Each week I try to tie the theme of the stock market to a song that embodies the feeling of the moment. The last month could best be defined by Rodney Atkins classic hit, “If You’re Going Through Hell…” The lyrics that follow, tell the whole story of where we are today:

Keep on going, don’t slow down

If you’re scared, don’t show it

You might get out

Before the devil even knows you’re there…

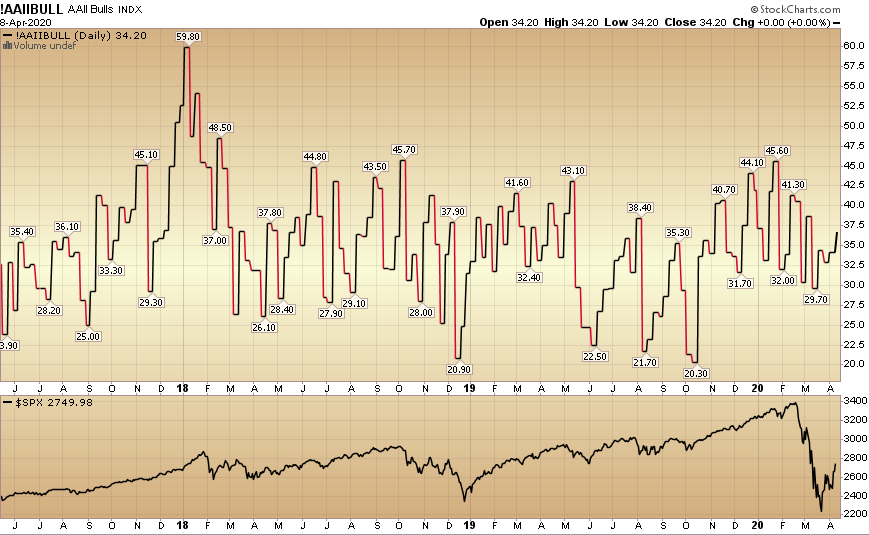

This reminds me a bit of December 2018 (left blue box above) when everyone was waiting for the next shoe to drop and it never came. The market never looked back and never let anyone in (for a 42% rally over the next 14 months). We cannot be sure that same scenario will play out again, but my sense is that the probabilities now favor it (although I think it will take much longer to make new highs based on the short term impact to earnings/employment).

If we were to go back for a retest at this stage, the higher likelihood would be a major overshoot to the downside to wipe out everyone looking for a “retest.” The further away we get, the lower probability that becomes.

This Monday, I had the privilege of being on the Claman Countdown on Fox Business. Thanks Liz Claman and Ellie Terrett for having me on. On the show, I laid out the case that the government learned from the 2008 financial crisis. Namely, to flood the market with aid and liquidity BEFORE the bad news comes versus waiting for everything to break and trying to fix it after the fact.

Simply put, it’s easier to put a trampoline next to the table so when the plate falls off, it can bounce back up gently and quickly, versus breaking on the kitchen floor and requiring years of piecing things back together.

Another analogy I used is that the Fed/Treasury is filling a $1.5-3T pothole (GDP contraction), with $7-9T of asphalt (CARES + Fed Section 13-3 + Fed Balance Sheet Expansion):

Many people are focused on waiting until the “coast is clear” on the health front before taking action. That is sensible and prudent, but the stock market is a discounting mechanism.

Just as the market crashed 35% in Feb/March anticipating the terrible news that is to come (Case Count, GDP Contraction, Unemployment, etc), it will be discounting an economic recovery long before the worst economic news has occurred.

As Warren Buffett says, “if you wait until the robins are singing, it’s already Spring.” You have to build your position when things look terrible or you don’t get the benefit/discount of assuming the uncertainty/risk.

The one thing I have struggled with as we have consistently suggested buying the highest quality stocks at huge discounts on red days (for the past 4 weeks) is why people were so convinced that things would not get better. If China, S. Korea, Singapore, etc. could get mostly through it, why wouldn’t we have confidence that we could do at least as well – if not better (with the best medical system in the world)?

By no means am I saying that we’re through the woods. Sadly, the case count and deaths will continue to build throughout the country. More people will lose jobs in the short term, but we will come back better, stronger and more prepared than ever. Never bet against America…or our ability to innovate and find solutions to our problems.

Secretary Mnuchin said that they are formalizing a plan (Treasury/Fed working together) for businesses with more than 500 employees – that are trying to refinance/raise capital in the “non-investment grade” (High Yield) credit market.

You can find the original interview with Secretary Mnuchin here (fast forward to 5:25):

This is the carve-out they (Fed/Treasury) are using (13-3):

Federal Reserve Act – Section 13-3

How it works (paraphrased from NYT):

The central bank’s emergency lending authorities, given to it by the Federal Reserve Act (section 13-3), allow it to make these loans to businesses. When the Fed declares that circumstances are unusual and exigent, and Treasury signs off, it can set up special programs that essentially buy debt from — or extend loans to — businesses large and small.

The $454 billion Congress dedicated to Fed programs in the CARES aid bill can be multiplied 10x to > $4T of lending.

A little color: They (Fed/Treasury) have been backstopping every major asset class on a rolling basis in the last few weeks (excluding equities – although indirectly they are by pushing money back out on the risk-curve).

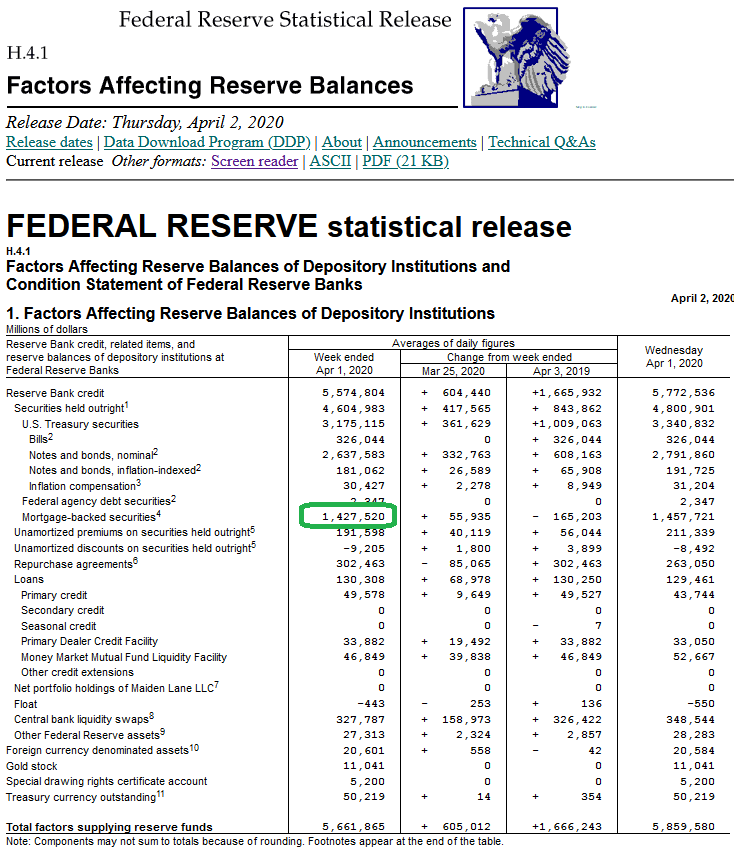

They started across the Treasury Curve, moved into ABS and MBS, and now it seems the next move is High Yield to calm the credit markets (based on Mnuchin/Faber’s) comments in video above. This gives you an idea of the current composition of assets (with the biggest change being Mortgage Backed Securities):

An oil deal (10-15M bbl/day cut) this week (Russia/Saudi’s) would go a long way to calm the high yield funding markets as well. That is causing the most distress in credit markets right now – due to the knock-on effects and heavy weighting (energy) in the high yield indices.

Now onto the shorter term view for the General Market:

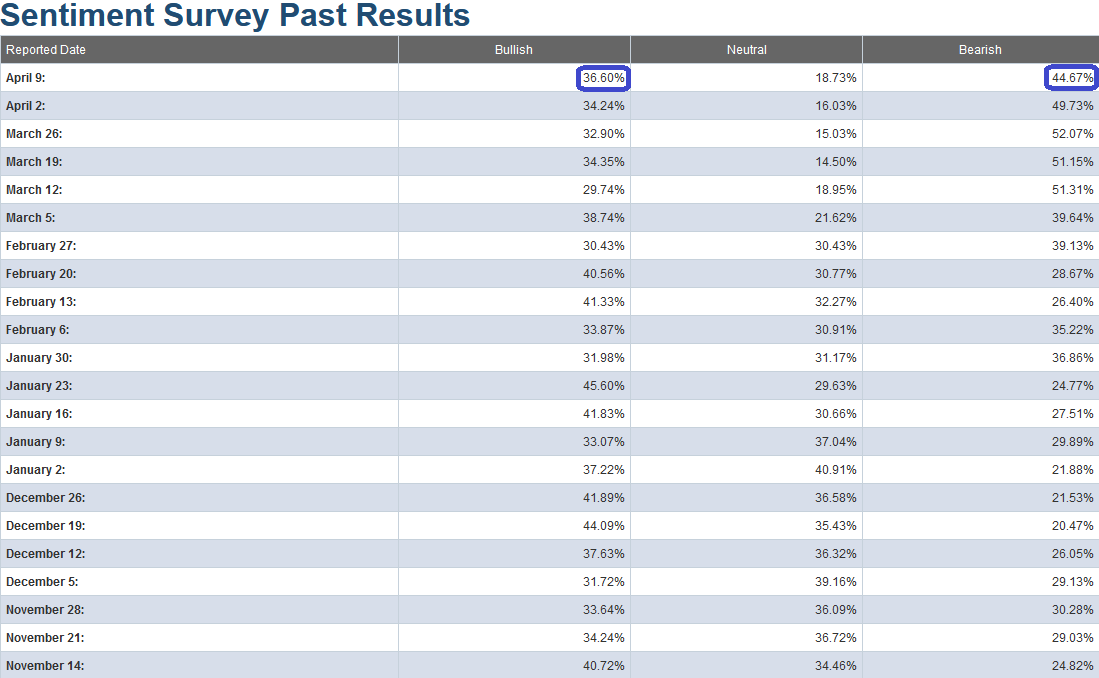

This week’s AAII Sentiment Survey result Bullish Percent (Video Explanation) ticked up to 36.60% from 34.24% last week. Bearish Percent ticked down to 44.67% from 49.73% last week. What is sitting in the back of my mind is the fact that while Bearish Percent is coming off an extreme level, the Bulls never got washed out in the crash.

The CNN “Fear and Greed” Index rose from 22 last week to 33 this week. The fear is slowly thawing and will move in fits and starts in coming weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) fell from 25.87% equity exposure last week, to 23.67% this week. Active managers will have to regain exposure in coming weeks as the worst of the news starts to move into the rear view mirror. We are not there yet. The worst news is still ahead but it will get better. It always does…

Our message for this week HAS CHANGED:

For the last few weeks we said,

“We are selectively and slowly adding to those stocks/sectors which are nearing valuation levels that we would define as ‘pricing in at/near the worst case scenario.’

Most stocks do not yet meet this measure (as the “worst case” is unlikely to materialize), but for those that do we are adding and will continue to do so as opportunity presents itself in coming days and weeks.”

Because we have taken advantage of most of the best discounts that were available, we shifted focus in the past week to start picking up a selective portfolio of distressed high yield credit that has fallen materially since the advent of COVID-19 (i.e. some bonds have fallen as much as 40-60% in the past 6 weeks – from par).

There are selective pockets that have not recovered to the same extent as the equity markets have. We believe that many of these securities will recover to par over time as credit markets repair and potentially government liquidity finds its way to this distressed corner of the market. We envision a scenario similar to how liquidity found its way to the MBS market in the past week or so (to the tune of ~$1.4T).

We also have dry powder available to add to equities in the event we do get a re-test (or lower in coming weeks and months), but that appears to be a lower probability at this point. If the facts change, we will adjust, and be ready to take advantage. But for the time being, the bulk of the opportunity is in a selective basket of researched individual distressed credit securities.

As was our repeated plan in the previous four weeks of buying the highest quality equities on every red/down day (and sitting on our hands on green days), we have followed and will follow the same template in the high yield credit markets.