In April 1982, John Cougar Mellencamp released a song entitled, “Hurts So Good.” I was never a huge fan of the song, but in thinking about what to write today, his lyrics came to me:

“Come on and make it a

Hurt so good

Come on baby make it hurt so good

Sometimes love don’t feel like it should

You make it, hurt so good”

Come on baby make it hurt so good

Sometimes love don’t feel like it should

You make it, hurt so good”

Last week we said, we agreed with Kenny Rogers’ “you got to know when to hold ’em” and that while we were in the midst of a “pause that refreshes” we would hold what we had and potentially look to add only in those sectors that had lagged – with emphasis on possibilities in the Biotech sector (among others).

We followed our own advice and added a bit in the last few days in biotech, and held what we had – but one ISM report later, we learned to love Mr. Mellencamp’s lyrics. This week was a perfect example of “sometimes love don’t feel like it should – you make it, hurt so good.”

With the correct backdrop in place, we see no reason to run for the hills – but rather accept the short term volatility in exchange for the intermediate term benefit, and “Lord knows there are things we can do, baby.” Here’s the backdrop for the “things we can do, baby” –

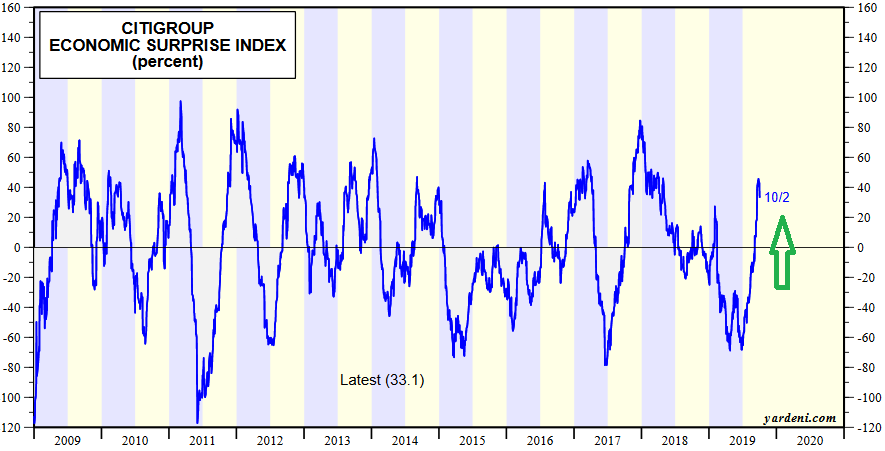

1. Data is getting better, not worse (exception is global manufacturing):

2. Fed has stopped Quantitative Tightening, reduced the discount rate by 50bps, and will likely cut a final 25bps this year. Just as it took 6 months to feel the effect of two years of tightening, it will take a few months lag to see the benefits of additional liquidity. It is reasonable to expect multiple expansion moving forward as 2020 estimates are strong and the lowered cost of capital increases the value of the future earnings stream.

3. Although the ECB committed to renewing QE at $20B/month starting in November, with German manufacturing data weak (due to China) – it may simply not be enough. Should President Trump move ahead with tariffs on Europe (and Brexit gets wobbly), the ECB’s next step is outright Stock Purchases like Japan has done with ETFs.

4. Estimates are set extremely low again for Q3 (-3.8% yoy). If the last two quarters are any indication, we should gain ~300bps through earnings season and finish flat/slightly negative year on year.

5. Most important is forward estimates for both the US and EU Stoxx 600 are at double digit growth (US S&P 500 at +10.6% and Stoxx 600 ~mid teens): Q3 Earnings: The Table is Set…

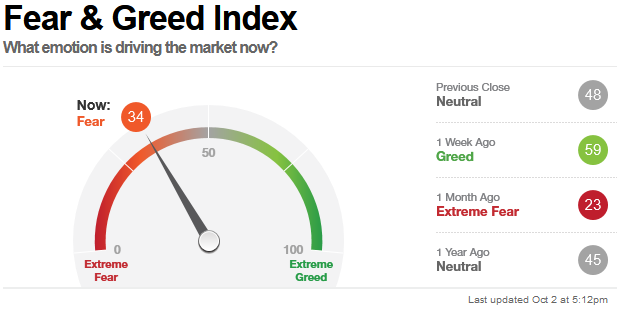

With the CNN Fear and Greed index pulling all the way back to 34 this week, it is unclear whether this is just a mid-range indecision, or it must pull back to an extreme (~20-25) to gain strength to power higher.

We’ll look at one more indicator to give us some color:

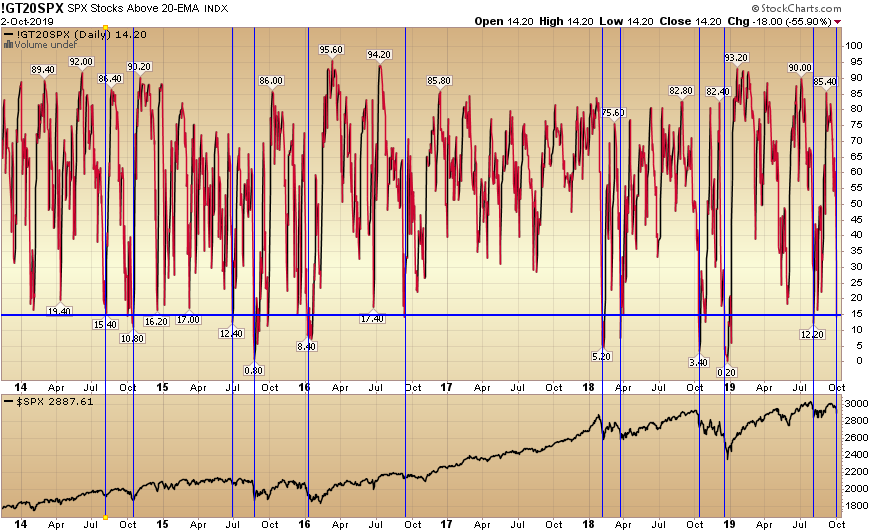

S&P 500 stocks above their 20 Day Exponential Moving Average – traded down to 14.2% last night. In the 11 times this has happened in the past 5 years, 10 times it paid to be a buyer – even if there was some sideways action for another week or so before you got the bounce/move up. One time it failed (last October). You can see the results below and we will post the video on it later this morning on the site:

But odds favor buying over selling in coming days and weeks at these levels (at least 10 out of 11 times).

So Where Are We on Sentiment This Week?

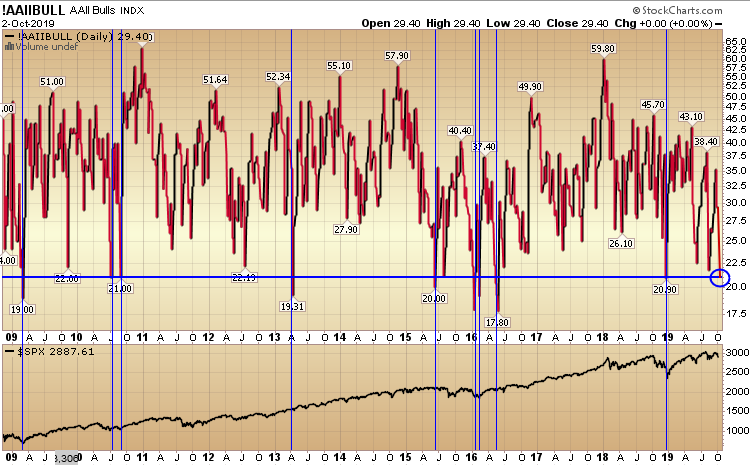

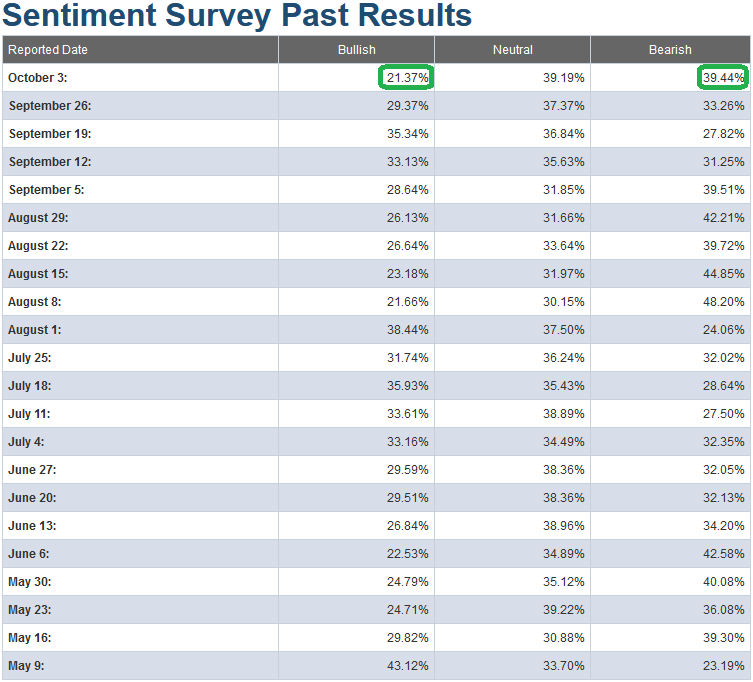

We are “Back to the Future” at an extreme level on Bullish Sentiment – which has plummeted to 21.37% from 29.37% in the past week. Bearish Sentiment has spiked up to 39.44% from 33.26%.

That’s the bad news. The good news is, it has paid to be a buyer at these levels historically. See featured chart above (blue vertical lines mark when bullish sentiment dropped to the low twenties and it is marked against the S&P 500 below). This does not mean it reverses the next day, but it does display that buyers of extreme fear are regularly rewarded in the intermediate term.

That’s the bad news. The good news is, it has paid to be a buyer at these levels historically. See featured chart above (blue vertical lines mark when bullish sentiment dropped to the low twenties and it is marked against the S&P 500 below). This does not mean it reverses the next day, but it does display that buyers of extreme fear are regularly rewarded in the intermediate term.So while it may “hurt” today, it’ll “hurt so good” in weeks and months ahead…