In recent weeks, we’ve talked about the concept of “crosswinds” in the market and that rather than focusing on the general indices, it was paramount to concentrate on sector rotation and the “rallies under the surface.”

There’s no better song than Van Morrison’s, “Into the Mystic” to embody the navigation of crosswinds that a sailor must face in his/her journey to and fro:

Smell the sea and feel the sky

Let your soul and spirit fly

Into the mystic

I will be coming home

Yeah, when that fog horn blows

I wanna hear it

I don’t have to fear it

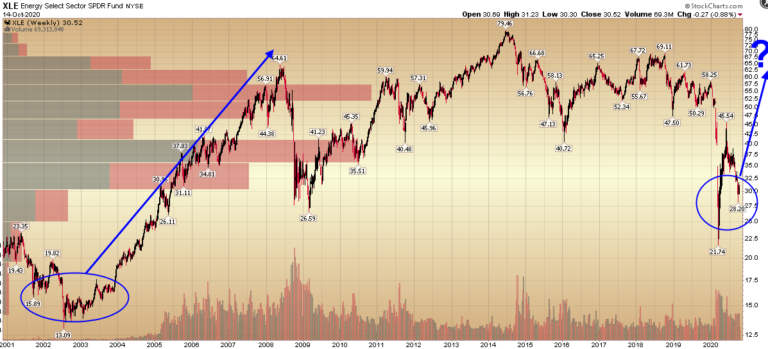

It seemed counter-intuitive to to buy energy when the world was in a pandemic, the economy in a recession and an election that pointed to a full-frontal attack on the sector. So why did it work, and why will it continue to work for the next few years+?

No one can put it better than Jamie Dimon (CEO of JPM) did in his annual letter to shareholders that come out yesterday:

Coal, oil and natural gas — the primary sources of GHG emissions — have powered the world’s energy economy for many decades, advancing significant economic growth and social development for billions around the world. But our reliance on these resources now threatens the very growth they have enabled.

The challenge we face is significant. While continuing to generate power for all of our needs, big and small — lighting and heating our homes, commuting to work, and charging our phones and computers, as well as operating manufacturing facilities that produce goods used around the world each day — we also need to bring energy to the nearly 800 million people who still don’t have reliable access to electricity. And we need to find a way to do all of these things while setting a path for achieving net-zero emissions by 2050.

The fact is we’re long past debating whether climate change is real. But we need to acknowledge that the solution is not as simple as walking away from fossil fuels. We will need resources such as oil and natural gas until commercial, affordable and low-carbon alternatives can be developed to meet all of our global energy needs. This is where business and government leaders need to focus their time and attention.

While wind and solar technologies have made huge strides, they’re principally deployed for electricity generation. We don’t have clean alternatives for industrial and manufacturing energy needs, for example. Nor do we yet have solutions for heavy transportation, such as trucking and air travel. What’s more, the projected growth of technologies like electric vehicles is going to place huge pressures on the need for rare earth minerals — which also presents geopolitical and environmental challenges.

When we cut through all the noise, here’s what we know to be true:

Traditional energy resources play an essential role in our global economy today. We can agree on the need to make our energy system much less carbon intensive. But abandoning companies that produce and consume these fuels is not a solution. Furthermore, it’s economically counterproductive. Instead, we must work with them.

There’s huge opportunity in sustainable and low-carbon technologies and businesses. While many of these technologies and companies are mature, many more are just getting started — and more will need to be created in the coming decades. In addition, all companies will need capital and advice to help them innovate, evolve and become more efficient while staying competitive in a changing world.

This is why we made a commitment in 2020 to align our financing activities in three carbon-intensive sectors — oil and gas, electric power and automotive manufacturing — with the Paris Agreement.

When Wells Fargo was trading between $23-$25 in mid-July I was on CNBC London laying out the bull case for the dividend cut they had implemented – while everyone else was dumping it as fast as they could. Why did it make sense to sail “into the mystic” with banks when no one wanted to touch them with a ten foot pole?

It all comes down to this chart. This is the ratio of the 2yr:10yr Treasury Yield. You sell banks when this ratio falls to zero (inversion) as that is when credit is choked off and banks have hit their maximum credit extension for the cycle. You buy banks after the crash and the fed lowers rates to steepen the ratio once again.

So now that most banks are up 75-100+% in a matter of months, it must be over right? How about, it hasn’t even started…

What? Yes, that’s correct – the cyclical move in banks is in its early days, not end of days. How do we know? For the same reason we knew to buy “in the hole” while most were shorting “in the hole” last year. You sell banks when the 2/10 spread INVERTS. You buy the banks when the Fed steps in to steepen the curve after the crash. We are still STEEPENING AND NOWHERE NEAR A NEW INVERSION – which might be many years away.

Will we have 10-20% corrections in banks on the way to the next inversion? You bet. Will they go even higher on that journey to the next inversion? I’ve put my money where my mouth is since the lows last year and plan to have exposure all the way to the next inversion (which may be years from now). I’ll peel some off on the way up – as they become too large a portion of the portfolio, but it ain’t over until the…

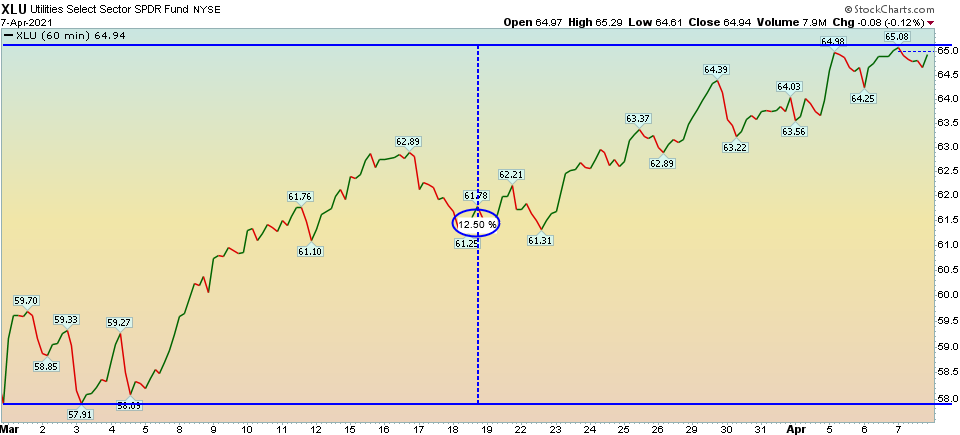

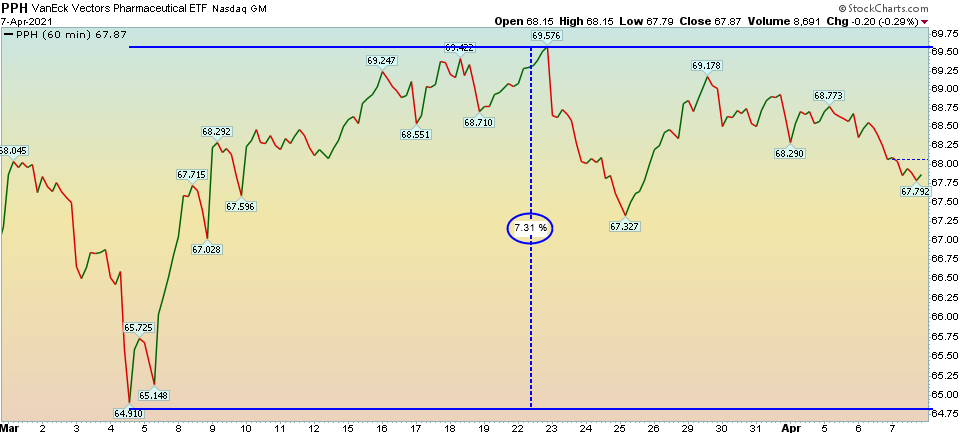

On Feb 25 and Mar 4 we emphasized that we were loading up on Utilities, Consumer Staples and Big Pharma. Why was the “fog horn” blowing for these three groups?

Like all quality market calls, they are usually predicated on rates. Our view was that the rate of change in the ten year yield was so aggressive that if the market didn’t rectify on its own (squeezing the overcrowded Hedge Fund bond short), the Fed would step in and jawbone moving their purchases further out on the curve (and solve it for the market). Here’s what has happened to the 10 year yield since:

Where crystal balls are scarce, a few gray hairs will suffice…

It has become harder and harder to find value in the short term. We think the laggard of our recent initiative (utilties, staples, pharma) – big pharma – will have the biggest near term performance in coming months. Other groups (Energy, Banks, Defense & Aerospace) have taken a breather – as anticipated – and will likely make new highs before year end.

Institutions have raised ~$200B of cash since the beginning of the year. Long/Short funds were down -7.5% on average in the month of March because they kept buying tech as it was rolling over. Now that certain pockets of Tech are finally getting the bounce we talked about last week, they have to chase in to play catch up.

While it has gotten harder to find value after the large run up, it’s difficult to get too bearish with M2 (Money Supply) up ~27% yoy, fiscal stimulus at $5.3T + $2.3-3.3T on the way. Couple that with an accomodative Fed and you you’ll find it hard to play the short side in a meaningful way.

This market environment most closely resembles the environments of 2013 and 2017 (green lines below). Both relentless grinds higher were preceded by aggressive crashes (red circles below) that kept everyone looking in the rear view mirror waiting for the next shoe to drop – while reluctantly being forced to buy up and chase their benchmarks. It’s no different this time.

If you think there is uniform euphoria in the market, the data shows otherwise. If you’ve followed me for some time, you know I refer to option skew on a regular basis. In simple terms, VIX measures the cost/demand (implied volatility) of insurance (S&P puts) AT THE MONEY, while SKEW measures the cost/demand (implied volatility) of “tail risk” insurance (S&P puts) OUT OF THE MONEY (2+ Standard Deviations from the mean). While this is not a comprehensive definition, it is an easy way to think about it to get the general idea.

Right now, the demand for “tail risk” insurance is high. That is concerning, but also a sign that many players do not believe this rally. The “wall of worry” continues to be climbed, but if I were a betting man – I’d be on the lookout for a scenario where the market BREATHES but does NOT pay off the “tail risk” buyers – simply because there are too many of them.

For the sports gamblers, this is the equivalent of a situation where your team wins but you lose the bet because the spread was too wide. In this case the sellers of the premium in demand (tail risk insurance) are the bookies. They love nothing more than when you’re right (the market pulls back) and you still lose (the pullback is shallow and they keep your money).

This is also consistent with the VIX breaking below 20 in recent sessions. At-the-money insurance premium (pricing and demand) is declining. Deep out-of-the-money insurance demand (and pricing) is rising. If you were the seller, where would you want to make your money? Where the price was the highest of course. On that basis, the very near term likelihood is modestly UP, and any pullbacks we get in coming months will be in the FAT part of the distribution curve – versus where people are betting (at the tails). In other words, more subdued than anticipated.

That last paragraph may be worth a second read…

Now onto the shorter term view for the General Market:

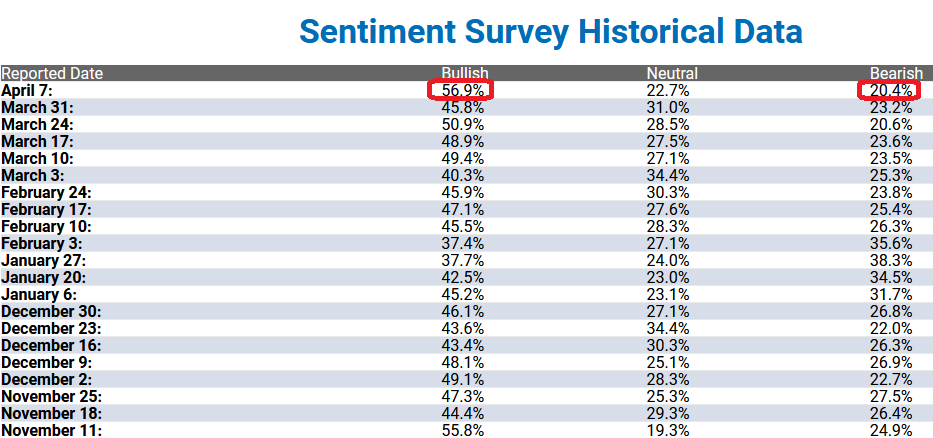

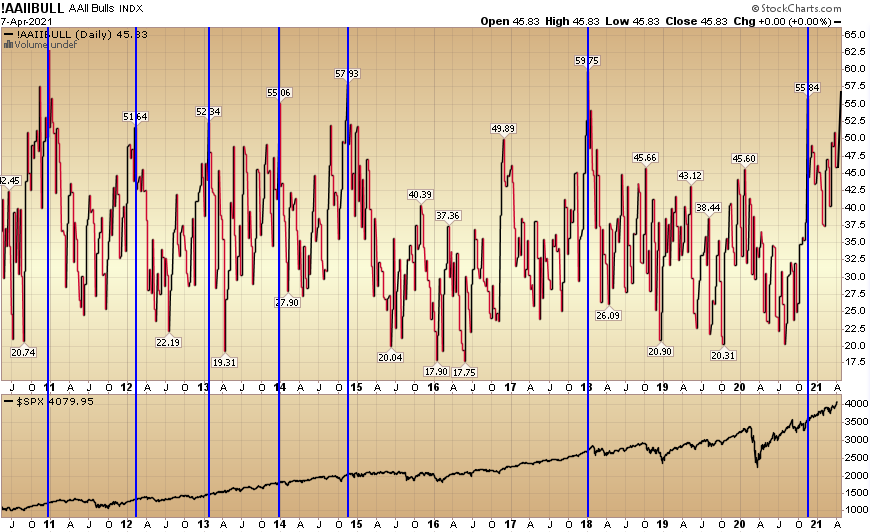

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 56.9% from 45.8% last week. Bearish Percent dropped to 20.4% from 23.2% last week. While this level of exuberance among retail investors is worrisome, we can see historically that it is not necessarily indicative of an immediate top (see blue vertical lines). The exception was January 2018.

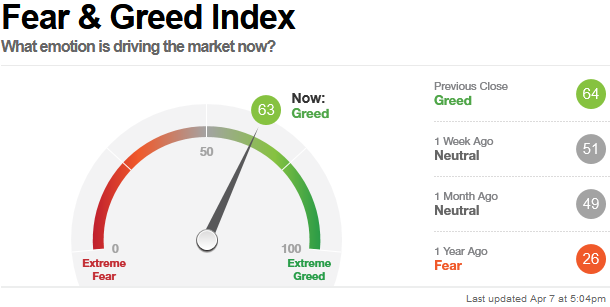

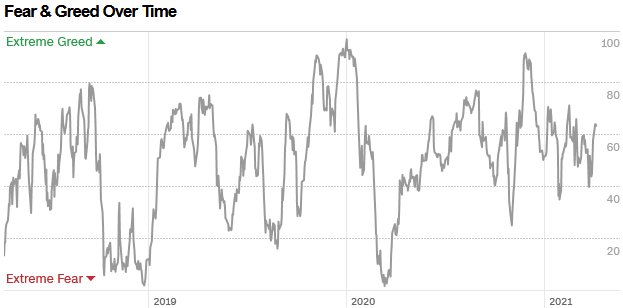

The CNN “Fear and Greed” Index rose from 51 last week to 63 this week. Greed is slowly creeping back in on this more comprehensive measure. You can learn how this indicator is calculated and how it works here: (Video Explanation)

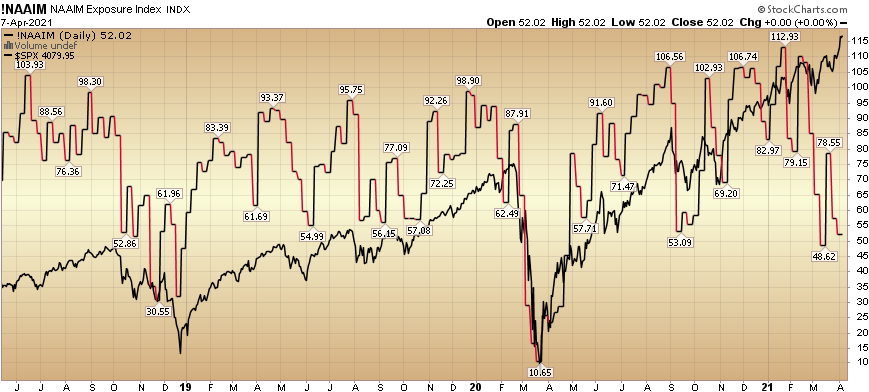

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 52.02% this week from 57.52% equity exposure last week. With the market up, managers will have to make up their lost ground quickly. We anticipate the next print will show they dove back in aggressively to chase the recent move higher.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of February. We think the rebound in this group should continue in coming months (even if we have a few fits and starts – after a very big jump in the past five weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they continue to take a breather – before resuming their uptrend/new highs later this year.

We will look for very selective opportunities in Tech/SAAS – particularly in stocks that have fallen 20-40% in the past few weeks – and will be less impacted by tough comps for Q1 and Q2. This is NOT a wholesale call on tech – as we believe certain pockets will continue to face headwinds.

We will also look to add to our Big Pharma positions – but only if weakness presents itself (the foghorn blows)…

I will be coming home

Yeah, when that fog horn blows

I wanna hear it

I don’t have to fear it…