I chose Garth Brooks’ song, “Friends in Low Places” – for this week’s Stock Market theme – because I think that’s where the money is going to be made in the next six to eighteen months.

In a market that has run quite a bit off the lows, we’ll take a closer look at some of the pockets of the market where there is still opportunity (left behind laggards). In other words, we’ll find some “Friends in Low Places…” Listen here:

On Monday, I was on Fox Business (The Claman Countdown) with Liz Claman. Thanks to Liz and Ellie Terrett for having me on. In the segment, Liz asked if there was anything I was worried about in the markets. The key I pointed out, both on Liz’s show and CGTN America with Mike Walter (thanks Ai Xing), was the importance of extending (to some extent) the enhanced unemployment benefits – by the end of this week.

On Liz’s segment I also talked about the Fed’s options moving forward, and the implications of Yield Curve Control for Banks and for Main Street. You can view it here:

In the CGTN America interview, I was asked about the specifics of the “Phase 4” stimulus package. I covered the 3 key points of agreement and 3 key points of disagreement between the HEROES ACT (D) and HEALS ACT (R). The most important point is that if they cannot get a “carve out” for the enhanced unemployment extension, I think it is possible and likely that President Trump could issue an emergency “Executive Order” to keep the payments going – under emergency powers.

If it comes to that, there will be no need to negotiate another Stimulus Package before the election. He may have the powers to both extend “enhanced” unemployment benefits and issue stimulus checks without Congress – as an “Emergency Measure.” That will either be the leverage to get a deal agreement, or a reason not to – but either way it looks likely that the most important components will be delivered.

“Friends In Low Places”

Our four friends in “low places” are Financials, Defense Stocks, Homebuilders and Energy. As we covered in the Bank of America Global Fund Managers Survey Summary two weeks ago, Tech is the “most crowded trade:”

July Bank of America Global Fund Manager Survey Results (Summary)

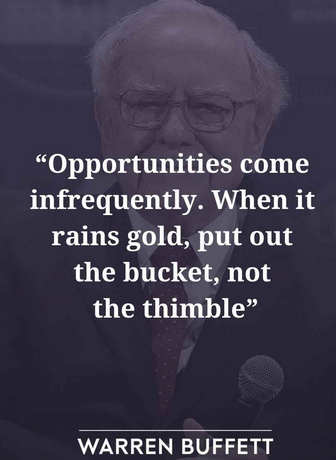

I’m now going to walk you through 4 “ratio charts” that map the relationship of these 4 “unloved” sectors relative to the “most loved/crowded” sector (Technology). As you view these extremes, keep in mind this quote from Warren Buffett:

These are EXTREME divergences that embody the essence of “The Oracle’s” quote. To believe these aberrations will persist indefinitely, you are betting against global population growth, 85 million millenials moving aggressively into housing formation, geopolitical tension and yield curve steepening (which is already happening).

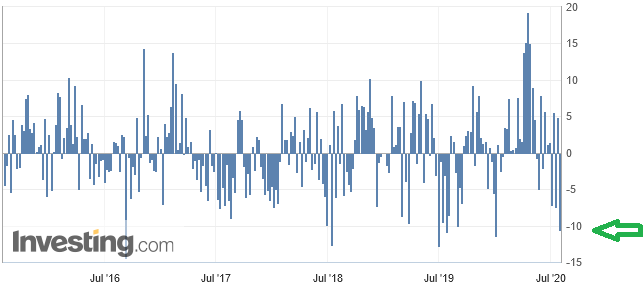

Let’s start with the yield curve and see where we are in the cycle. While everyone is focused on “record low rates” they are “missing the forest for the trees” as the magic is in the spread between the short end of the curve and the long end of the curve (what banks pay for money and what they charge for money):

As you can see in the updated chart above, the yield curve (difference between 2yr yield and 10 yr yield) is the steepest it has been since 2009 and 2003 (red/white line going straight up). The green line is the XLF ETF that represents financials/large banks. You can see what happened to financials the last two times the yield curve steepened this quickly.

Looking at it another way (above), these points in history also correlate to those periods that Financials were dramatically under-owned and unloved relative to “the most crowded trade” (Technology). In both 2000 and 2009 Financials ROCKETED after this extreme (inefficiency).

What made it “inefficient” and hence created the type of opportunity that made Buffett wealthy?

The fact that anyone looking out 1-2 years would have acknowledged that while banks were trading at a discount to book and there was credit risk, it would revert back to normal over time – coming out of the recessions. The same will be true this time.

For what it is worth, Buffett reportedly bought back ~$5B of his own Berkshire (Financial) stock in the last few weeks, and also added $1.2B of Bank of America stock in the last 8 days:

Buffett Buys $1.2B of BAC in 8 Days

Buffett did not make his fortune buying stocks that were “efficiently priced.” In recent weeks there have been countless articles asking if Warren Buffett has lost his touch:

2020 Articles:

Financial Times: Light on tech, heavy on banks — has Warren Buffett lost his touch?

Motley Fool: Has Warren Buffett Lost His Midas Touch?

They asked the same question in 2000:

CNN: With Berkshire stock near 52-week low, questions raised about investor’s touch

In case you were wondering, Berkshire’s stock returned 274% in the 8 years following the last time they asked whether he lost his touch in 2000. Tech was down -53.6% over the same eight year period (for a relative outperformance – by Buffett – of +327.6%).

Our next “unloved” inefficiently priced “friend in low places” is the Defense Sector (chart above). As you can see above, the last time the Defense and Aerospace sector traded at such an extreme discount (blue line) relative to Technology was 2003 (and 2012). The Defense sector (green line) subsequently rallied 201% and 346% respectively. Or, you can bet that Tech will keep going and no one will ever fly (or defend their countries) again…

Our next extreme is Energy relative to Tech (chart above). You have to look back to 2000 to find a similar inefficiency. XLE (Energy Sector ETF) subsequently rallied 393% following the last period of inefficiency (despite some early weakness). On CNBC Indonesia two weeks ago – I went into further detail on Emerging Markets demand, inflation, and commodities outlook. You can view it here:

Warren Buffett also did a $10B deal in the energy space this month – buying the natural gas transmission and storage assets of Dominion Energy:

Warren Buffett’s Berkshire buys Dominion Energy natural gas assets in $10 billion deal

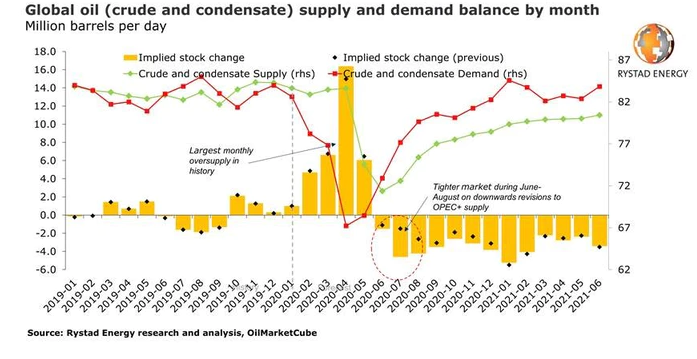

The most important thing you need to understand on this subject is what the OPEC cuts (through April 2022) – and lack of substantial energy investment in the past five years – will do to the supply/demand imbalance moving forward:

In case you missed it yesterday, we had the biggest Crude draw since 2019 (right on schedule with the table above – which we put out over a month ago):

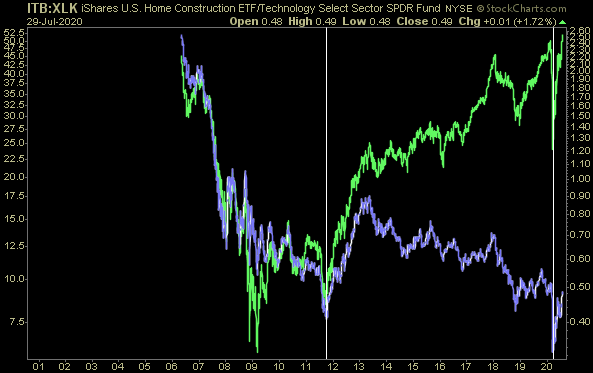

And for our final “friend in low places,” Homebuilders have already elevated themselves and have room to go in coming years. We won’t see this picture slow until the 10yr Treasury Yield is >5% and that is years away:

I can’t tell you when the “downpour” of inefficiency and opportunity will stop (particularly for the first three “friends”), but my suggestion is to stop asking for an umbrella and start filling you bucket!

I would worry less about the “market” and whether Tech is “overvalued” and more about where is opportunity/inefficiency NOW?…

Now onto the shorter term view for the General Market:

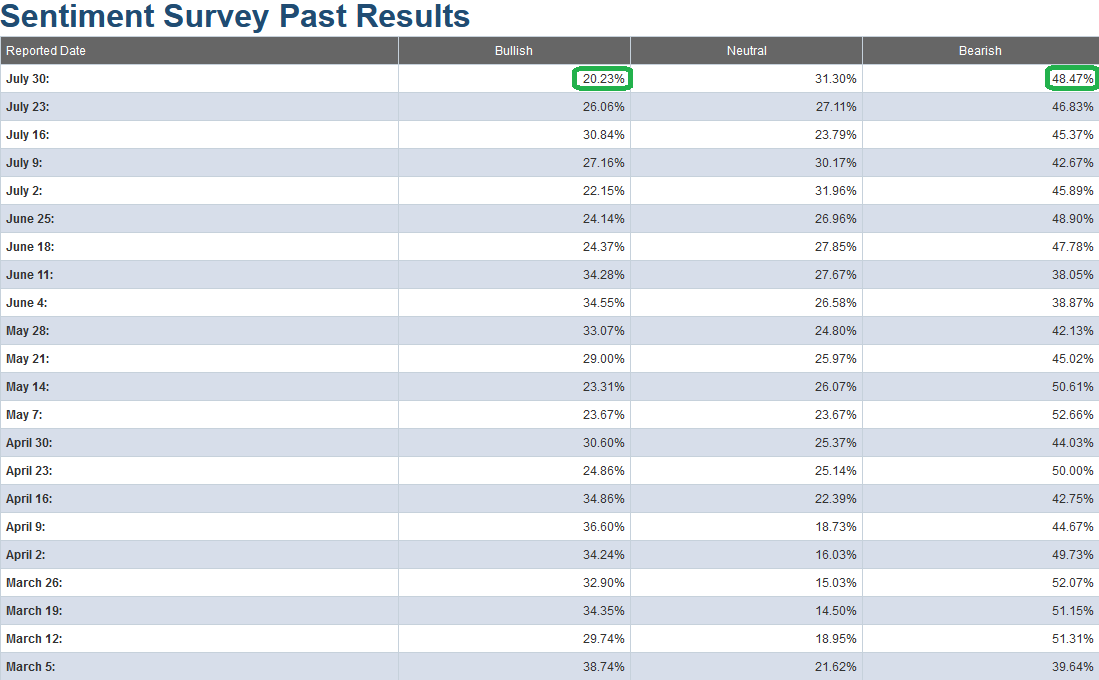

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 20.23% from 26.06% last week. Bearish Percent rose to 48.47% from 46.83% last week. These are extreme levels that historically favor being a buyer versus a seller. This is one unloved rally riddled with constant skepticism and disbelief. Because of that, we can continue to scale the “wall of worry.”

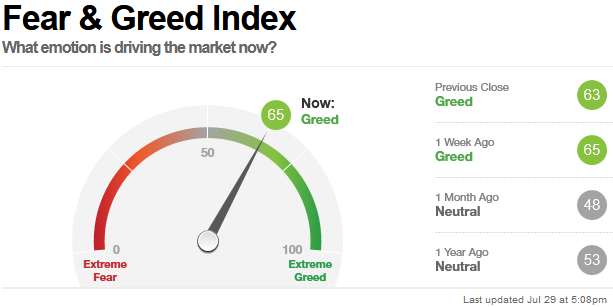

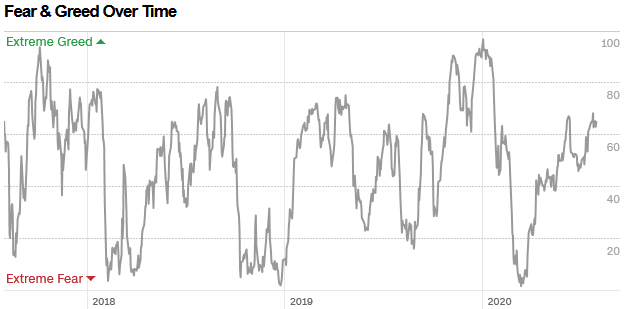

The CNN “Fear and Greed” Index flat-lined from 65 last week to 65 this week. Despite the market moving up >45+% off the lows, we have still not hit an extreme/euphoric level (>80/90) yet. You can learn how this indicator is calculated and how it works here: (Video Explanation)

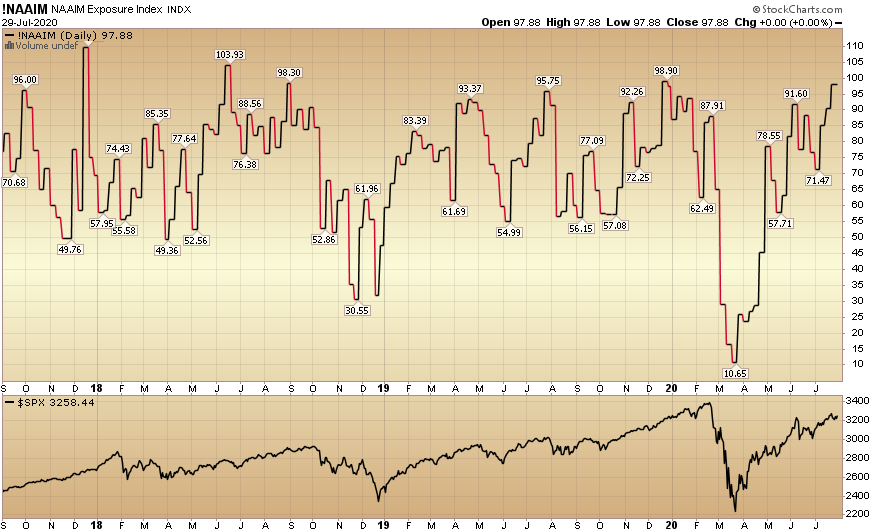

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose from 90.53% equity exposure last week, to 97.88% this week. This is an extreme level, so we must keep an eye on it now.

Our message for this week:

I don’t think I’ve ever seen such a divergence between active managers (NAAIM) being “all in” and individual investors being scared out of their minds (AAII). Because of that – I’m using the CNN Fear & Greed as a tie-breaker for now – and it shows ample room until hitting “euphoric” levels.

We remain very constructive in the intermediate term and will take advantage of any additional buying opportunities in laggard/cyclical names (per discussion above) – should they arise over the Summer/Fall. I would not be surprised to see a bit of volatility/chop related to the Stimulus Bill/Earnings over the next few week(s).

Until next time, it’s time to make some “Friends in Low Places…”