Several weeks ago I was asked to speak to the University of Bristol’s, “Women in Finance Society.” I had never spoken to college students before, and did not know what to expect, but I was glad to share my experiences and see if it could help the next generation of Women Leaders in the finance industry.

I learned this philosophy of “pay it forward” from my first mentor/employer in the industry. He used to fly in an entire class from his mid-west college Alma Mater (at his own expense) each year to either meet Warren Buffet in Omaha or major business leaders like Jamie Dimon in New York City. They would share their experiences and impart their wisdom on the young students just starting their careers.

I was put at ease when I received the following list of questions the day before yesterday’s interview. I could tell Nell Boyd (the organizer and interviewer) was a professional and on top of her game. If you know any young people looking to break into the industry this may be worth passing along as it will save them some time and effort with the normal path of “trial and error.”

There were also very thoughtful questions posed on how we find market opportunities and how we respond when positions go against us. You will hear a ton of strategies and techniques discussed – that you may not have heard in anything I’ve put out to date – as Nell asked some incredibly thoughtful questions.

Here’s the list of topics we started with, and you’ll see how it evolved as I walked her and her classmates through many concrete career and market experiences that will likely prove to be very helpful to all viewers:

Careers

- How did you break into and progress in the hedge fund industry?

- Which other managers do you look up to?

- What kinds of people do you like working with or for you?

Investment Style and Stock Analysis

- What is your investment style/strategy and how do you generate alpha?

- Why would an investor buy into your fund instead of going passive?

- What is your attitude towards risk in your core strategy and what would cause you to buy or sell a stock?

- Do you tend to be contrarian?

- Does your investment process change during times of increased/decreased volatility?

Micro

- What is the best investment you have made over the past two years/lifetime?

- What is the worst investment you have made over the past two years/lifetime?

- In the industries that you watch do you expect any major disruptions – what could those be?

- What companies are you expecting to make a splash this earnings season, why?

- Do you think the rise of big-cap stocks, as they reach record levels seemingly unsupported by traditional fundamentals, is a new normal or is the S&P 500 overvalued?

Macro

- Powell has said that the Fed has intentions to begin tapering, but that it will wait until employment and inflation goals have been reached; however, given the Delta Variant, supply chain disruptions and the Non-farm miss:

- When do you think tapering will begin?

- How will your fund respond to the short/long-term market reaction?

- How would an investor prepare for the impending Evergrande collapse in China and subsequent (global?) contagion fears?

- How do you see your fund, or hedge funds in general, evolving in the next 5 to 10 years in light of increased regulation domestic and abroad and market expectations?

- What are the key issues that your fund faces or that you face as a manager today?

Watch it Here:

Also on Wednesday, I joined Kristen Scholer on Cheddar News to discuss the Stock Market, Earnings, Outlook, Two Stock Picks and respond to live earnings results from Tesla. Thanks to Kristen, Ally Thompson and Jeff Cohen for having me on:

Click Here to Watch HD Version Directly on Cheddar

On Monday I joined Alexis Christoforous and Karina Mitchell on Yahoo! Finance for General Market Outlook and spots we like in the market through year end. Thanks to Alexis, Karina, Taylor Clothier, Ivana Freitas, Brent Sanchez, and Alexandra Canal for having me on:

Watch Directly on Yahoo! Finance

Also on Monday, I joined Mike Walter on CGTN America to discuss the slowdown in China’s GDP and Industrial Production, Chinese Economy, the Property Market, Economic Policy and outlook moving forward. Thanks to Mike and Zeina Al Shaib for having me on:

And finally, on Thursday night (after last week’s podcast|videocast) I joined Avril Hong on CNA’s, “Asia First” live from Singapore. Thanks to Avril, Marianne Inacay and Olivia Marzuki for having me on. In this segment we discussed Inflation, Supply Chains, Evergrande and general outlook:

Sentiment

On Tuesday morning I put out a summary of this month’s “Bank of America Global Fund Manager Survey”:

October 2021 – Bank of America Global Fund Manager Survey Results (Summary)

The three biggest takeaways in my view were:

- “Short China” was the third most crowded trade. In the mean time, Alibaba is now up ~28.5% off its lows in the past 2 weeks:

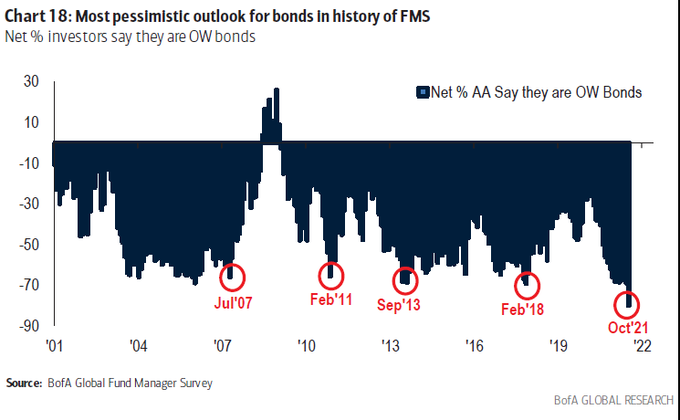

- Allocation to bonds is at an ALL TIME LOW. This means that we will likely see a peak in the 10-yr yield when taper is finally started in the next few months. With all of the sellers out, it will be time to BUY – but NOT YET! I think we see a 2 handle (2%+) on the 10yr yield before that happens.

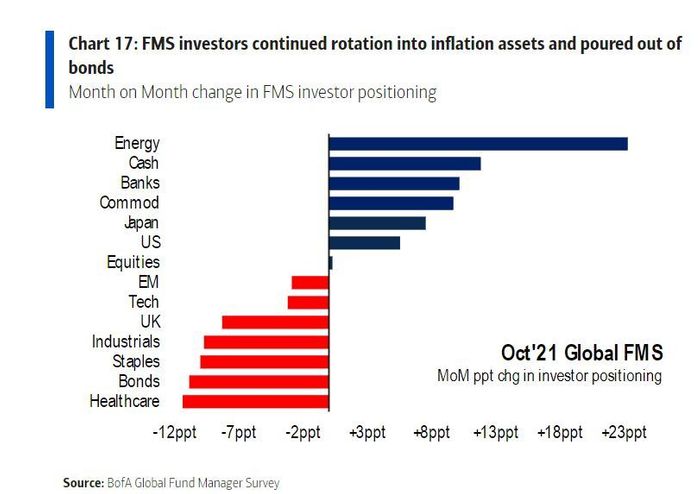

- Managers crowded into banks and energy. No one wanted them last year when we were pounding the table, everyone wants them now they are up 100%+ across the board. We’re nearing a (short-term) trimming opportunity (long term we still like both).

Now onto the shorter term view for the General Market:

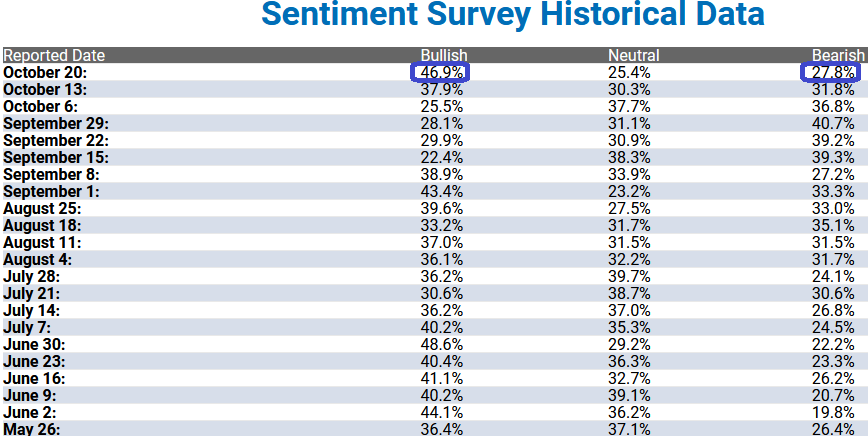

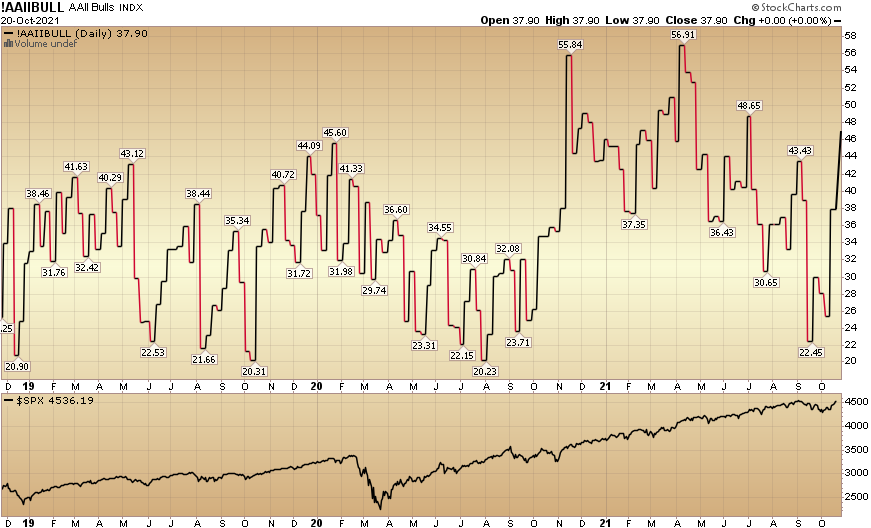

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 46.9% this week from 37.9% last week. Bearish Percent dropped to 27.8% from 31.8% last week. Exuberance is returning at the retail level.

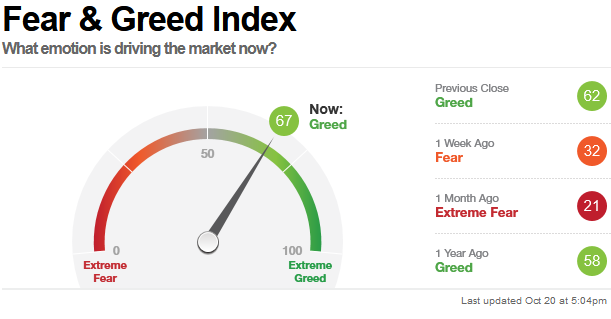

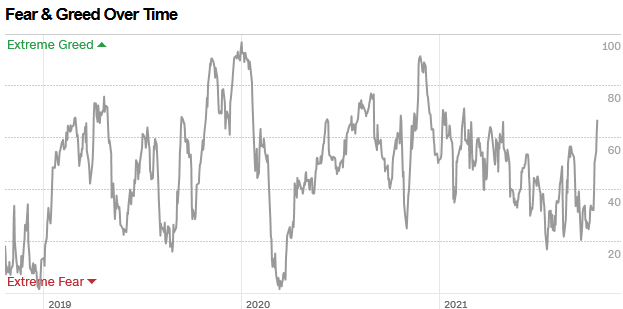

The CNN “Fear and Greed” Index jumped from 32 last week to 67 this week. The chase is on as earnings come in better than expected. You can learn how this indicator is calculated and how it works here: (Video Explanation)

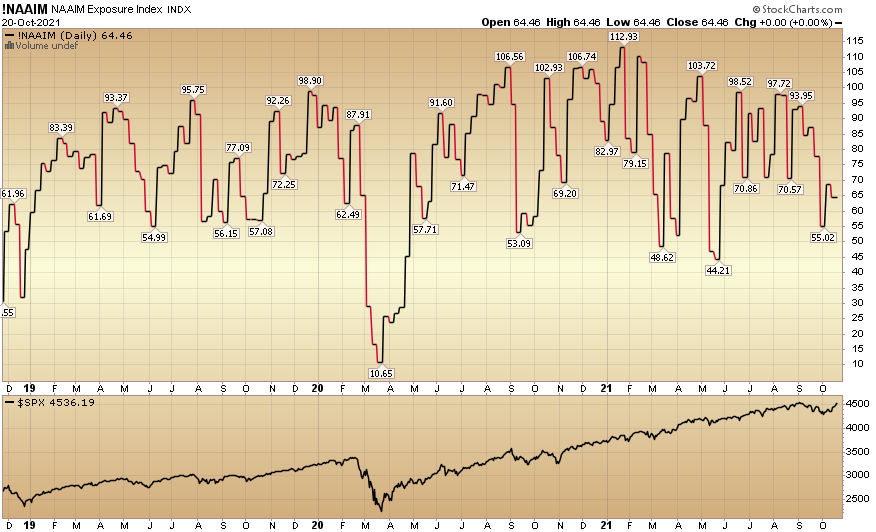

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 64.46% this week from 68.6% equity exposure last week. Managers will have to chase into year end – as they are underweight with the market pressing higher into year-end.

Remember, when you finally “make it” to whatever your definition of “making it” is, be sure to leave the door open and lend a hand to help others up the ladder. You’ll find the reward of “paying it forward” may be more fulfilling than that of having “made it.” I look forward to sharing more on this week’s podcast|videocast.