Right now we are trading at 18.6x 2020 EPS for the S&P 500.

Here is our latest note (data) on Earnings from this past Friday:

For this rally to sustain (through 2020) we need some additional earnings power (to support the multiple expansion). There are 3 factors that could help us get there:

1. Weaker US Dollar year on year.

2. Increased confidence and guidance from CEOs/CFOs now that Phase 1 is signed.

3. Boeing gets a positive surprise after “kitchen sinking” expectations this week.

U.S. Dollar:

Yesterday we put out a summary of the Bank of America “Global Fund Managers Survey:”

One of the stats that caught my eye was the fact that 53% of the survey participants felt the US Dollar was overvalued. This is the second highest reading since 2002. Here’s what happened to the Dollar after 2002:

The data sample is way too small to draw any definitive conclusions about the $USD, but if this trend was to persist it would have a materially positive impact on S&P 500 EPS.

Analysts estimate that between 40 percent to 50 percent of S&P 500 sales are from abroad.

Jurrien Timmer of Fidelity put out a chart implying that a weakening dollar was possible – provided the Fed continues to add reserves to the banking system:

Increased Guidance:

Negative guidance is better than average as of Friday. 60% of S&P Companies that have reported issued negative guidance versus the five year average of 70%. The sample size is too small this early into earnings season to draw any conclusions.

Boeing:

Today Boeing’s new CEO threw in the “kitchen sink” lowering any expectation that the 737 Max will be airborne until summertime. Here’s why this is so important:

Despite Boeing’s 2020 EPS estimate coming down $5.77 in the past 60 days, S&P 500 EPS estimates for 2020 have held strong at 9.5% earnings growth. If not for this debacle, the S&P 500 would have 13.24% earnings growth (which would be higher than 2016-2017 when the S&P 500 rallied 37% in 15 months).

In other words, provided that Boeing can get its act together sooner rather than later, we could have a large expected jump in earnings power for the back half of 2020. Once that plane is airborne, the backlog comes back VERY quickly in a duopoly situation.

This would also be consistent with a chart that Ryan Detrick of LPL Financial posted today regarding the average seasonality of the S&P 500 in a Presidential Incumbent election year (2nd half takeoff coincides with 737 Max takeoff?):

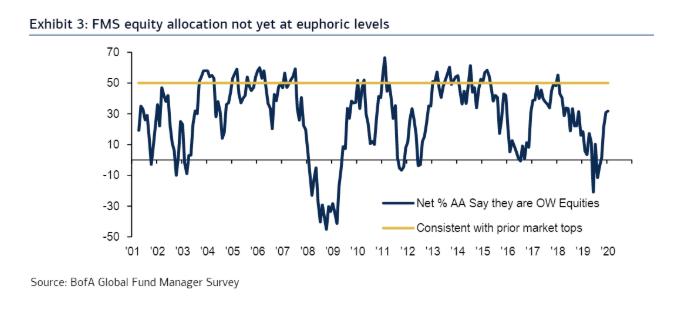

Also consistent with Ryan’s average seasonality is the fact that the BofA survey above implies that there is room to run for the year (optimism not yet at euphoric levels).

Notes on The Fed:

The Fed has remained accommodative adding > $400B of liquidity back into the system since August. My concern is that they start to talk it down at the next meeting saying that they met the “cash crunch” at the New Year and they now will start to taper back.

That type of rhetoric would set the table for the 1st half seasonality to play out (as outlined above) prior to getting the Boeing bump in the back half. It would be unwise for the Fed to talk hawkish on this liquidity provision as they have ~$385B more of the $785B of quantitative tightening left to unwind.

Tapering too early (particularly when another cut is probably off the table) would be unwise (but possible considering what was done the back half of 2018 – which was completely unnecessary).

If Chair Powell is as earnest about putting another couple million people (at the margins) back to work (who have not yet benefited from the recovery), he will resist his temptation to taper liquidity expansion and let the economy run a bit hot.

There is no way to take this (Labor Force Participation Rate) back up to 65% + without unwinding 100% of the Quantitative Tightening program.

Either he follows through on his commitment that was laid out in the December meeting, or he back tracks, but “maximum employment” is at the core of the Fed’s dual mandate. 3.5% historic unemployment rate is nice, but it would be a lot more significant if we got the participation rate back over 65%.

This is not outside the realm of possibility with 85M millennials now supplanting 80M boomers and my wimpy sized 65M Gen X. Ex-persistent 2.5-2.8% inflation OR a Labor Force Participation rate >65%, there is nothing within the Fed’s mandate that should allow them to taper back on the current program.

We will find out on January 29 if they will stick to the plan. If they follow through, it will make a huge difference for millions of people who stopped looking for work years ago – and would be drawn back into the workforce with wages running a bit hotter and employers willing to invest in training to find new labor.

So far Chair Powell’s actions have matched his rhetoric since August 2019. Next week we will see if that persists or if the “forgotten” men and women remain in the shadows…

Now onto the shorter term view:

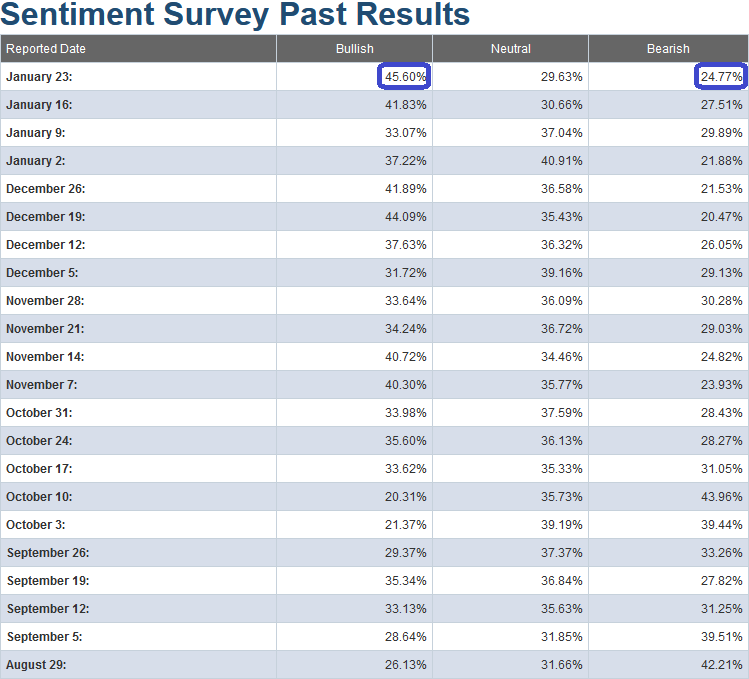

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent came in at 45.60%, UP from 41.83% last week. Bearish Percent fell to 24.77% from 27.51% last week.

The CNN “Fear and Greed†Index – which fell 12 points (from 86 last week to 74 this week) did not confirm the increase in the AAII Sentiment Survey. However, it is still at a high level.

This is generally not the place you want to be adding a lot of NEW exposure unless it is in stocks/sectors that have not yet participated in the rally and have solid fundamentals. You can learn how this indicator is calculated and how it works here: (Video Explanation)

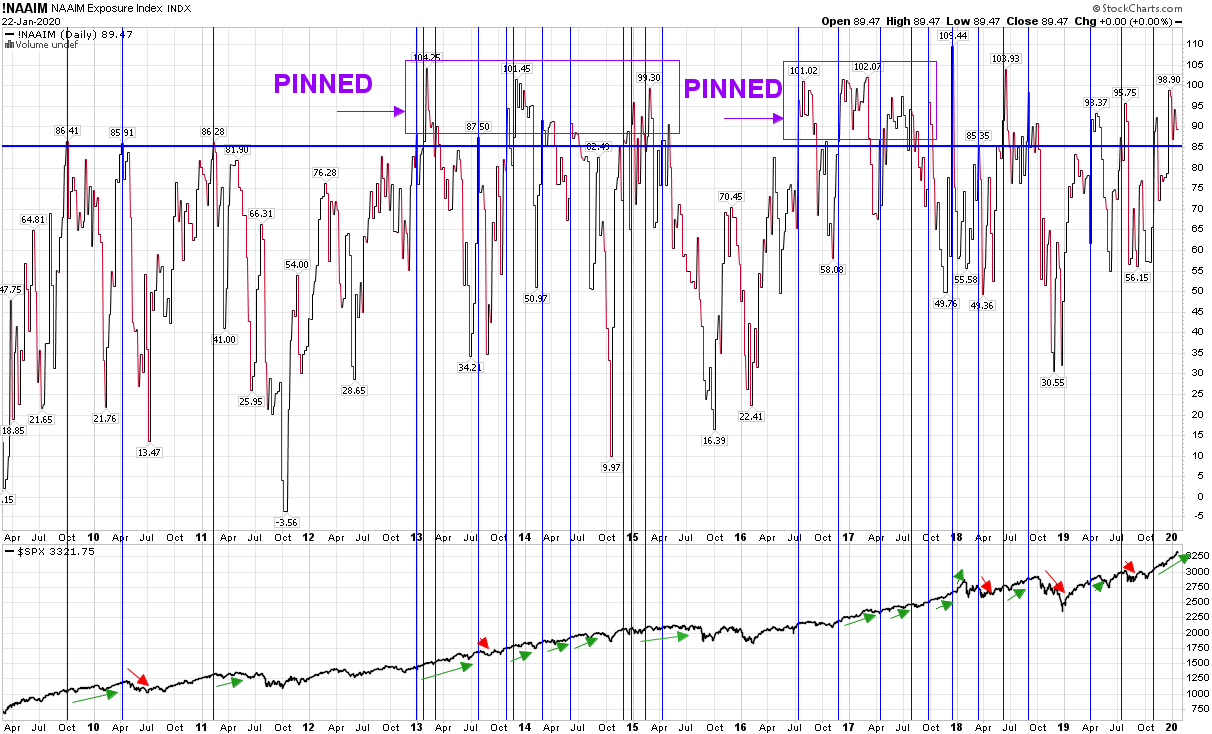

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) declined from 94.16% equity exposure last week, to 89.47% this week. While this is still an elevated level, these levels can stay “pinned†for some time when they are emerging from a significant trough (like early 2016 and late 2018).

Our message for this week is similar to last couple of weeks:

We remain bullish in the intermediate term (for 2020). As we have stated in our recent notes, we have trimmed some names that have had huge runs off of the August/September lows, and had re-allocated some profits into sectors/stocks that had just begun to participate.

We also recently added a few selective shorts. The short positions are not due to bearishness per se, but rather “special situations†that we believe will work even in a sideways to up market and outperform in the event of a pullback.

You can review our previous notes under the category “Sentiment†on the right side of the site.