Last week we said sentiment was “As Good As it Gets” from a historical perspective to step in and buy.

We’ve since had a nice (but choppy) bounce, and in the interim, sentiment has improved this week:

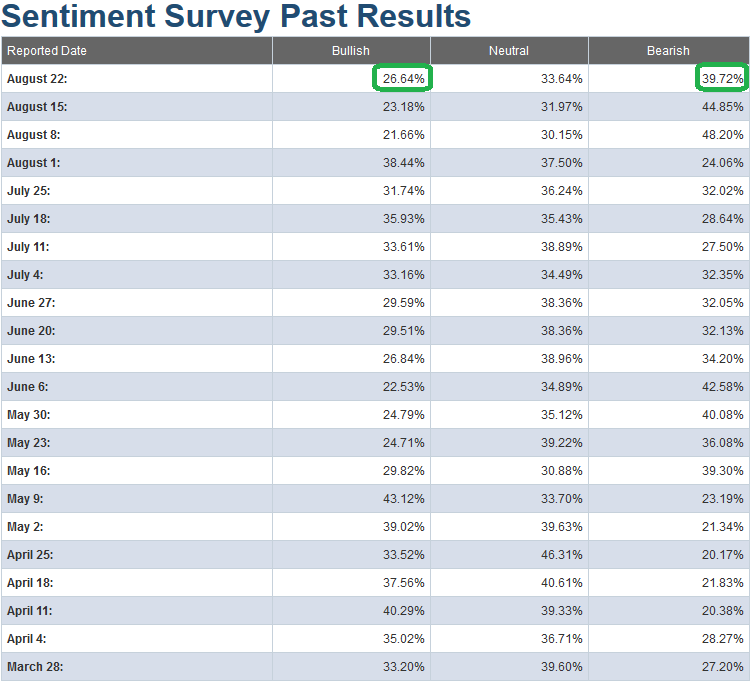

Albeit modest, bulls are slowly coming out of the bunkers (up to 26.64% this week compared to 23.18% last week). Bears have come down a bit as well (from 44.85% to 39.72%). This suggests some thawing is taking place – similar to the looks off of the bottom in June and December (see featured chart of bullish sentiment relative to the S&P 500 above).

Any positive spark would cause a stampede back into markets given the underweight positioning to equities, short covering and career risk of missing a move back to new highs. That said, nothing is ever a guarantee – simply a probabilistic advantage that you calculate and manage the risk as you take up exposure.

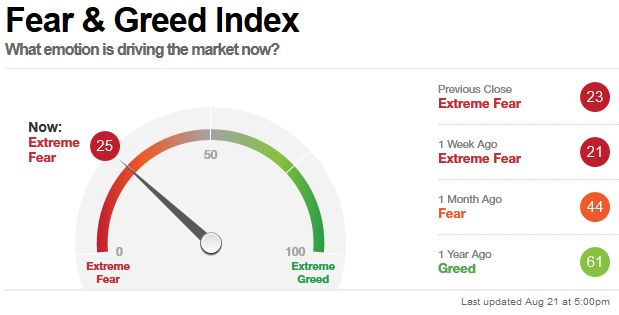

Offering further support is that there is still extreme fear showing up in the CNN Fear & Greed index – which is pinned at 25 [a range historically associated with contrarian reversals to the upside – particularly on secondary versus primary pullbacks (like what we are having now)].

Many of our other indicators are confirming the viewpoint that it pays to be getting some long exposure when pessimism is in this range. We have published a couple of dozen indicators we look at over the past few weeks (each in a ~60 second video so that you not only get the “academic” explanation, but you can see how it applies works/doesn’t work in real life).

https://www.hedgefundtips.com/category/market-indicators/

Is it possible that Powell’s speech on Friday will be the spark that ignites a rally? If you charted his last 10 or so appearances they would point to a contra-indication (i.e. sell when he speaks). Friday is his opportunity to change the trend. So far the market is not betting on it, but the indicators continue to favor a reversal.