This week we had a DEMOCRAT President invite a Country Singer (Garth Brooks) to sing at his Inauguration Ceremony, and a REPUBLICAN President pardon a Rapper (Lil Wayne). THAT is what makes America Great.

We have a lot more that brings us together than separates us in America. As a fan of both Country and Rap music, I can comfortably say – we’re going to be okay…

Through many dangers, toils and snares

We have already come

‘Twas grace has brought us safe thus far

And grace will lead us home…

On Monday I was on Fox Business with Liz Claman on the “Claman Countdown.” Thanks to Liz and Jacqueline D’Ambrosi Scales for having me on.

In this segment, Liz asked me what I was watching in the market. My response was, “The U.S. Dollar.”

Right now, Commercials (green line) have been buying the $USD and Hedge Funds (red line) are record short. Commercials usually have it right, and as I explained to Liz, that may have some short term “counter-trend” implications.

While the Dollar is in a clear downtrend, the recent buying by commercials could lead to a (counter-trend) bounce. As I said in the interview this would potentially be a short-term headwind for stocks and commodities. In other words, the re-opening trade could potentially take a breather (either in time – grinding sideways for a bit – or price/pullback).

In the event the dollar does show some short term strength, you could see a bounce in recently weak sectors like utilities and consumer staples (as well as bonds and tech – as yields compressed). I want to emphasize, this is short-term counter trend, and for most people the best play is to ride it out and do nothing.

As I concluded last week’s note:

“This can be by simply grinding sideways for a month or two to digest the > 70% gains off the March Lows OR more likely get a health pullback. As we have stated in recent weeks, this is the beginning of a new business cycle and it does not pay to get too cute trying to predict the when and how much of a short term correction we will get.

As we saw after a monster rally off the lows in 2009, it did not pay to play the short term pullbacks in 2010 and 2011 – as you may very well have missed out on a decade long bull market run.

We’ll be using any weakness that potentially comes our way in Q1 to add more value/cyclical names (themes listed above) to hold for the next 3-5 years…”

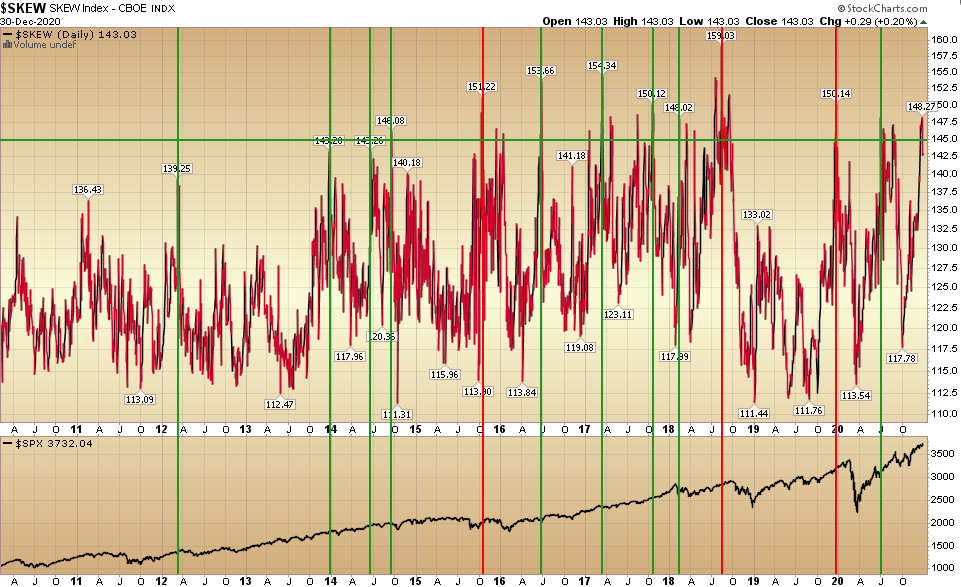

SKEW UPDATE

In our December 31, 2020 note, we pointed to the reading in option skew as a reason to STAY INVESTED despite everyone calling for a correction since late November. My quote (with chart) was:

“Skew is elevated – which as I stated above – means many people are betting on a “black swan” as evidenced in the pricing of 1-2SD out of the money options. I would generally prefer to be a buyer (of the general indices) when skew has collapsed following a crash – so this is not ideal.

However – if you look at the chart I annotated above you will see that elevated skew leading to meaningful corrections (>10%) are the minority. Most elevations simply lead to some sideways consolidation in an uptrend or pause that refreshes.

Also, SKEW is generally a warning shot (yellow light), not a red light – as often in those instances/signals that did lead to a large correction – the market rallied for a month+ after the “signal” before rolling over.”

Now the math has changed. We are closer to one month since it got elevated and the “insurance writers” (who sold all of the “tail risk” premium) got paid on January 15th. Now we see SKEW coming down and close to a month (that I referenced above) has passed:

Does this mean we crash? Not necessarily. But it may mean a short term pause or pullback to consolidate the >75% gains off the March lows. For most people, the answer is to do nothing and ride it out. The odds (which we have covered in recent weeks – related to earnings, policy, stimulus, etc.) favor a positive (mid-teens) year for the general indices (irrespective of any pullbacks or consolidations that occur throughout the year). For a refresher course on SKEW, review the December 30th note.

Sentiment and Positioning

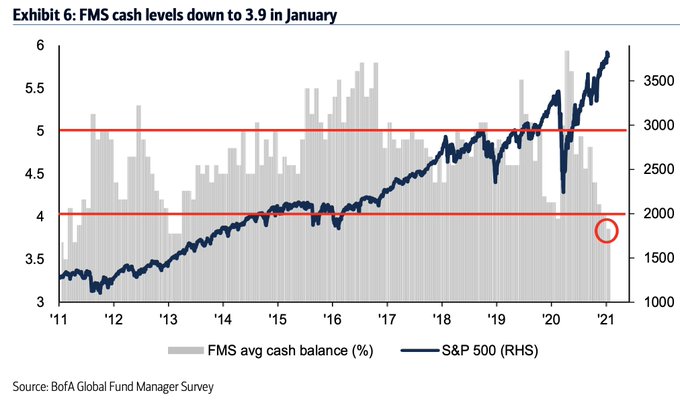

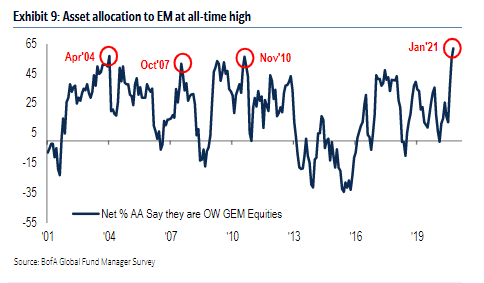

On Tuesday, Bank of America issued their monthly Global Fund Managers Survey. You can find our Summary here:

January Bank of America Global Fund Manager Survey Results (Summary)

The key takeaways support our general view that we can expect a breather in coming weeks. The reason I have emphasized that for most people it would not pay to play it (as the year will likely end up) is because even if you get a 3-5% (or more) pullback, the market may rally a few more percent before you get it.

The message I am trying to convey is that the short-term risk:reward ratio is different than it has been for the 9+ months we have been non-stop bullish (in the face of uniform skepticism every step of the way).

Here are the points that stood out for me:

-Cash level of investors dropped to 3.9%, lowest level since March 2013, triggering a “sell signal.” Back-tested 1 month later, S&P 500 return -3.2%.

-Exposure to EM stocks increased 7 percentage points to a net 62% overweight (highest overweight for EM on record). Looking back at the previous three instances, Emerging Markets took a short-term breather after hitting these allocation levels:

-With investors the most optimistic on profit expansion since 2002, “extremely bullish” sentiment raises the risk that a market correction is “imminent.” (Michael Hartnett – Bank of America).

Policies of the New Administration

Despite option SKEW and the Dollar, you cannot underestimate the power of MASSIVE STIMULUS. Here’s where we’ve been (and where we’re going):

- $2.3T CARES ACT

- $900B COVID RELIEF BILL ($500B was NEW MONEY, $400B carried over from the CARES ACT)

- $1.9T proposed “AMERICAN RESCUE ACT”

- $2T proposed CLIMATE AND INFRASTRUCTURE PACKAGE

If you add up the money (net) – we’re at $6.7T. Couple that with another ~$3T of balance sheet expansion by the Fed and you’re rounding out at $10T (almost 50% of GDP).

That is a TON of solution. How big was the problem?

~$750B (-3.5% GDP in 2020).

So more than 10x the solution to problem ratio. We have NO IDEA what kind of growth we’re going to see once we have 100M+ people vaccinated (new Administration targets June) and “pent up” demand is unleashed.

I was talking 5-6% GDP growth for 2021 in August of last year. People thought that was too optimistic, now it may wind up being too conservative.

We keep pumping money in, but until the economy is fully re-opened we will not see the full impact of this level of stimulus. The recent US Dollar weakness and 10yr yield increase have been sniffing out inflation, but we’ll get a better sense of how much in 2H 2021 and beyond.

In the mean time, here’s what’s coming in the next 2 proposed packages:

- An additional $1.9 trillion to tide over consumers and businesses until normalcy returns.

- $1,400 stimulus checks (on top of recent $600 payments to middle and lower income households).

- Supplemental weekly unemployment benefits would rise to $400 from $300 and last through September instead of March.

- $350 billion to state, local and territorial governments.

- $15-an-hour minimum wage.

- Eviction moratorium extended to Mar 31.

- Student loans paused until Sept. 30.

- Child Tax Credit offers payouts would rise to $3,600 for kids under age 6 and $3,000 for children ages 6 to 17.

- Earned Income Tax Credit payout would almost triple to around $1,500.

- $30 billion to help struggling households catch up on overdue rent, water and energy bills.

- $20 billion in a national vaccination program, including launching community vaccination centers around the country and mobile units in hard-to-reach areas.

But wait, there’s more…

- Another $2T for Climate and Infrastructure.

- 0% Carbon from power grid by 2035.

- Rebuild Roads, Bridges, Infrastructure.

- Ban Fracking on federal land.

- Cut emissions in half by 2030.

- Cash for Clunkers: EV trade in program.

- 500k new charging stations around the country.

Here are the risks:

- Converting Capital Gains tax rate to Ordinary Income rate.

- Increasing Corporate Tax Rate from 21% to 28% (loss of ~$20 to S&P 500 earnings).

- Package sizes reduced as they don’t make it through a narrow majority in the Senate.

- Impeachment trial derails policy priorities in first 100 days.

The good news on the risks is that it historically takes ~15 months to pass a comprehensive tax package from “go.” This means there will be plenty of time for the vaccinations to unleash demand and the Trillions of stimulus circulate BEFORE growth is slowed by tax increases. The hope is that one offsets the other…

Now onto the shorter term view for the General Market:

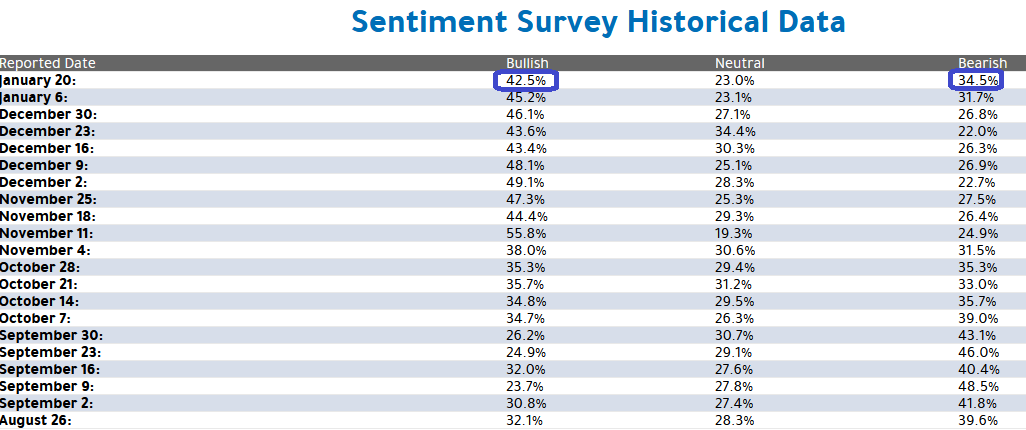

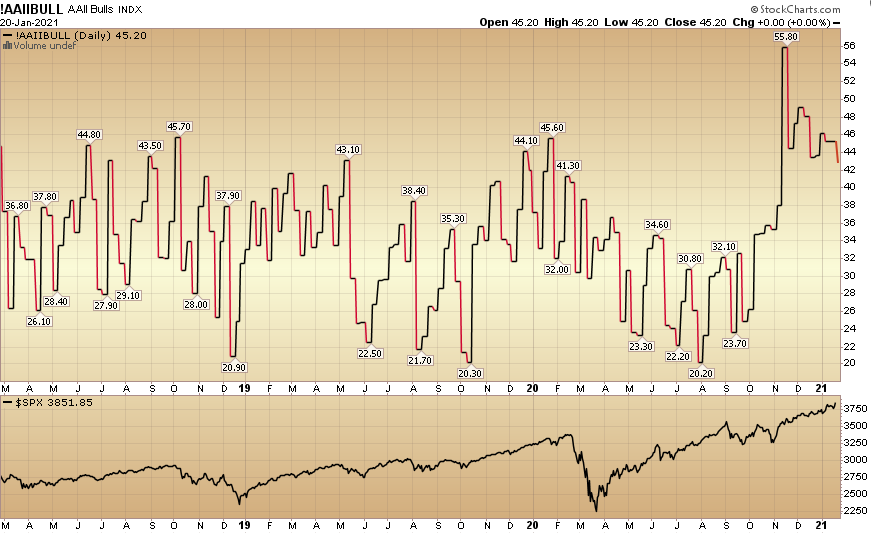

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 42.5% from 45.2% on January 6. Bearish Percent rose to 34.5% from 31.7% on January 6. We are still at an extreme in sentiment for retail investors.

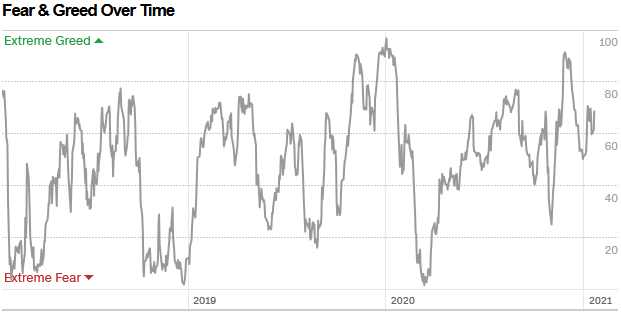

The CNN “Fear and Greed” Index flat-lined from 70 last week to 69 this week. This is still a relatively neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

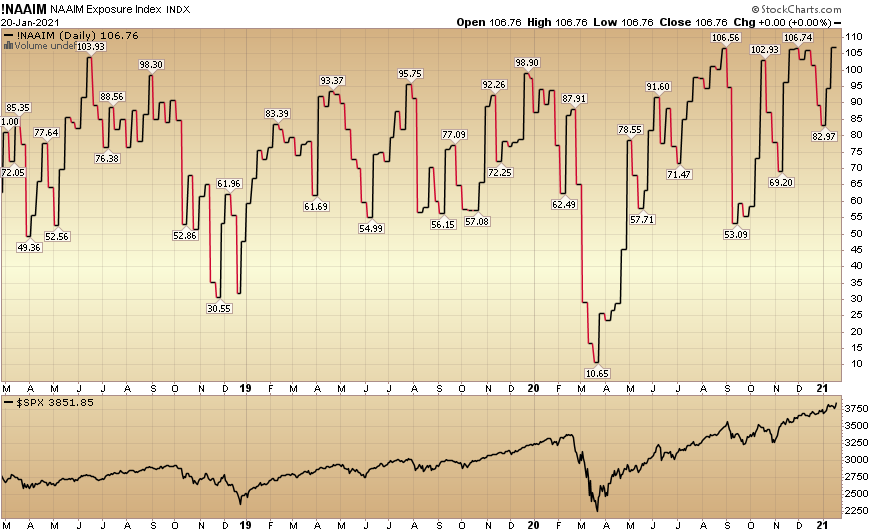

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 106.76% this week from 94.51% equity exposure last week. This is at an extreme.

Our message for this week:

Last week I said:

“The stock market can correct in TIME or PRICE. While I do think we may push a bit higher first, I expect the market will finally begin to consolidate some gains in coming weeks.

This can be by simply grinding sideways for a month or two to digest the > 75% gains off the March Lows OR more likely get a health pullback. As we have stated in recent weeks, this is the beginning of a new business cycle and it does not pay to get too cute trying to predict the when and how much of a short term correction we will get.

As we saw after a monster rally off the lows in 2009, it did not pay to play the short term pullbacks in 2010 and 2011 – as you may very well have missed out on a decade long bull market run.

We’ll be using any weakness that potentially comes our way in Q1 to add more value/cyclical names (themes listed above) to hold for the next 3-5 years…”

My view has not changed, but I would add, “do not underestimate the impact of $10T to solve a $750B problem.”

If/when we get some consolidation or a pullback, do not expect it to be material or long in duration. The catalyst for any weakness will likely be “threats” to the stimulus – as the Senate debates size and scope – OR saber-rattling about Tax Increases…