I had a tough time coming up with a song to describe Stock Market sentiment this week. After Coinbase IPO’d at a $100B valuation, it hit me. Market participants must be singing from the same hymnal in Justin Bieber’s latest hit “Peaches”:

I got my peaches out in Georgia

I get my weed from California…

You can tell me all of the reasons why Coinbase (at ~$100B) is as valuable as Raytheon, General Electric, or Goldman Sachs. How about worth more than the CBOE and ICE exchanges combined? To that I would simply turn on “Peaches” and assume you must be smoking what Bieber gets in California. This tweet by Karen Finerman summed it up best:

Coinbase tomorrow. From page 327 of their filing doc pic.twitter.com/UXHhnolRV2

— Karen Finerman (@karenfinerman) April 13, 2021

Contrast this mania with the pockets of the market where you can still find value (after an ~85% move off the March 2020 lows).

Big Pharma

On Tuesday I was on Fox Business with Liz Claman on The Claman Countdown. Thanks to Liz and Ellie Terrett for having me on.

We used this segment to discuss the current opportunity set in the market – and where there are still bargains:

Fox Business Show Notes from Tuesday:

With market up ~85% of March lows, it’s harder to find value. Big Pharma is one pocket of the market that still represents tremendous value at these levels.

With the 10yr yield stabilizing, we continue to like Big Pharma as they have a strong dividend yield and defensive properties in case of market chop/volatility:

JNJ

We would be a buyer of JNJ on this short term bad news. It is currently a “1 in a million” scenario so far – with 6 cases out of 6.8+ million vaccines (similar to Flu Vaccine adverse effects). JNJ trades at 15.29x 2022 earnings (compared to 18x historic PE). Yields 2.5%. JNJ has raised its dividend every year for almost 6 decades.

Usually bad news takes 3 days to bottom out. We suggested buying a a bit Tuesday, Wednesday and Thursday – as it should be in very good shape looking 6 months out.

JNJ has ongoing momentum from its diversified pharmaceutical business and strong pipeline.

Contributing close to 50% of total revenue, the pharmaceutical division boasts several industry-leading drugs, including immunology drugs Remicade (arthritis), Stelara (psoriasis) as well as cancer drugs Darzalex and Imbruvica.

The Medical Device group brings in almost 1/3 of sales. Consumer division < 20%.

PFE

We also like Pfizer. Up ~10% since we suggested it a month ago – it has more room to run. PFE is trading at ~12x 2022 EPS. This compares to its average historic multiple of 14x. PFE still yields 4.2% (> 2.5x 10yr yield). Pfizer was the first to get FDA emergency approval for its vaccine. As first mover people will have confidence in this vaccine moving forward. PFE expects to deliver 2B vaccines this year ($15B in vaccine sales). Eliquis (blood thinner) sales up 17% yoy.

NVS

Anticipate a meaningful acceleration in the second half of the year on the back of more normalized healthcare conditions, gains in the oncology portfolio, and further penetration in key long-term growth drivers, Entresto (heart failure) and Cosentyx (psoriatic arthritis). NVS trades at 12.7x 2020 EPS. This compares to its average historic multiple of 22x. NVS yields more than 2x 10yr treasury at 3.66% div yield.

Outlook and Opportunity

Earlier on Tuesday I joined Stephanie Hamill on OAN’s “In Focus with Stephanie Hamill.” Thanks to Stephanie and Camryn Kinsey for having me on.

In this segment we discussed the Stimulus, Inflation, Bank Earnings and NFTs:

OAN Show Notes from Tuesday:

Bad News: Getting tougher to find value after an ~85% move since March 23, 2020 lows (~13 months ago).

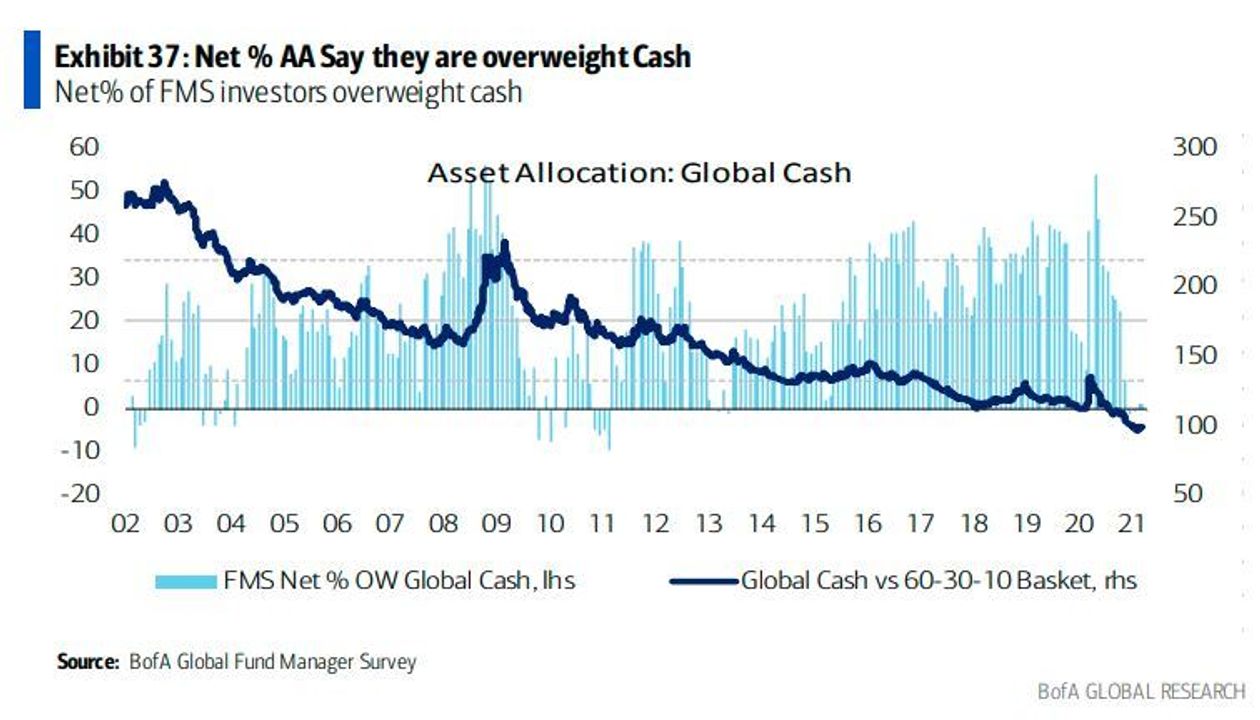

Good News: Still Opportunity. $4.5T cast on the sidelines ($1.5T retail investors). Institutions raised $200B+ cash so far this year. That money will have to be re-deployed.

7DMA cases/death coming down steadily. Vaccinations topped 4M in one day this weekend.

Problem:

-GDP contracted -3.5% in 2020 or ~$750B.

Solution:

-We have spent $5.3T on stimulus so far, and another $2-3T is on the way. You add $4T of Fed Balance sheet expansion, you’re ~50% of GDP to solve a $750B problem. Now you know why houses around the country are in bidding wars (selling above list price), and prices at the pump have doubled.

Outlook:

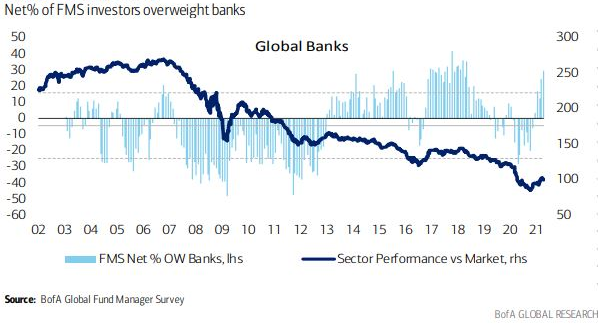

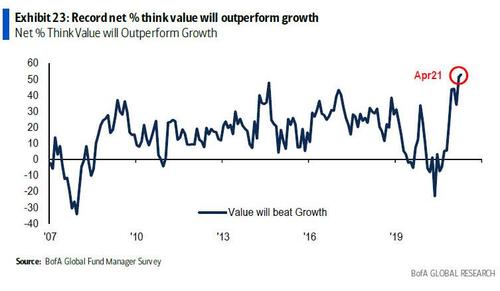

-Last year our biggest picks were, Banks, Energy and Defense (and Aerospace). Banks and Energy were the top performers in Q1 2021. We believe all three groups still have room to run over the next 12-18 months and will make new highs before the end of the year. Cyclical stocks like these groups always outperform in the first 2 years of a new cycle. We are 1 year into the new bull market and while they are consolidating gains/resting, there is plenty of upside ahead. Hedge Funds and Institutions are still underweight these groups and will have to chase to “catch up” to their benchmarks.

-Bank Earnings start this week. Expected to be strong as NIM (net interest margin) has rebounded from a yield curve that is at its steepest in ~5yrs. Expect loan loss reserves to be reversed and come back as income/earnings. Banks over-reserved on the basis of 20% unemployment expectations last year. Instead, we are at 6%. That all comes back as earnings. Lastly, we will look for guidance on dividends and buybacks – which we expect to resume/increase in earnest after the June Stress Tests. Furthermore, banks will be rationalizing their operating footprint as they found that many of their staff can work remotely.

-Energy; steep decline in supply as there has been no significant investment in the past five years. Federal restrictions will hurt supply and increase price (biggest players will be the winners). Demand for business travel/jet fuel/commercial aviation is going to explode in 2H this year. Already > 1.5M per day are traveling again. The sector is under-owned and has more to go in the next couple of years (despite a 75-100% move off the lows).

-Early last month, we started aggressively adding Utilities (AEP, D), Consumer Staples (K, CPB) and Big Pharma (PFE, NVS). While they have moved up considerably in 6 weeks, there is still room to run for these defensive (yield sensitive) high dividend payers – now that the 10-yr yield on the US Treasury has stabilized. Investors will demand yield as rates stop going up so aggressively and these are the groups that money is moving to as most in the group yield 2x (or more) than the 10yr treasury yield (and they increase their dividends regularly). This will also be a good place to hide if we do get some short-term chop in the market as institutional managers hide in these groups to get defensive.

Current estimates for 2020 GDP are ~6%. We expect 7-9%.

Current estimates for 2020 S&P Earnings are ~$175. We expect $185-200.

Both are too low – which is what gives us confidence we could see another 7-9% increase in the S&P 500 before year-end (even if we see some chop in coming months).

Bonds and Currency

On Wednesday, Ruth Carson (from Bloomberg) sent me some questions on US Treasuries and the US Dollar – regarding my outlook. Here are my latest thoughts and how we’re playing it:

One of the key factors I look at is what the “Commercials” are doing on a weekly basis in the “Commitments of Traders” report each week. They were buyers (of the USD) into the bottom in January – which we apprised you of (leading to the recent rally). We have gotten a bounce, but I think there’s some more strength left in this move in coming months as they (Commercials) have not started selling aggressively ahead of a top. This is also consistent with the likelihood that the US will be among the first nations to achieve “herd immunity.” The European and Emerging Market vaccine rollouts have been delayed – and less efficient – than what we are seeing in the US. It is understandable that money will flow where there is recovery strength.

As for the 10yr, the key story is that the rate of change has slowed (yields stopped rising at an accelerated pace and are now in a short term sideways range between ~1.56% and 1.76%).

The “disorderly” part of the move is behind us – and while we could get a short term bounce in bonds (compression in yields), it is likely that yields end the year a bit higher than where they are today. Commercials have not been buying bonds in a quantity that would lead me to believe a strong bottom is in at this time, so while a short term bounce is certainly possible, Bonds are likely to finish the year modestly lower than where they are today (yields higher).

I would not expect the 10yr yield to finish 2021 much higher than 2.25% at most (and may go lower first).

We are not taking aggressive currency or bond bets at the moment.

Early last month we aggressively added Utilities, Consumer Staples, and Big Pharma Equities as an intermediate term play on the stabilization of rates (and relative yield). PFE (Pfizer) trades ~12x 2022EPS (compared to its historic PE of ~14x) and has a dividend yield of 4.2% (2.5x 10yr yield). NVS (Novartis) trades at 12.7x 2020 EPS. This compares to its average historic multiple of 22x. Yields more than 2x 10yr treasury at 3.66% div yield. We bought late Feb/early March: Pharma: PFE, NVS. Utilities: AEP, D. Staples: K, CPB. This is the best way to play the intermediate stabilization of yields in our view (as they sold off in Jan/Feb on the abrupt rate rise). They also have the added benefit of being “defensive” sectors in case we come up against any short-term chop/volatility in the general indices. These sectors will be where money goes to hide.

Sentiment and Positioning

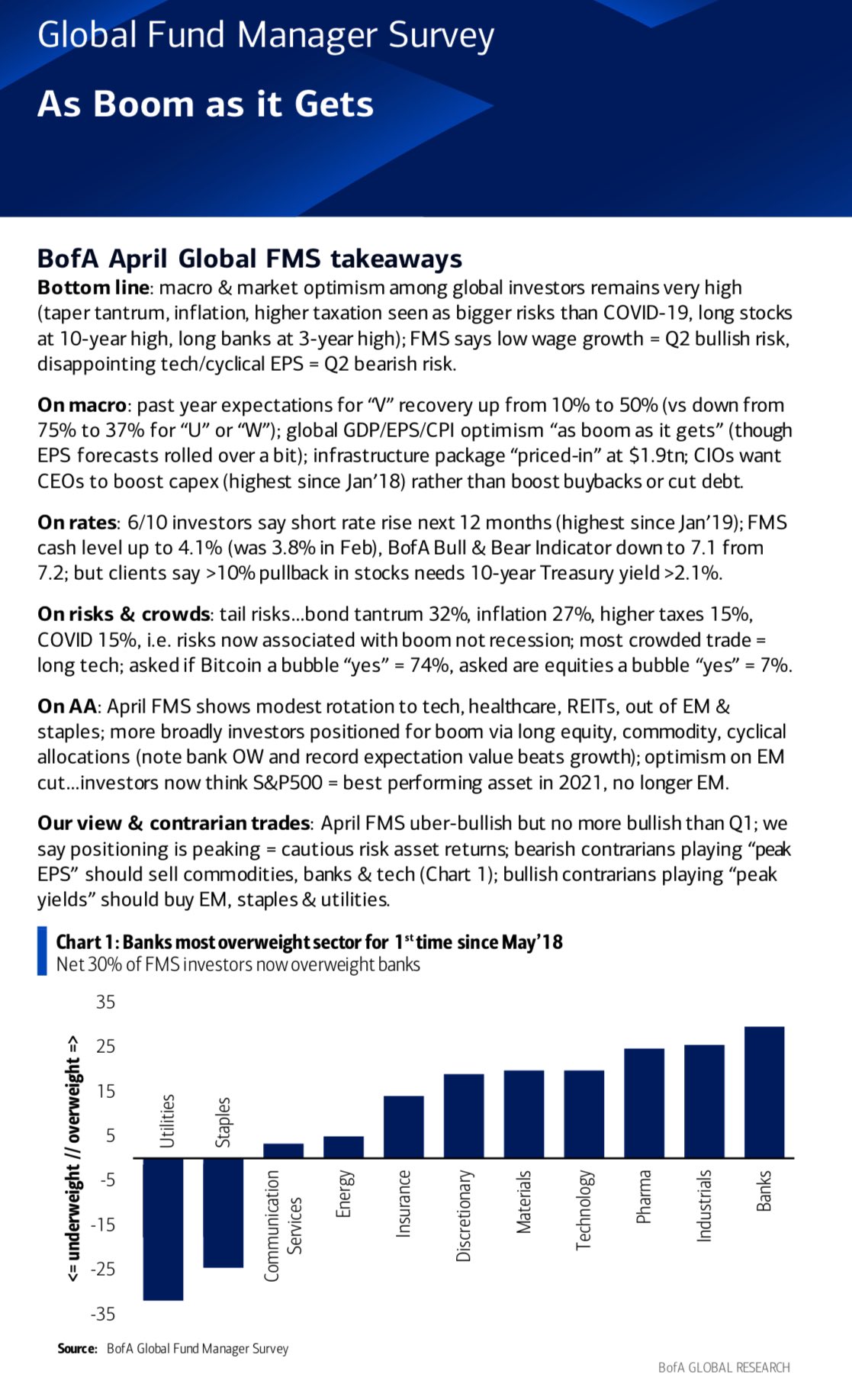

~200 Managers overseeing ~$600B AUM responded to this month’s Bank of America Fund Managers survey. Here are the highlights:

OUTLOOK:

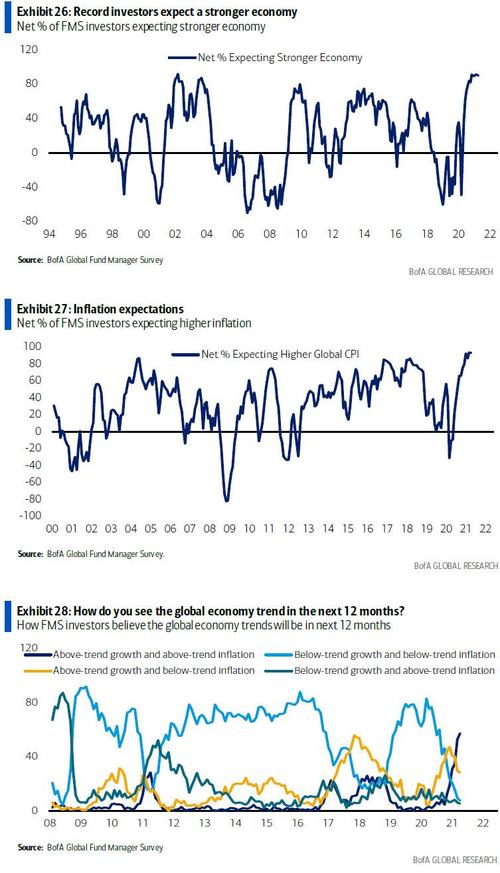

-Net 90% of respondents expect a stronger economy in the next 12 months.

-85% of respondents expect global profits to improve over the next 12 months.

-93% of survey respondents expect higher inflation in the next 12 months.

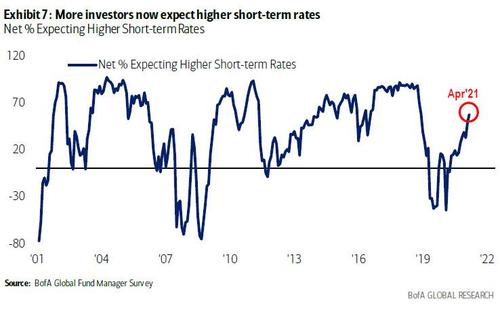

-57% are expecting higher short-term rates in the next 12 months.

-50% say the economy is experiencing a V-shaped recovery, vs. only 10% believing that in May.

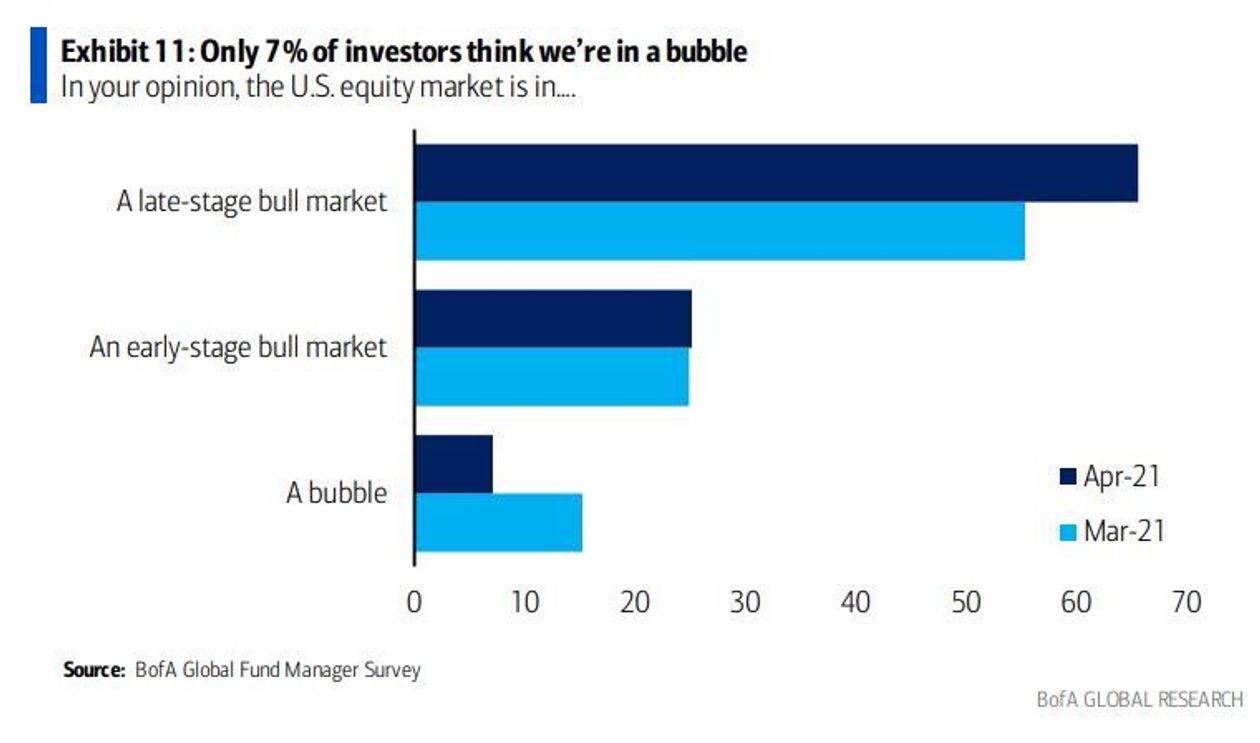

-7% of investors think the U.S. equity market is in a bubble.

-25% think it’s an early stage bull market.

-66% believe it’s a late-stage bull market.

SENTIMENT and POSITIONING:

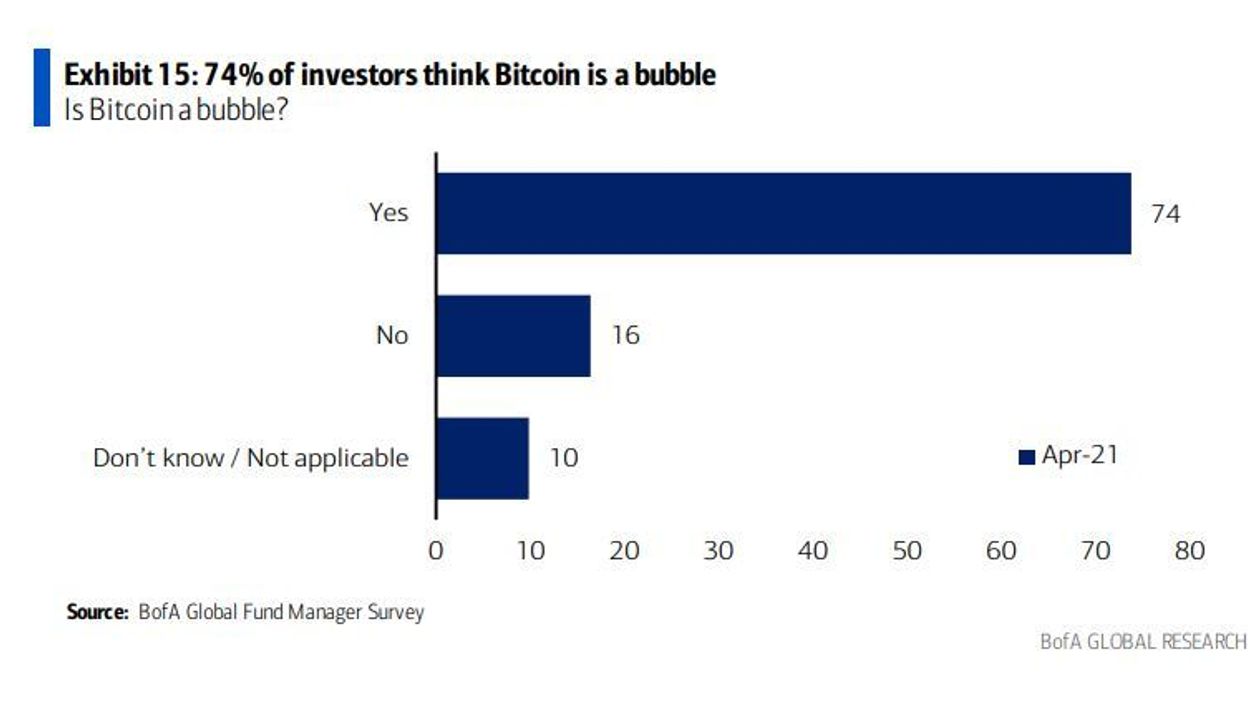

-74% say Bitcoin is a bubble.

-74% say Bitcoin is a bubble.

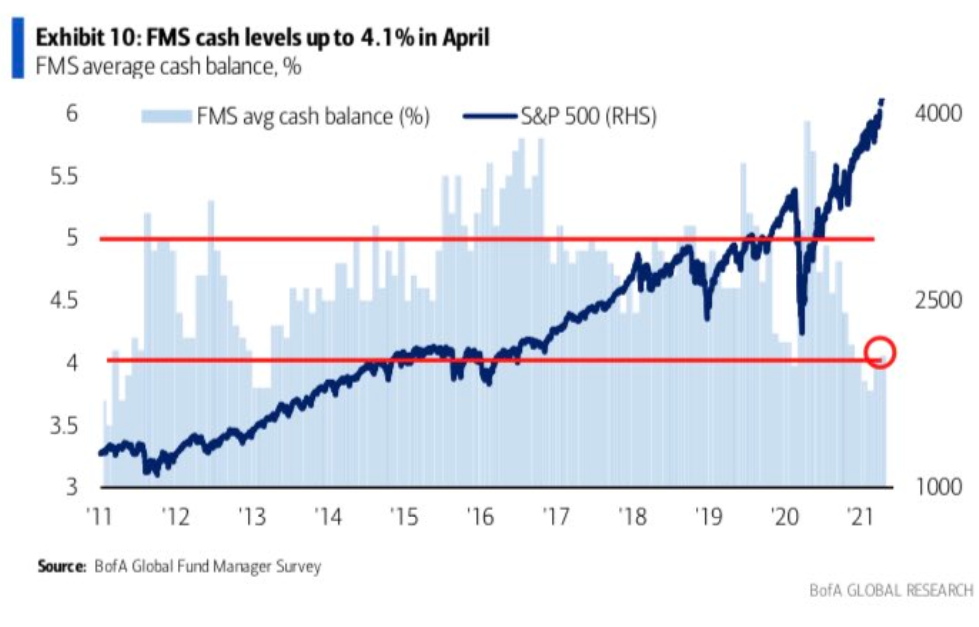

-Cash levels among surveyed money managers rose to 4.1% from 4%.

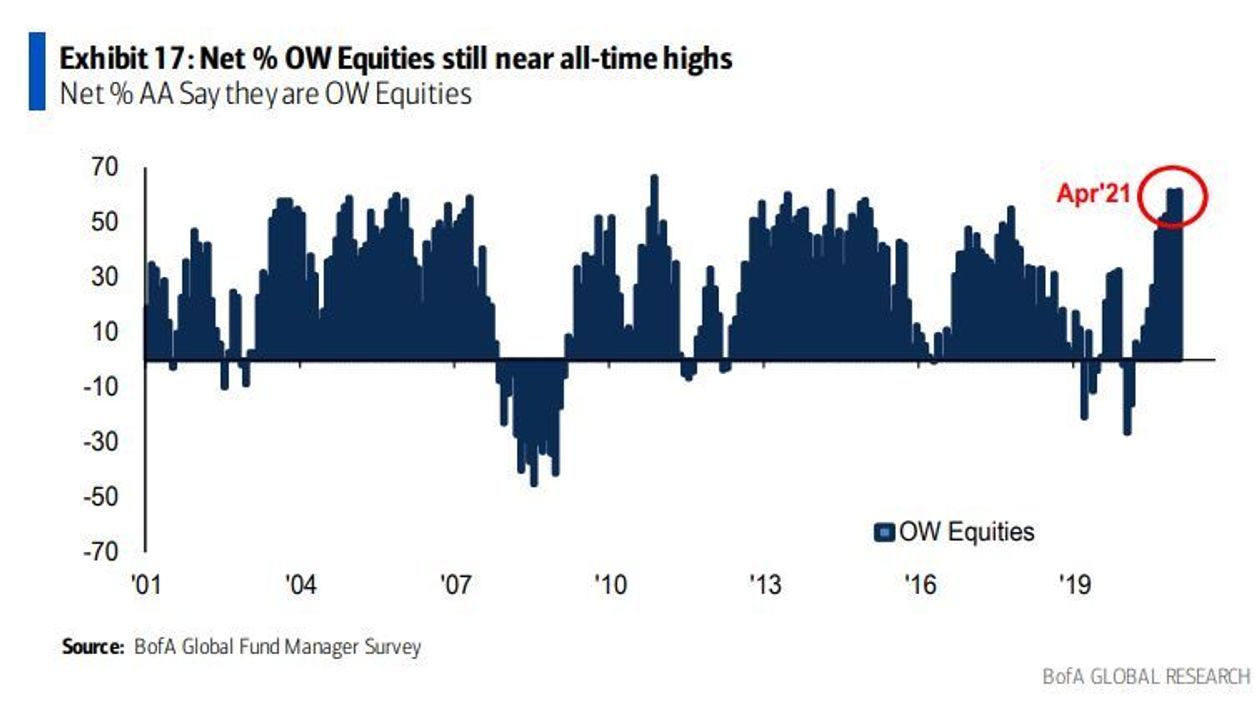

-62% of survey respondents said they are net overweight to equities, which is close to all-time highs.

-Fund manager optimism on commodities has peaked and fallen to a net 23%, down 5 percentage points from its all-time high of 28% in March.

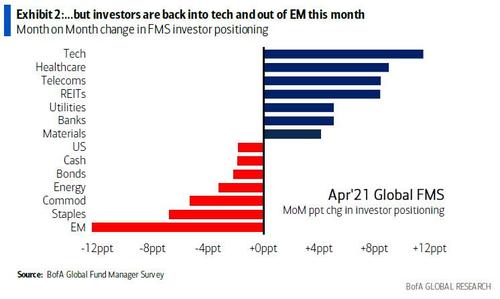

-Allocations to Technology, Healthcare and Reits were on the rise.

-Emerging Markets and Staples allocations declined.

-Banks overweight at a three-year high. Allocation to global banks increased to a net 30% overweight this month.

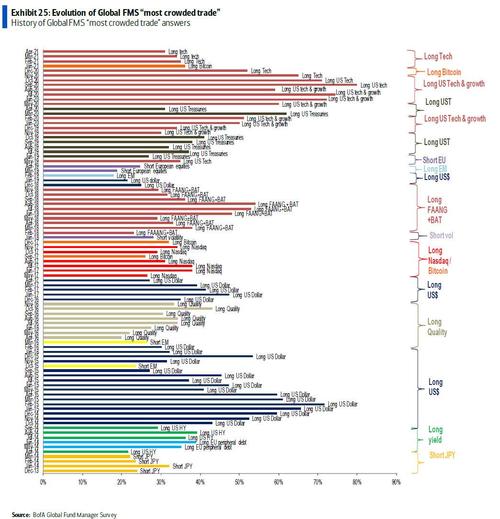

MOST CROWDED TRADES:

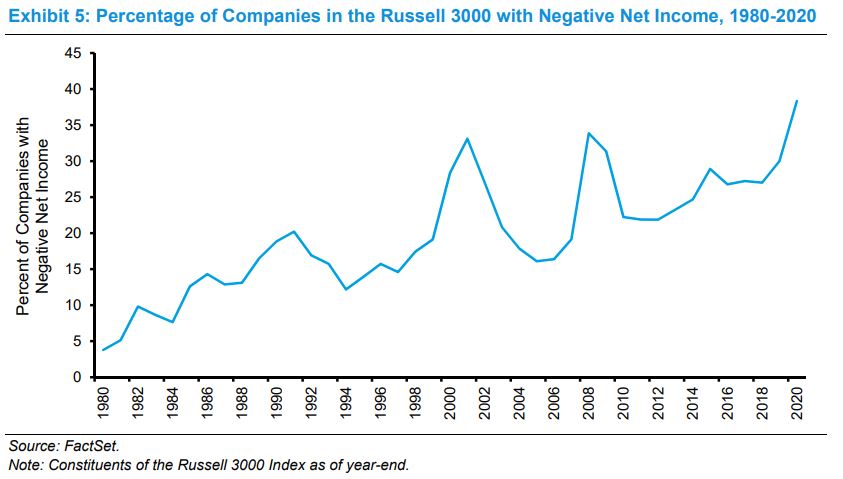

Given the “Most Crowded Trade” is still “Long Tech”, this chart from FactSet is worth noting:

-Long Tech

-Long Bitcoin

-Long ESG

-Long global cyclicals

-Short US Treasuries

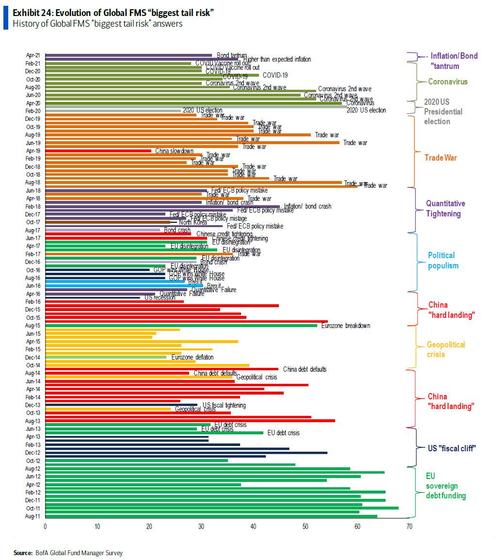

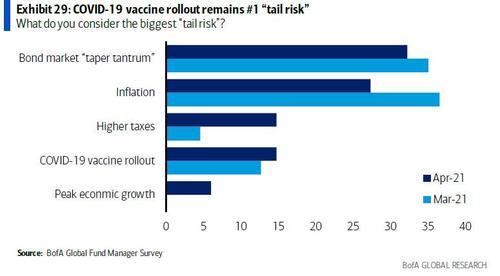

BIGGEST TAIL RISKS:

-32% – “Taper Tantrum”

-27% – Inflation

-15% – Higher Taxes

-15% – COVID-19

BANK OF AMERICA COMMENTARY:

Michael Hartnett, “April FMS [fund manager survey] uber-bullish, but no more bullish than Q1: we say positioning is peaking = cautious risk asset returns.”

The contrarians (with a bullish market outlook) were buying into emerging markets, staples and utilities – the exact areas where the majority of respondents were found to be reducing exposure.

Now onto the shorter term view for the General Market:

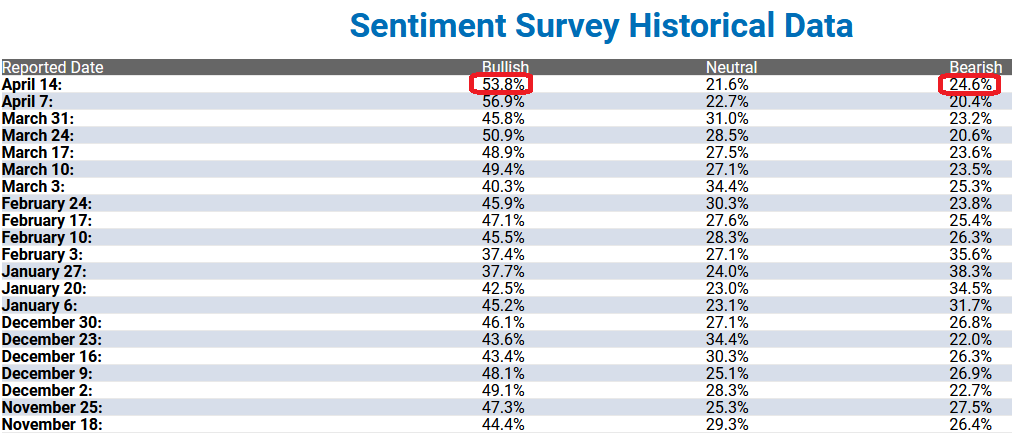

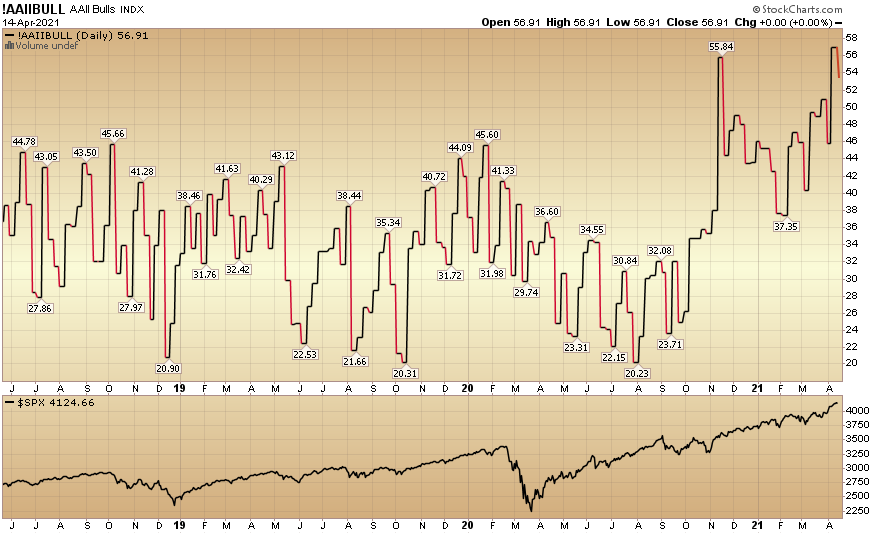

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 53.8% from 56.9% last week. Bearish Percent rose to 24.6% from 20.4% last week. Retail investors are still exuberant.

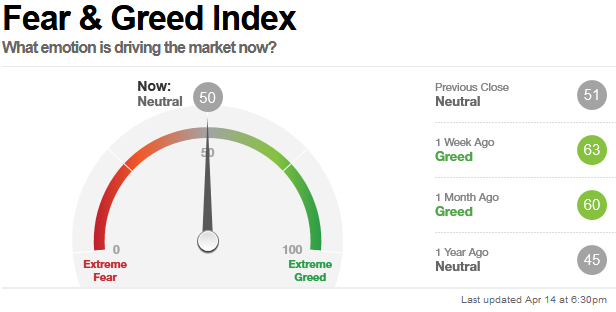

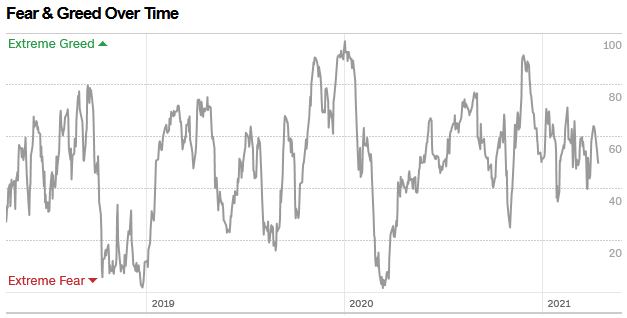

The CNN “Fear and Greed” Index declined from 63 last week to 50 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

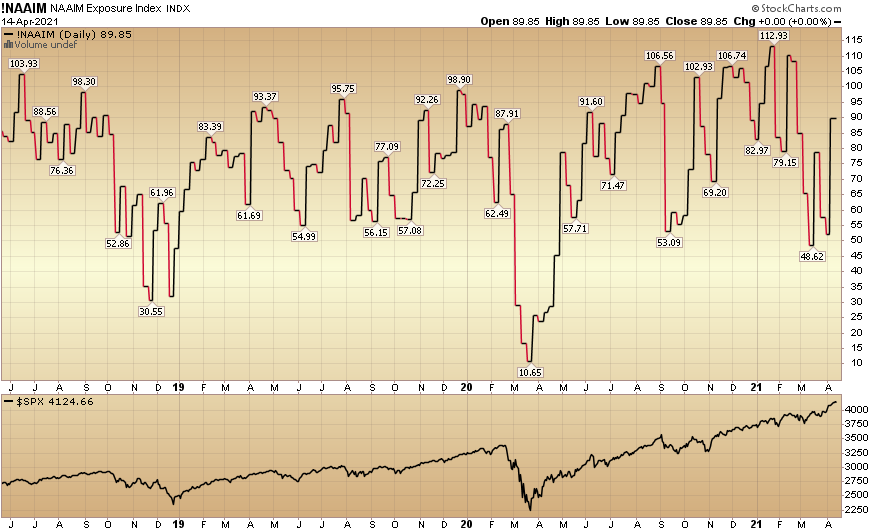

And finally, (as anticipated) this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 89.95% this week from 52.02% equity exposure last week.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of February. We think the rebound in this group should continue in coming months (even if we have a few fits and starts – after a very big jump in the past six weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they continue to take a breather – before resuming their uptrend/new highs later this year.

With the market up 85% off the March lows, we are very selective where we put new new money to work. We will look to add to our Big Pharma positions – but only if any weakness presents itself.

In the mean time, be careful buying IPO’s and SPACs that are big on promises and small on profits. If you make the mistake of chasing the “flavor of the month” without discipline/analysis, you’ll soon find people asking you if you’re like Bieber and, “get your weed from California…”