“Crazy Rich Asians” is a 2018 American romantic comedy film directed by Jon M. Chu. The film chronicles a Chinese-American professor who travels to meet her boyfriend’s family and is surprised to discover they are among the richest in Asia.

The timely metaphor for today’s stock market is that we are coming up on December 15 – the day that we will find out if a “phase 1” deal is agreed upon, tariffs are implemented, or the deadline is delayed.

The Chinese have one of two choices. They either can be:

1. CRAZY: Not concede on any points and scuttle the deal.

OR

2. RICH: Agree to a win-win deal with the U.S., recover from their recent economic decline and move onward and upward to tremendous prosperity.

But they cannot be BOTH (Crazy and Rich) – as was so elegantly portrayed in the film.

The same goes for President Trump. He has been credited and complimented for being, “crazy like a fox.” But if there’s no deal done, you have no “fox” and you’re just left with…(and likely a Democratic campaign slogan that begins along the lines of, “I thought trade wars were easy to win”).

Why is this important?

Many say, coming off the exceptionally strong jobs report on Friday, “why doesn’t President Trump just walk away now, we don’t need a deal?”

This is a reasonable stance in the short term, but it underestimates the intermediate term impact it will have on S&P 500 earnings. As I have said in the last couple of weeks, part of the reason we were able to maintain close to double digit growth estimates for 2020 (9.8% as of Friday) is because 2019 Q4 estimates have come down – making the year on year growth rate stronger. Here are the latest figures/article from Friday:

I also made the case that in the event that a sensible phase one deal is completed before year-end, what is not priced in or anticipated is the possibility that estimates could actually begin to rise (depending on the terms/timing of the deal). The more certainty that can be provided for C-Suites around the country, the more investment (and growth) we will see moving forward.

So while the dynamics have changed somewhat, with the strong jobs report having potentially given President Trump more leverage, sentiment is paramount to how earnings will look going forward. It is unequivocal that estimates, multiple and price will come down without a deal. And with that will come declining sentiment and increased uncertainty – which are the precursors to any slowdown.

So while every day that a deal is not done for the U.S. will start to impact 2020 earnings estimates, every day a deal is not done for the Chinese, they lose leverage. Unless they know something that the rest of the world does not know about President Trump’s odds of re-election, the closer he gets to the election, the less incentive he has to complete a deal.

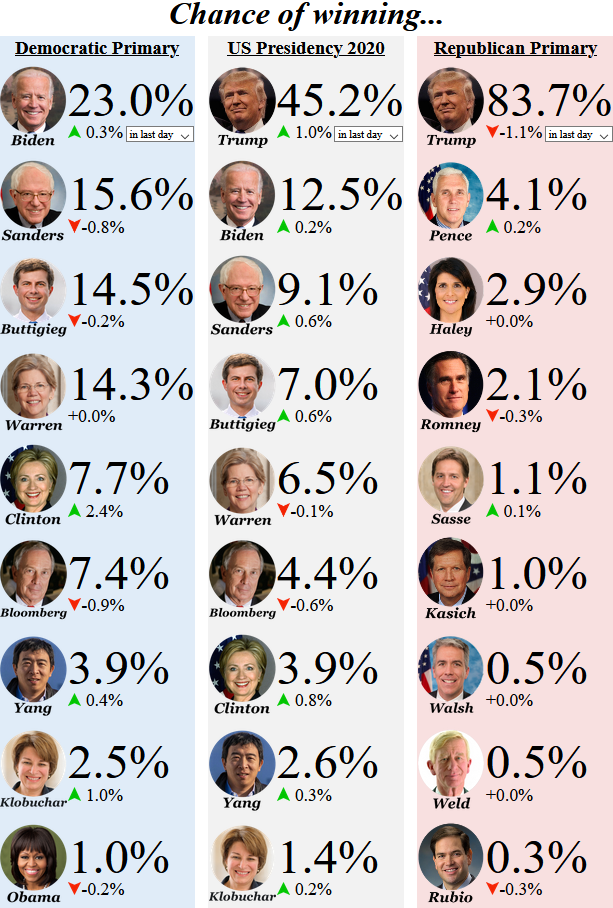

Here are the latest numbers from ElectionBettingOdds.com

The problem with waiting for the election is that if these odds hold (which there is no guarantee), President Trump will have ZERO incentive to concede on any points and will thereby further devastate the Chinese economy in his second term. You don’t need to read too many history books to know that economic devastation leads to political upheaval – elections or not.

So that’s the leverage on both sides. For President Trump, he gets the phase one signed – estimates will hold and possibly rise – yielding the fulfillment of his major campaign promise of a strong economy and full employment at election time. If he misses the opportunity to do a fair deal – he rolls the dice and hopes that the numbers above hold – but once sentiment and price start to erode it can be a very slippery slope at the wrong time.

Similarly, China has a very small window to lock in a fair deal now and work constructively with the Administration over the next five years. Ultimately, if President Trump is not re-elected they can then re-trade the deal with the next Administration, so they have nothing to lose by inking a win:win deal now. They only lose big if they miss this window now and President Trump is re-elected – then all bets are off for China. They do not have nearly the same insulated domestic economy as the U.S. (nor are they the world’s reserve currency) and will not be able to weather the storm without our partnership (and business). We will fare much better, but still feel the impact of subdued earnings.

For the final point on the Phase 1 deal, I would not overestimate the strength of the economy without a deal signed. 9.8% earnings growth can quickly deteriorate in a matter of weeks if sentiment and expectations change. Equally, it would not be out of the question to see earnings improvement to low double digits (10-13%+) if the two parties can come together this week.

The former outcome yields multiple contraction in the face of slowing growth. The latter yields multiple expansion in the face of improving growth expectations. I know which environment I would want to run my campaign in.

The Fed:

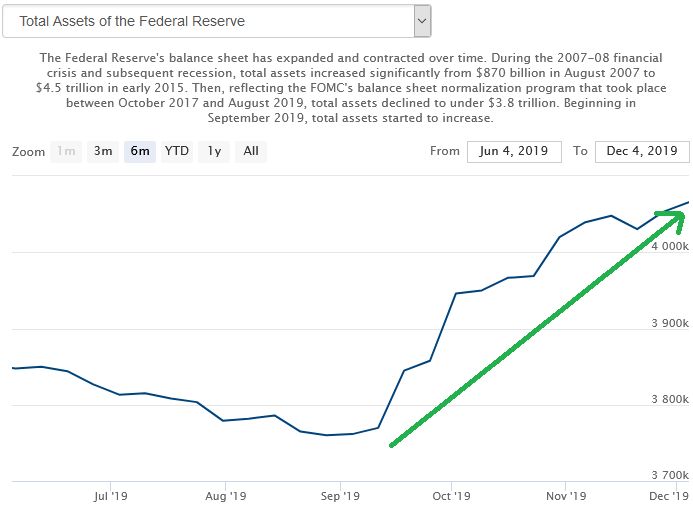

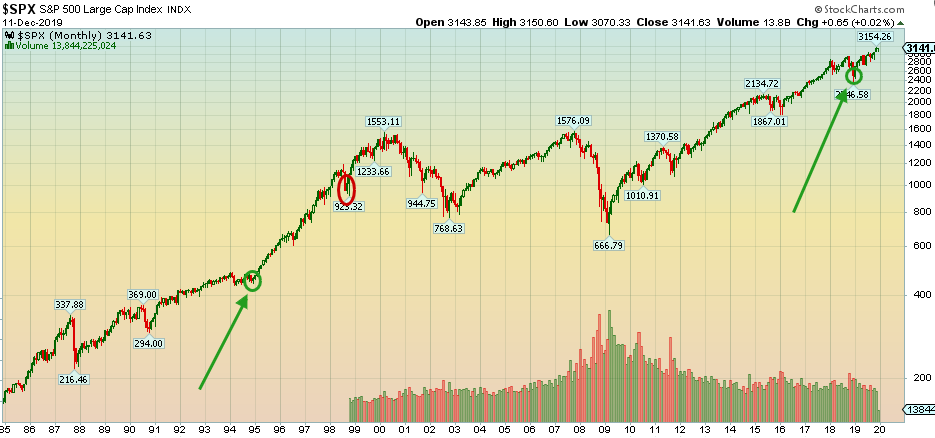

In the mean time, the Federal Reserve has done its part to provide liquidity after nearly choking off the cycle in Q4 2018. Following 2+ years of incessant rate raises and $785B of Quantitative Tightening – we experienced the lagged effect of these actions – in the form of 3 consecutive quarters of negative year on year earnings growth in 2019.

Fortunately, The Fed realized the error of their ways in the nick of time and have cut 75bps and added over $300B in liquidity since this Summer. That reversed almost half of the quantitative tightening program in just four months. At this pace we will have recovered full liquidity by Spring.

We are just now beginning to feel the lagged effects of the Fed reversing course and – coupled with a phase 1 completion – could manifest a very constructive outcome in 2020 (in the form of Earnings Growth and improved Securities/Markets pricing).

What was paramount about Chair Powell’s comments this Wednesday was the fact that he ruled out the possibility of taking back the cuts too early like in 1998. The Fed cut 75bps – from September to November of 1998 – to avert a catastrophe caused by the Russian Financial Crisis and LTCM’s leveraged exposure. They (The Fed) were successful, but then immediately took the cuts back in 1999 by starting to tighten just 7 months later in June 1999. The rest is history…

The communication of Chair Powell this week echoed an earlier statement he made (that the markets misinterpreted), when he called the cuts a “mid-cycle adjustment.” As time passes, it is becoming clearer and clearer that Chair Powell sees this as 1995 and not 1998.

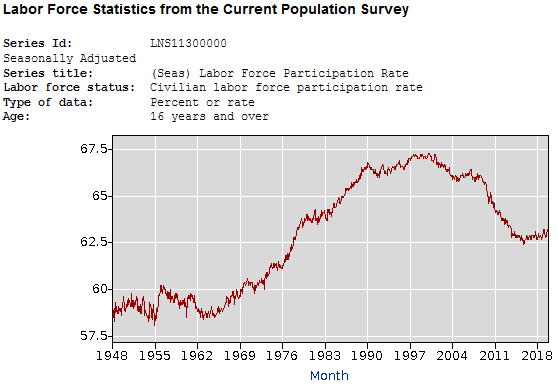

Based on his actions and his communication, we wants to extend this cycle so that all of the people who are still on the sidelines (as evidenced in a lower labor force participation rate compared to pre-crisis levels) will be pulled back into the workforce with opportunity.

Source: Bureau of Labor Statistics

If the Fed maintains liquidity (which he stated he would do on Wednesday) by not tightening again until at least 2021, we could see these participation numbers go back up to the 65-67% range as employers make it irresistible for sidelined workers to return to the workforce and marginal workers finally get a chance. This type of behavior would be more inline with mid-cycle than late cycle and also consistent with the demography of Millenials entering the workforce on one end and beginning housing formation on the other end.

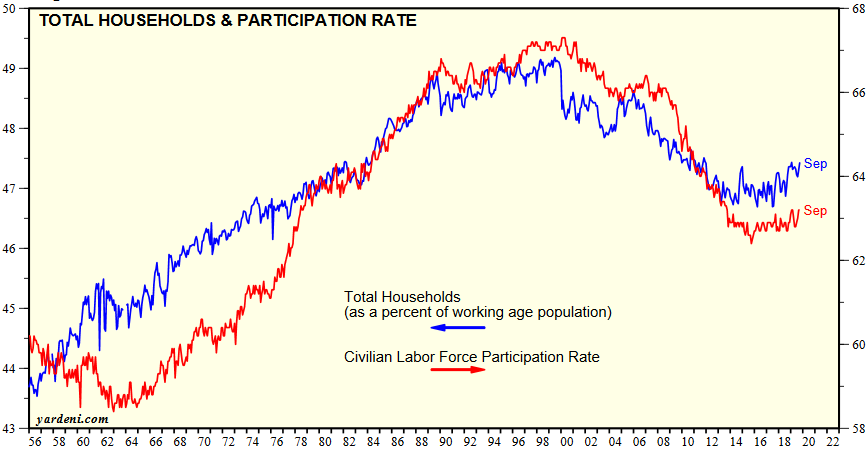

If Chair Powell is correct in that he is able to improve Labor Force participation though the correct policy path, the impact it could have on housing formation would be magnificent:

Chart Source: Yardeni via BLS

As the red line goes up (labor force participation), sooner or later it drags the blue line up with it. We have seen hints of this phenomenon in the strong performance of the home builder sector in 2019. Expect more of these positive trajectories to continue so long as Chair Powell follows through on his prescription from Wednesday.

Chair Powell effectively made the case that he believes this is 1995 and he is committing to deploy policy that enables mid-cycle outcomes similar to 1995 versus policies that ensure 1998 outcomes. Here is what is potentially back on the table:

It is nowhere near guaranteed as we did invert the curve (2/10) in August (for a short time). We will just have to watch the data as it comes in and see how estimates look moving forward (a phase one deal will help estimates stabilize and possibly move higher in coming weeks and months). This would start to put odds in the favor of Powell’s plan coming to fruition (increased labor force participation rate => increased household formation => many more years left in the cycle). On the flip side if we get an exogenous shock in the form of a deal breakdown and companies become reluctant to hire and invest, all bets are off and the game changes.

So no, I would not rely on one jobs report to play games on closing the deal…get it done and move on. Our relative momentum, demography and data supports us pulling dramatically ahead of any competition in coming years. There is no need to choke it off when it’s just getting started. What we make up in growth will more that offset a few hundred billion dollars of short term tariffs we think we gained by playing hardball.

Now onto the shorter term view:

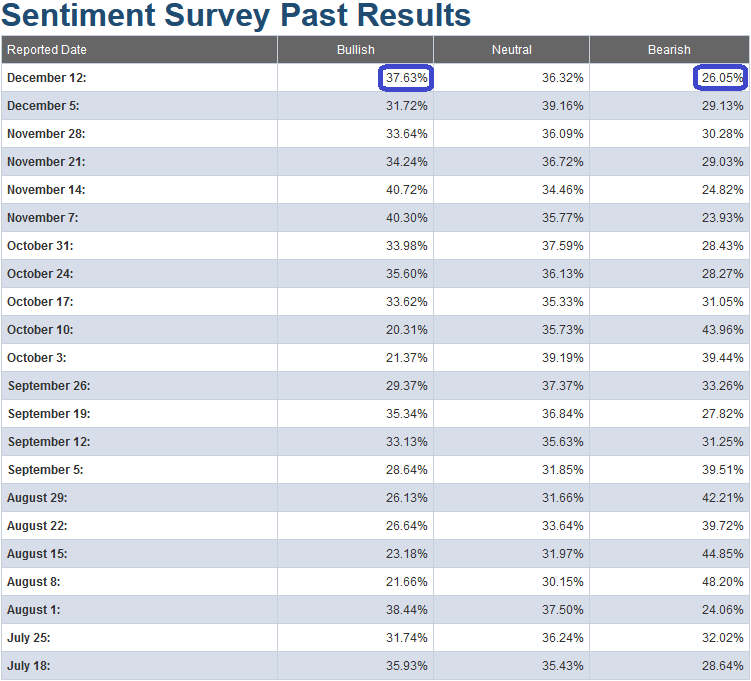

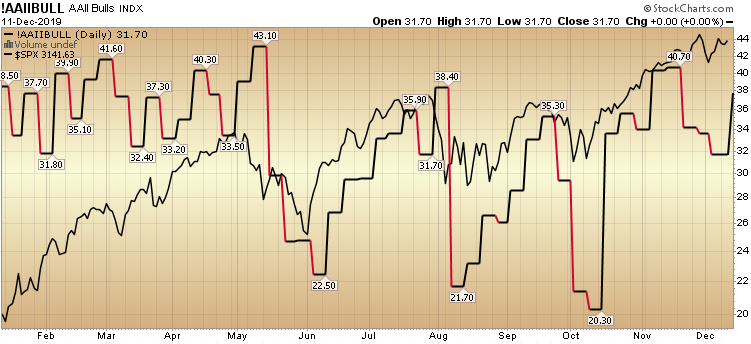

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent came in at 37.63%, up from 31.72% last week. Bearish Percent fell to 26.05% from 29.13% last week.

This improvement in sentiment was not confirmed by the CNN “Fear and Greed†Index – which came in 6 points (from 67 last week to 61 this week). You can learn how this indicator is calculated and how it works here: (Video Explanation).

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) ticked up modestly (from 76.66% equity exposure up to 77.80%).

We remain bullish in the intermediate term, but as we have stated in our last note, we are trimming names that have had huge runs off of the August/September lows (like our call on Biotech in September), and re-allocating some profits into sectors/stocks that are just beginning to participate (like energy – among others).

For proper context and review, you can see our September note on Biotech, our October note on Energy, last week’s note on Energy, and a Financial Times article from this weekend (about Energy) here:

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)