- Stocks Continue to Rise. How Much Is Due to the ‘January Effect?’ (Barron’s)

- Trump administration nears decision on LNG shipping by train (Financial Times)

- Goldman Sachs says Europe’s stocks have a huge ‘cushion’ not seen since the financial crisis (Business Insider)

- Commodities may not stay cheap forever (Financial Times)

- History will repeat itself when it comes to stocks in 2020, Goldman Sachs says (MarketWatch)

- Biotech Stocks Could Soar In 2020 On CRISPR Gene Editing And Precision Medicine (Investor’s Business Daily)

- Time to Buy Long-Dated TIPS, Says Bank of America (MarketWatch)

- Stock Picker Who Pummeled The Market By 76% Reveals His 2020 Bets (Investor’s Business Daily)

- China’s yuan rallies, yen slides ahead of U.S. trade deal (Street Insider)

- Photos of Yelp’s top 100 places to eat in 2020 (USA Today)

- U.S.-China phase one trade deal: 7 things you need to know (FoxBusiness)

- Barron’s Picks And Pans: Apple, Bank of America, Lockheed Martin And More (Yahoo! Finance)

Tag: Euro Stoxx 600

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Podcast – Hedge Fund Tips with Tom Hayes – Episode 2

Article referenced in podcast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

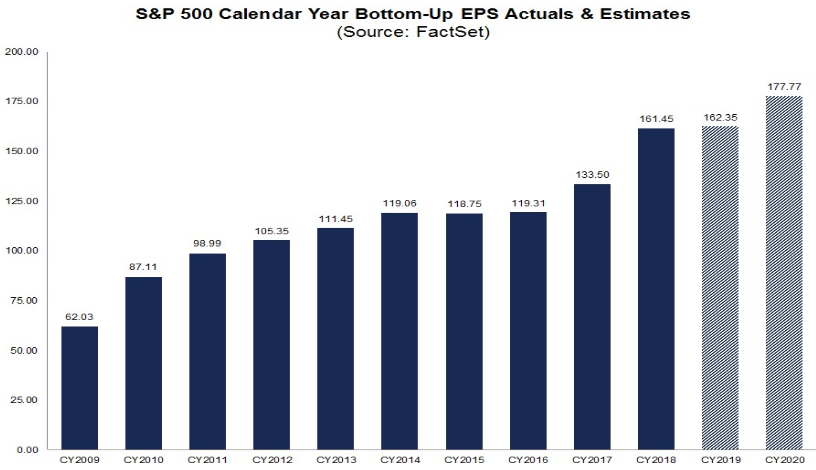

2020 Earnings Estimates: U.S. – DOWN. EUROPE – UP.

Data Source: Factset

2020 Earnings Estimates for the S&P 500 trimmed from 177.77 to 177.64 in the past week. Conversely, the Earnings Estimates for the Euro Stoxx 600 increased by 160bps for 2020 in the past week. Continue reading “2020 Earnings Estimates: U.S. – DOWN. EUROPE – UP.”

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In 2001, the band CAKE released their hit song, “Short Skirt, Long Jacket.” If you replace the word “girl” for “stock market” (in the lyrics below) you’ll see the commonalities with today’s investor. Continue reading “The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)”

Podcast – Hedge Fund Tips with Tom Hayes – Episode 1

Article referenced in podcast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

2020 Earnings Estimates: US down modestly, Europe UP

Data Source: Factset

S&P 500 Earnings:

This week, 2020 EPS estimates came down from 178.24 to 177.77. While this is a drop of 26bps, the 2020 Earnings Growth rate stayed up at 9.6% due to a slight down-tick in 2019 estimated results. Q4 2019 Estimates have dropped 10bps (from -1.4% to -1.5% since 12/20). Continue reading “2020 Earnings Estimates: US down modestly, Europe UP”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 8

Article referenced in VideoCast above:

The J. Paul Getty (Energy) Stock Market (and Sentiment Results)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 7

Article referenced in VideoCast above:

The “Crazy Rich Asians” Stock Market (and Sentiment Results)

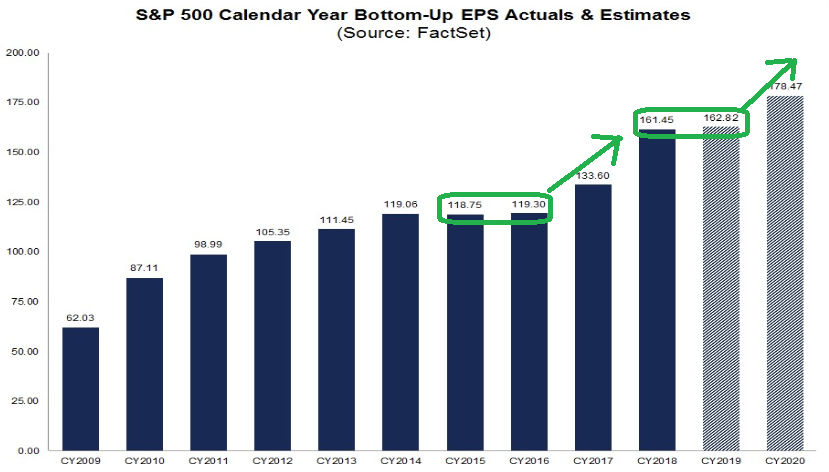

2020 Earnings Estimates Stand Strong

Data Source: Factset

S&P 500 Earnings estimates for 2020 held in strong this week at $178.47 – down modestly from $178.57 last week. While the normal trajectory over the next two weeks – heading into earnings season – would be to lower estimates further, we may find that this time is different. Continue reading “2020 Earnings Estimates Stand Strong”