Market Overview

CNBC – London

This morning I joined Karen Tso and Arabile Gumede on CNBC London to discuss my 2024 outlook and a lot more…

Thanks to Chris Kang, Karen and Arabile for having me on:

The Claman Countdown – Fox Business

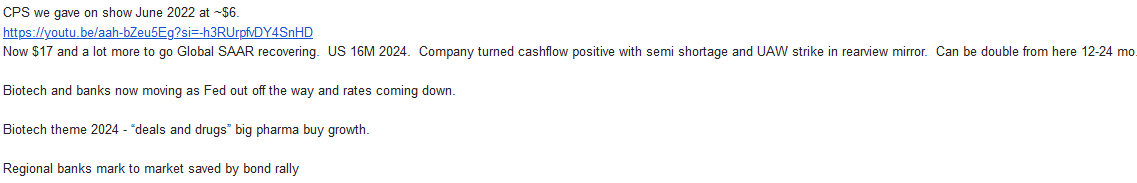

On Friday, I joined Liz Claman on Fox Business – The Claman Countdown – to discuss general market overview, CRK, CPS, XBI, KRE. Thanks to Liz and Milanee Kapadia for having me on:

Watch in HD directly on Fox Business

Here were my “show notes” ahead of the segment:

Here were my “show notes” ahead of the segment:

Making Money with Charles Payne – Fox Business

On Tuesday, I joined Ashley Webster on Fox Business – Making Money with Charles Payne – (at the NYC studio) to discuss market outlook for 2024, PYPL, GNRC and more. Thanks to Charles, Ashley, Kayla Arestivo and Nick Palazzo for having me on:

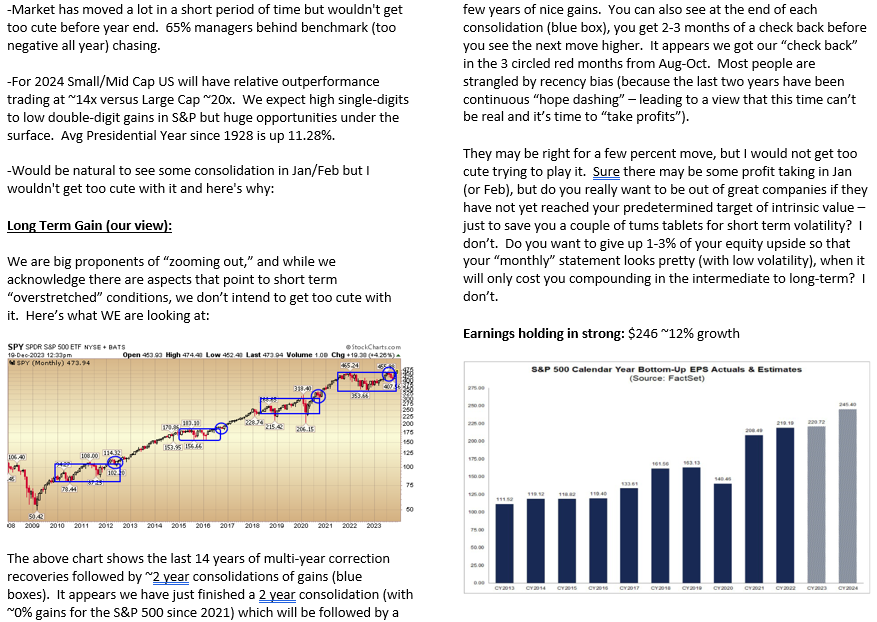

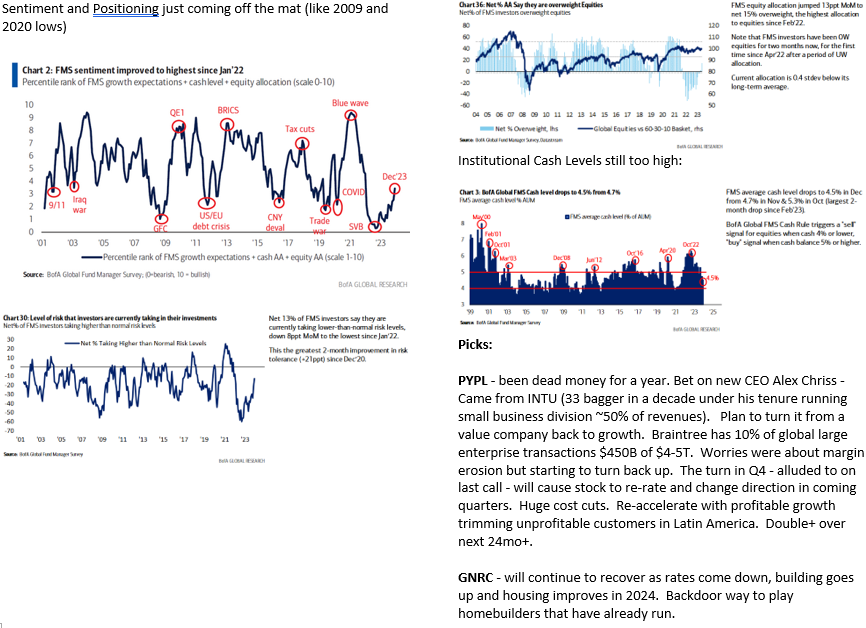

Here were my show notes ahead of the segment:

Here were my show notes ahead of the segment:

Yahoo! Finance

Yesterday, I joined Brad Smith and Brian Sozzi on Yahoo! Finance to discuss where to find the best investment opportunities for 2024. Thanks to Brad, Brian, Ellie Cunningham and Alex Frangeskides for having me on:

The Last Shall Be First

The Last Shall Be First

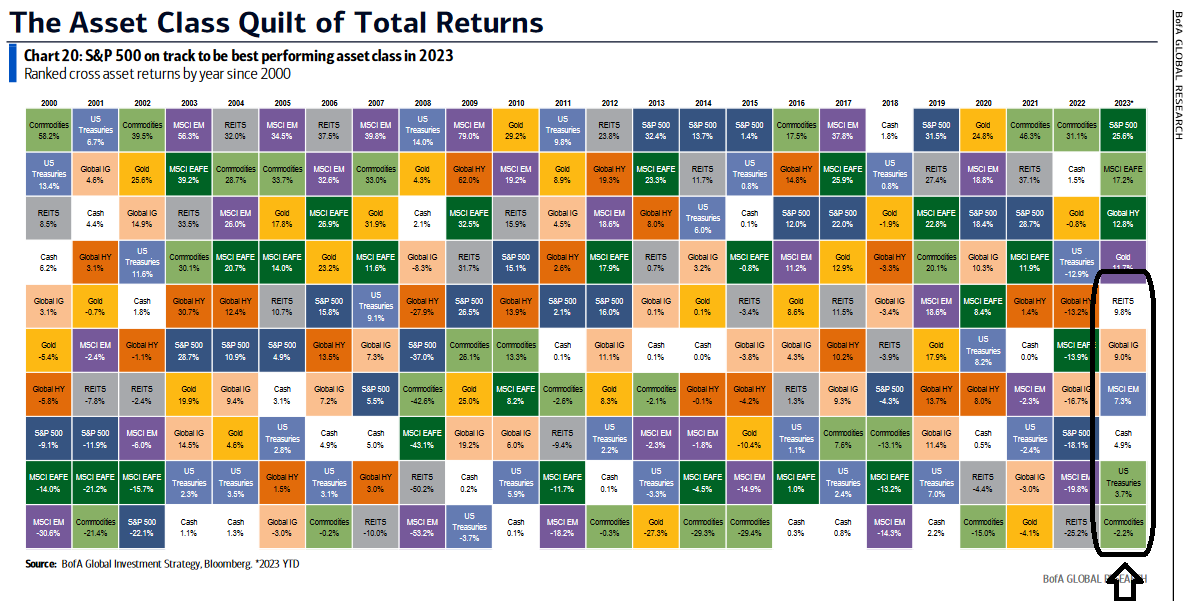

In addition to some of the names we have covered above, we like to look at sector performance by year. Despite the final column being improperly colored, you can see in previous years that what is at the top in previous years tends to trend down – while what is at the bottom tends to trend up in following years.

In addition to some of the names we have covered above, we like to look at sector performance by year. Despite the final column being improperly colored, you can see in previous years that what is at the top in previous years tends to trend down – while what is at the bottom tends to trend up in following years.

This year, in addition to many of the names we have covered on previous podcast|videocast(s), we are paying close attention to the areas on this quit that have underperformed in 2023 for opportunities in 2024. In many cases we are ahead of the curve with Treasuries (TLT this fall), Emerging Markets (Alibaba), and REITS (VNO already booked the double+, CCI this fall). We do want to get some commodity exposure (which is consistent with our view on an Emerging Markets recovery). That’s where this name comes in:

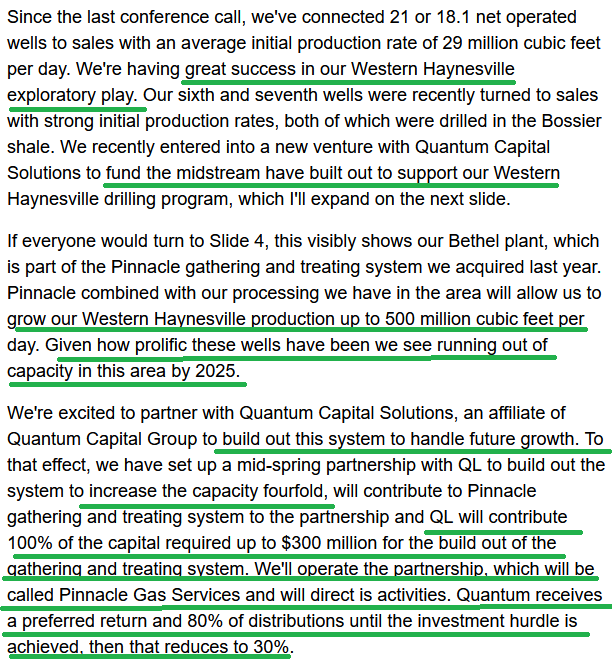

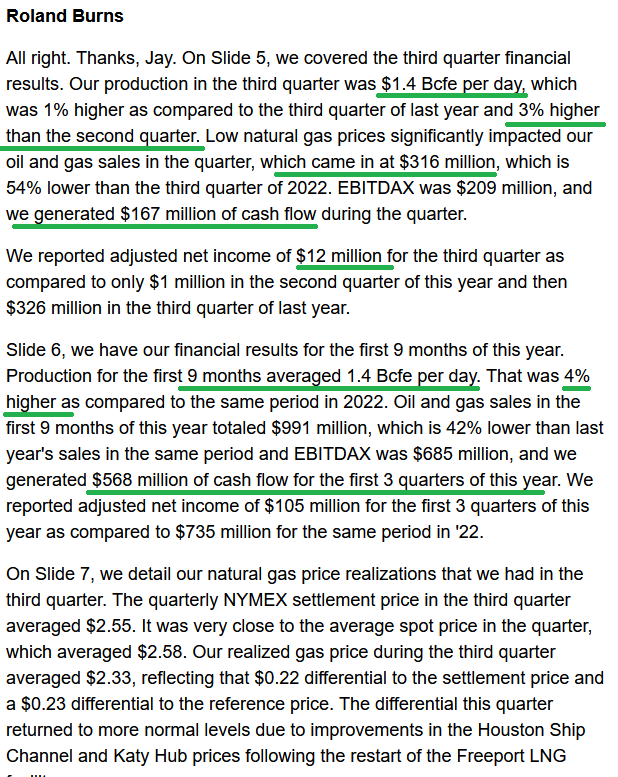

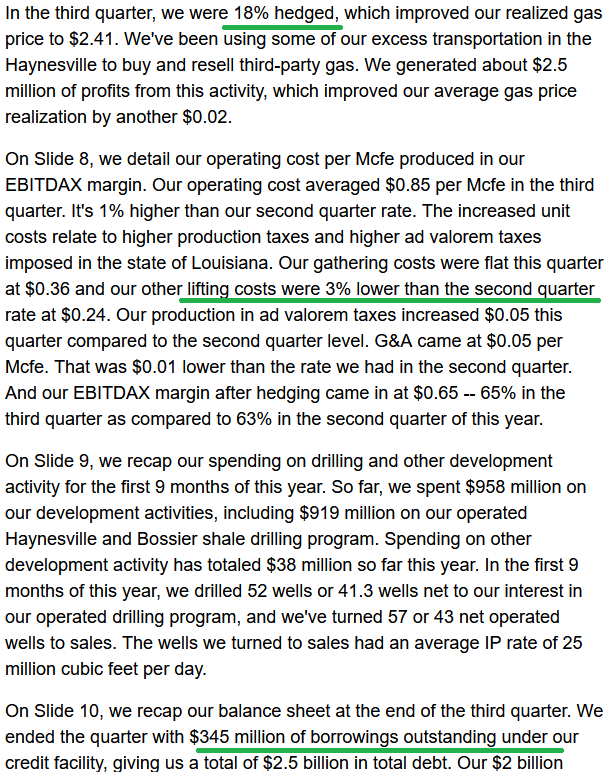

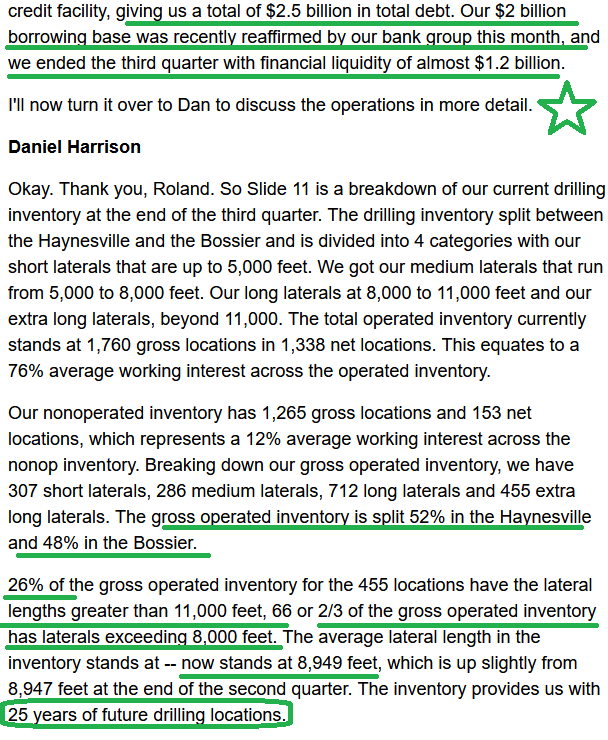

Comstock Resources

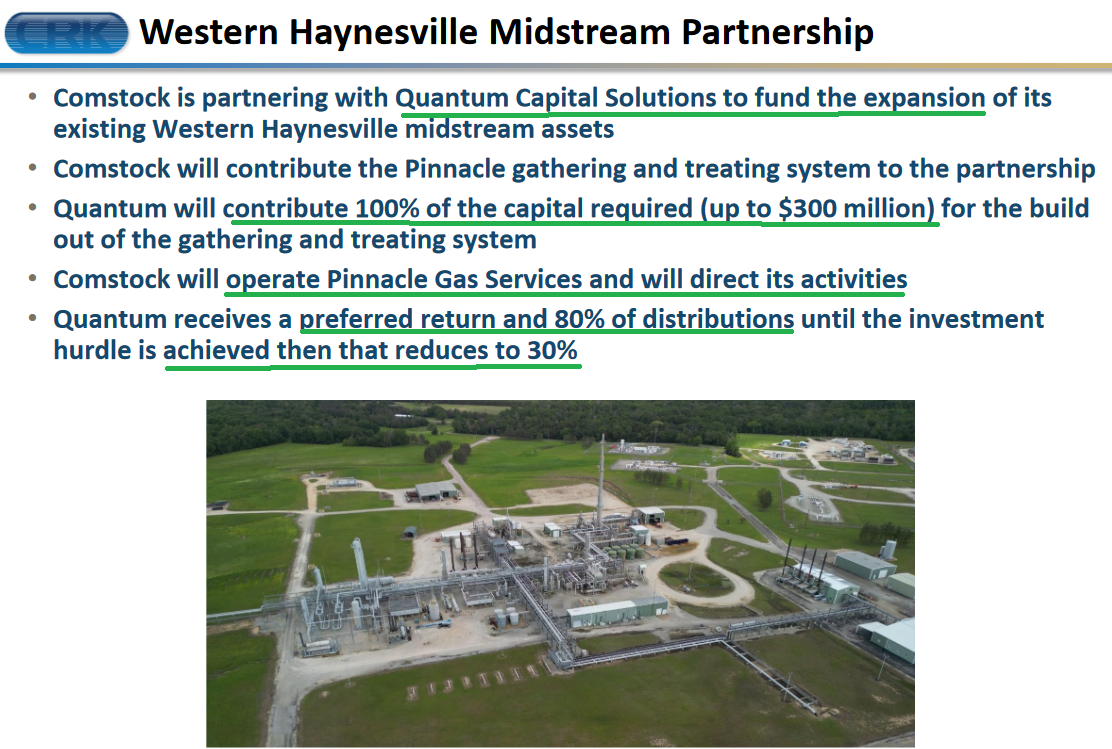

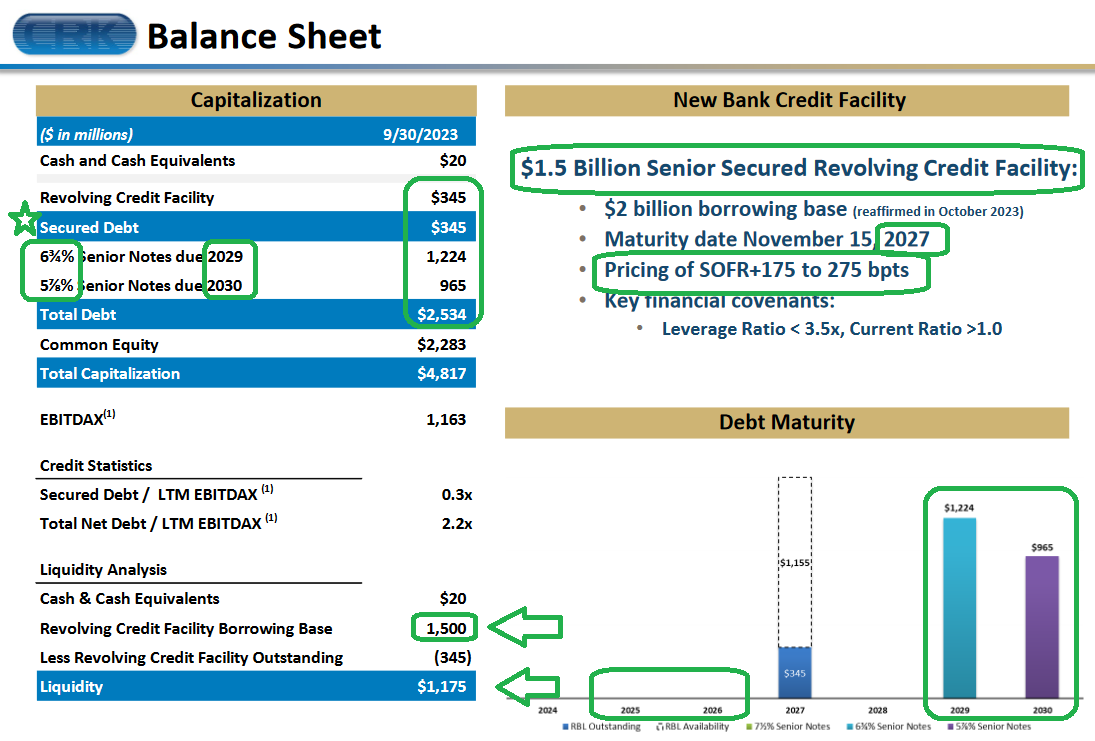

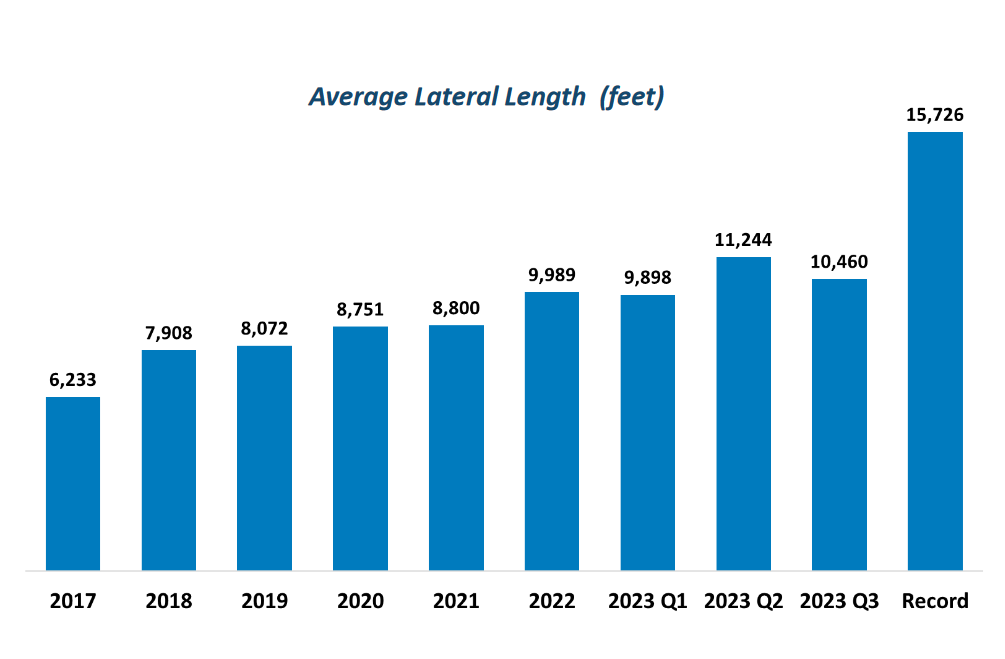

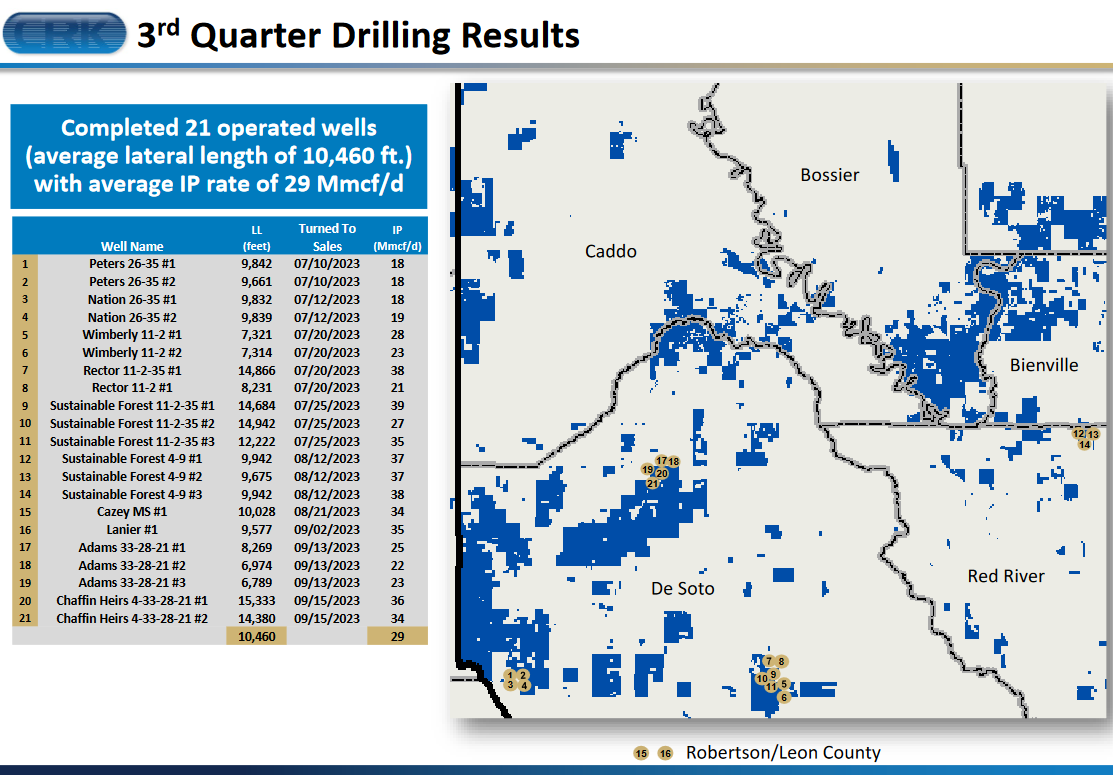

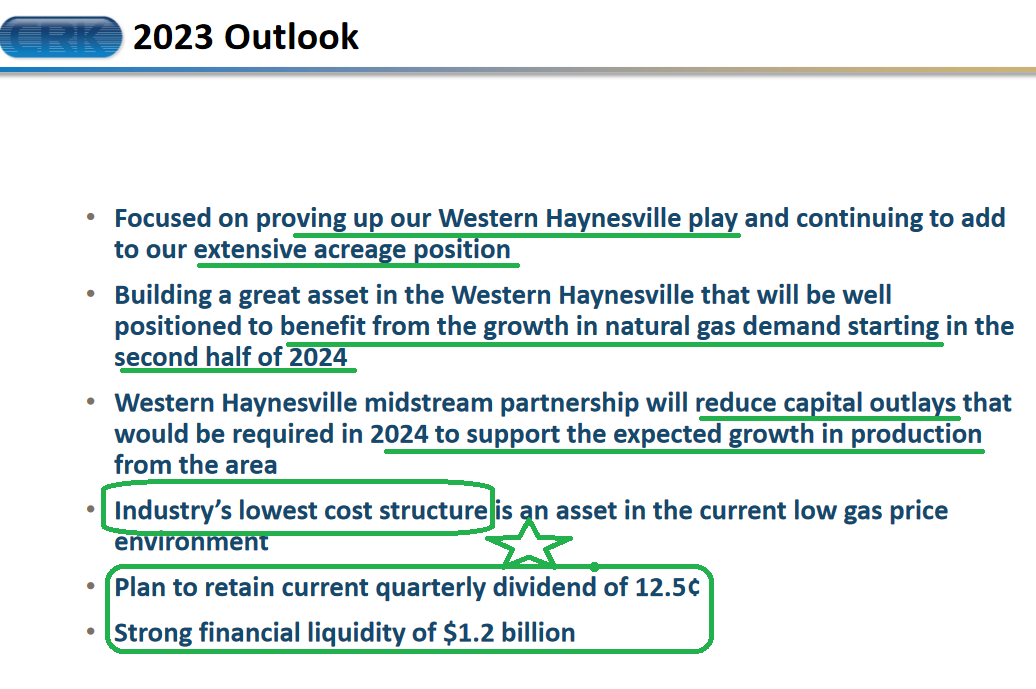

We talked about this name last week on our podcast|videocast because we decided to add the name across new and existing accounts (where there was capacity) and in some cases take our basis UP.

We talked about this name last week on our podcast|videocast because we decided to add the name across new and existing accounts (where there was capacity) and in some cases take our basis UP.

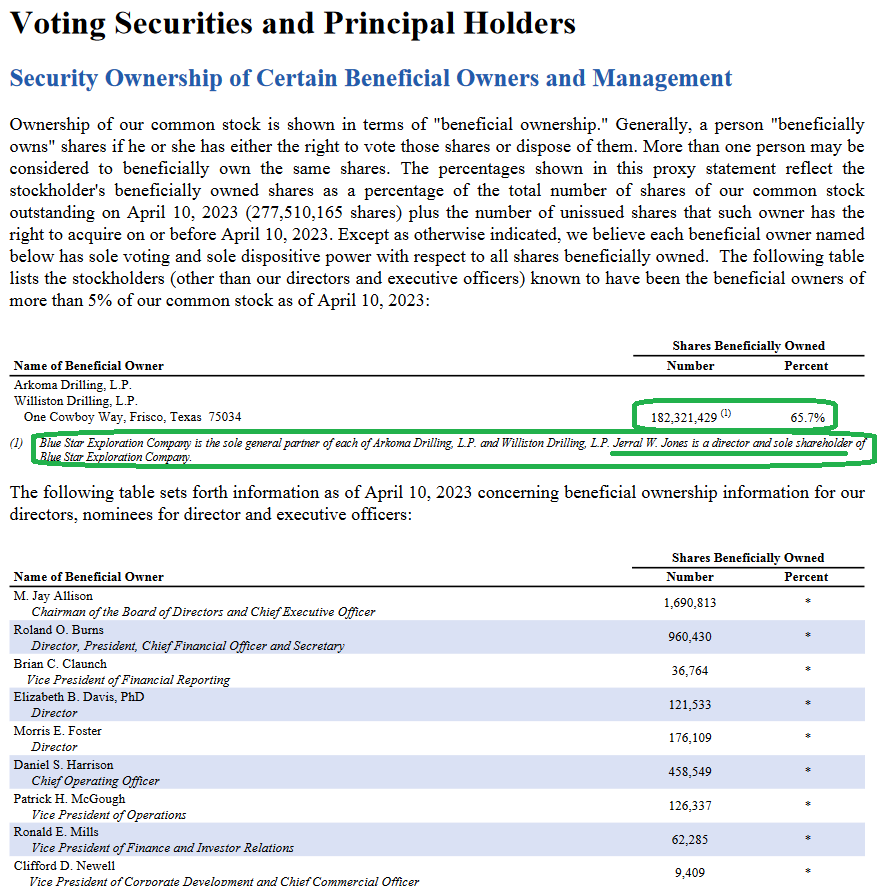

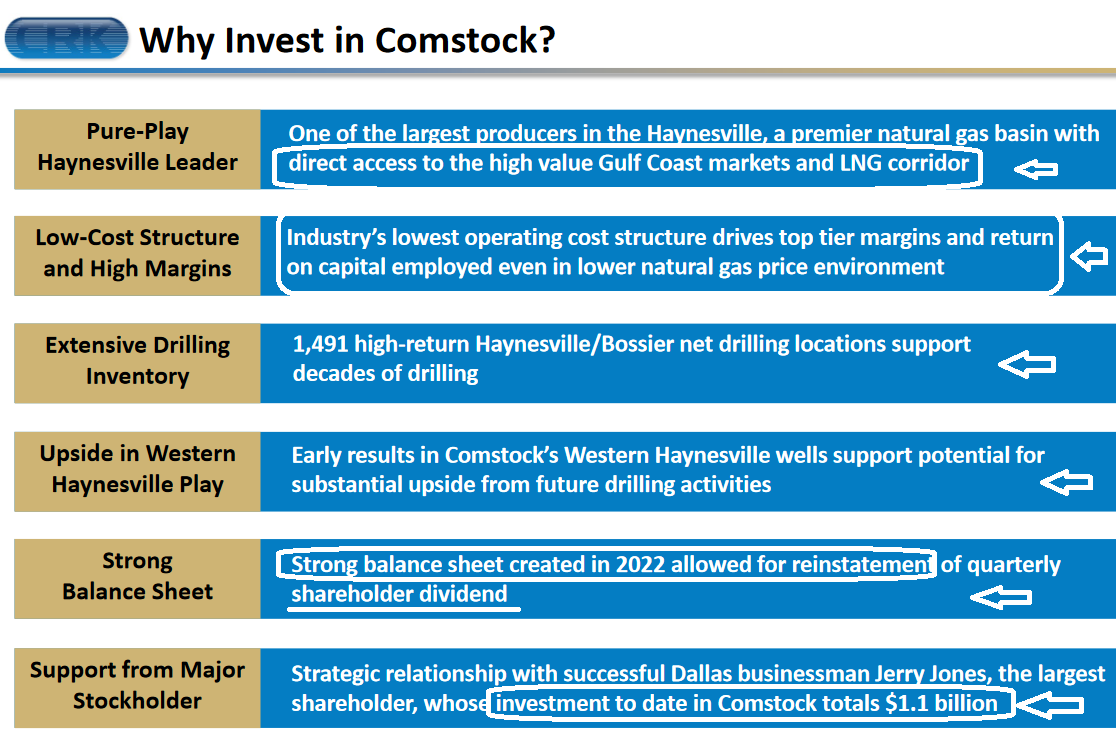

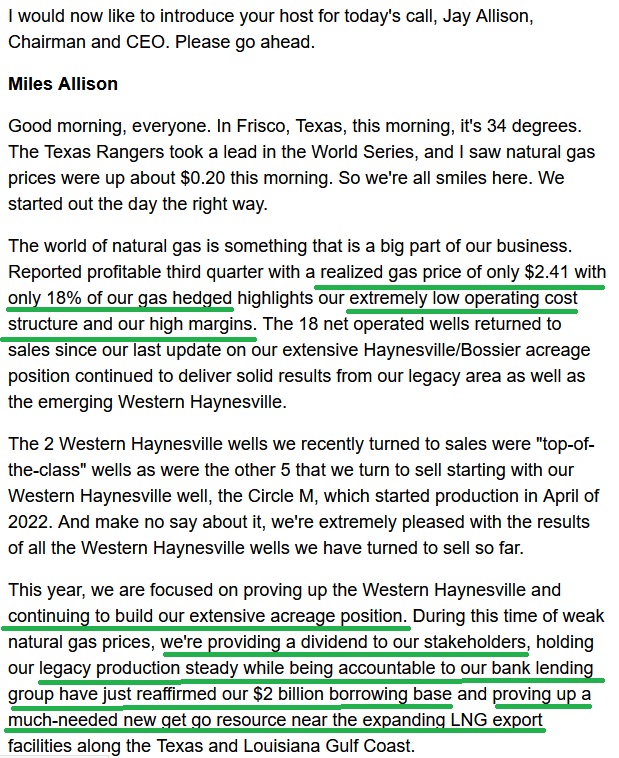

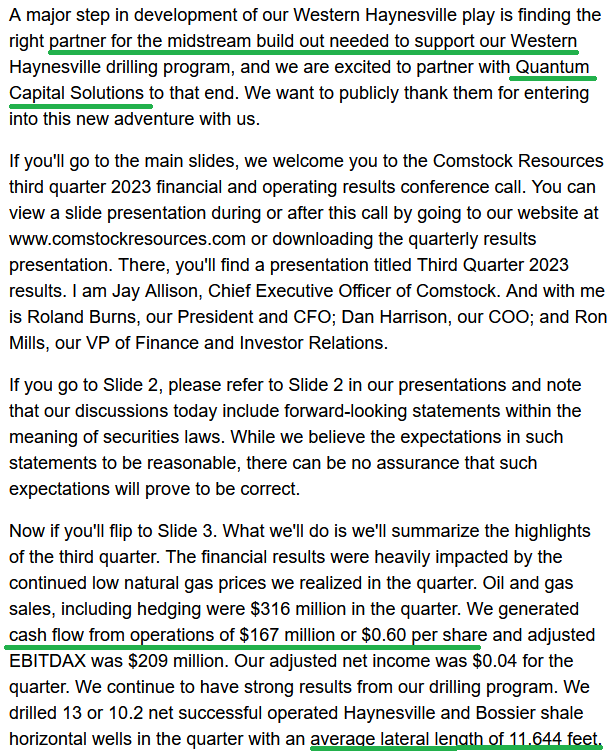

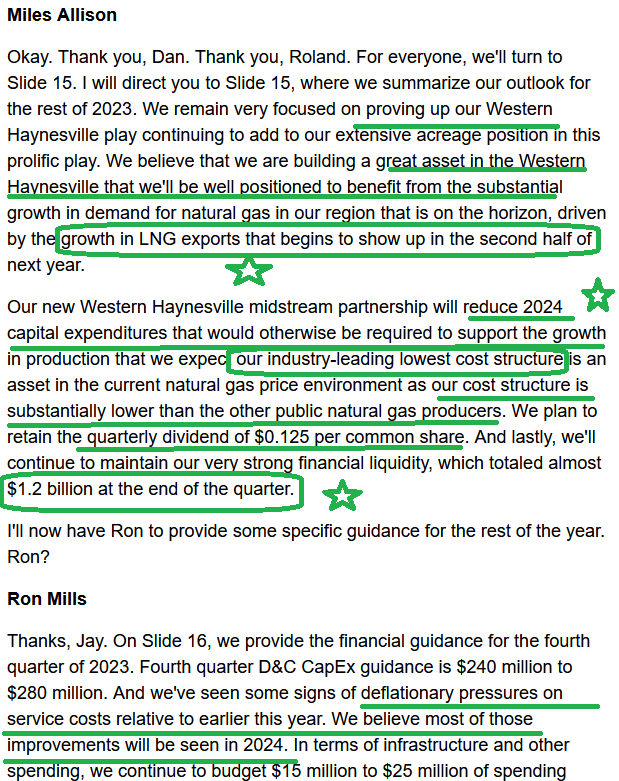

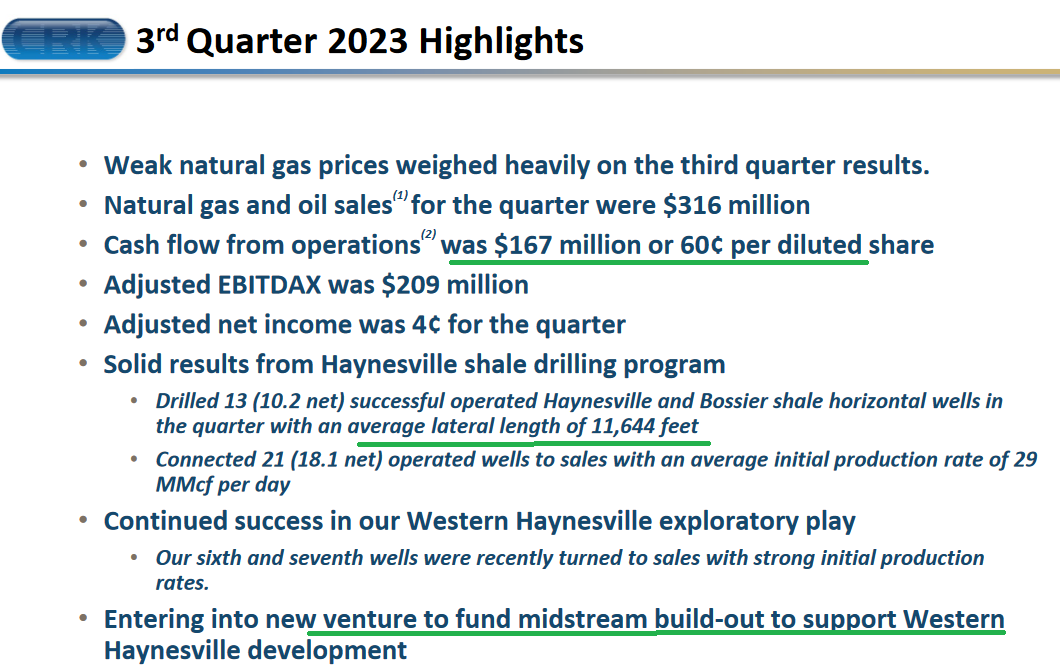

Jerry Jones (owner of the Cowboys) who made his initial fortune in Oil & Gas owns ~65% of the company at ~$7/share basis. He has stated in his public interviews that his Oil & Gas interests are worth well more than the Dallas Cowboys. We agree.

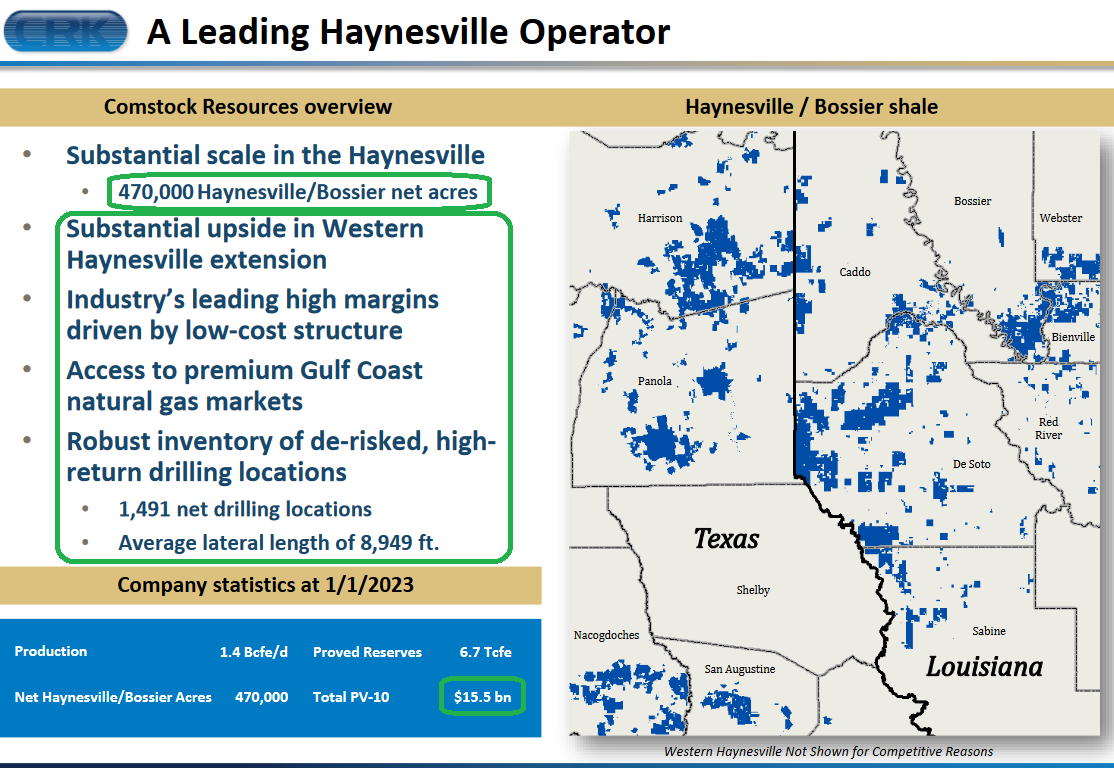

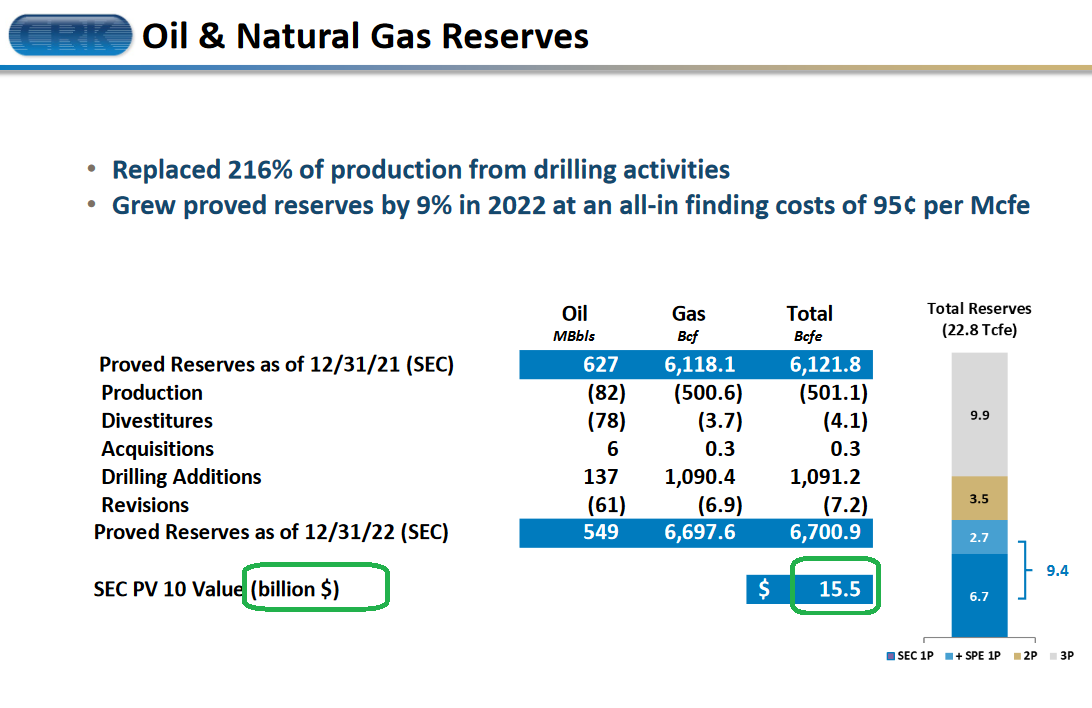

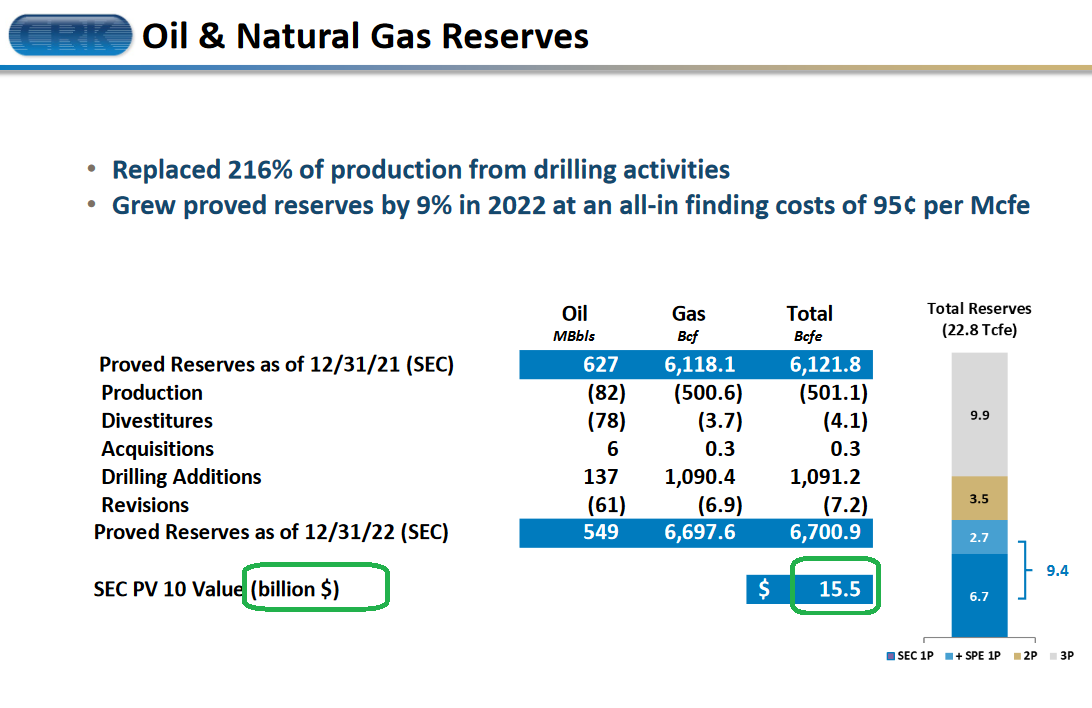

With a PV-10 proved reserves value at $15.5B and an Enterprise value of ~$5.1B, this implies if the company was liquidated tomorrow you would have a triple. BUT, that excludes the UNPROVED reserves which are estimated at an additional 15yrs of inventory beyond the PV-10 reported to the SEC. In English, that means the company likely has an intrinsic value somewhere around ~$60+. It’s just a question of how long it takes to realize that value.

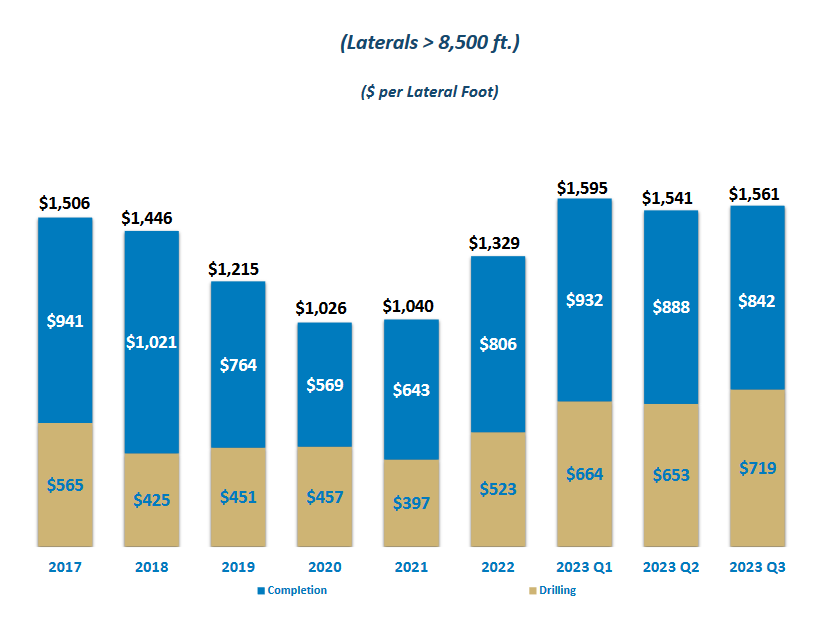

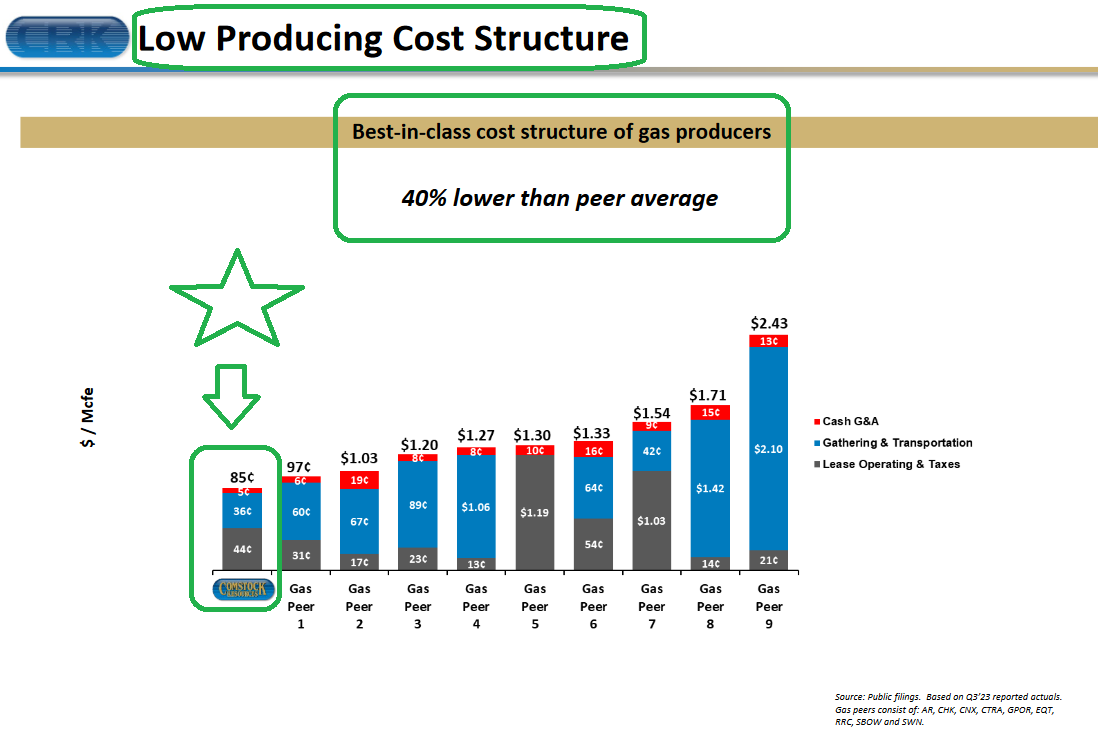

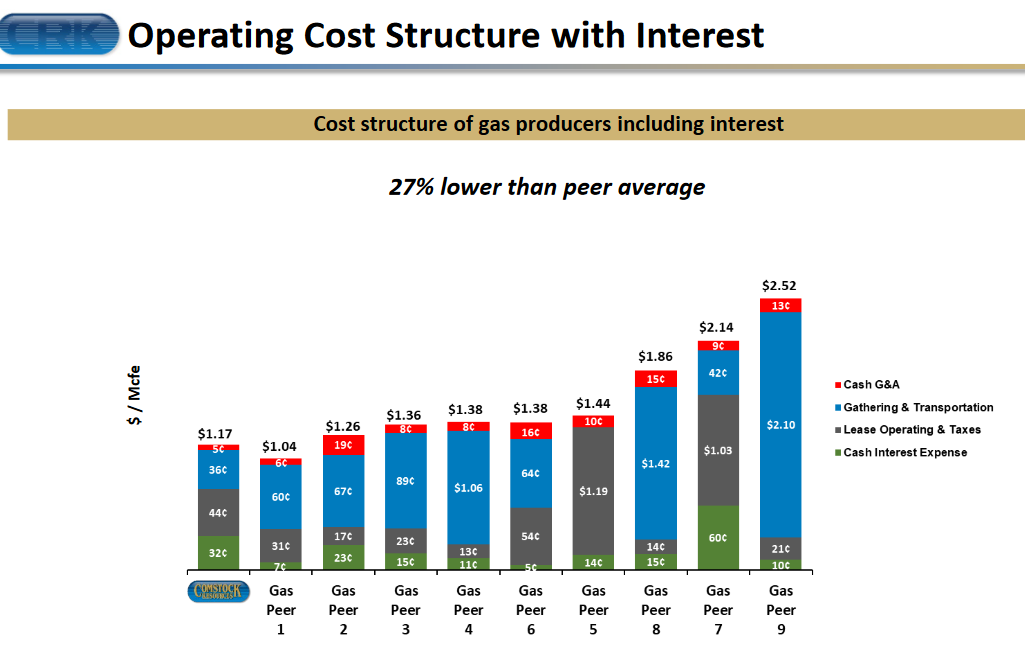

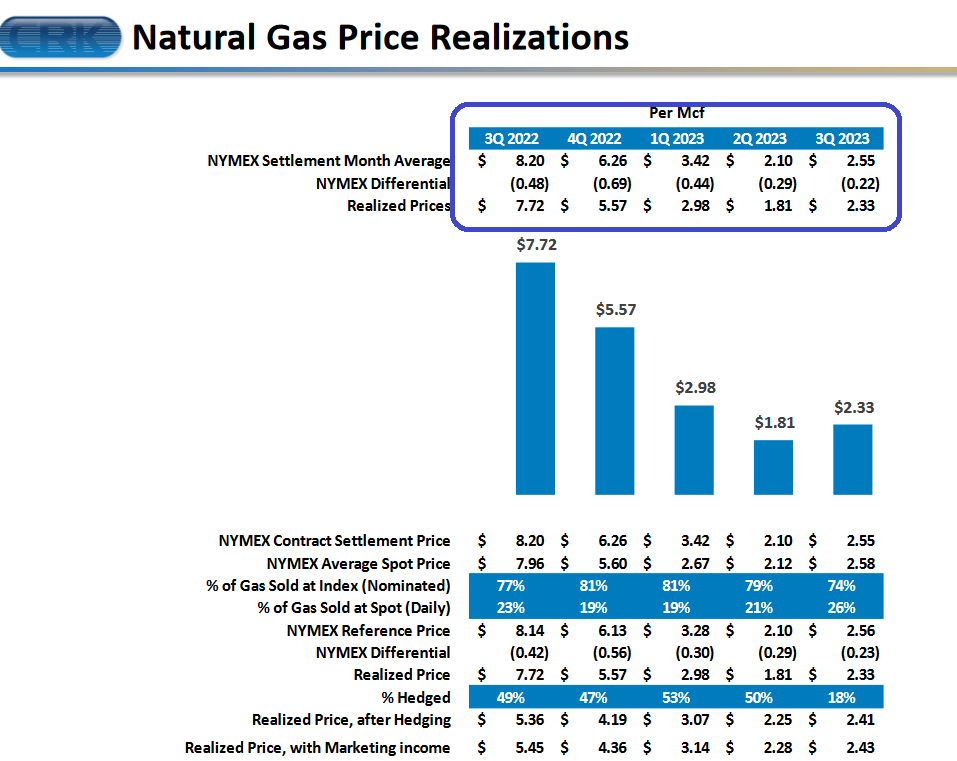

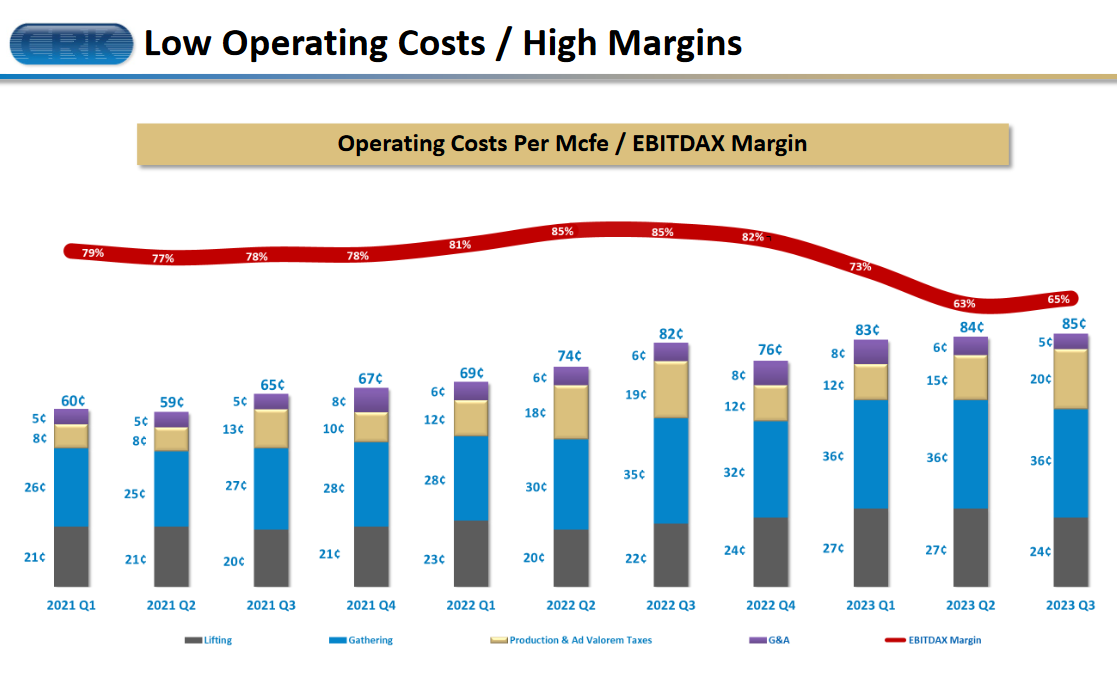

Given that Comstock has among the lowest cost of production in the industry and access to export through the gulf, the value creation story is just beginning. With Natural Gas prices currently in the doldrums we will likely have some time to accumulate an even larger position over time.

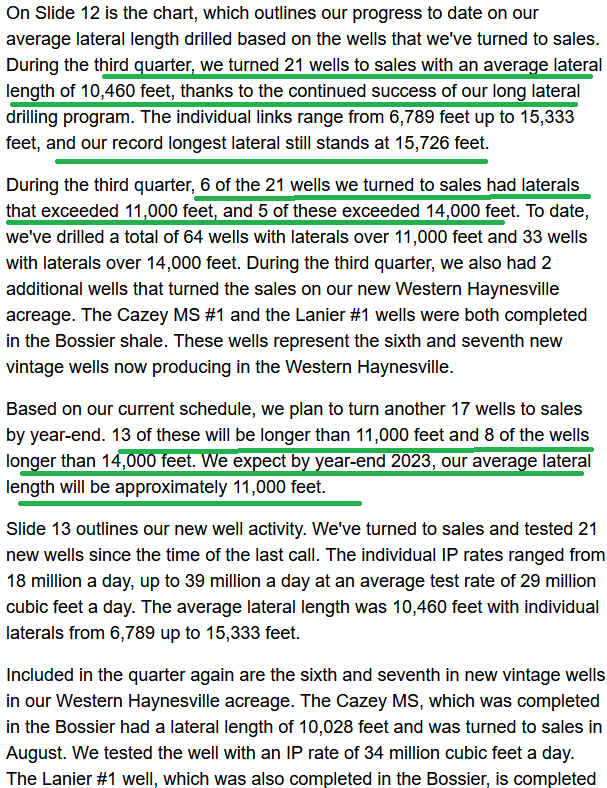

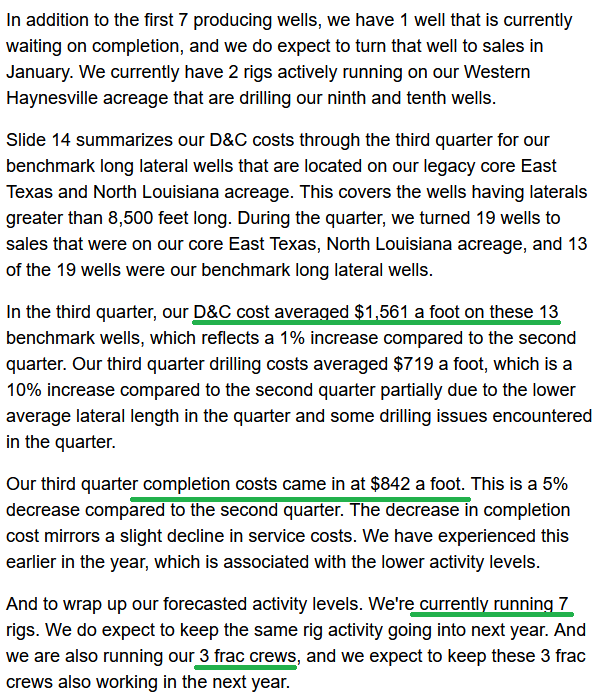

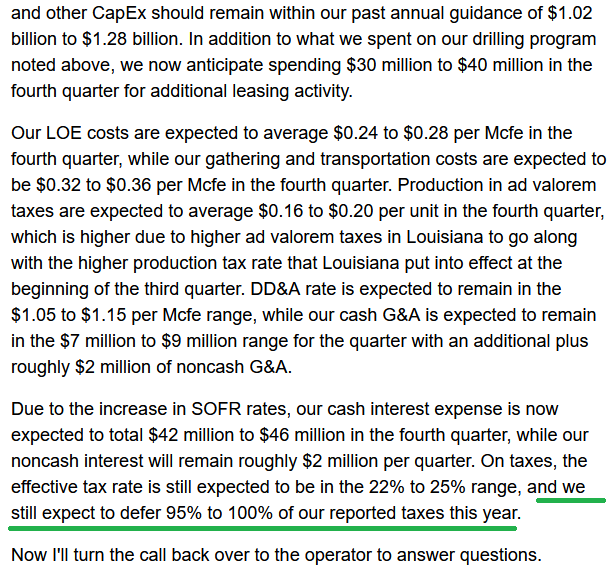

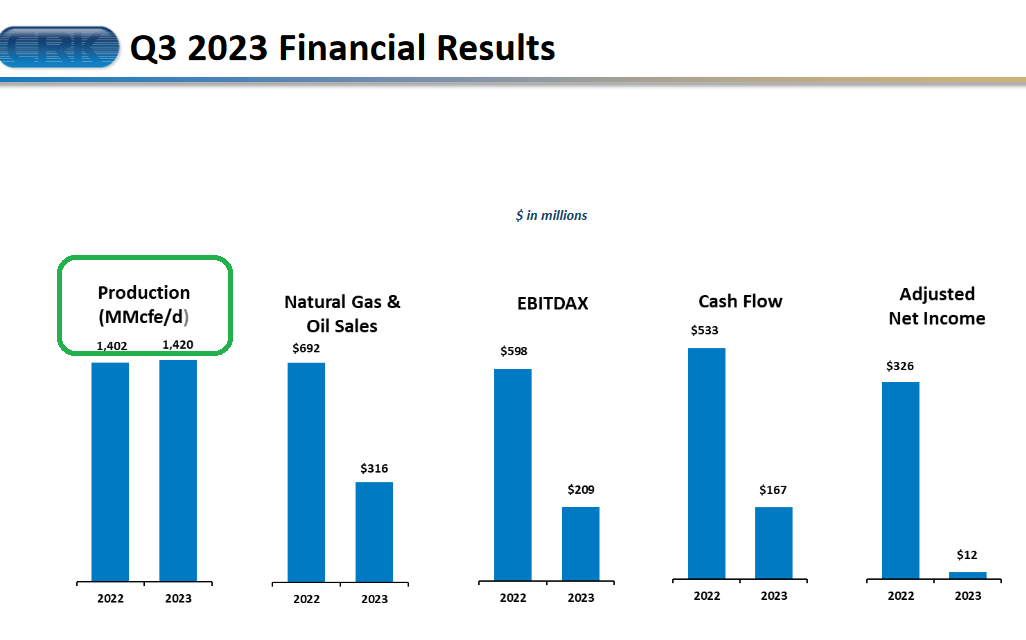

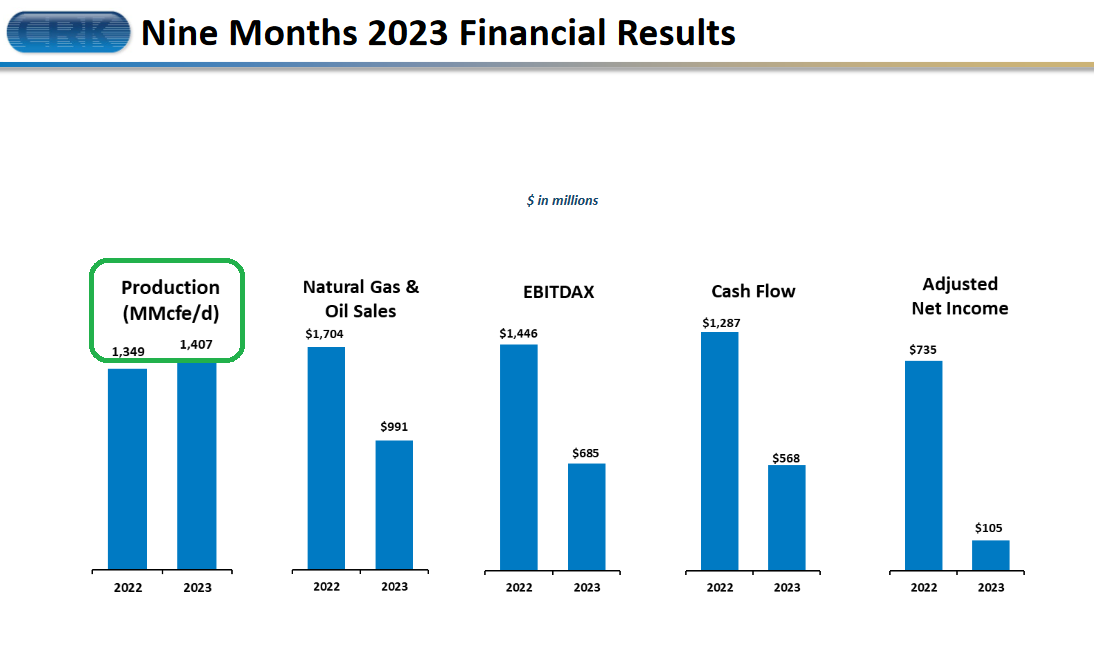

From Q3 Earnings Call and Presentation:

Now onto the shorter term view for the General Market:

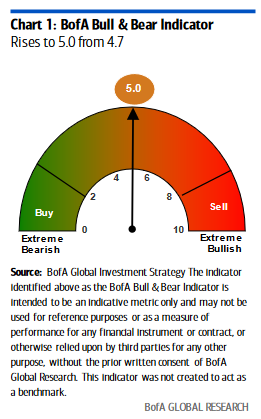

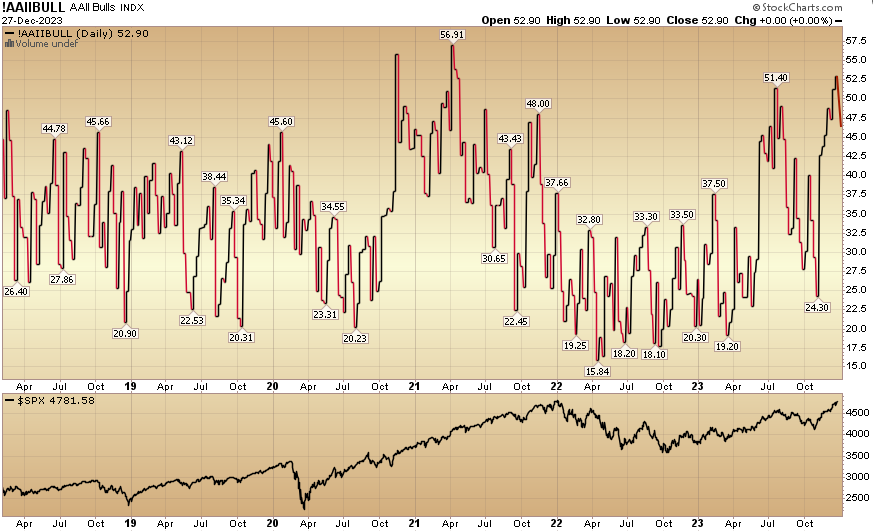

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dipped to 46.3% from 52.9% the previous week. Bearish Percent rose to 25.1% from 20.9%. Retail investors are bullish.

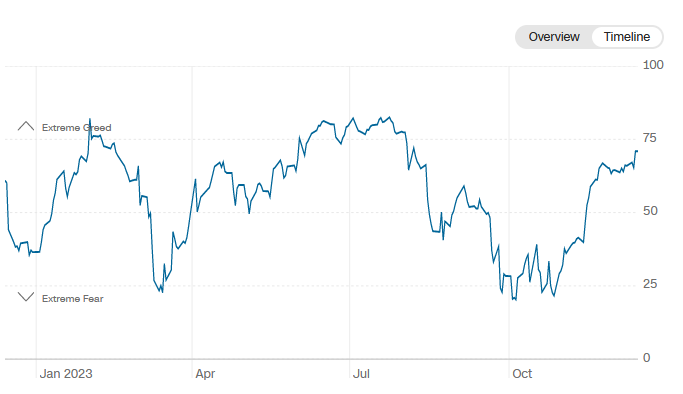

The CNN “Fear and Greed” moved up from 73 last week to 78 this week. By this metric, investors are giddy, but not yet fully euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” moved up from 73 last week to 78 this week. By this metric, investors are giddy, but not yet fully euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

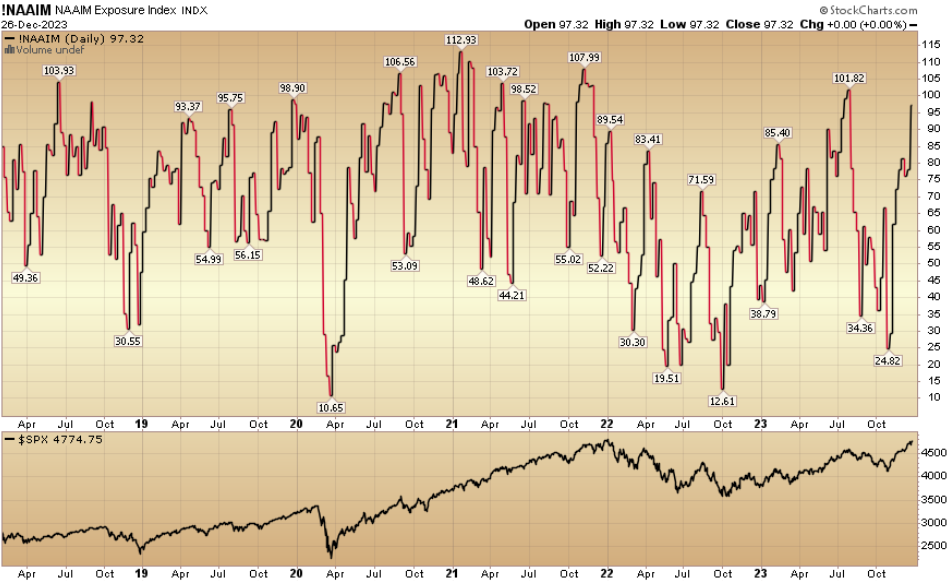

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 97.32% this week from 77.97% equity exposure last week ago. This is what a year end chase looks like!

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 97.32% this week from 77.97% equity exposure last week ago. This is what a year end chase looks like!

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms