Just when you thought the coast was clear…

-The Fed does an about face in Summer 2019 and begins accomodative policy after 2.5 years of tightening.

-Trump Administration completes two major favorable trade deals (Phase 1 China and USMCA).

-U.S. Earnings on track for near double digit growth in 2020 after two years of flat growth.

…and there was nothing left to worry about, some Chinese Bat virus pops out of nowhere and sends everyone into a panic.

Let’s go through the facts:

-As of 1/29 at 10pm, Chinese officials have confirmed over 7,700 cases of the mysterious illness and 170 deaths.

-SARS (2003) resulted in a total of about 8,100 people being sickened during the 2003 outbreak, with 774 people dying (according to WHO).

-This compares to the common flu – which the CDC estimates that has resulted in between 9 million – 45 million illnesses, between 140,000 – 810,000 hospitalizations and between 12,000 – 61,000 deaths annually since 2010.

What can history tell us regarding a stock market reaction?

We have had 12 Epidemics since 1981.

The average return of the S&P 500 1 month out: +.44%

The average return of the S&P 500 3 months out: +3.08%

The average return of the S&P 500 6 months out: +8.50%

Data Source: Charles Schwab/Factset (MarketWatch)

Here was my take on coronavirus this Monday on Yahoo Finance TV:

Watch it directly on Yahoo! Finance here

What is going right?

- The Chinese Government reacted to the problem more swiftly and aggressively than they have to past incidents.

- US Drug companies sent over $2M of drugs for the Chinese to test on their infected population (Wall Street Journal).

- AbbVie’s HIV Drug Aluvia/Kaltera: Wang Guangfa, the leader of Peking University First Hospital’s pulmonary and critical care medicine department, contracted the virus as a member of a national expert team dispatched to Wuhan. HIV Drug Kaletra killed his disease, Wang told state-run China News Service in a report (Chinese) on Thursday. ()

- There are already three drugs fairly effective on novel coronavirus at cellular level (ECNS.cn)

- Expert: More new coronavirus cases than SARS, but less severe. Many people being diagnosed are healing on their own. (BBC)

My sense is that we will wake up one morning and find out that some pre-existing HIV drug cures coronavirus in ~75% of the severely infected and the spread will halt overnight. Whether that is in a day, week or month is hard to tell, but given the fact that the Chinese have mapped the genome – which was not possible in past instances, they are many steps ahead.

The Fed+

In last week’s VideoCast I said I was concerned that Chair Powell would overemphasize tapering the liquidity expansion in this week’s Fed Meeting. Instead, he emphasized the Fed’s displeasure with inflation chronically running below 2%.

If you recall in December, the Fed said it would continue adding liquidity through the month of January. Today Chair Powell pushed that date out again to “at least into Q2.” This is a global theme (a reversal from tightening to accomodative central banks in the past 6 months).

While the coronavirus is not a welcome brick in climbing the “wall of worry” higher that we have experienced for the last 12 months, it probably helped to give Chair Powell cover today in pushing for symmetric inflation above the 2% target.

In short, the Fed remains a tailwind for the time being.

Today the Democrats even called for a $760B infrastructure plan (fiscal stimulus). (Reuters)

Now onto the shorter term view:

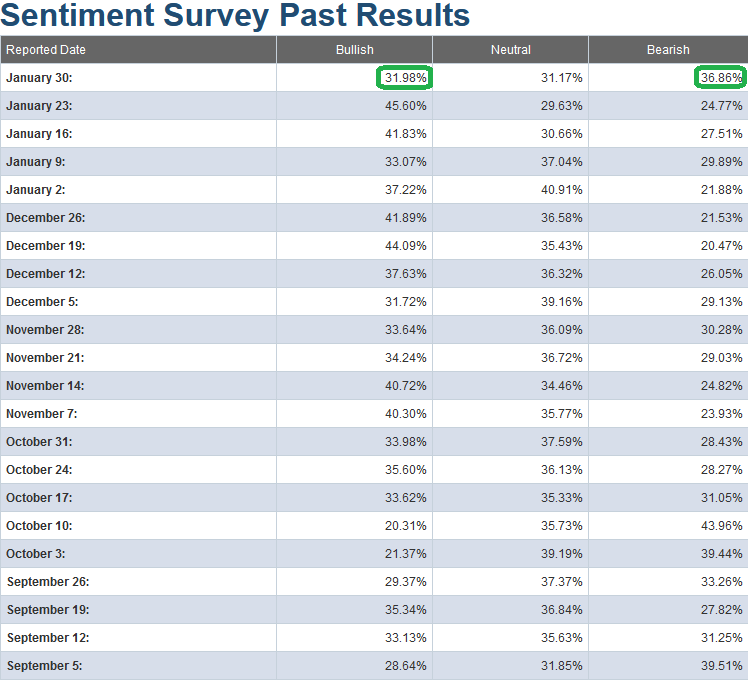

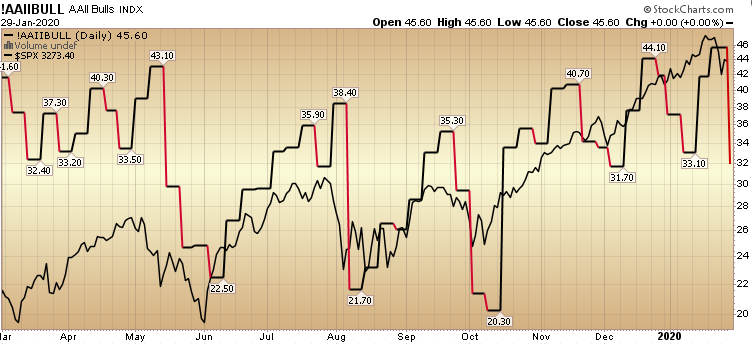

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent dropped to 31.98%, DOWN from 45.60% last week. Bearish Percent jumped to 36.86% from 24.77% last week.

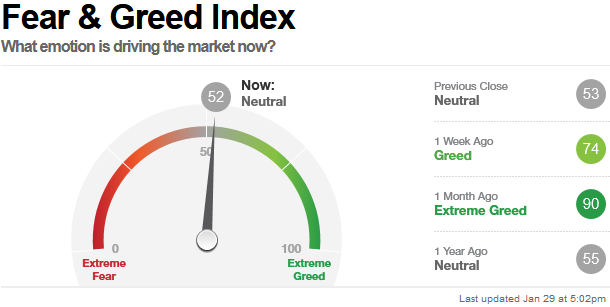

The CNN “Fear and Greed†Index – which dropped 22 points (from 74 last week to 52 this week) confirmed the drop in the AAII Sentiment Survey. You can learn how this indicator is calculated and how it works here: (Video Explanation)

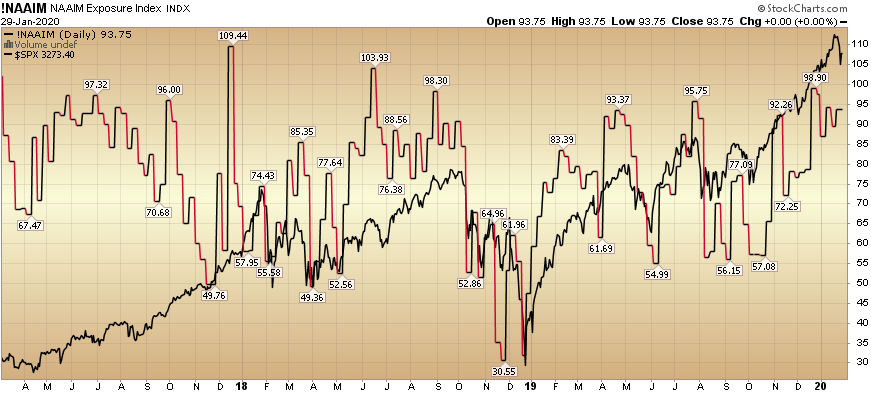

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) rose from 89.47% equity exposure last week, to 93.75% this week. While this is still an elevated level, these levels can stay “pinned†for some time when they are emerging from a significant trough (like early 2016 and late 2018).

Our message for this week is similar to the last couple of weeks:

We remain bullish in the intermediate term (for 2020). As we have stated in our recent notes, we have trimmed some names that have had huge runs off of the August/September lows, and had re-allocated some profits into sectors/stocks that had just begun to participate.

We also recently added a few selective shorts. The short positions are not due to bearishness per se, but rather “special situations†that we believe will work even in a sideways to up market and outperform in the event of a pullback.

You can review our previous notes under the category “Sentiment†on the right side of the site.