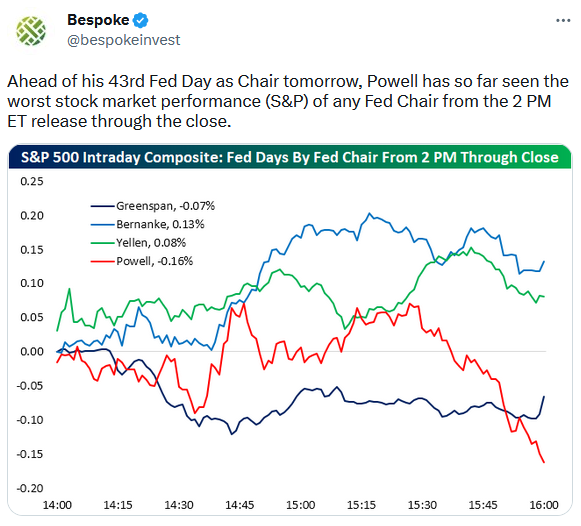

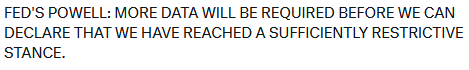

On Wednesday, Chairman Powell bumbled his way to another selloff. Par for the course – as he holds the record for worst market performance following his communications:

To a man with a hammer, everything looks like a nail. Powell is single-mindedly focused on lagging inflation data. He fiddles at the alter while Rome burns (more banks will follow the liquidation path with no clear cap on funding costs and no enhanced deposit insurance plan).

To a man with a hammer, everything looks like a nail. Powell is single-mindedly focused on lagging inflation data. He fiddles at the alter while Rome burns (more banks will follow the liquidation path with no clear cap on funding costs and no enhanced deposit insurance plan).

I covered this specific issue (Powell vs. Volker) on Sunday night when I joined Karishma Vaswani on the BBC. Thanks to Joao Da Silva and Karishma for having me on:

I covered it in greater detail with David Lin on Thursday afternoon – along with many other positions and general market outlook:

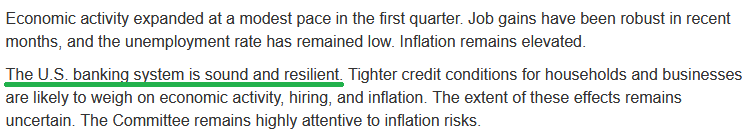

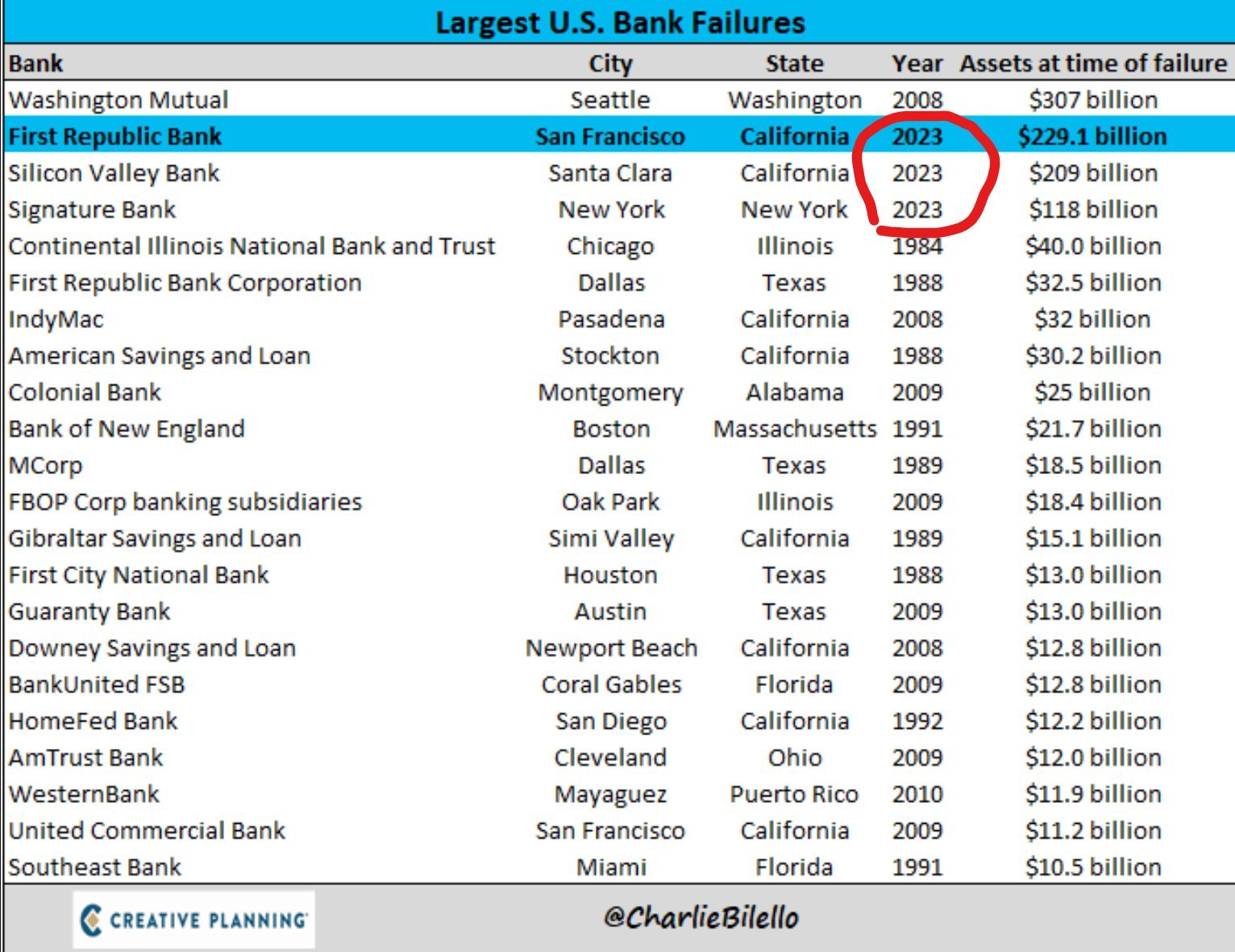

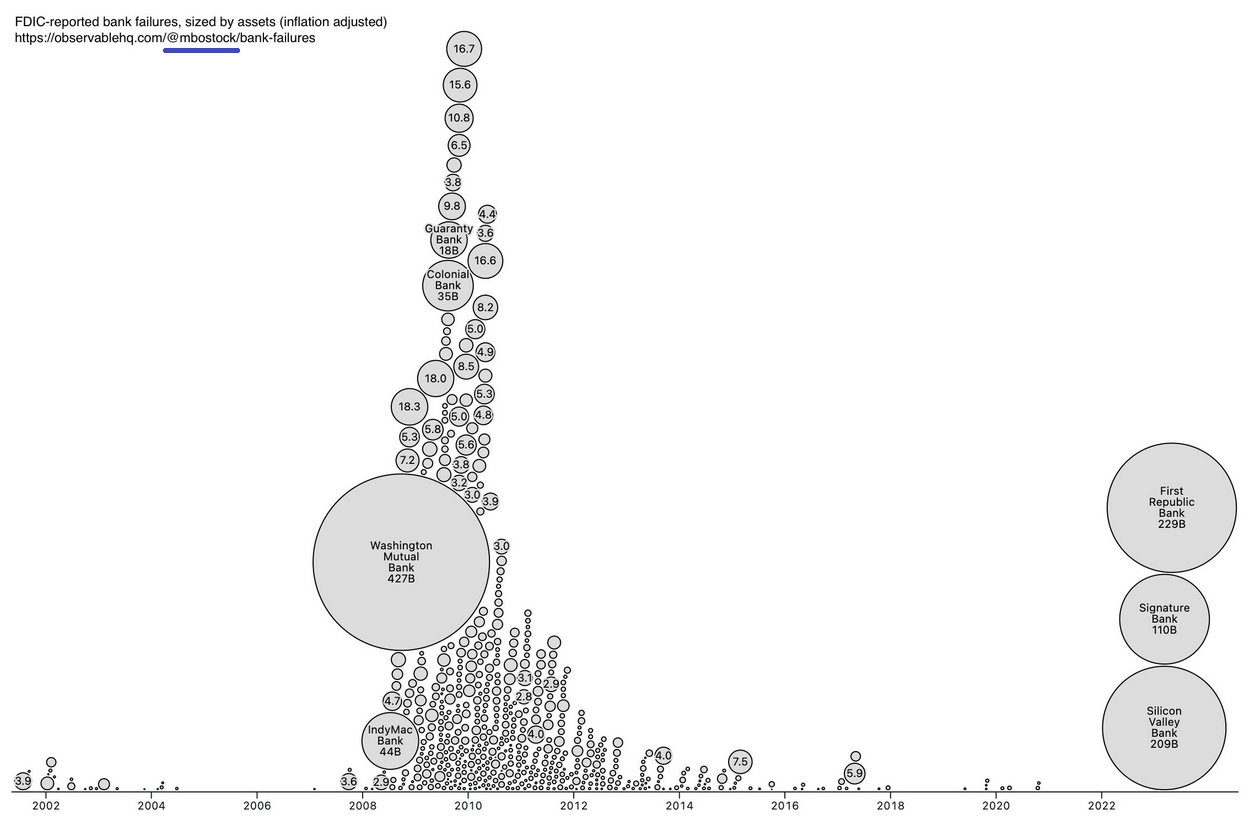

Among the statements I found completely out of touch with reality was the FOMC press release that began with the following assertion, “the U.S. banking system is sound and resilient.” Tell that to the 1000s of employees, equity holders and debt holders of the four large banks that have failed in the last few months.

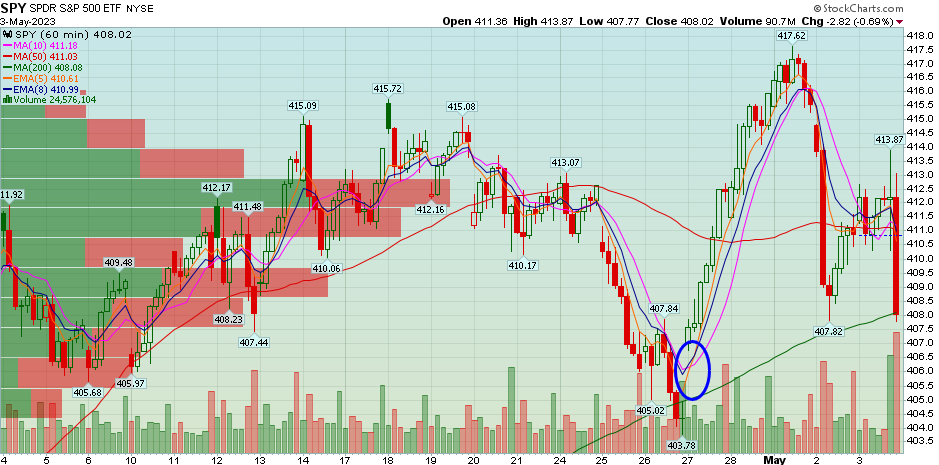

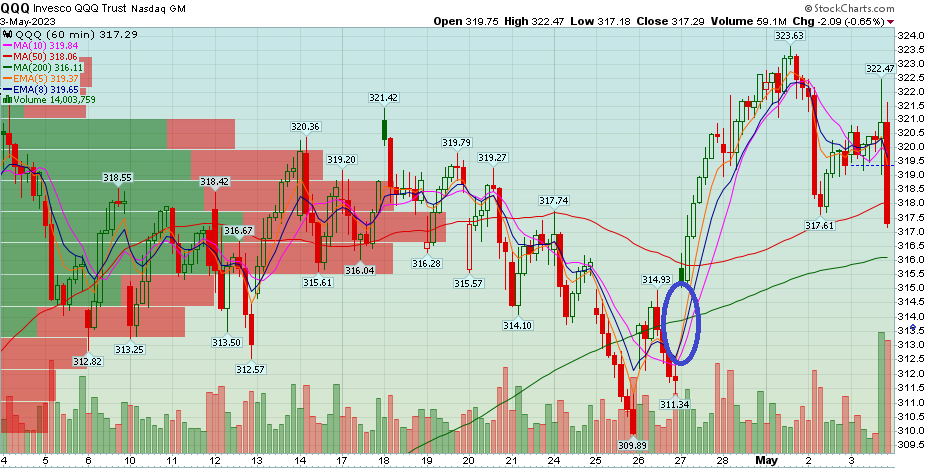

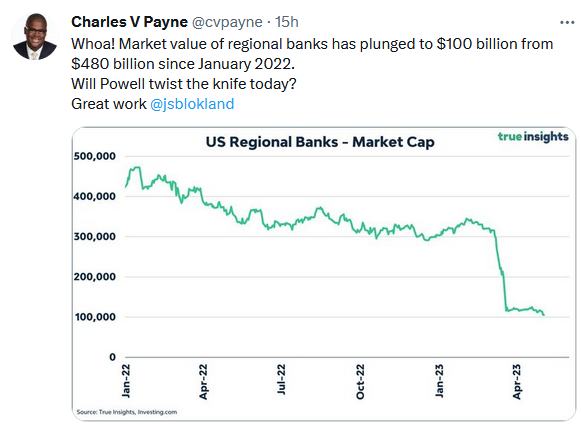

Does this look like a “sound and resilient” banking system that you want to kick in the teeth when it’s down?

Does this look like a “sound and resilient” banking system that you want to kick in the teeth when it’s down?

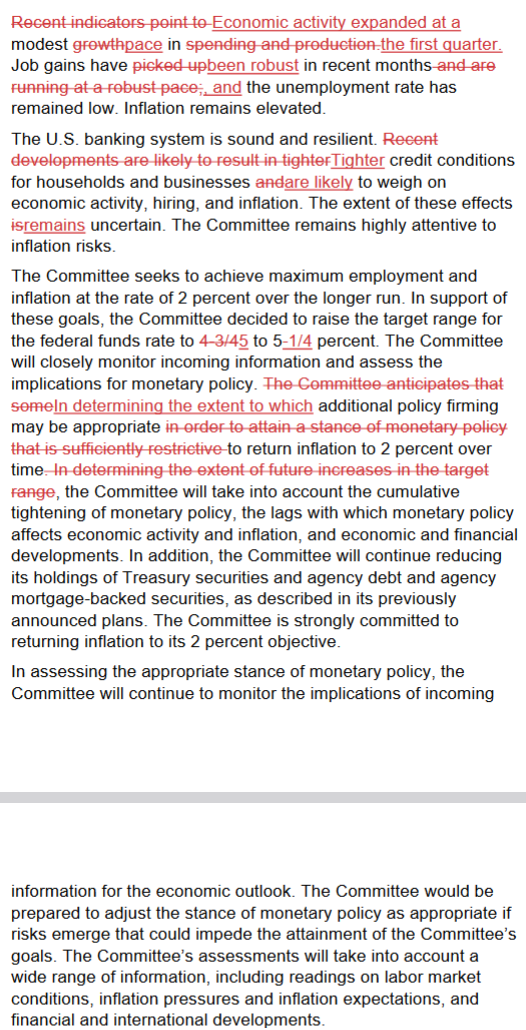

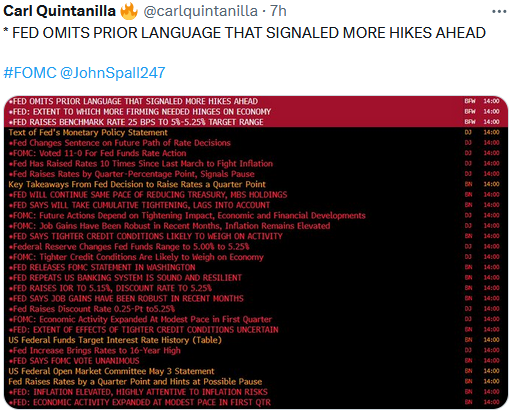

Here are the statement changes from the last Fed meeting to Wednesday’s Fed statement (in red via CNBC):

Here are the statement changes from the last Fed meeting to Wednesday’s Fed statement (in red via CNBC):

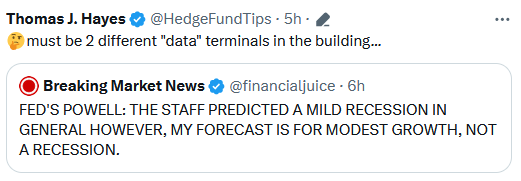

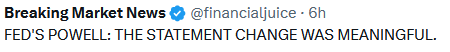

I also found this statement odd:

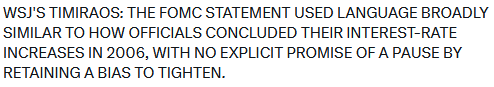

But it wasn’t ALL bad news:

![]() Listen and judge for yourself (if you understand people who speak out of both sides of their mouth you will understand EXACTLY what he is saying):

Listen and judge for yourself (if you understand people who speak out of both sides of their mouth you will understand EXACTLY what he is saying):

Ultimately this waffling will wind up being more inflationary than explicitly pausing today. More banks will fail in coming weeks and the FDIC insurance fund will likely be drained as no one steps up to buy the underwater assets. The balance sheet will re-expand back to record levels as they try to keep toothpaste in a tube with holes on both sides. It is a reactive versus proactive stance that will ultimately be more costly than doing the right thing now. BUT, it will probably work…

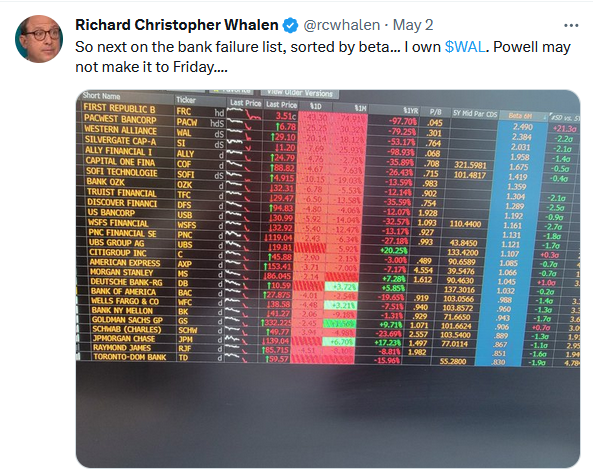

Here’s the latest bank dead pool. Hopefully Powell (and other policy makers) wake up before too many get ticked off the list. So far they are NOT hearing the message of the markets:

Since I find people who identify problems without offering solutions relatively intolerable, I will reiterate the two solutions I have been repeating since the mini banking crisis began:

Since I find people who identify problems without offering solutions relatively intolerable, I will reiterate the two solutions I have been repeating since the mini banking crisis began:

- The executive branch has the authority to act in times of emergency. They could instantaneously enact a temporary deposit backstop for 12-24 months until things cool down and Congress can formally pass legislation to increase the insurance cap. Currently 45% of US deposits are uninsured.

- The Fed needs to explicitly PAUSE (not cut), in their “Fed Speak” parade in coming days and weeks. This will stop/slow bank funding cost acceleration and deposit flight (competition with money markets/treasuries). If the Fed wants to continue to drain liquidity/battle inflation, do it through slow/methodical balance sheet reduction (sell bonds), NOT more hikes.

***Until one or both of these actions are taken, keep your eye on the “dead pool.” The outcome will NOT be like 2008 because they will pump mass liquidity into the system and expand the balance sheet to record levels, but it is not the prudent, proactive way to deal with the situation (and will ultimately be more inflationary and directly or indirectly more costly to taxpayers).

Everyone knows this, but for now they remain like an ostrich with their head in the sand hoping and praying the wind goes away by itself. It can’t and won’t as the genie is out of the bottle. Only proper and swift action can put her back in.

Constructive?

With that mouthful out of the way, we remain constructive. Presley – who cuts all of my media appearances and posts them on social media – came up with this excerpt (from the David Lin Report) on Wednesday. Presley (a college student) has a better feel for the markets than most members of the FOMC and here’s what he thought was important for the day:

Why we’re not worried about our core positions 👇

Full interview: https://t.co/w3LcNesA4s pic.twitter.com/GAkqeejVIQ

— Thomas J. Hayes (@HedgeFundTips) May 3, 2023

CPS

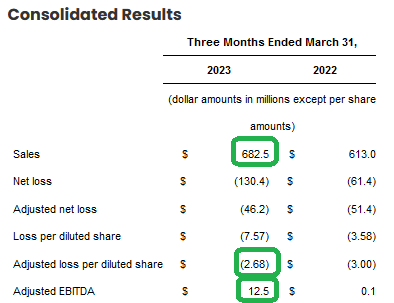

Cooper Standard reported after the bell. Revenues blew away estimates coming in at $682.5M vs. $663M estimate. This compares to $613M in sales for Q1 2022:

$81.9M of the loss was a 1x refinancing fee. We saw +12.5M in Adjusted EBITDA for the quarter compared to $0.1M same period last year. We will learn more from management on the conference call today.

$81.9M of the loss was a 1x refinancing fee. We saw +12.5M in Adjusted EBITDA for the quarter compared to $0.1M same period last year. We will learn more from management on the conference call today.

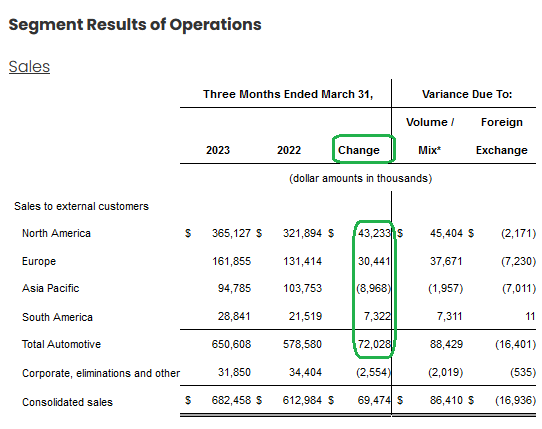

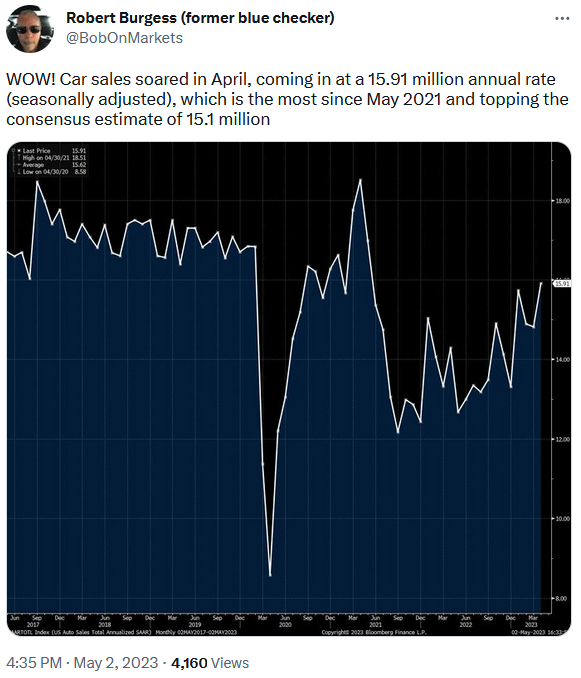

Car sales continue to recover in line with our original thesis (when the stock was $5.50):

Car sales continue to recover in line with our original thesis (when the stock was $5.50):

VNO

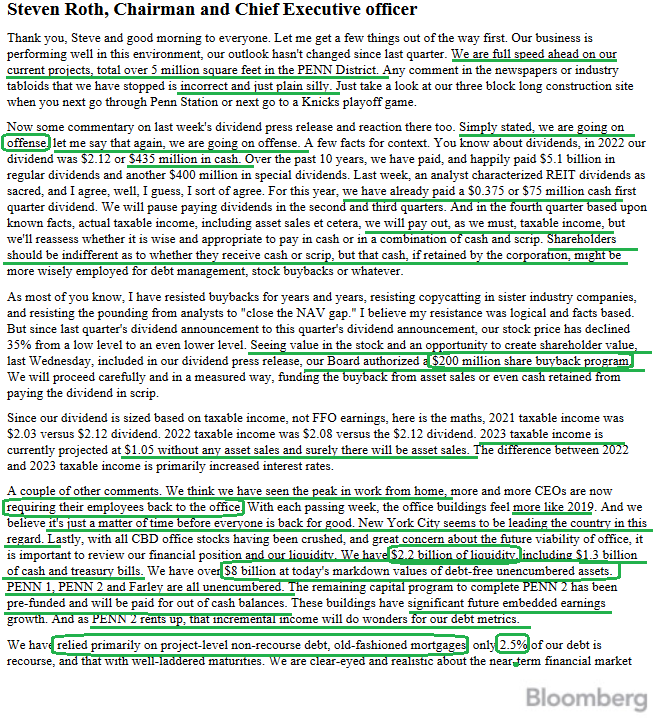

Vornado reported on Monday. The stock trades with regional banks so expect more volatility until the next few banks fail and they finally take proper actions on deposits and/or “fed speak.” But nothing changes on the thesis and if anything, I found Steve Roth’s assertion (on the conference call) that he was “going on offense” very predictable. He didn’t become the best in the business by being unprepared when opportunity strikes. He is ready, strong and opportunistic regarding what lies ahead. Here are some highlights from the call:

BABA

BABA

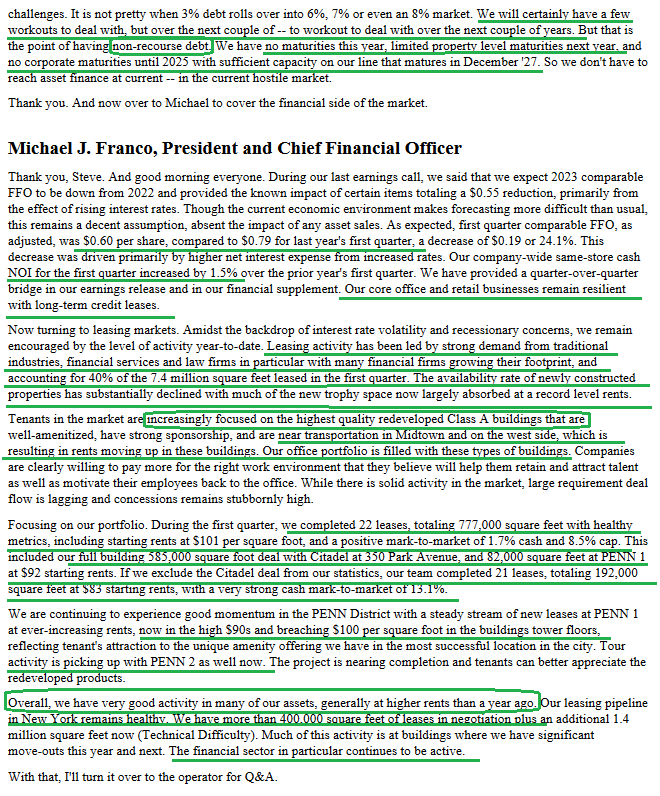

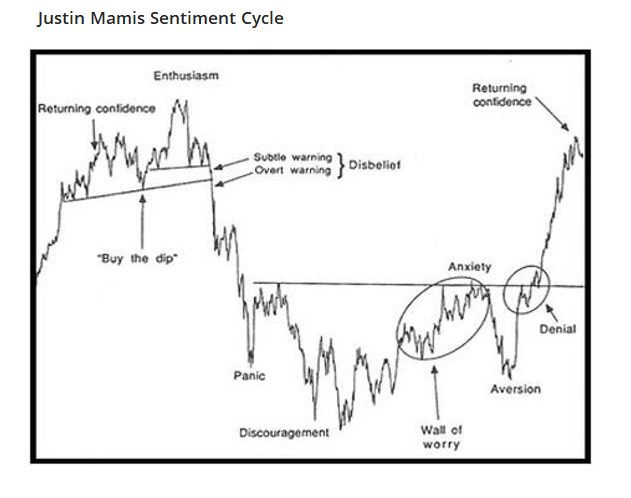

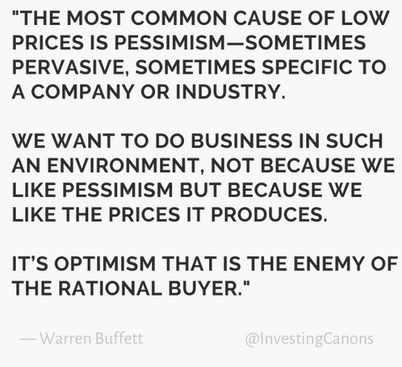

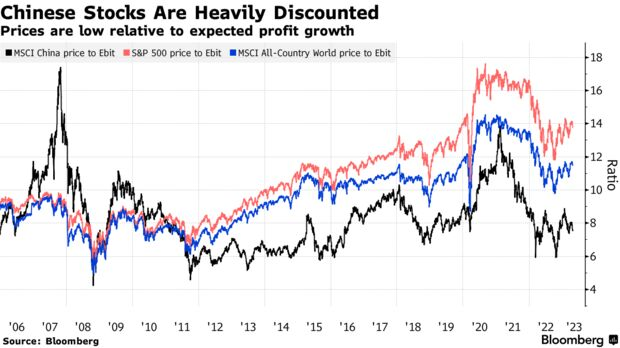

Alibaba continues to fill out its pattern to shake out the final weak hands ahead of earnings later this month. Many of you won’t make it through the volatility and will throw in the towel at the exact wrong time. It’s simply the way the market works:

We covered many underlying statistics on clothing sales and cloud traffic on last week’s podcast|videocast which give us optimism coming into the earnings call later this month. Based on the weakness, fear and whining I am seeing on twitter and hearing from commentators, a nice overthrow into the 70’s (like we saw in March of ’22 and ’23) should break the back of the final weak hands before we accelerate higher following earnings. Better to get them all out now rather than having dead weight sellers (who have no idea what they own) trying to “get out at their basis” on the way up.

We covered many underlying statistics on clothing sales and cloud traffic on last week’s podcast|videocast which give us optimism coming into the earnings call later this month. Based on the weakness, fear and whining I am seeing on twitter and hearing from commentators, a nice overthrow into the 70’s (like we saw in March of ’22 and ’23) should break the back of the final weak hands before we accelerate higher following earnings. Better to get them all out now rather than having dead weight sellers (who have no idea what they own) trying to “get out at their basis” on the way up.

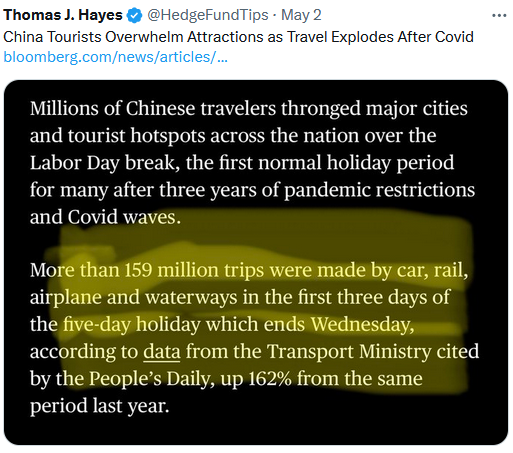

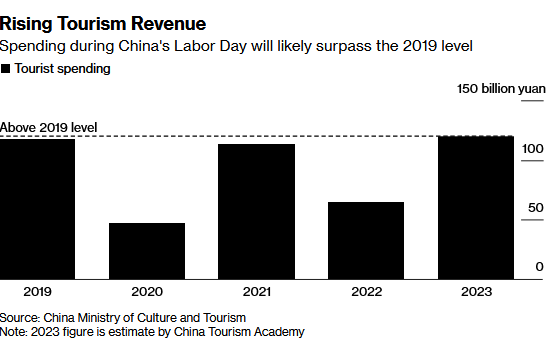

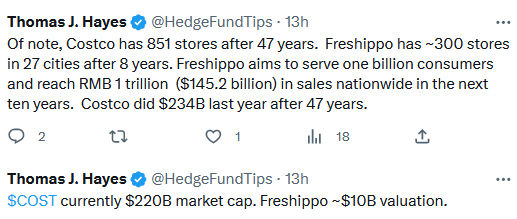

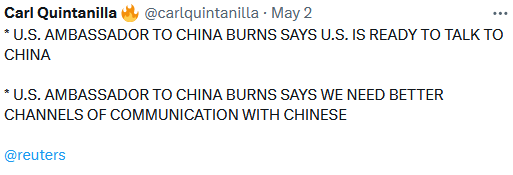

We got some additional data this morning:

Presley put out the following clip on Tuesday:

Presley put out the following clip on Tuesday:

Watch it Here

I added the following commentary to his post:

Earnings

Earnings

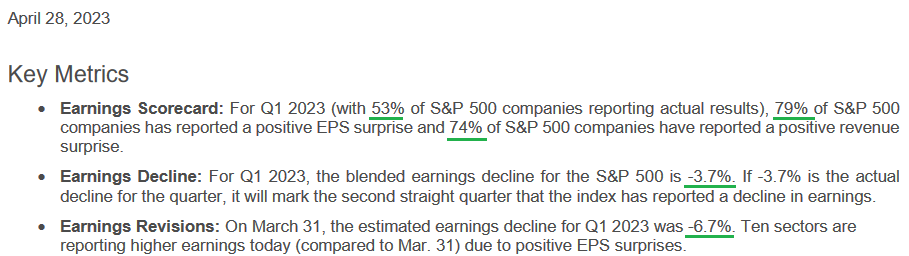

Earnings are coming in better than expected and estimates are starting to revise UPWARD in the past 2 weeks:

Here are the biggest upside surprising sectors:

Other names we’ve covered of late in our podcast|videocast and on media appearances have been performing very well in recent weeks so there are no updates we need to cover at present: BAX, INTC, XBI, SWK, GNRC, AMZN, GOOGL, and DIS. We spend our time fixing temporary problems, not patting ourselves on the back talking winners.

Other Factors

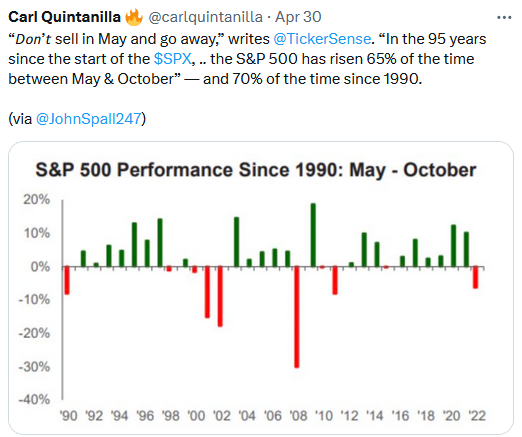

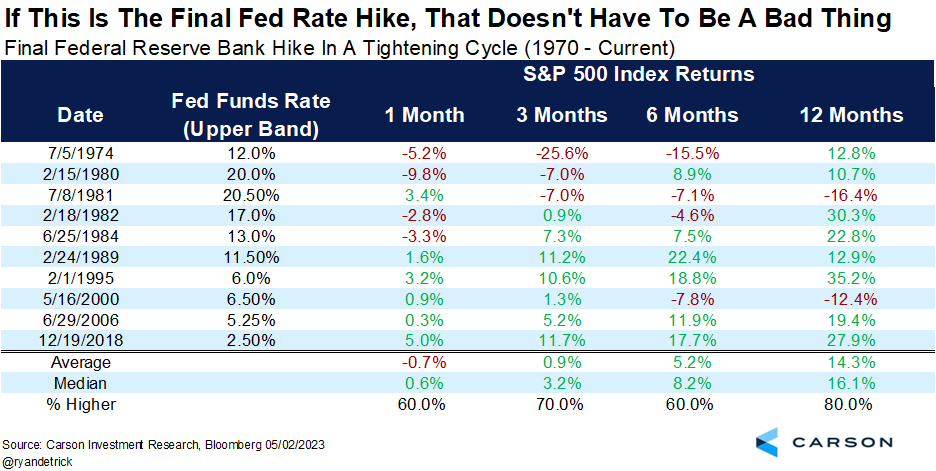

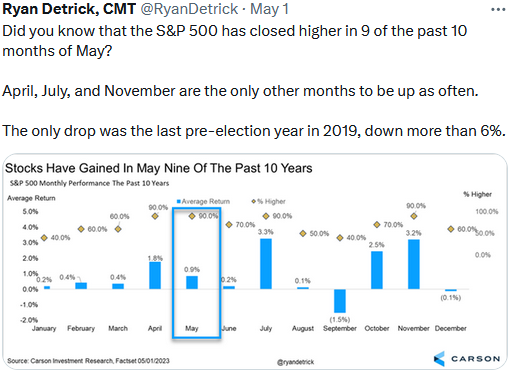

Now onto the shorter term view for the General Market:

Now onto the shorter term view for the General Market:

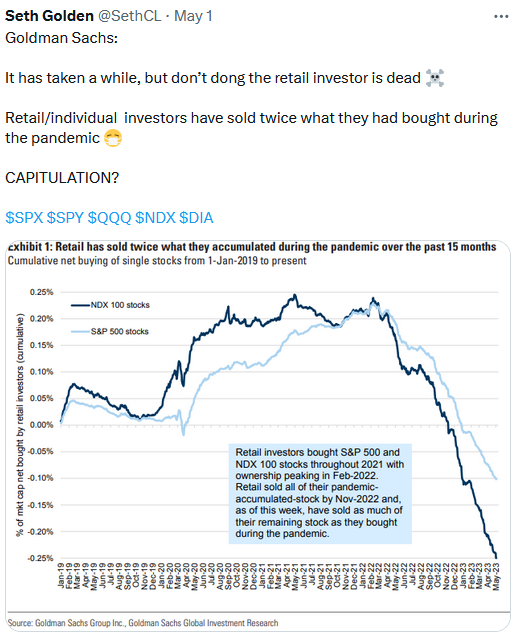

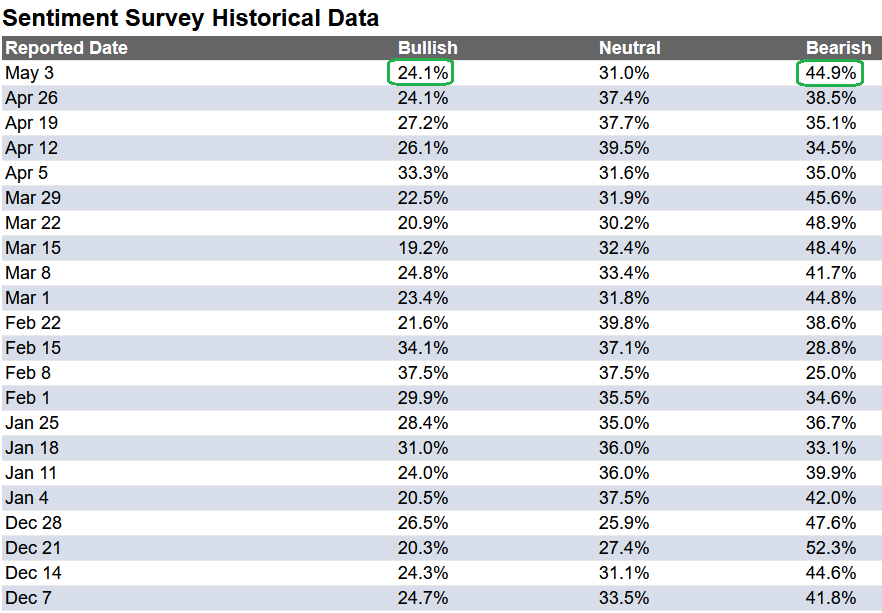

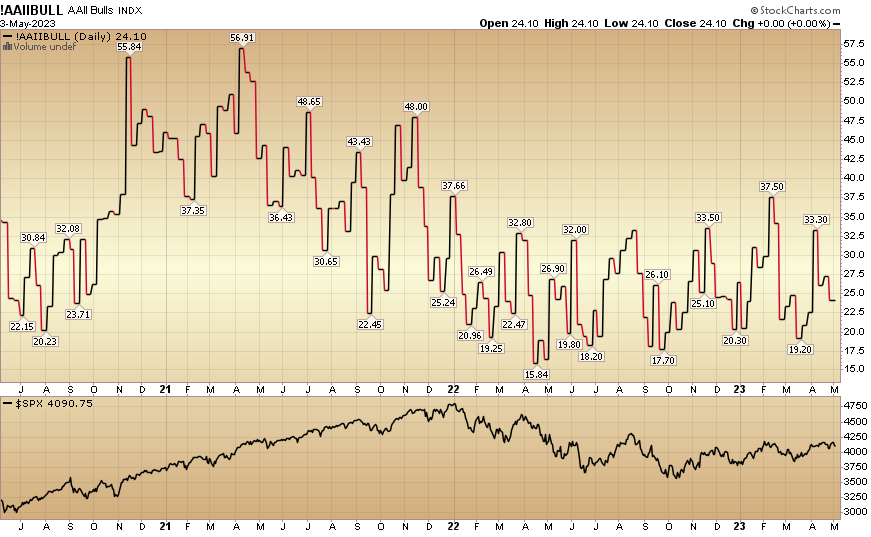

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 24.1% from 24.1% the previous week. Bearish Percent jumped up to 44.9% from 38.5%. The retail investor is still petrified…

The CNN “Fear and Greed” flat-lined from 52 last week to 52 this week. Sentiment is indecisive. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” flat-lined from 52 last week to 52 this week. Sentiment is indecisive. You can learn how this indicator is calculated and how it works here: (Video Explanation)

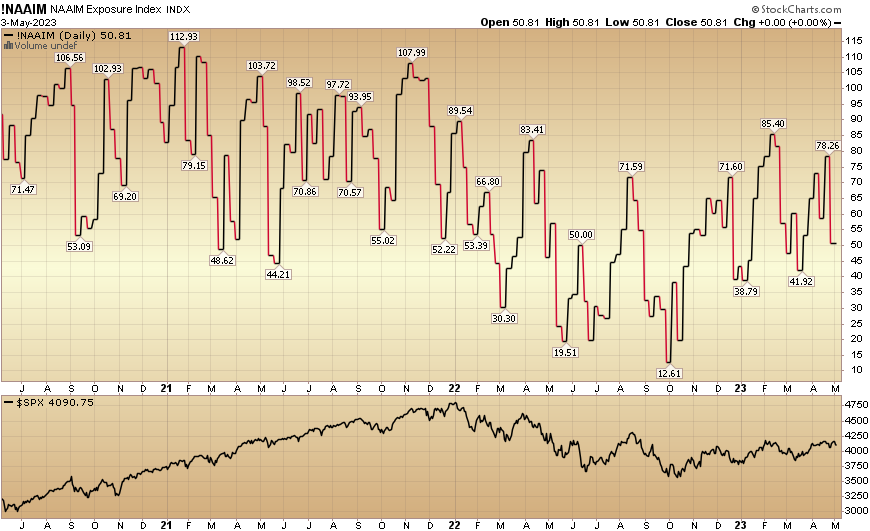

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) plummeted to 50.81% this week from 78.26% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) plummeted to 50.81% this week from 78.26% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.