Tag: StockMarket

Be in the know. 8 key reads for Monday…

- Banks Get Tough on Shale Loans as Fracking Forecasts Flop (Wall Street Journal)

- This strategist picked two blockbuster stocks in 2019 — here’s what he likes for 2020 (MarketWatch)

- China to Cut Tariffs on Range of Goods Amid Push for Trade Deal (Wall Street Journal)

- What is the Santa Claus Rally? (USA Today)

- China Vows More Support for Private Sector to Stabilize Growth (Bloomberg)

- Robert Shiller: A Trump effect could drive the record market rally through 2020 (CNBC)

- No. 1 Stock Market in Americas Forecast to Climb 15% Next Year (Yahoo! Finance)

- Oil billionaire schools Elizabeth Warren on energy industry (Fox Business)

Be in the know. 13 key reads for Sunday…

- Peter Lynch Draws on 50 Years of Stock-Picking to Find Growth Opportunities in (Barron’s)

- Warren Buffett’s favorite Christmas gifts include See’s Candies, dresses, and $10,000 in cash (Business Insider)

- Today’s MarketWe Buy A Junk Bond! (NPR Planet Money)

- China Mobile Dominates the World’s Biggest Market. Its Stock Is Cheap. (Barron’s)

- Episode 958: When Reagan Broke the Unions (NPR Planet Money)

- How Artificial Intelligence Is Totally Changing Everything (howstuffworks)

- History’s Largest Mining Operation Is About to Begin (The Atlantic)

- Warren Buffett Says Anyone Can Achieve Success by Following This 1 Personal Rule He Lives By (Inc.)

- Space Force will start small but let Trump claim a big win (Fox Business)

- Natural Gas Futures Gain as Bulls Look to Early January for Colder Temps (naturalgasintel)

- Almost No One’s Starting New Hedge Funds Anymore (Institutional Investor)

- 10 of the Best Energy Stocks to Buy for 2020 (Yahoo! Finance)

- Barron’s Picks And Pans: Alibaba, Biogen, China Mobile, Peter Lynch Picks And More (Yahoo! Finance)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 8

Article referenced in VideoCast above:

The J. Paul Getty (Energy) Stock Market (and Sentiment Results)

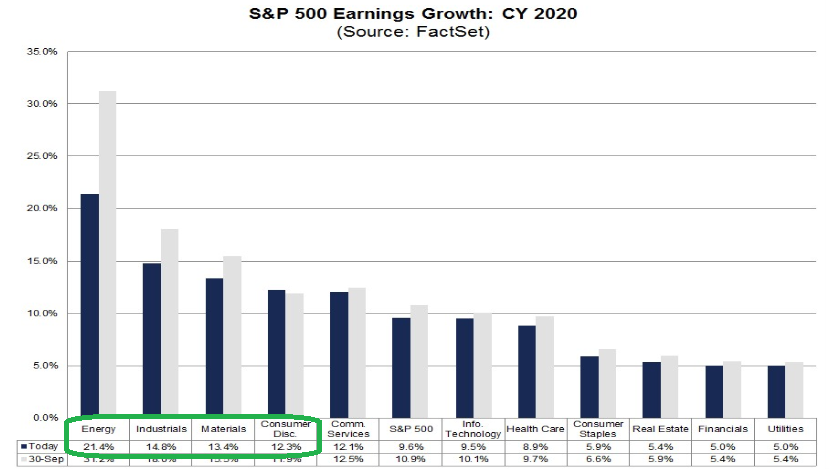

2020 Earnings Estimates plus S&P 500 Target Price

Data Source: FactSet

This week 2020 Earnings Estimates for the S&P 500 ticked down modestly from $178.47 to $178.24. This puts the 2020 EPS growth rate at 9.6% for 2020.

Continue reading “2020 Earnings Estimates plus S&P 500 Target Price”

Where is money flowing today?

Data Source: Finviz

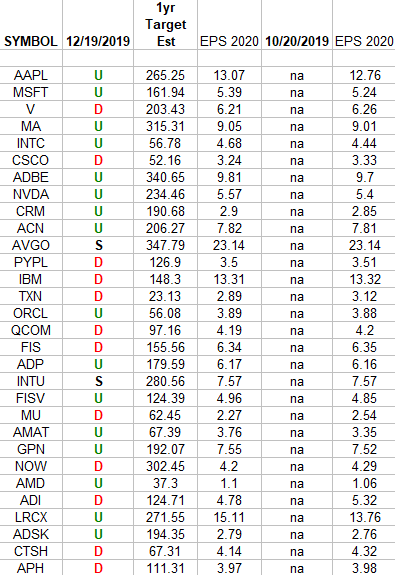

Technology Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

Be in the know. 8 key reads for Friday…

- Florida SBA’s Strategic InvestmentTeam Has It Eye on Energy (Institutional Investor)

- Fidelity mutual fund guru Peter Lynch: Market will be higher in 10 years (FoxBusiness)

- These 10 S&P 500 stocks were lousy in 2019, but they could return 40% or more in 2020 (MarketWatch)

- China can fulfil $40 billion U.S. farm purchase pledge: consultancy (Reuters)

- 3 Top Retail Picks for Stronger Than Expected Gains in 2020, With Runners-Up (24/7 Wall Street)

- The Secure Act Has Passed. 2 Insurance Stocks That Could Benefit. (Barron’s)

- There’s Still More Upside to Squeeze Out of My On-Fire Energy Picks (TheStreet)

- U.K. Picks Safe Hands to Lead Central Bank (Barron’s)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- 10 Undervalued Energy Stocks for 2020 (24/7 Wall Street)

- Biotech Stocks Are In a Position to Break Out in 2020, Analysts Say (MarketWatch)

- Opinion: Takeaway from Abu Dhabi money conference: So much money is looking to find a home (MarketWatch)

- BOJ to begin lending ETFs to prop up market liquidity (Reuters)

- The J. Paul Getty (Energy) Stock Market (and Sentiment Results) (ZeroHedge)

- Oil Stocks To Buy As Prices Rebound: Here Are U.S. Shale, Market Cap Leaders (Yahoo! Finance)

- Think the Dow Is OId-Fashioned? It Beat the S&P 500 Over 5 Years. (Barron’s)

- The Best Cars—Including Two Electric Vehicles—I Drove in 2019 ()

- Tesla shares close at a record high. Next stop $420? (CNBC)

- ‘I couldn’t have been more wrong’: Legendary investor Stanley Druckenmiller reveals a mistake he made that cost him major market returns (Business Insider)

- The ‘ultimate smart money indicator’ is signalling a big move in the stock market by the end of the week (MarketWatch)

- China says in touch with U.S. on signing of Phase 1 trade deal (Reuters)

- Biotech Analysts See Deals, Drug Data Carrying 2020 Performance (Yahoo! Finance)

- Investors Pony Up More Than $2B for Distressed Fund (Institutional Investor)

- US House poised to approve USMCA trade deal (Financial Times)