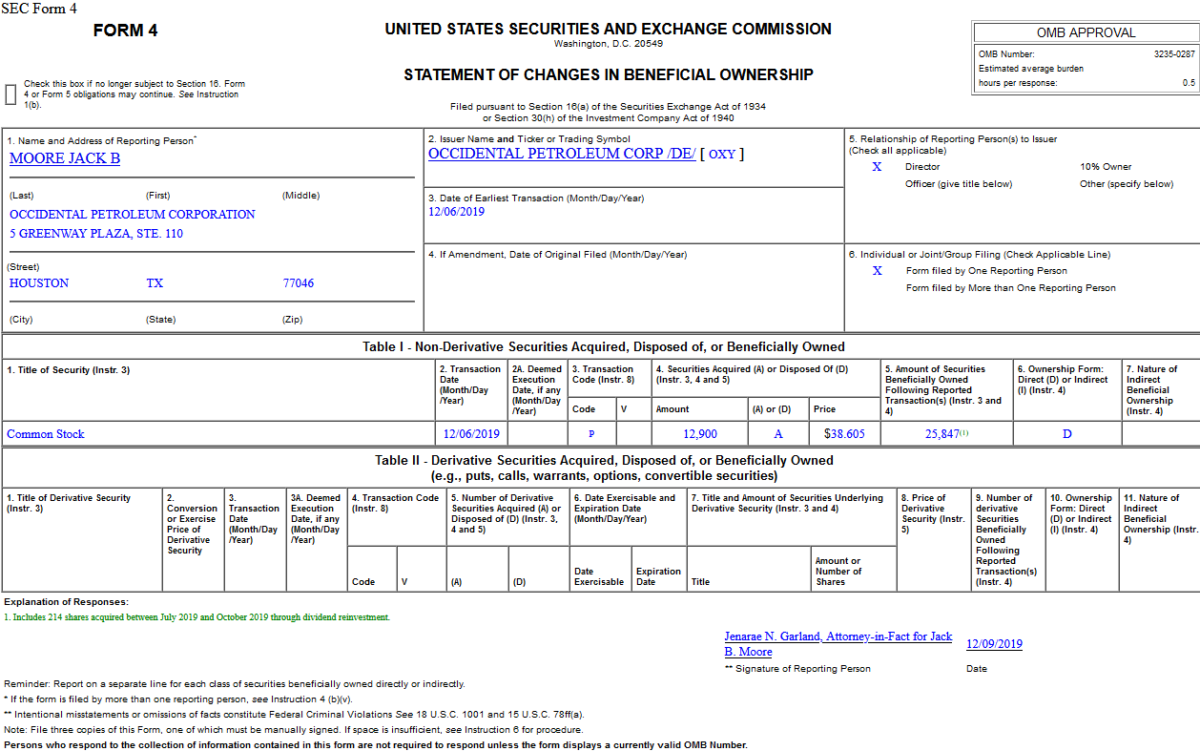

Insider Buying in Occidental Petroleum Corporation (OXY)

On December 6, 2019, Jack Moore – Director of Occidental Petroleum Corporation (OXY) – purchased 12,900 shares of OXY at $38.61. His out of pocket cost was $498,005. Continue reading “Insider Buying in Occidental Petroleum Corporation (OXY)”

Where is money flowing today?

Data Source: Finviz