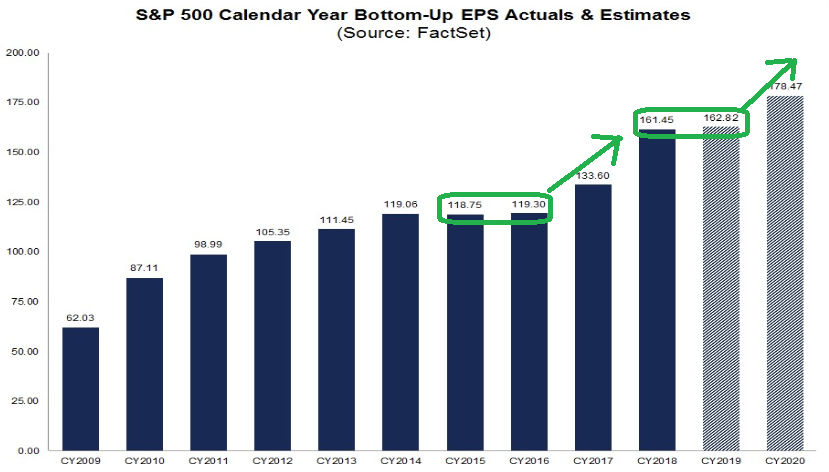

Data Source: Factset

S&P 500 Earnings estimates for 2020 held in strong this week at $178.47 – down modestly from $178.57 last week. While the normal trajectory over the next two weeks – heading into earnings season – would be to lower estimates further, we may find that this time is different.

What most analysts could not count on until it was announced is that President Trump would deliver on the first phase of a trade deal with China – which was announced today. As the details are released in coming days, analysts will begin to determine the potential impact on earnings moving forward – and in many cases that will be to the better.

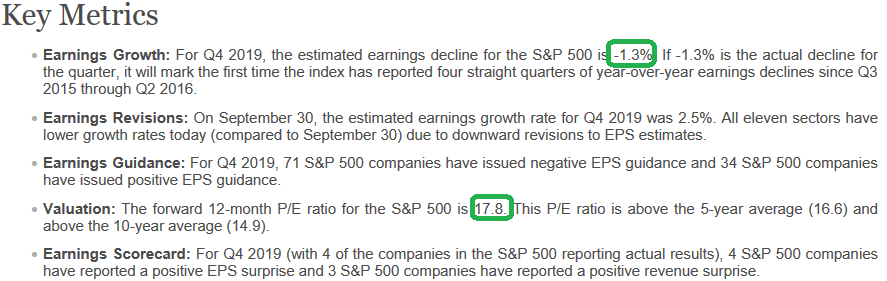

Q4 2019 estimates actually ticked UP from -1.5% last week to -1.3% this week. With the average quarterly improvement of 3.7% through the earnings period, it is likely that Q4 will end the three quarter losing streak of negative year on year earnings growth.

Q4 2019 estimates actually ticked UP from -1.5% last week to -1.3% this week. With the average quarterly improvement of 3.7% through the earnings period, it is likely that Q4 will end the three quarter losing streak of negative year on year earnings growth.

It is unusual to see estimates rise in the weeks leading into the reporting period – and a sign that the Fed’s “about face” this Summer is starting to work its way into the system. Just as there was a lagged effect to slow the economy in 2019 after two years of tightening, there has been a lagged effect to impact growth from the Fed’s newfound loosening stance – assumed this summer (75bps of rate cuts and $300B+ of added liquidity).

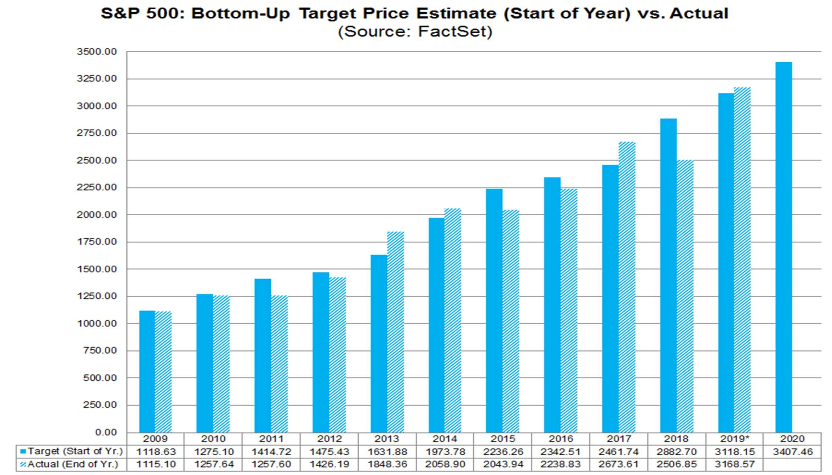

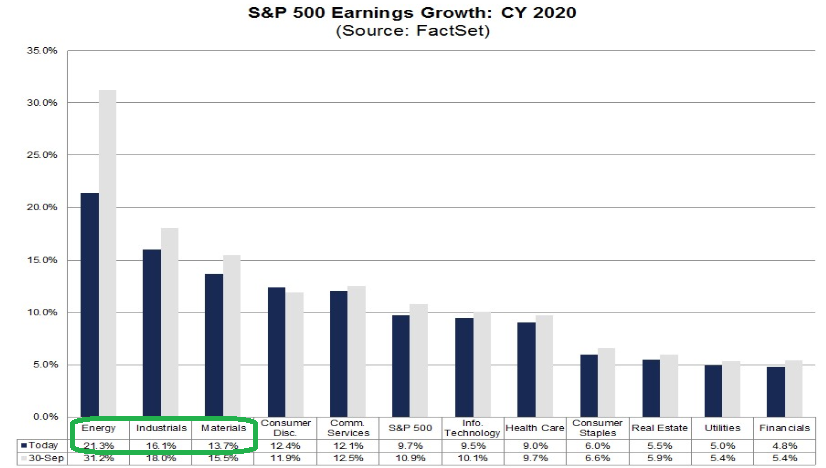

The bottom-up consensus target price for the S&P 500 for 2020 is up 7.5% or 3,407.46. If estimates hold (or increase with the trade deal progress), with the advent of a cooperative Fed and newfound earnings growth (9.7%) it would be well within the realm of possibility to see multiple expansion leading to higher prices than estimated. We will continue to watch the weekly data as it comes in and determine if this possibility remains on the table as we move forward.

The Energy sector is expected to see the largest price increase (+14.9%), as this sector has the largest upside difference between the bottom-up target price and the closing price. This expectation is consistent with earnings growth estimates for 2020 being led by Energy, Industrials and Materials. The worst performing sectors from 2019 are expected to be the best performers in 2020 (partially due to easy comps).

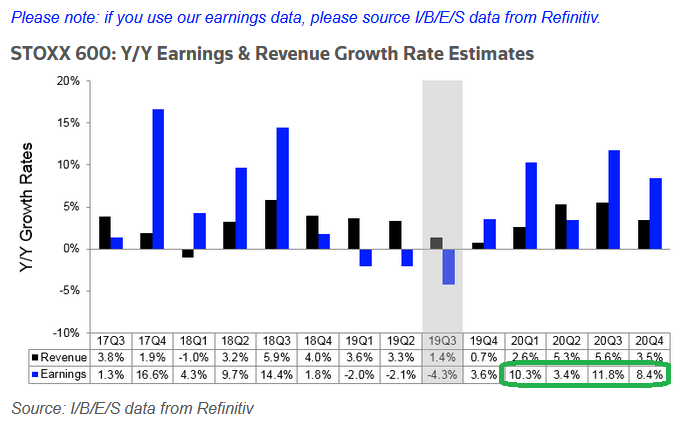

Euro Stoxx 600 also held in strong this week. While Q1 2020 came in 30bps, Q2-Q4 2020 estimates rose a cumulative 60bps. This is a very constructive theme moving forward.