Data Source: Factset

For the last 4 weeks I have been pounding the table that, “what no one is expecting is the possibility that earnings estimates for 2020 (S&P 500) will actually start to go UP (as the China deal is passed and CEO/CFO visibility and confidence returns)!”

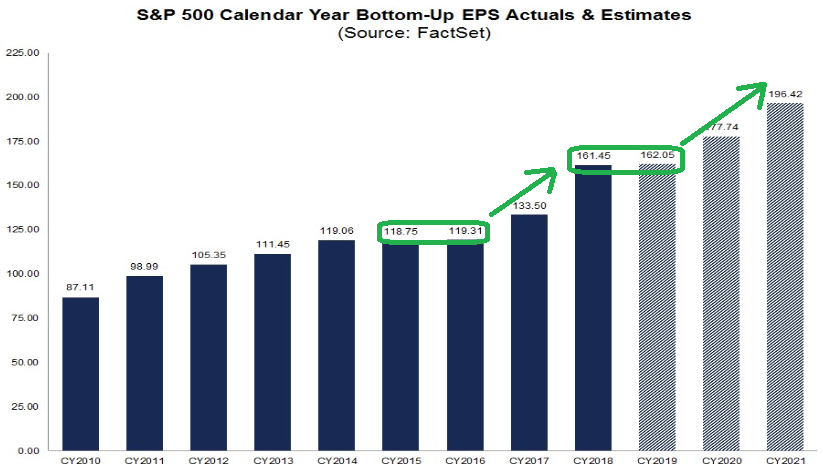

Well it happened for the first time in a long time this week. Consensus EPS for 2020 increased 10 cents from $177.64 last week, to $177.74 this week! While it’s not a lot, it’s a start.

This is not the direction that analysts were expecting. It’s too early to tell if the reversal will persist, but as we covered in our weekly commentary note this week, Boeing’s earnings estimates for 2020 came down $5.12 in the past 60 days. You can read it here:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

Why is Boeing so important?

Because we have been able to retain near double digit earnings growth for 2020 (+9.5% as of today) in spite of Boeing’s short term woes.

If Boeing had recovered by year-end 2019 as originally expected, the S&P 500 earnings growth rate would be off the chart at a whopping 12.33% for 2020. Once they are cleared for take-off on the 737 MAX (whether Q1 or Q2 2020), that run rate will be immediately restored and earnings expectations will jump. How do I know? Because that’s how a duopoly works…they don’t have to knock on doors to find customers.

What else of note happened this week regarding earnings?

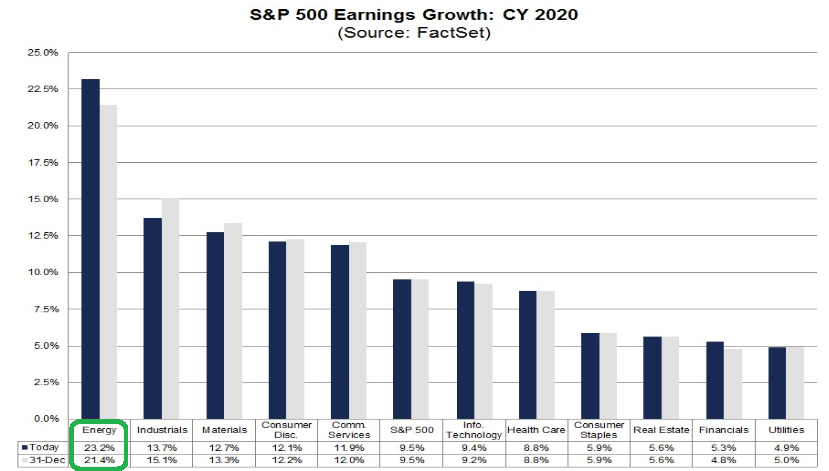

Earnings estimates for 2020 were taken up meaningfully for the Energy Sector. The Energy Sector was the worst performing sector of 2019, but is now expected to have the highest earnings growth rate in 2020 (worst to first). And this week it got even better:

The Energy sector is now expected to grow earnings by 23.2% this year, versus 21.8% just a week ago!

So we’re off to a good start for earnings season. Let’s see how the data continues to come in next week…