If it feels like the market is running in place, you’re right. Look at the Small Caps (Russell 2000) above and the Dow Jones below, and your suspicions are confirmed:

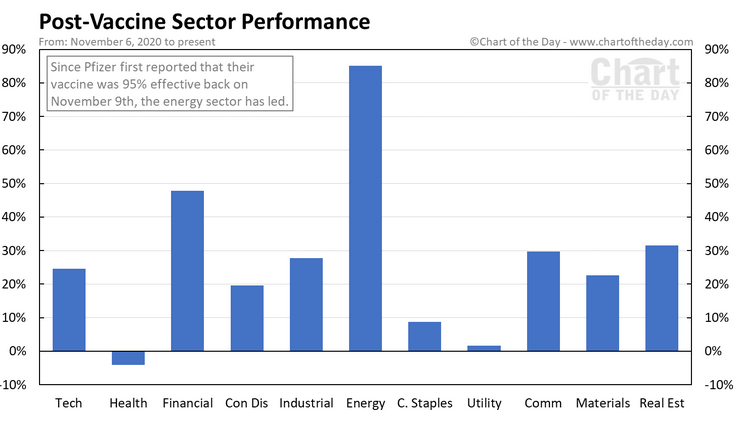

That’s basically your cyclical/re-opening trade taking a much deserved breather after a record Q4 and Q1. As you can see below, since the vaccine was announced on November 6, they have earned a much needed rest:

As anticipated, the 2021 laggard tech sector picked up the baton in recent weeks – pushing the S&P 500 and Nasdaq higher.

It’s a pause that continues to refresh from value to growth, from cyclicals to tech (and back again)…

With the general indices up dramatically off their pandemic lows and a constant “under the surface” rotation, where do we look to find bargains?

Beneficiaries of Regulation

On Friday I was on Fox Business – The Claman Countdown – with Liz Claman. Thanks to Liz Claman and Jacqueline D’Ambrosi Scales for having me on.

In this segment, I was asked to comment on President Biden’s 72 new Executive Orders/Actions released that day, declaring war on anti-competitive practices.

While the EO focused on cracking down on the power of Big Tech firms, other sectors like the job markets, healthcare and transportation are also part of the order.

What does this EO mean for these sectors? Which companies/sectors will be a winner/loser as agencies are told to scrutinize mergers more closely?

Premise of Total EO: In over 75% of US industries, a smaller number of large companies now control more of the business than they did 20 years ago. This is true across health care, financial services, agriculture and more.

Beneficiaries of EO: Small Cap stocks (which are flat since February – see featured chart above), should benefit from the essence of breaking up concentrated power.

Health care EO: Allow states to import prescription drugs from Canada, where government regulation keeps down the cost of medications. It directs the Food and Drug Administration to work with states to safely import drugs. Canada has opposed the idea, and experts question whether the country has enough of a supply to make a significant dent in US drug prices. Manufacturers have also filed a lawsuit to stop the effort.

It also cracks down on shipping costs for companies and prescription drug costs for Americans.

Department of Health and Human Services to issue a plan within 45 days to combat high prescription drug prices and price gouging.

Health care EO beneficiaries: As the Biden Administration looks to control drug costs, languishing generic manufacturers (that have spent the last couple of years working through legacy issues) could start to benefit. Companies like:

VTRS (Viatris) – the old Mylan is trading at 3.91x 2022 EPS estimates. You’re paid a 2.99% dividend while you wait for the stock to recover. This could be a multi-bagger over the next few years.

TEVA – another generic manufacturer trading a 3.6x 2022 EPS estimates. Demand will continue to grow as the administration looks for new ways to lower drug costs.

Transportation EO: The White House argues “inadequate competition” has reduced incentives for airlines to provide good service.

Transportation EO beneficiaries: Boeing (BA) and General Electric (GE) will benefit. Incentives to increase carriers will increase demand for aircraft. Boeing and GE are two undervalued industrial companies positioned to benefit.

Technology EO: Crack down on big tech companies, arguing that they gather too much information on consumers, purchase potential competitors and unfairly compete with small businesses.

FCC to restore the agency’s net neutrality rules for broadband companies that would prohibit them from selectively blocking, slowing or speeding up websites. Those rules, approved during the Obama administration, were pared back under the Trump FCC.

Administration-wide policy to scrutinize mergers more heavily, including completed mergers. It zeroes-in on so-called “killer acquisitions” involving nascent competitors, the kind of deal critics say Facebook engaged in when it bought Instagram and WhatsApp.

Technology EO beneficiaries: Shareholders of GOOGL, FB, AMZN would all benefit as the “sum of the parts” is greater than the whole if: YouTube/Waymo were spun out from GOOGL, Instagram/WhatsApp were spun out from FB, or AWS was spun out from AMZN.

These are low probability outcomes and most of the executive order will not get traction in Congress.

How To Get a 51% Dividend Yield (with Safety)? Become an Aristocrat…

Later on Friday I was on TD Ameritrade Network – Market Overtime – Nicole Petallides. Thanks to Nicole and Declan Murphy for having me on.

In this segment, I was asked to discuss where to find long-term dividends and dividend growth in this low rate environment:

For long term dividends, we focused on a few “Dividend Aristocrats.”

There are 65 companies (also members of the S&P 500), which haven’t just paid dividends for at least 25 consecutive years – they’ve raised their dividends for a minimum of 25 straight years as well.

An example of how this works: Warren Buffett bought 400M shares (~$1.3B) of Coca Cola (KO) between 1988-1994. His basis (split adjusted) works out to about $3.25/share. While the current dividend yield is ~3.1%, his yield on cost is ~51.6% because Coke raised the dividend every single year since he purchased the shares ~30 years ago.

Since 1994, Buffett has received $21.45/share in total dividend income or 6.6x what he paid, PLUS the stock is trading at ~$54 or 16.61x his basis (for a total return of 23.2x his basis over 27 years.

With the 10yr yield trading well below 1.5%, stock with yield are starting to come into major demand and should continue over the summer. We are primarily focused on defensives (Staples, Utilities, Pharma).

It is also notable that Defensives: Staples, Utilities, Healthcare tend to outperform (on average over the past 20yrs of data) during the Summer Months when the market is more volatile).

| Staples | Years of Dividend Raises | Current Dividend Yield | P/E on 2022 EPS Est. | |

| The Clorox Co. (CLX) | 45 | 2.59% | 23.5 | Passing through higher costs to consumers. Margins will rise. |

| Colgate-Palmolive (CL) | 59 | 2.2% | 23.4 | “ |

| Procter & Gamble (PG) | 65 | 2.56% | 23.1 | “ |

| Kimberly Clark (KMB) | 48 | 3.37% | 17.11 | “ |

| Utilities | ||||

| Consolidated Edison (ED) | 47 | 4.28% | 16.16 | Just received rate increase approvals. |

| NextEra Energy (NEE) | 25 | 2.07% | 27.2 | Sizable presence in renewables |

| Healthcare | ||||

| Johnson & Johnson (JNJ) | 59 | 2.5% | 16.29 | |

| Walgreens Boots Alliance (WBA) | 45 | 3.88% | 9.33 | Same day prescription delivery service all US |

General Market Outlook

On Monday Morning I was on Cheddar News – with Brad Smith. Thanks to Brad and Ally Thompson for having me on.

General Market Outlook and Notes:

Q2 Earnings Season started on Tuesday. Earnings are expected to grow 63% yoy (off easy comps). I think it could be as high as 70%. However, many people will be pointing to “peak growth” in coming weeks’ commentary. While we won’t continue to grow at 70%, we will continue to grow ABOVE TREND, and that is a key reason to be optimistic – just over 1 year into a new business cycle.

After a 95%+ push off the pandemic lows, are there any bargains left?

The key factor in housing demand is an improving jobs market – which we saw with +850k jobs this month.

With 72MM Millenials around age 30 and starting housing formation, demand for mortgages will persist in the next few years.

A few weeks ago, the Supreme Court rejected most claims by a group of investors who challenged a government decision to channel (GSE) Fannie Mae and Freddie Mac profits to the Treasury Department.

The Biden administration can now appoint a new chief overseer rather than keep the holdover from the Trump administration, who was seeking to release the companies from government conservatorship during his term.

The Biden administration has signaled it won’t be in a hurry to privatize the companies.

Under President Biden, the GSEs’ regulator may put in place other initiatives with the primary aim of making mortgages cheaper and more widely available. If GSEs were to cut fees, or expand the types of borrowers or loans they back, that could increase the market size for the firms that originate many so-called qualified mortgages—the type that the GSEs buy—such as Rocket Cos. RKT, UWM Holdings UWMC, LoanDepot. LDI.

UWMC trading at 9.3x 2022 EPS

LDI trading at 4.75x 2022 EPS

RKT trading at 11.8x 2022 EPS

Couple 10yr yield moderating in recent months (below 1.5%), and Lumber prices collapsing in June (allowing builders to put new supply on the market) points to a recovery for these decimated mortgage originators over the next 12-24 months.

There are still bargains, you just have to look harder to find them.

Another Bargain?

Later on Monday I was on Fox Business – The Claman Countdown – with Lauren Simonetti. Thanks to Lauren and Ellie Terrett for having me on.

In this segment I was asked what I was watching most closely and what’s the investment play this week?

What we are looking for:

Great earnings results are already baked into the market. The name of the game is GUIDANCE. While 2022 earnings estimates have steadily climbed higher to $213 (for the S&P 500), we need to see what managements have to say about their outlook to support current valuations and beyond.

We may find out that estimates are still too low and we begin to see 2022 estimates headed toward $225-$230 over the next couple of months.

The Trade:

The KBW Bank index has dropped ~8% over the past month as falling longer-term interest rates have raised fears about a key gauge of bank profitability — net interest margin, which measures the difference between what banks pay for deposits and what they earn on loans and other assets. Many of the big banks have pulled back in concert with rates.

While there is still a lot of good news priced into banks at these levels, Citigroup is down ~13% in the past month, is trading at .9x tangible book and offers a 3% dividend. With a turnaround story led by new CEO Jane Fraser, and a plan to streamline operations, Citi may offer a relative bargain in the sector after earnings results settle out.

When will the Chip Shortage End?

On Wednesday night I was on CGTN America – Global Business – with Roee Ruttenberg. Thanks to Roee and Kamelia Kilawan for having me on.

In this segment we discussed semiconductors, why they’re so important, global leaders in production and dealing with the shortage. We also outlined the timeline under which today’s shortage may turn into tomorrow’s glut:

Sentiment

This week we posted our summary of the Bank of America “Global Fund Manager Survey” here:

July Bank of America Global Fund Manager Survey Results (Summary)

In this month’s survey ~270 managers with ~$805B AUM participated.

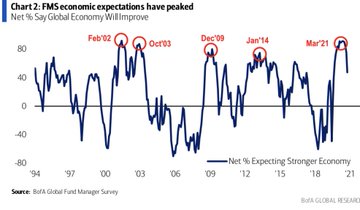

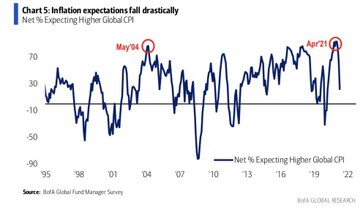

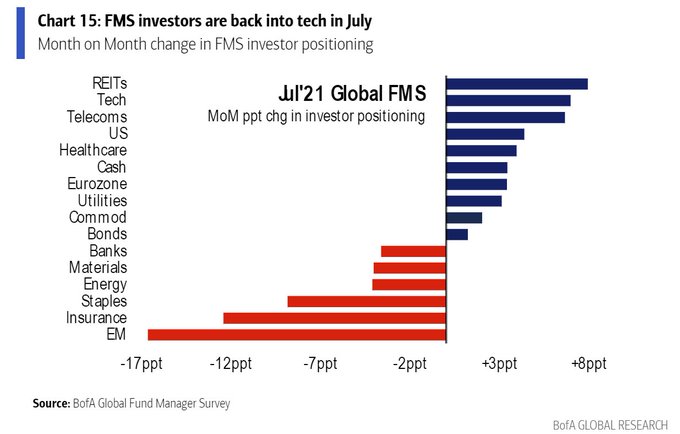

The key takeaway was that Inflation, Economic and Profit expectations have all peaked. While that may sound like bad news, it’s NOT! The same thing happened at the BEGINNING of the last two business cycles (in 2009 and in 2002/2003).

Managers jumped out of the reopening trade and into Tech overnight. This should reverse again later in the year – as we have anticipated in recent notes:

Now onto the shorter term view for the General Market:

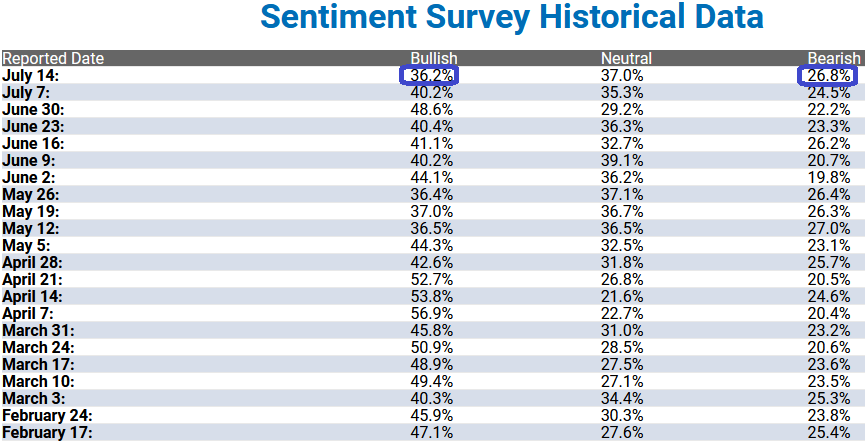

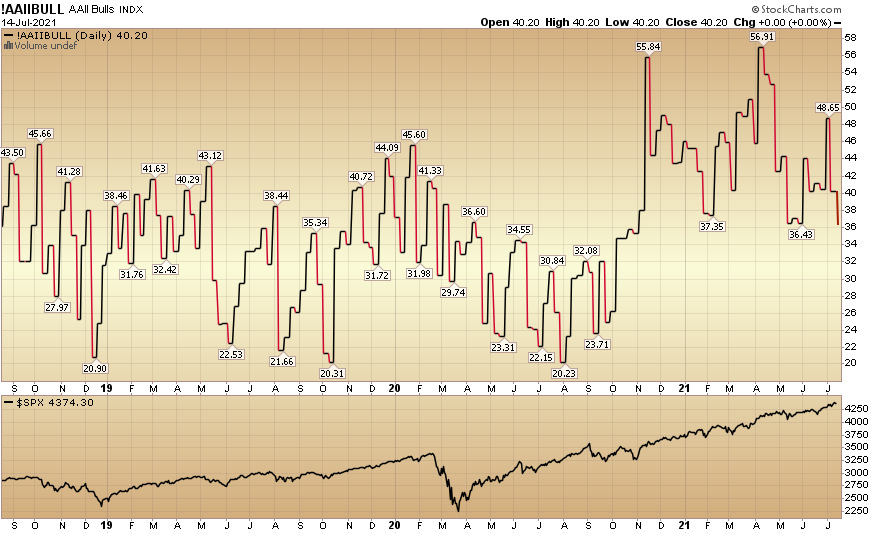

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 36.2% from 40.2% last week. Bearish Percent increased to 26.8% from 24.5% last week. Retail traders/investors are beginning to curb their enthusiasm.

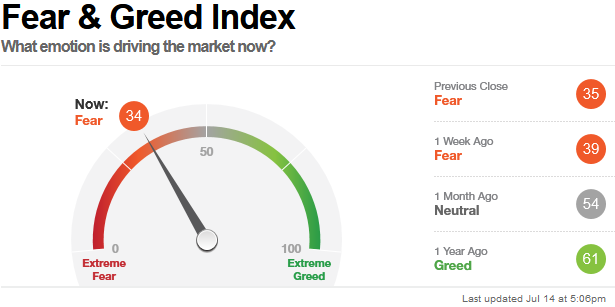

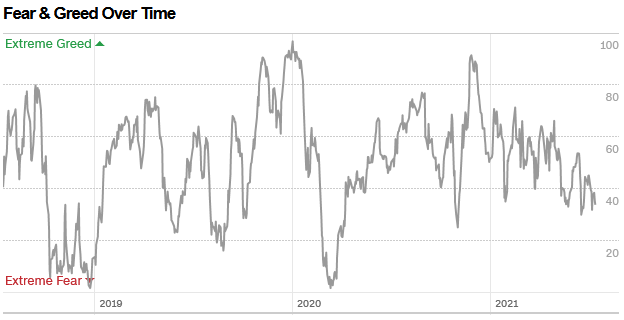

The CNN “Fear and Greed” Index faded from 39 last week to 34 this week. Fear is present in the market. You can learn how this indicator is calculated and how it works here:(Video Explanation)

The CNN “Fear and Greed” Index faded from 39 last week to 34 this week. Fear is present in the market. You can learn how this indicator is calculated and how it works here:(Video Explanation)

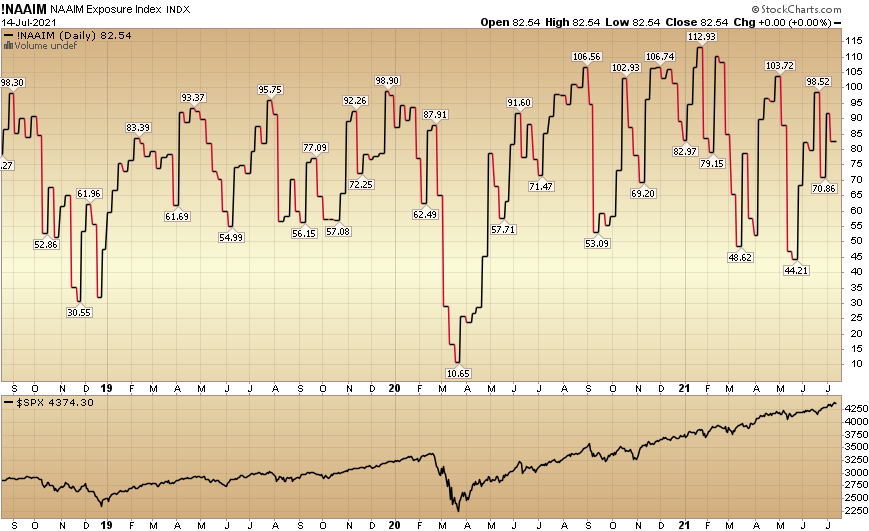

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) slipped to 82.54% this week from 91.72% equity exposure last week.

Our message for this week:

We made no major changes to our outlook this week. Tech has continued to grind higher as anticipated. We added some pockets of value which are referenced in the segments above.

We continue to like laggard defensives for the next couple of months+ (utilities, staples, pharma), and we finally saw a nascent turn in BABA this week (after adding materially on last Thursday’s weakness – which we referenced in the podcast).

We will go into further detail this week on FRIDAY‘s podcast/videocast.