Since the last Fed Meeting and press conference on September 22, with Chair Powell, we’ve seen a move FROM “Fancy” (Tech/Growth – high multiple stocks) TO “Fancy like Applebee’s on a date night” stocks (re-opening, value, cyclical – lower multiple stocks). Walker Hayes outlines the shift in his recent Country hit “Fancy Like”:

Yeah, we fancy like Applebee’s on a date night

Got that Bourbon Street steak with the Oreo shake

Get some whipped cream on the top too

Two straws, one check, girl, I got you…

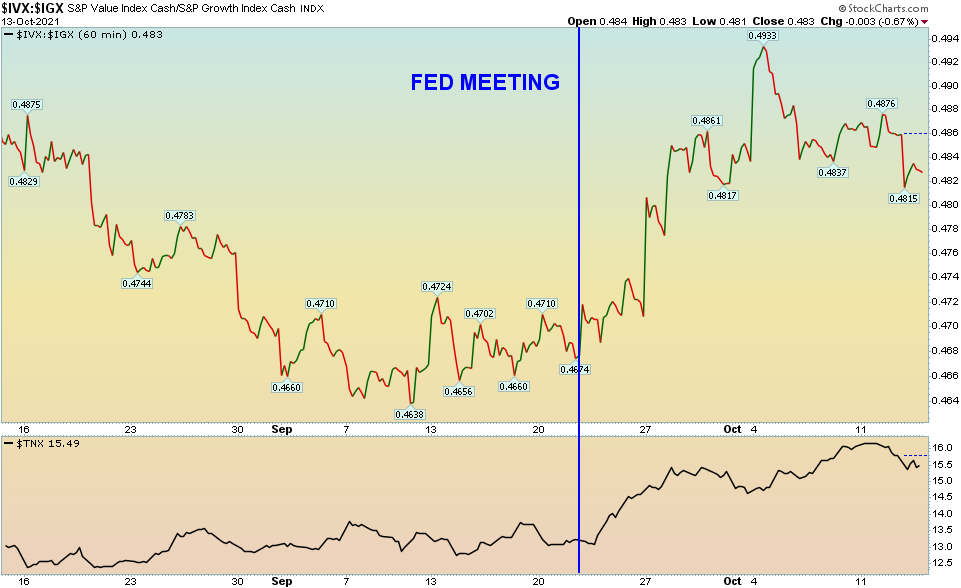

Here’s what the relationship of Value:Growth looks like since the press conference (with the 10-year Treasury yield below):

On Monday Morning I was on Cheddar TV with Ken Buffa. Thanks to Ally Thompson, Stephanie Brooks and Ken for having me on:

Click Here to Watch HD Version Directly on Cheddar

There’s a ton of pessimism coming into Q3 earnings season (inflation, supply chain, labor shortage, margins, peak growth, etc). I take a different tact in my interview with Ken and stick to the data regarding earnings and multiples. Hat tip to John Butters over at FactSet who publishes Earnings Insight for key earnings data points. Here are my show notes for the interview above:

Jobs Report – Impact on Taper:

–Jobs report miss: non-farm payrolls rose by 194,000 vs. 500,000 est.

–7.7M still unemployed versus 5.7M pre-pandemic.

-Unemployment rate 4.8% versus 3.5% pre-pandemic.

-The labor force is still down about 4.9 million people since the start of the pandemic.

-The labor-force participation rate was 61.6% last month. If it were to return to its February 2019 level of 63.3%, the labor force would gain 4.3 million people.

–Chair Powell: we have achieved “substantial further progress” on Inflation, we are close but not at “substantial further progress” toward full employment. He said he would need to see a “decent” employment report to get there. We got a large miss on Friday’s jobs report which gives the Fed cover to push the decision from Nov to the Dec meeting as we will not have the October jobs numbers before the next Fed meeting on Nov 2-3. Earliest Fed announcement for taper will now be Dec 14-15 meeting provided the Oct. and Nov. jobs reports rebound from the Delta lull – as global cases decline.

-We think Taper will be an early 2022 event and the first rate raise should come in early 2023.

Earnings and Guidance:

-We are in an information vacuum waiting for earnings. Guidance will be the name of the game.

-We start with banks on Wed with JPM. WFC, BAC, MS and C follow on Thursday. Earnings and guidance should be strong with a steep yield curve, increasing loan demand, more credit reserve releases and a rising rate environment moving forward. This will set the tone for a positive earnings season.

-After rising for months, 2022 earnings estimates have flat-lined for the last month or so. We think this is about to change as the S&P earnings growth is likely to dramatically exceed the estimated 27.6% in Q3 and as a result, forward guidance will come up with it. This will be the 3rd highest growth rate since 2010. As such, we could see a jump in 2022 EPS estimates from ~$220 on the S&P 500 to >$230 before the end of the year.

–June 30, the estimated earnings growth rate for Q3 2021 was just 24.2%.

-Over the past five years, actual earnings reported by S&P 500 companies have exceeded estimated earnings by 8.4% on average.

-If this average increase is applied to the estimated earnings growth rate at the end of Q3 (September 30) of 27.5%, the actual earnings growth rate for the quarter would be ~35%.

-However, during the past five quarters (Q2 2020 through Q2 2021), actual earnings reported by S&P 500 companies have exceeded estimated earnings by 19.1% on average.

-If this average increase is applied to the estimated earnings growth rate at the end of Q3 (September 30) of 27.5%, the actual earnings growth rate for the quarter would be ~47%.

-The forward 12-month P/E ratio for the S&P 500 is 20.5. This is above the five year average of ~18.3x. As earnings estimated go up, this multiple will come down – more in-line with the 5-yr average.

-The 12 month consensus bottom-up target price for the S&P 500 is 5051.70, which is ~14.8% above the close. We think this is a reasonable expectation considering ~10% earnings growth next year.

–GUIDANCE: More S&P 500 companies have issued positive EPS guidance for Q3 2021 than average as well. At this point in time, 103 companies in the index have issued EPS guidance for Q3 2021, Of these companies, 47 have issued negative EPS guidance and 56 have issued positive EPS guidance. The percentage of companies issuing positive EPS guidance is 54% (56 out of 103), which is well above the 5-year average of 39%.

-MARGINS:

-The estimated net profit margin for the S&P 500 for Q3 2021 is 12.1%, which is above the 5-year average of 10.9% and the year-ago net profit margin of 10.9%, but below the previous quarter’s record-high net profit margin of 13.1%.

Supply Chain

–Supply chain disruptions and costs have been cited by the highest number companies in the index to date as a factor that either had a negative impact on earnings or revenues in Q3, or is expected to have a negative impact on earnings or revenues in future quarters.

-The factors pressuring supply chains and inflation include port delays, container shortages, COVID disruptions, shortages on various components, raw materials, and ingredients, labor cost pressures, and trucks and driver shortages.

-Of the 21 companies that have already reported Q3 earnings, 15 (or 71%) have discussed a negative impact from this factor. After supply chain disruptions, labor shortages and costs (14), COVID costs and impacts (11), and transportation and freight costs (11) have been discussed by the highest number of S&P 500 companies.

________________________________________________

The one thing I would be cautious about is that while we believe value/cyclicals will outperform on a relative basis to tech/growth as the 10yr yield climbs toward 2%, it is not a zero sum game. There will be plenty of individual tech stocks (likely the more reasonably valued variety) that do well during this period as well. The positioning suggests that it will not be “either or,” and that pockets of tech that are out of favor can get a bid as well (now that most are pessimistic on the group):

Options traders are betting on tech trouble.

The aggregated put/call ratio among Nasdaq 100 members is the highest it’s been in over a year. pic.twitter.com/1DhHssL0sg

— SentimenTrader (@sentimentrader) October 13, 2021

______________________________________________

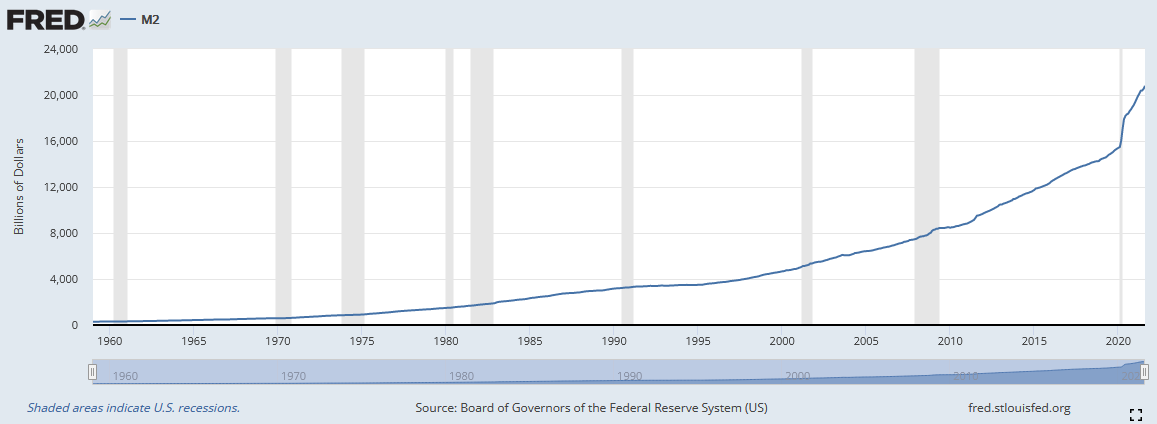

M2 Money Supply is up 35% since January 2020 (pre-pandemic), until the balance sheet goes flat (sometime 8 months after beginning taper), it will be hard to find material distress in the US.

This is one reason we have been so aggressive with Alibaba in recent weeks. It is now up ~21% off the lows it put in last week. We believe this will continue to work higher in coming months and represents one of the true values available in public securities today.

_______________________________________________

On Wednesday night I was on CGTN America talking about the Chinese economy with Rachelle Akuffo. Thanks to Ryan Gallager and Rachelle for having me on:

Show Notes:

-EXPORTS beat expectations: 28% vs. 21% est.

-IMPORTS missed expectations: 17.6% vs. 20% est.

– China’s trade surplus with the U.S. rose to a monthly record of $42 billion.

– Chinese imports of soybeans, of which the U.S. is the largest supplier, fell 30% in September from a year ago.

– Purchases of crude oil declined by 15.2% from a year ago to 41.1 million tons last month

– China’s imports of coal and related products surged 76% from a year ago in September to 32.9 million tons.

– Chinese imports of natural gas rose 21.8% year-on-year to 10.6 million tons in September.

Bad News:

– The KEY reason that EXPORTS beat expectations and IMPORTS missed expectations: The Chinese Government started tightening policy (fiscal stimulus and monetary policy) early this year FAR before the pandemic was contained.

-In contrast, the developed world has continued to be accommodative through much of the year. U.S. M2 Money Supply up 35% since Jan 2020 (pre-pandemic).

-China’s central bank began gradually curbing credit expansion to control financial risks this year once they thought the economy’s recovery from the pandemic was well underway.

-However, the economy started showing signs of weakening in the second half, prompting authorities to make a surprise shift in July by reducing the amount of cash banks must hold in reserve — in part to help banks with liquidity needs, but also to boost lending to small businesses.

-Since then, growth risks have only gotten worse. Stringent virus control measures to contain sporadic outbreaks have made still-cautious consumers even more wary of spending.

–Retail sales missed big last month and China Manufacturing PMI was in contraction last month.

-Beijing’s tighter restrictions on the real estate market have caused a slump in construction investment. Evergrande’s debt crisis is upsetting China’s credit markets.

Good News:

– That weaker outlook means the central bank will likely reduce the reserve requirement ratio for banks again (by 50bps) in October or November, and possibly even lower its policy rates.

-These actions should start to stabilize the economy in time for the 20th Annual Congress next year when President Xi Jinping is set to assume a third term in power.

Now onto the shorter term view for the General Market:

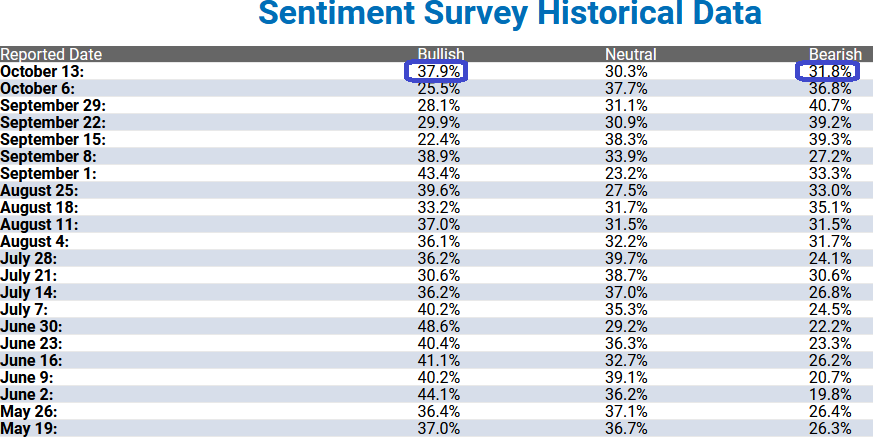

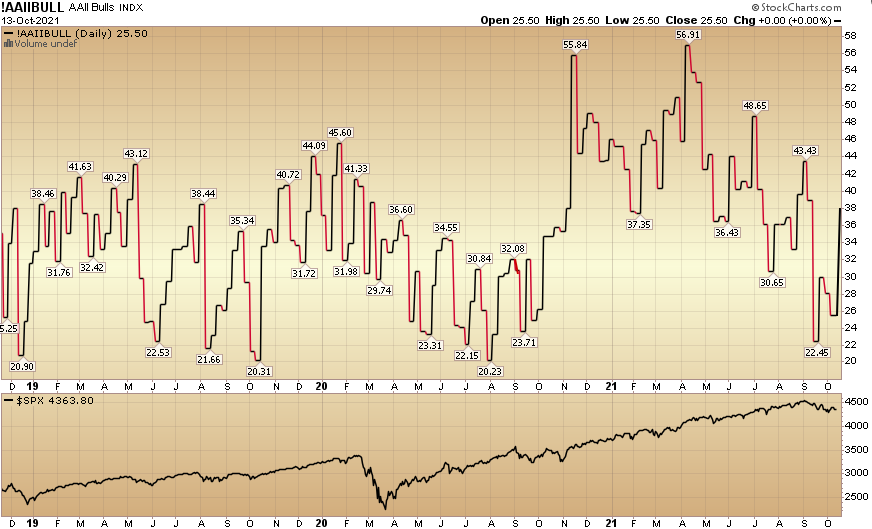

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 37.9% this week from 25.5% last week. Bearish Percent dropped to 31.8% from 36.8% last week. Confidence is returning at the retail level.

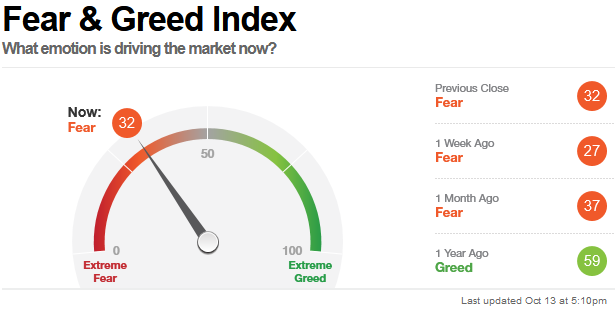

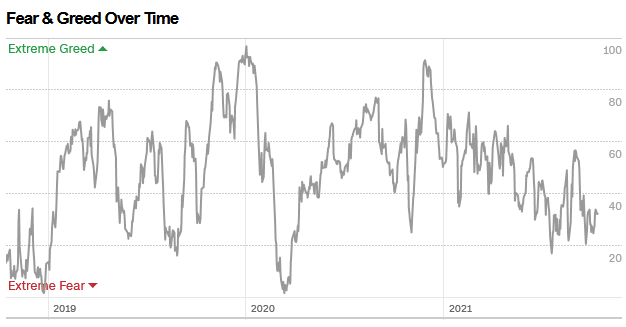

The CNN “Fear and Greed” Index ticked up modestly from 28 last week to 32 this week. Fear is still present. You can learn how this indicator is calculated and how it works here: (Video Explanation)

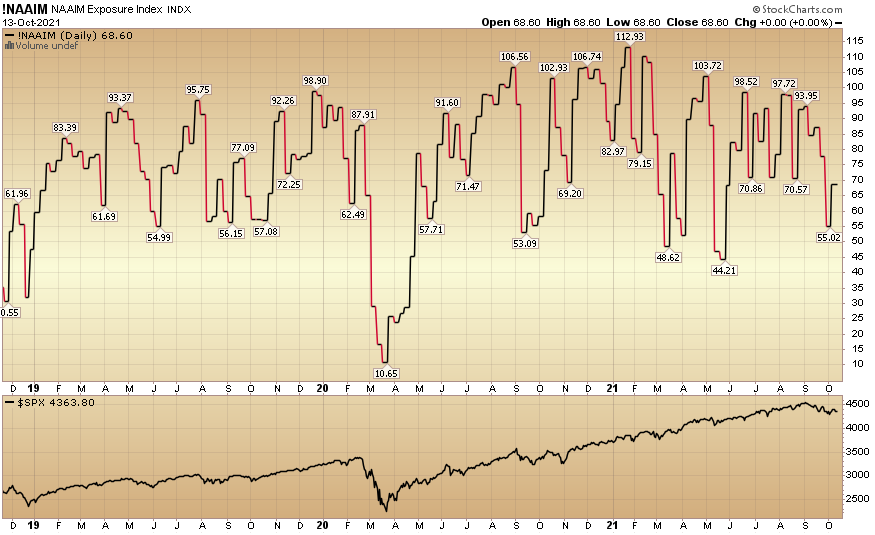

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 68.6% this week from 55.02% equity exposure last week. Managers will have to chase into year end – as they are underweight if the market follows through on its recent bounce.

As we said in previous notes, while everyone debated whether we were going to have a “September Swoon”/”October Crash” or not, we took a step back and looked for sectors/stocks that have already had a “Summer Swoon” and bought (or added to) the quality stocks that were on sale. We will discuss these “Fancy like Applebee’s on a date night” stocks on this week’s podcast|videocast.