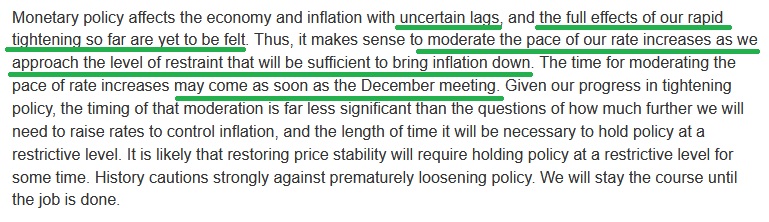

On Wednesday, Fed Chair Jay Powell shifted his messaging just enough to cancel the Grinch from stealing Christmas this year. In his prepared speech on Wednesday he made the following statements which eased market participants’ jittery sentiment over the past few days:

In the press conference Powell made two unexpected statements:

1. “I don’t want to over-tighten.” Up until now, the Fed has consistently implied they would lean toward over-tightening.

2) It’s “not appropriate to execute some ‘shock and awe’ strategy to crash the economy and clean up afterwards.” They were on track to do this. It’s nice to see they are finally recognizing the impact of their aggressive tightening.

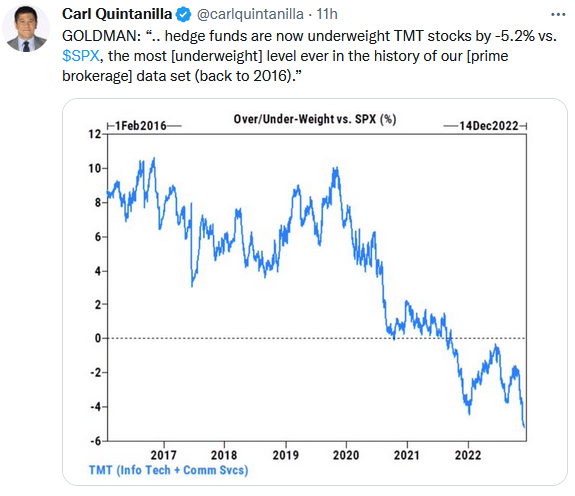

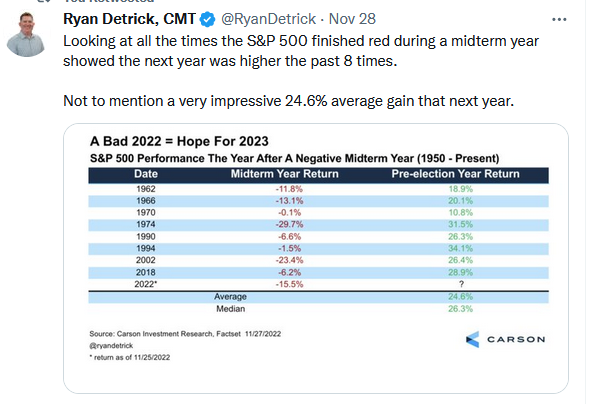

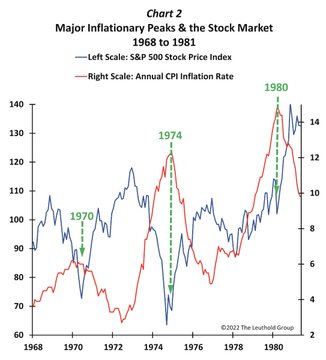

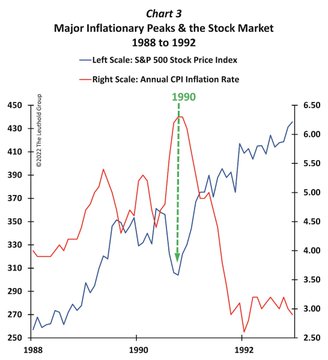

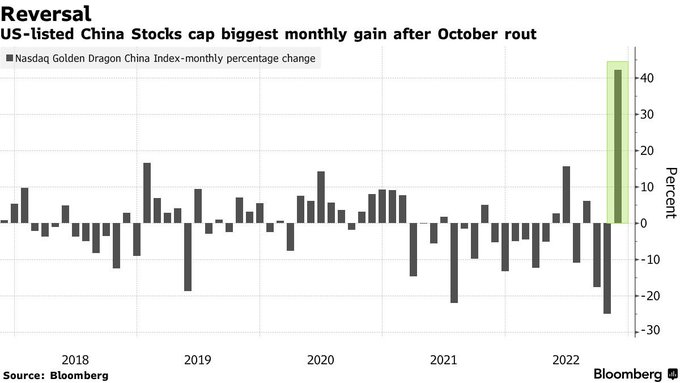

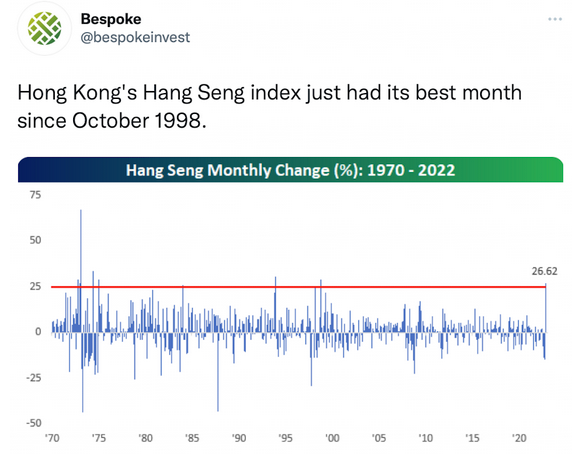

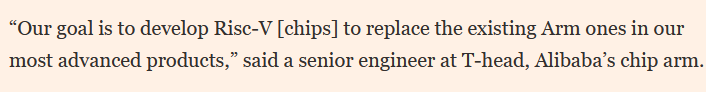

The market abruptly rallied on the news led by China Tech, Biotech, U.S. Tech and Semiconductors. We’ve covered the opportunity in all of these unloved groups in recent weeks and this was the shift that caused a bid. We expect to see continued follow-through in fits and starts through year-end. Some data points to pay attention to moving forward:

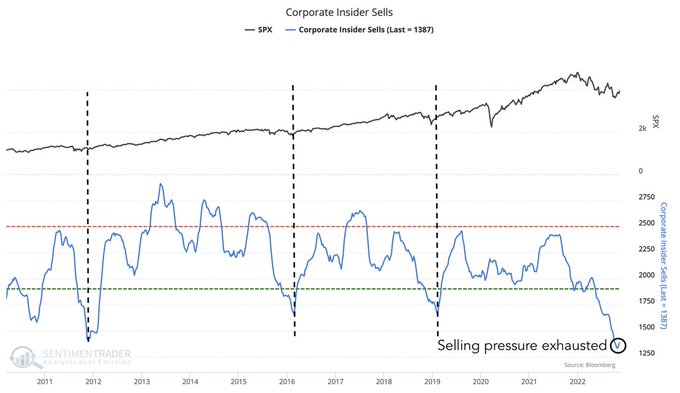

Sentiment Trader:

One of the best strategists on the Street – Marko Kalanovic of JPM (who has been bullish all year) – literally threw in the towel and finally capitulated/went bearish (exactly 1 hour before Powell spoke):

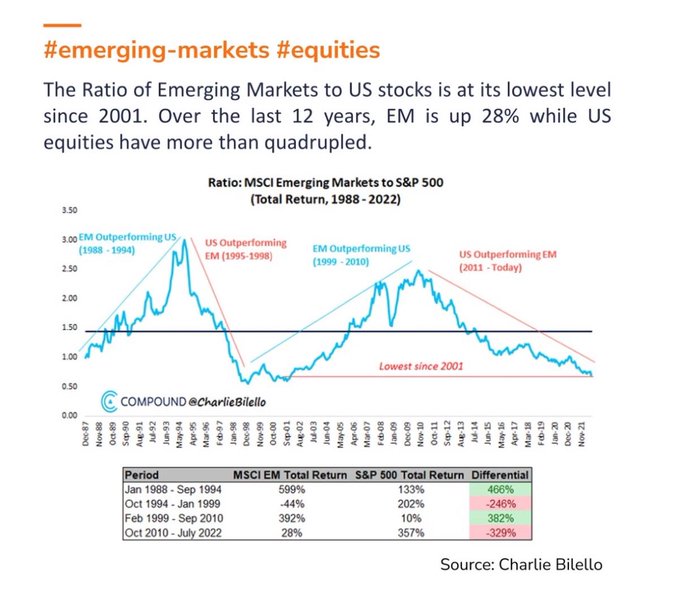

On Tuesday, I joined Mitch Hoch “Money Mitch” on Benzinga to discuss stock market end of year outlook (the best trades for 2023-2024), U.S. dollar, Emerging Markets, the Fed, Inflation, Tech, clearance sale, Black Friday, China, casinos, oil, Volker, rail strike, and “thumb suckers.” Thanks to Mitch and Zoltan Suranyi for having me on. Pay special attention to the commentary on Tech and Emerging Markets in this segment:

On Tuesday, I joined Mitch Hoch “Money Mitch” on Benzinga to discuss stock market end of year outlook (the best trades for 2023-2024), U.S. dollar, Emerging Markets, the Fed, Inflation, Tech, clearance sale, Black Friday, China, casinos, oil, Volker, rail strike, and “thumb suckers.” Thanks to Mitch and Zoltan Suranyi for having me on. Pay special attention to the commentary on Tech and Emerging Markets in this segment:

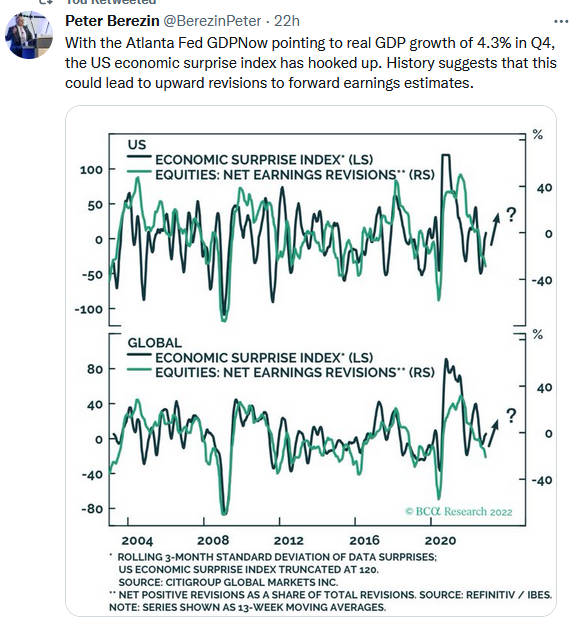

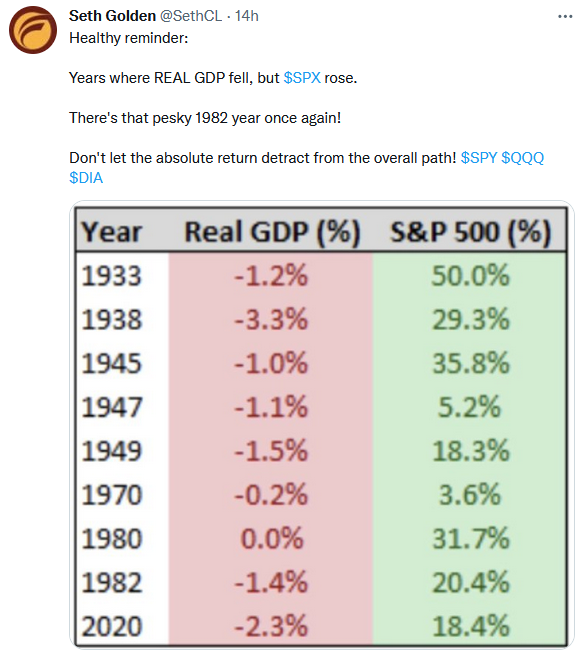

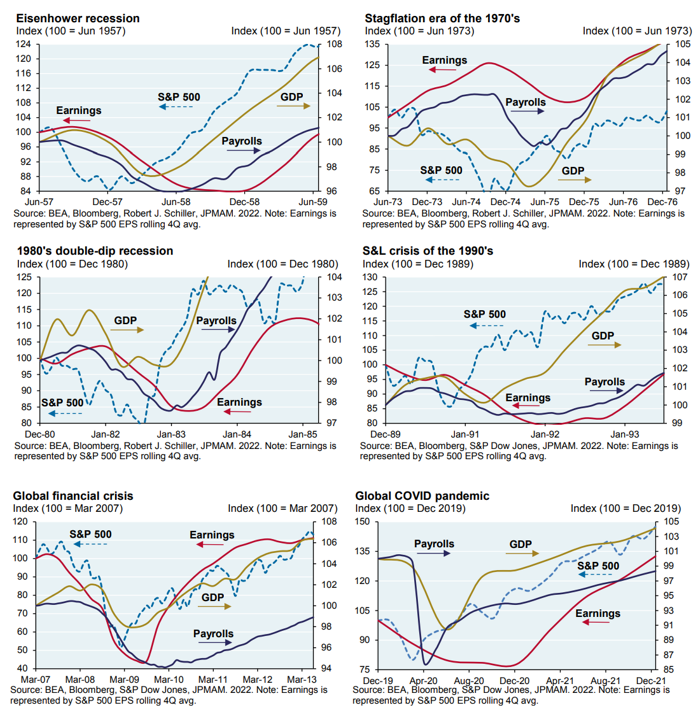

For the fourth consecutive weekly reminder: Most analysts are calling for earnings to come down another 20% and are therefore bearish on the market. History shows the stock market bottoms WELL BEFORE earnings. In most cases the S&P 500 had recovered to new highs by the time earnings bottomed 6-12 months later: 1957, 1974, 1982, 1990, 2009, 2020.

Over the weekend I joined Xen Sams on 710 AM WOR iHeart radio to discuss capital markets and market outlook. Thanks to Xen for having me on. Pay special attention to the farm analogy I lay out to understand why short term volatility does not bother us and why growth and value are joined at the hip:

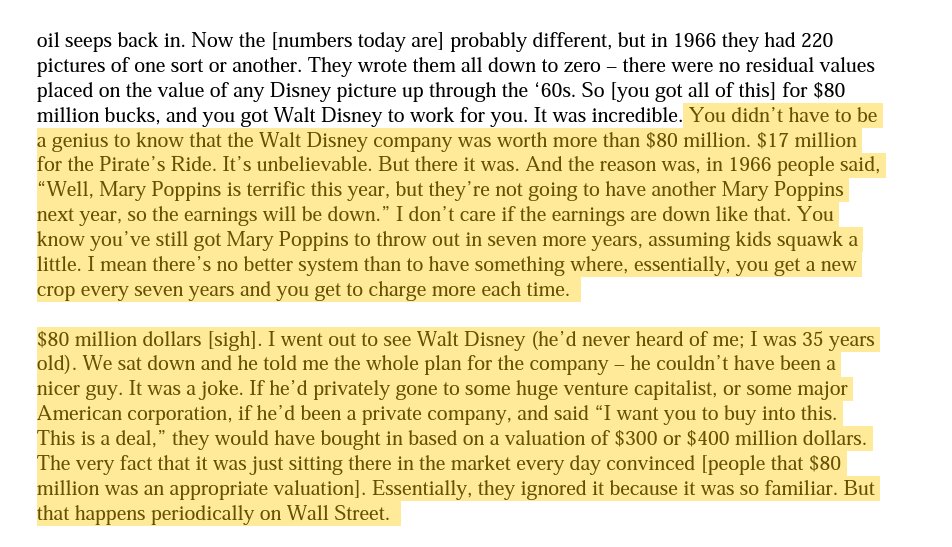

Funny how history rhymes. One stock I spoke about with Xen was Disney. Here’s what Warren Buffett had to say about it at a previous time this quality franchise was “out of favor.” From 1966 (via Q compounding):

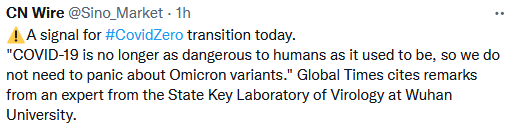

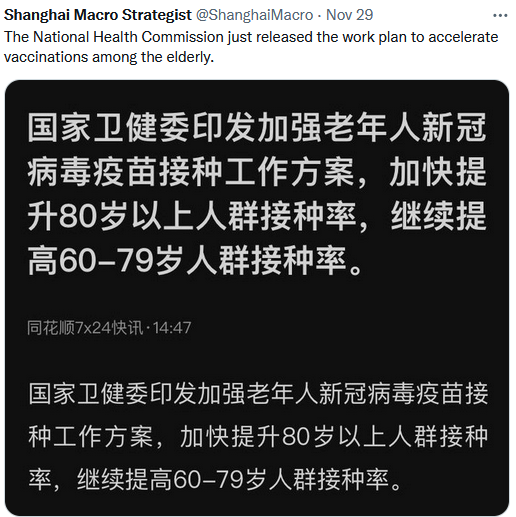

China Update

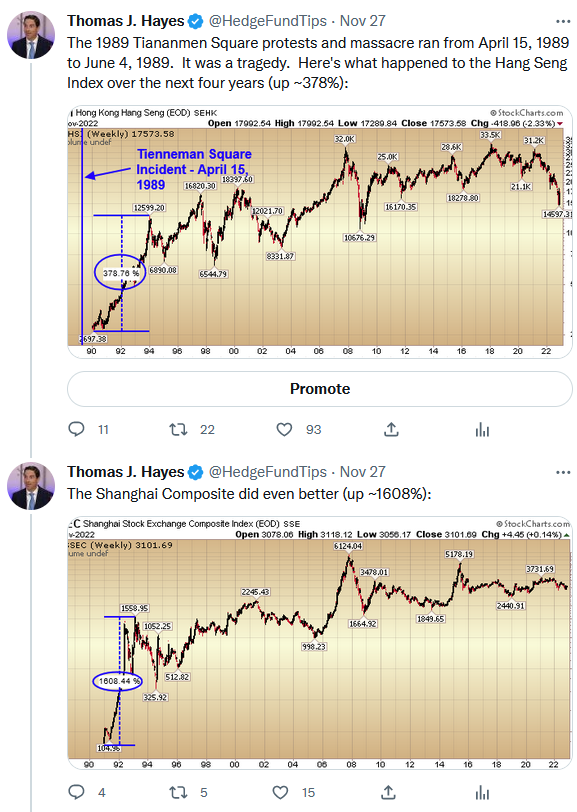

On Sunday night when China/HK futures were down big (on the protests over the weekend) I sent the following note to clients and also posted on Twitter:

Since we posted these 18 points on Twitter – during the October final capitulation flush to ~$58 – BABA has rebounded ~50% off the lows:

“It’s Five O’Clock Somewhere” Stock Market (and Sentiment Results)…

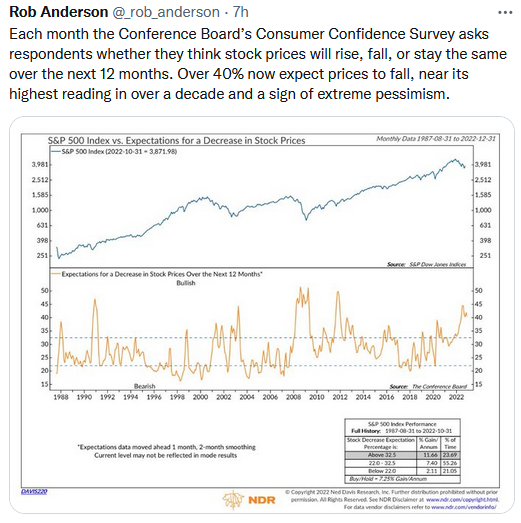

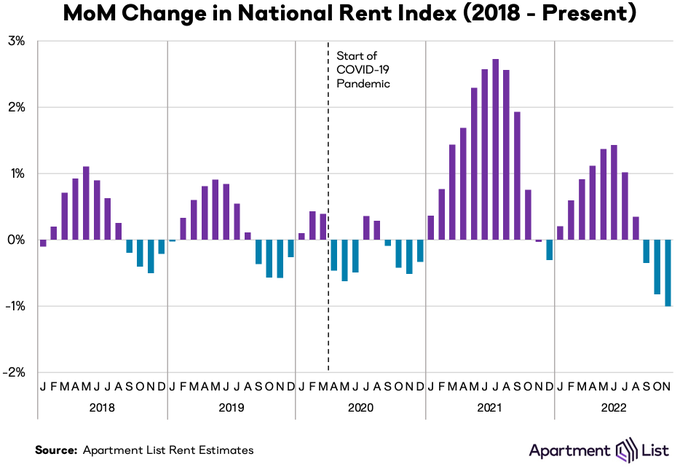

Conditions are improving to create a playing field conducive to climb back to fair and ultimately full valuation. There will be more “fits and starts” but we are making progress:

Cooper Standard

No change since the last comprehensive update. View it here:

Now onto the shorter term view for the General Market:

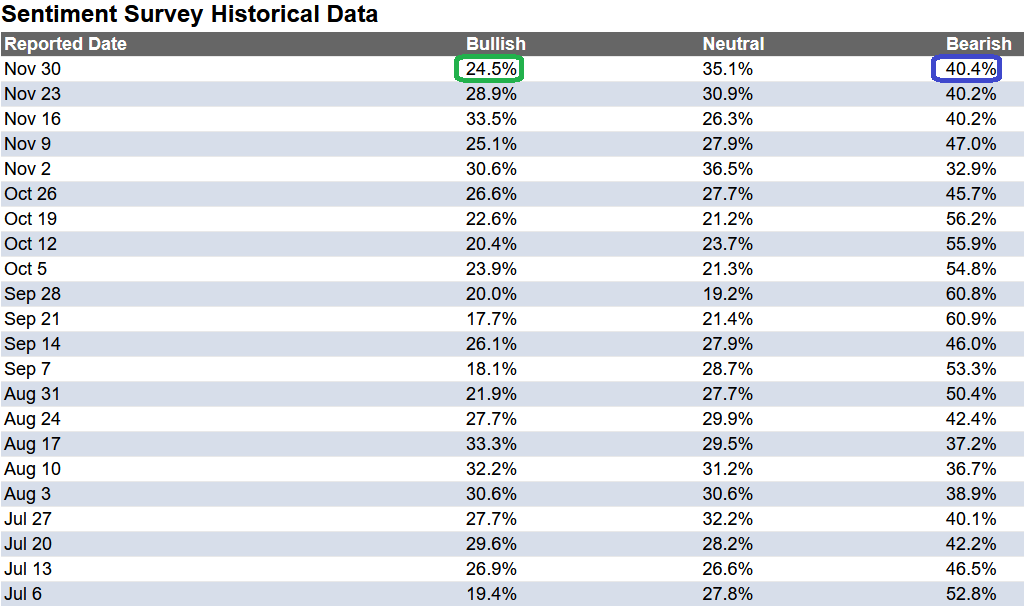

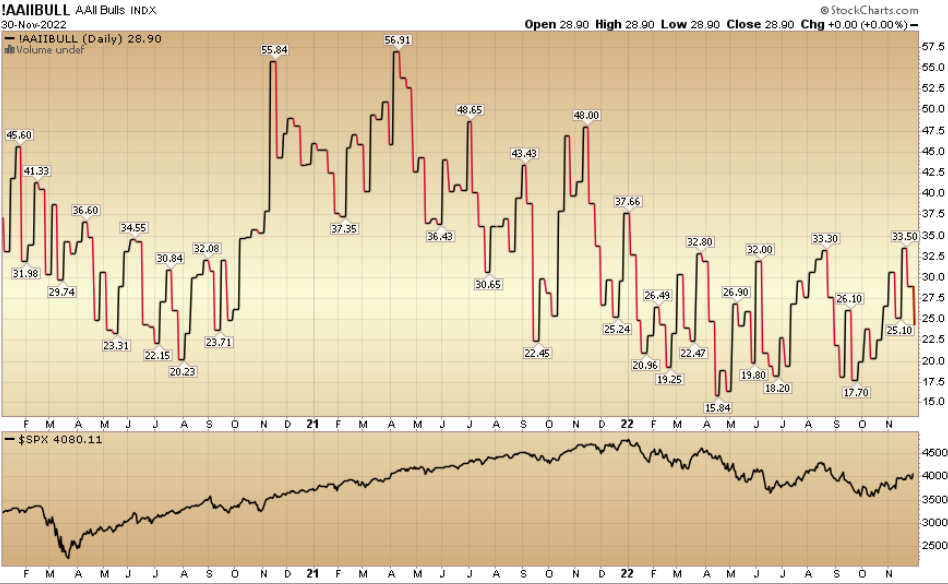

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked DOWN to 24.5% from 28.9% the previous week. Bearish Percent ticked up to 40.4% from 40.2%. Sentiment is STILL despondent for retail traders/investors.

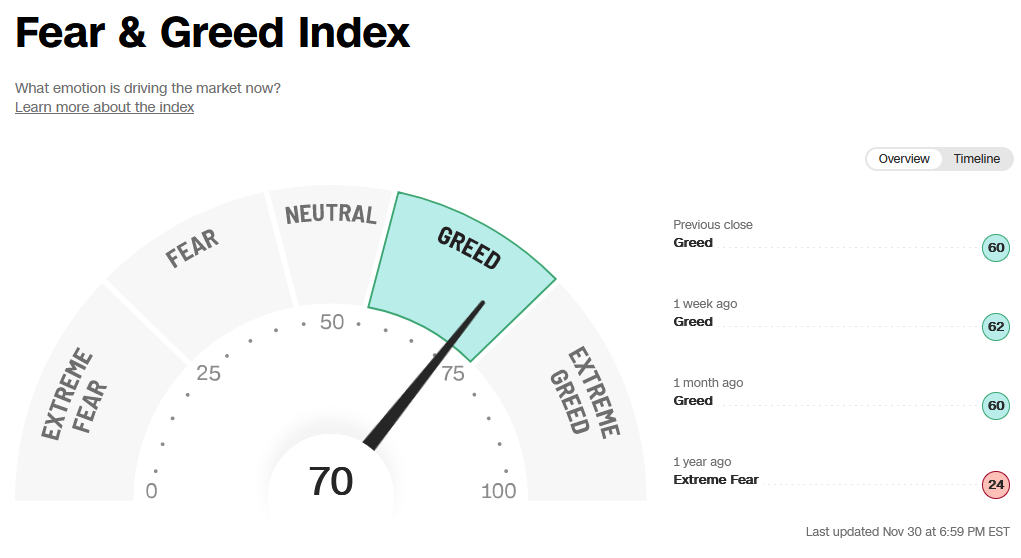

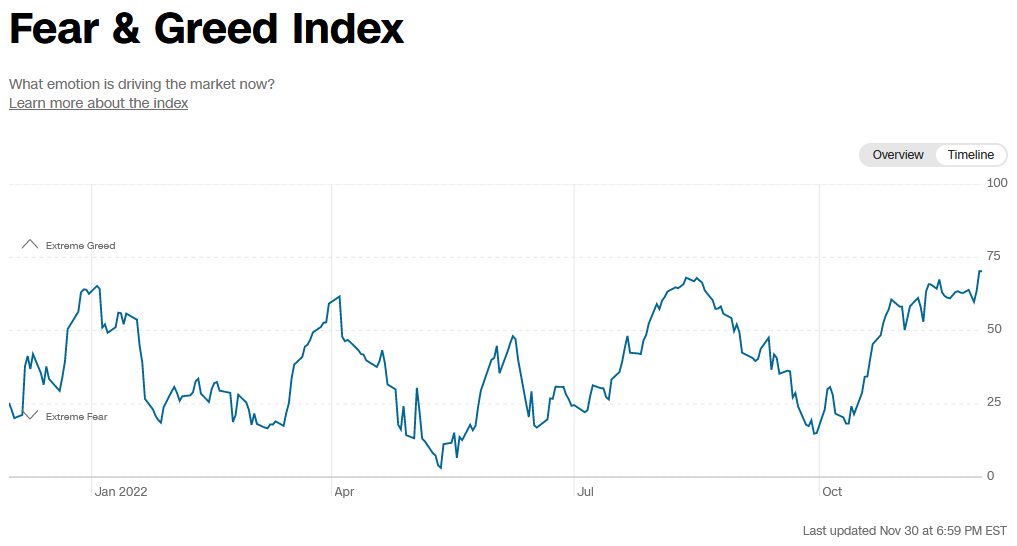

The CNN “Fear and Greed” moved up from 62 last week to 70 this week. Sentiment is accelerating. You can learn how this indicator is calculated and how it works here: (Video Explanation)

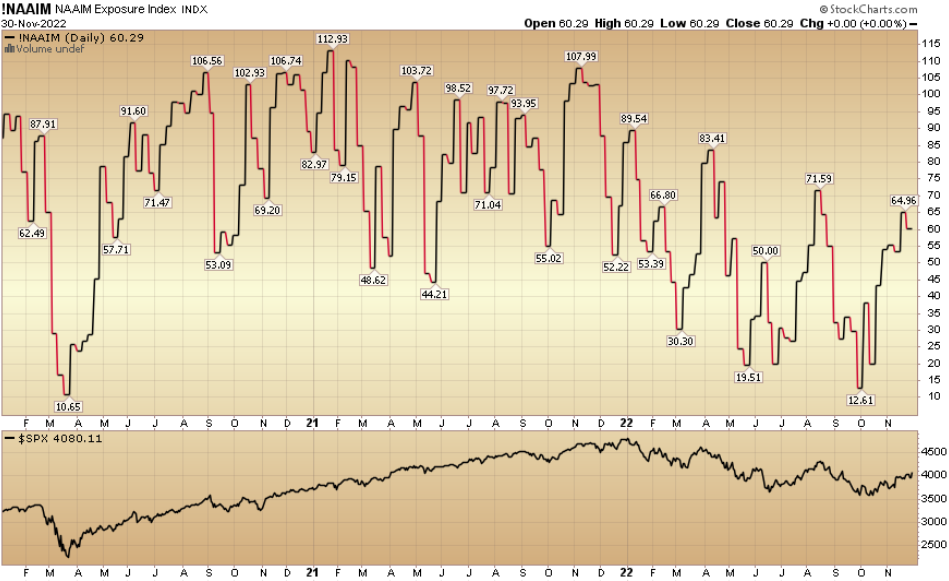

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 60.29% this week from 64.96% equity exposure last week. This likely changed overnight as managers were caught flat-footed yesterday and will have to chase into year-end.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 60.29% this week from 64.96% equity exposure last week. This likely changed overnight as managers were caught flat-footed yesterday and will have to chase into year-end.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.