On Friday I was on Fox Business – The Claman Countdown – with Lauren Simonetti. Thanks to Ellie Terrett, Liz Claman and Lauren for having me on.

In this segment, I was asked to comment on the Jobs report and what was “the trade” moving forward:

Key Points from Jobs Report:

-The number of unemployed persons increased from 9.3 million to 9.5 million.

-The number of job leavers – that is, unemployed persons who quit or voluntarily left their previous job and began looking for new employment – increased by 164,000 to 942,000 in June.

-The number of long-term unemployed (those jobless for 27 weeks or more)increased by 233,000 to 4.0 million.

BIGGEST GAINERS:

-Employment in leisure and hospitality increased by 343,000, as pandemic-related restrictions continued to ease in some parts of the country.

-Employment rose by 155,000 in local government education, by 75,000 instate government education, and by 39,000 in private education.

“THE TRADE”

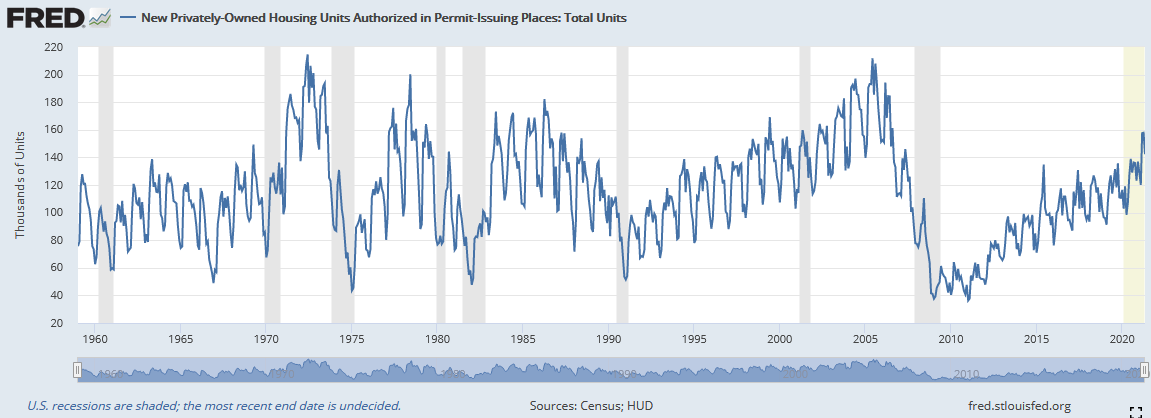

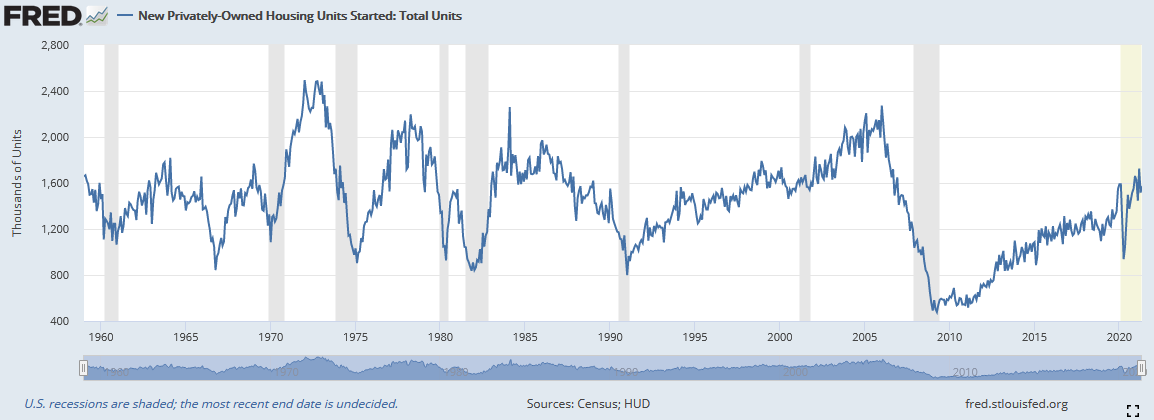

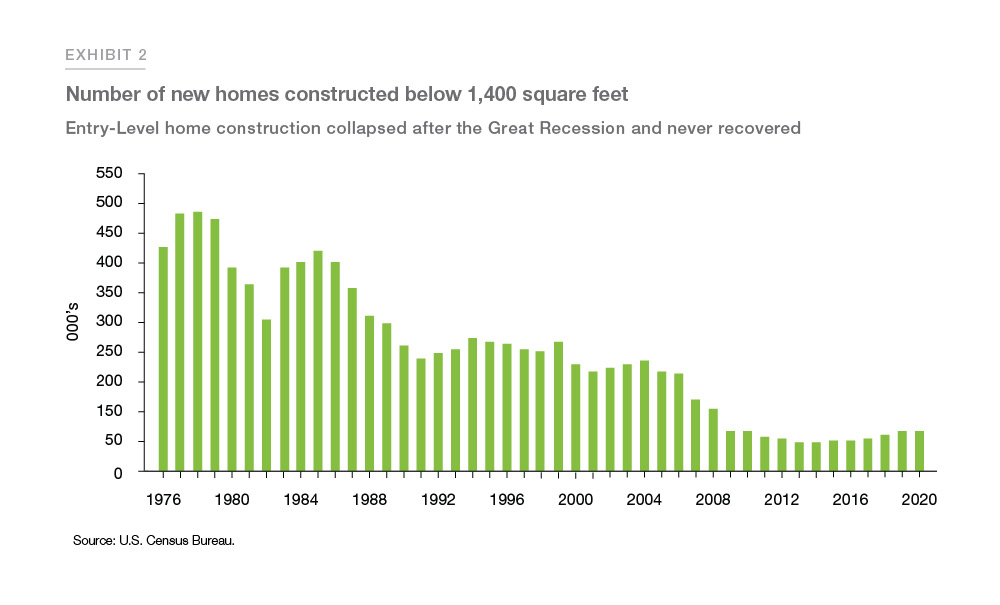

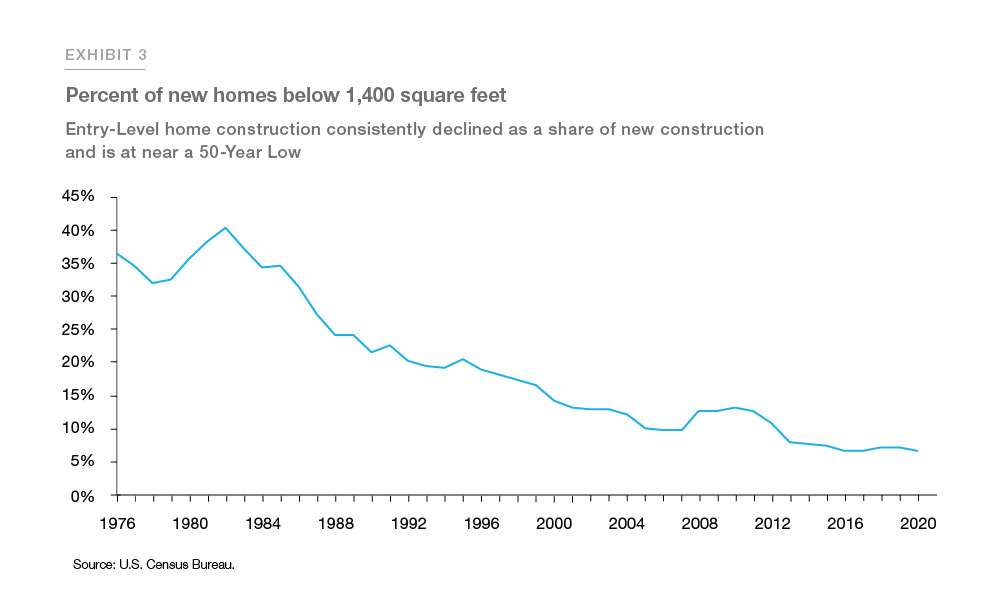

After a 90% push off the pandemic lows, are there any bargains left? Yes, a derivative trade on housing is our latest target.

The key factor in housing demand is an improving jobs market – which we saw with +850,000 new jobs on Friday.

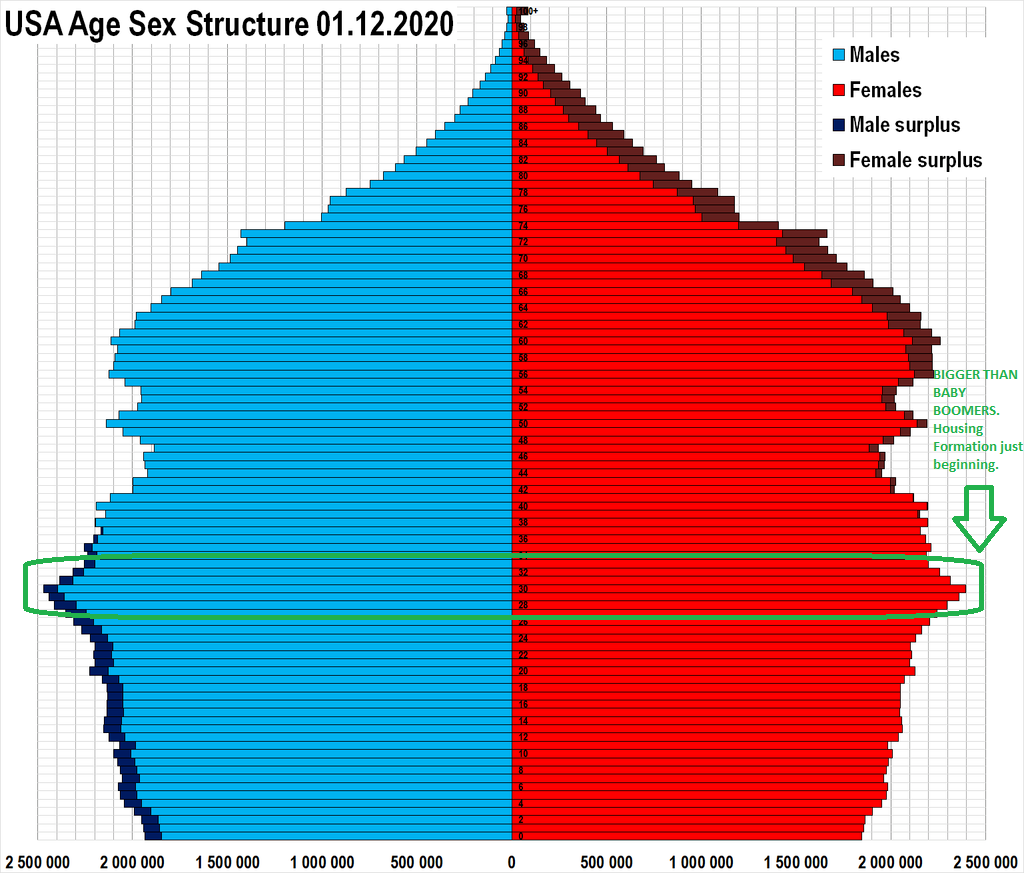

With 72M Millenials near age 30 and in the midst of housing formation, demand for mortgages will persist in the next few years (irrespective of rates).

Qualified Mortgage Lenders Face Favorable Tailwinds of New Administration

Per WSJ: Two weeks ago, the Supreme Court rejected most claims by a group of investors who challenged a government decision to channel (GSE) Fannie Mae and Freddie Mac profits to the Treasury Department.

The Biden administration can now appoint a new chief overseer rather than keep the holdover from the Trump administration, who was seeking to release the companies from government conservatorship during his term.

The Biden administration has signaled it won’t be in a hurry to privatize the companies.

Under President Biden, the GSEs’ regulator may put in place other initiatives with the primary aim of making mortgages cheaper and more widely available. If GSEs were to cut fees, or expand the types of borrowers or loans they back, that could increase the market size for the firms that originate many so-called qualified mortgages — the type that the GSEs buy — such as Rocket Cos. (RKT), UWM Holdings (UWMC), and LoanDepot (LDI).

UWMC is trading at ~9.3x 2022 EPS

LDI is trading at ~4.75x 2022 EPS

RKT is trading at ~11.8x 2022 EPS

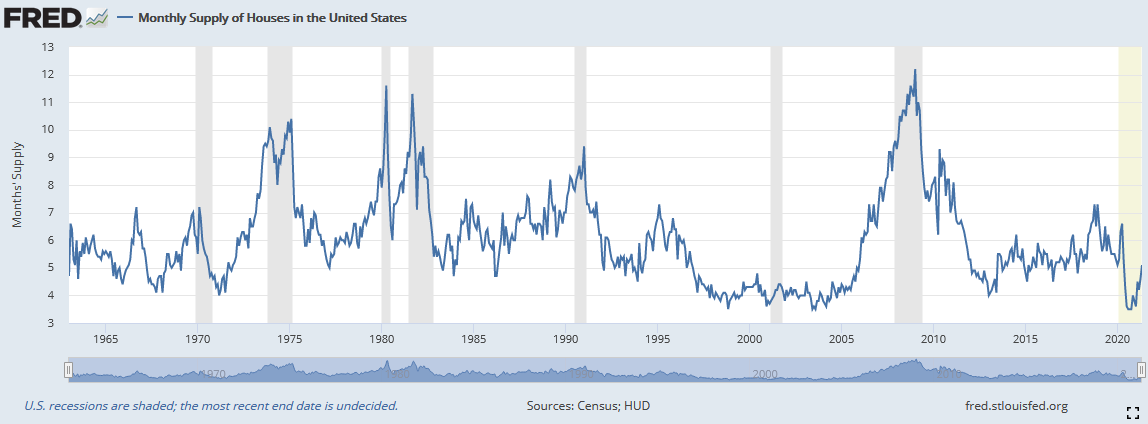

Couple these factors with the 10yr yield moderating in recent months (below 1.5%), and Lumber prices collapsing in June (allowing builders to put new supply on the market) points to a recovery for these decimated mortgage lenders over the next 12-24 months.

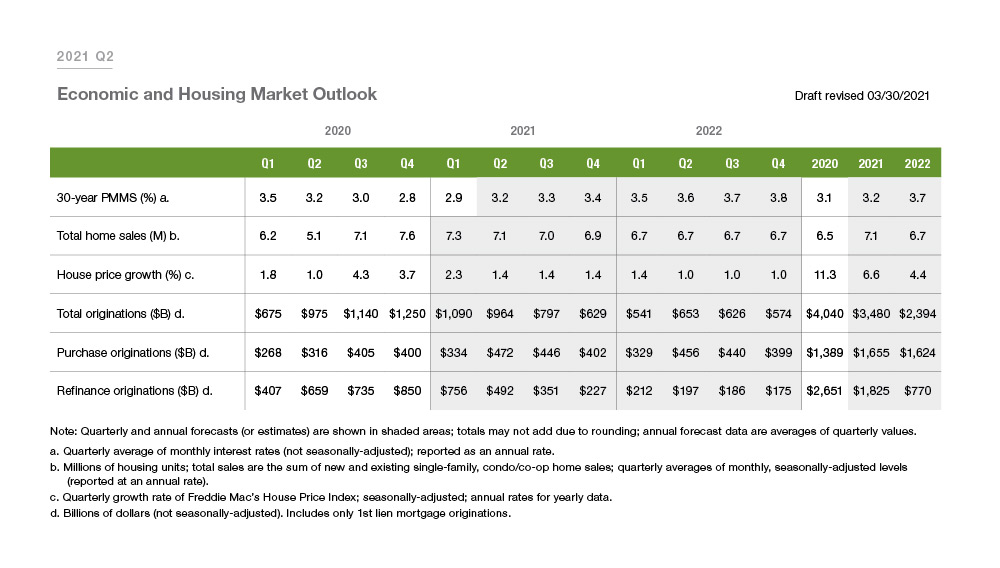

The stocks are trading heavy due to difficult comps off of record demand in 2020. Freddie Mac has projected reduced demand for refinancing in 2021 and 2022 relative to 2020. Embedded in this assumption is a meaningful rise in rates – which may or may not come to pass. It also does not account for increased demand that may come from a moderation of lending standards – favored by the current administration.

The group is taking a short-term step back in 2021 following last year’s record performance. These lenders have benefited from a housing and refinancing boom that manifested shortly after the COVID-19 pandemic struck. It will persist in coming years as similar favorable age demographics existed in the economic booms of 1982-2000 and 1948-1966.

Image: Wikipedia (with green annotations)

There are still bargains, you just have to look harder to find them. Like the Wells Fargo and Energy trades last year and Alibaba in the past month, it will take some time (and short-term bumpiness) for these to form a solid bottom and finally take off, but we think the risk:reward has become compelling (as a basket).

As a reminder for new readers, financials (and lenders) continue to do well AFTER the initial flattening of the yield curve (until inversion). We are still in the early days of steepening (despite the short-term counter-trend move), and have some time to run until the flattening process begins [red line (ratio of 10yr Treasury Yield : 2yr Treasury Yield) goes back toward zero]. If anything, rising rates spur buyers on the sidelines to finally take action (as we saw in 2003-2005).

Now onto the shorter term view for the General Market:

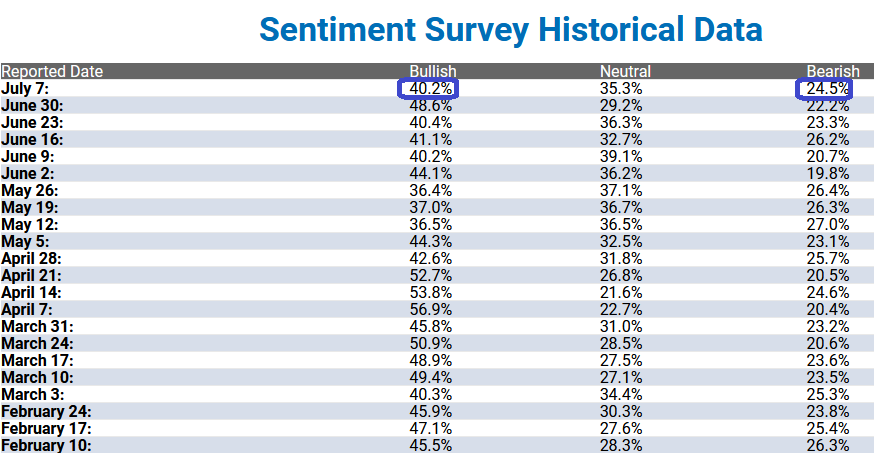

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 40.2% from 48.6% last week. Bearish Percent increased to 24.5% from 22.2% last week. Retail traders/investors are still enthusiastic.

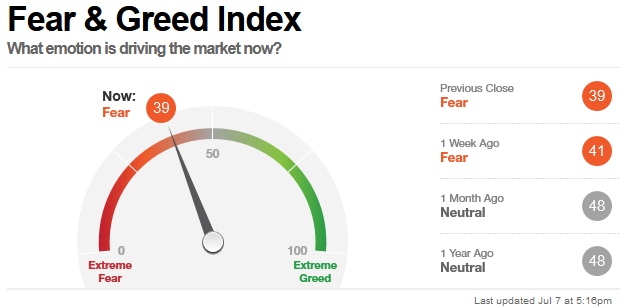

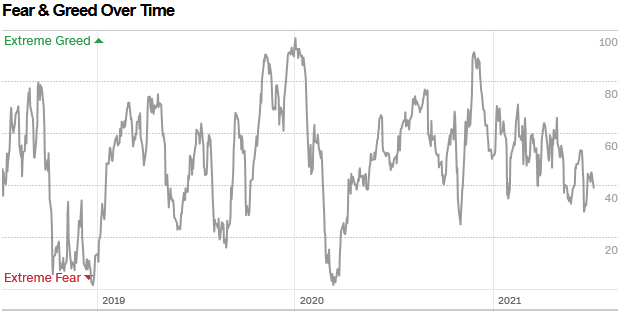

The CNN “Fear and Greed” Index faded from 43 last week to 39 this week. There is some modest fear present in the market. You can learn how this indicator is calculated and how it works here:(Video Explanation)

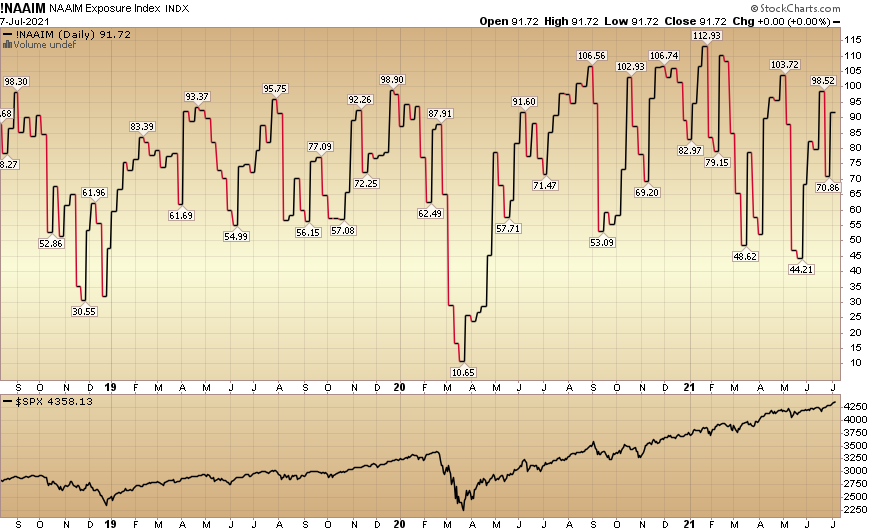

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 91.72% this week from 70.86% equity exposure last week.

Our message for this week:

With Q2 earnings season coming up in the next week, expectations are high. Consensus is that S&P 500 grew earnings by 62.8% year on year. The good news is that number will likely be beaten and come in ~70%. The bad news is that you will start hearing “peak growth” every time you turn on the TV in coming weeks and months. That may keep rates subdued in the short term.

Selective Tech and Defensives (Utilities, Staples and Pharma) is where we believe opportunity is right now (for Summer) as cyclicals will likely continue to shake out some of the “late money” in coming months – before resuming their uptrend/new highs later in the year (we are still in the early stages of a new business cycle).

We are using this week’s volatility in Chinese stocks to add to Alibaba. The fundamentals of the business have not changed, just the noise coming out of Beijing.

Our view is that at some point, the Chinese Government will stop shooting itself in the foot. If it aspires to become a true economic superpower, it must compete globally. Handicapping and fining their largest, best performing companies will put them at a competitive disadvantage and begin to limit their access to global capital markets. If this behavior continues, the Chinese Government may retain the control they desire domestically, but materially diminish their power, influence and stature globally.

My bet is that cooler heads will prevail – as sooner or later people do what’s in their best interest. Unfortunately, sometimes the correct decisions come only after they’ve exhausted all other options. We hope that is not the case with the Chinese Government’s posture toward the best Chinese enterprises – as this will set them back – perhaps irreparably. Once the world’s deepest and most robust capital markets close to you, its takes years for those doors to re-open – if ever.

Of Note: Just this morning, the headline hit that China’s central bank would ease policy and stimulate the economy with cuts to the amount of funds banks need to hold in reserve. This has the market concerned that China’s growth may be slower than anticipated. While the market is taking this as bad news in the short term, it is actually good news in the intermediate term.

China started tightening policy prematurely ~6 months ago – hoping they could piggyback/free-ride on the easy monetary and fiscal policies in the West. I repeatedly said on my appearances on CGTN America that this premature tightening (in the middle of the pandemic) would come back to bite them. They have now realized their error and started to correct it. That is good news.

The question now is whether they will realize that now is not the time for the regulatory rigidity they have displayed with their fastest growing tech platforms (and foreign listings). If they don’t change their stance soon, the capital markets will do it for them by shutting down to Chinese companies. Having shown the flexibility to correct their economic policy errors this morning, we are hopeful they will correct their regulatory rigidity and timing errors as well.

It’s always darkest before dawn…